Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am quite pressed for time! Can someone help me find this solution? Life of new machine = 3 years ABC Limited is are considering

I am quite pressed for time! Can someone help me find this solution? Life of new machine = 3 years

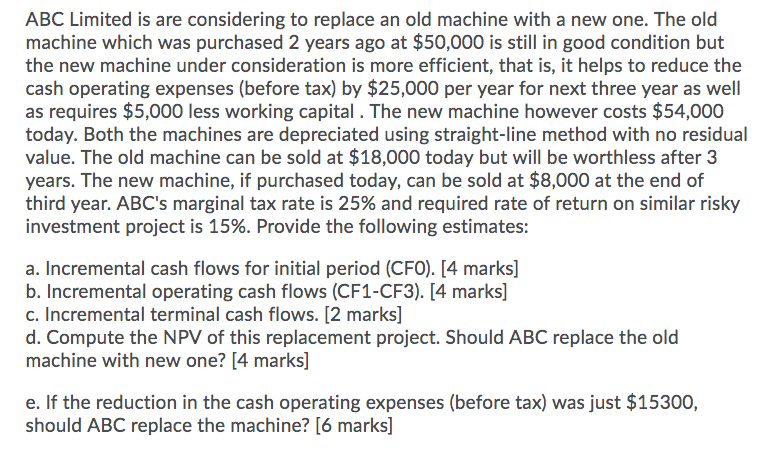

ABC Limited is are considering to replace an old machine with a new one. The old machine which was purchased 2 years ago at $50,000 is still in good condition but the new machine under consideration is more efficient, that is, it helps to reduce the cash operating expenses (before tax) by $25,000 per year for next three year as well as requires $5,000 less working capital. The new machine however costs $54,000 today. Both the machines are depreciated using straight-line method with no residual value. The old machine can be sold at $18,000 today but will be worthless after 3 years. The new machine, if purchased today, can be sold at $8,000 at the end of third year. ABC's marginal tax rate is 25% and required rate of return on similar risky investment project is 15%. Provide the following estimates: a. Incremental cash flows for initial period (CFO). [4 marks] b. Incremental operating cash flows (CF1-CF3). [4 marks] c. Incremental terminal cash flows. [2 marks] d. Compute the NPV of this replacement project. Should ABC replace the old machine with new one? (4 marks] e. If the reduction in the cash operating expenses (before tax) was just $15300, should ABC replace the machine? [6 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started