Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am pretty certain the calculations are correct for 1 and 2 but I wasn't sure what to do about number 3, The PMT is

I am pretty certain the calculations are correct for 1 and 2 but I wasn't sure what to do about number 3, The PMT is wrong on both it should be 543.59 for the first question and 493.94 for the second question

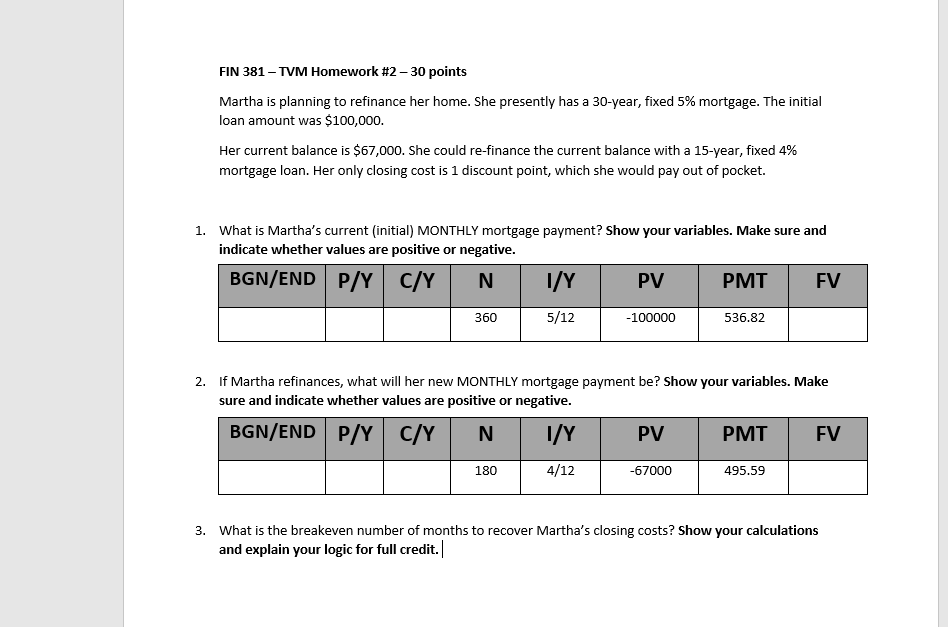

FIN 381 TVM Homework #2 - 30 points Martha is planning to refinance her home. She presently has a 30-year, fixed 5% mortgage. The initial loan amount was $100,000. Her current balance is $67,000. She could re-finance the current balance with a 15-year, fixed 4% mortgage loan. Her only closing cost is 1 discount point, which she would pay out of pocket. 1. What is Martha's current initial) MONTHLY mortgage payment? Show your variables. Make sure and indicate whether values are positive or negative. BGN/END PAY C/Y N 1/Y PV PMT FV 360 5/12 -100000 536.82 2. If Martha refinances, what will her new MONTHLY mortgage payment be? Show your variables. Make sure and indicate whether values are positive or negative. BGN/END PAY CAY N 1/Y PV PMT FV 180 4/12 -67000 495.59 3. What is the breakeven number of months to recover Martha's closing costs? Show your calculations and explain your logic for full credit. | FIN 381 TVM Homework #2 - 30 points Martha is planning to refinance her home. She presently has a 30-year, fixed 5% mortgage. The initial loan amount was $100,000. Her current balance is $67,000. She could re-finance the current balance with a 15-year, fixed 4% mortgage loan. Her only closing cost is 1 discount point, which she would pay out of pocket. 1. What is Martha's current initial) MONTHLY mortgage payment? Show your variables. Make sure and indicate whether values are positive or negative. BGN/END PAY C/Y N 1/Y PV PMT FV 360 5/12 -100000 536.82 2. If Martha refinances, what will her new MONTHLY mortgage payment be? Show your variables. Make sure and indicate whether values are positive or negative. BGN/END PAY CAY N 1/Y PV PMT FV 180 4/12 -67000 495.59 3. What is the breakeven number of months to recover Martha's closing costs? Show your calculations and explain your logic for full credit. |Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started