Question

I am So confused about what to do; I filled in the values but they are not coming out correct I need help understanding what

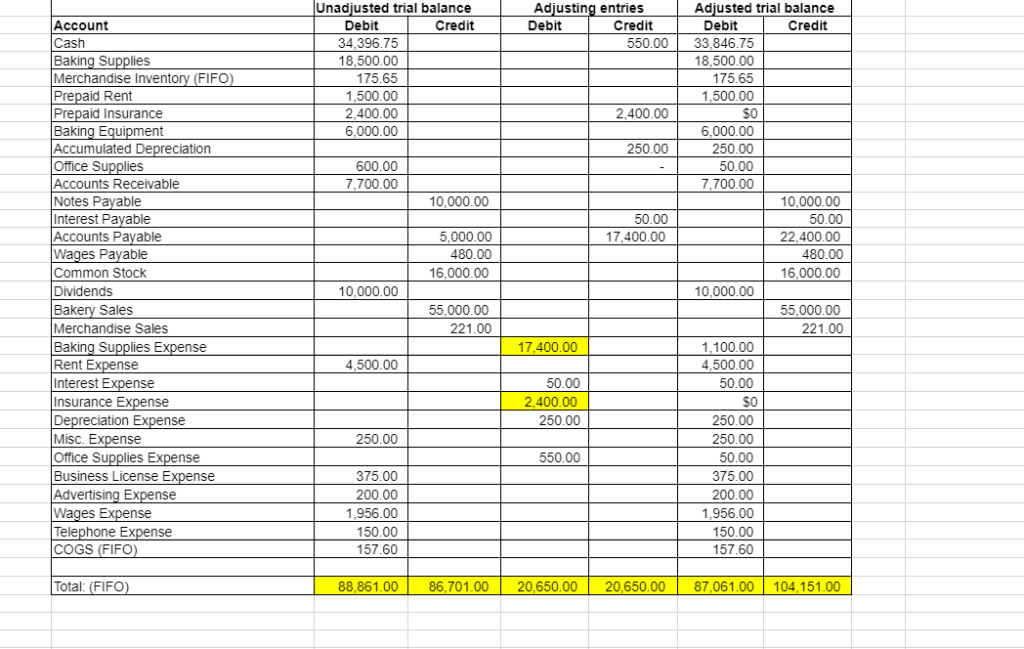

I am So confused about what to do; I filled in the values but they are not coming out correct I need help understanding what it is I am doing wrong. (The values I was given per my instructor are as follows: The Unadjusted Trial Balance should be $86,701 & It was but my instructor told me that I keyed in the insurance incorrectly so I had to update that from $240 to $2,400 which threw my book off, The Adjusted Trial Balance should come out to $18,750 and The 1Adjusted Trial Balance should equal $87,101).

Any help would be greatly appreciated here is the prompt:

On September 30, the following adjustments must be made: Depreciation of baking equipment transferred to the company on 7/13.

Assume a half month of depreciation in July using the straight-line method.

Accrue interest for note payable. Assume a full month of interest for July. (6% annual interest on $10,000 loan from parents.)

Record insurance used for the year.

Actual baking supplies on-hand as of September 30 are $1,100. Office supplies on-hand as of September 30 are $50.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started