I am still learning how to do this. I think that my answers are correct, but could you please check my work and if I have done anything incorrectly could you please explain why it is incorrect? Thank you.

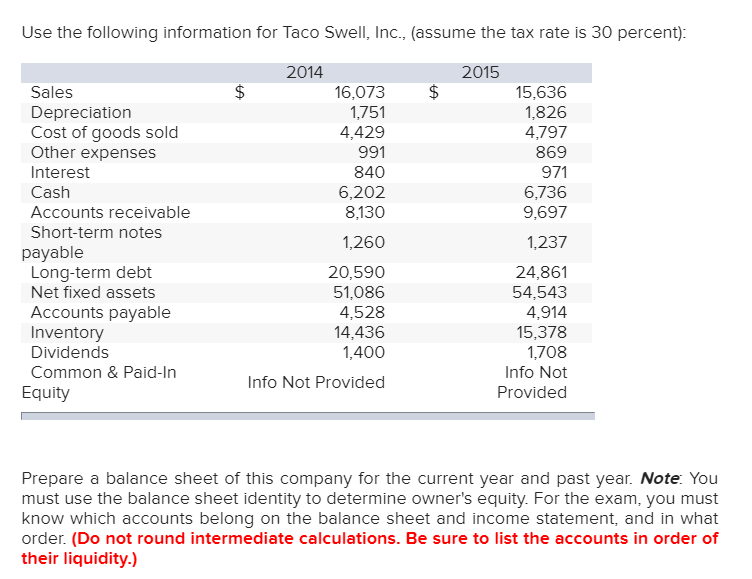

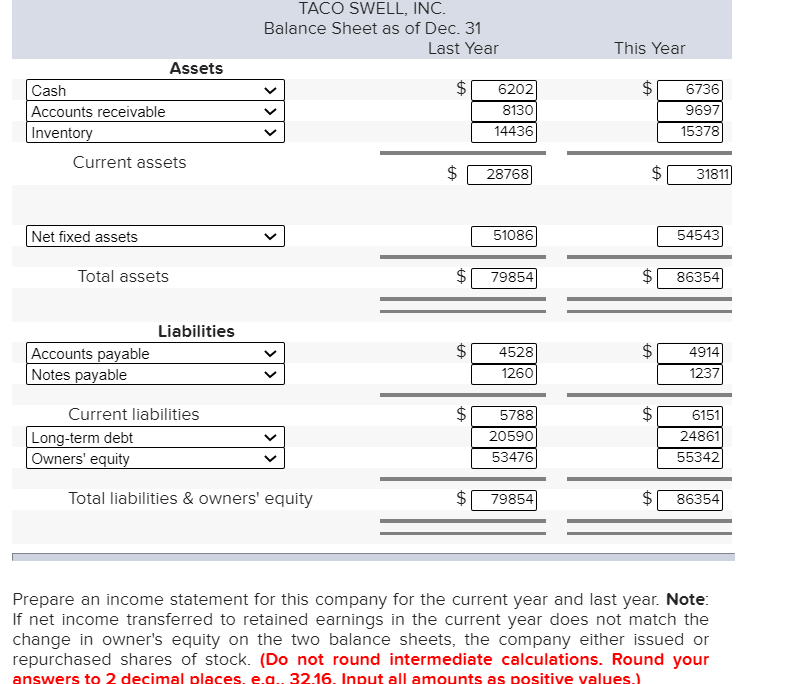

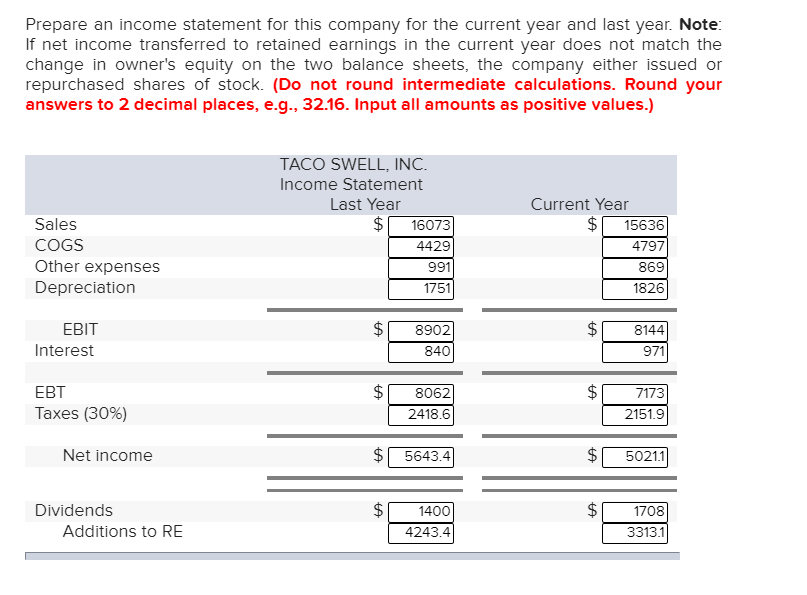

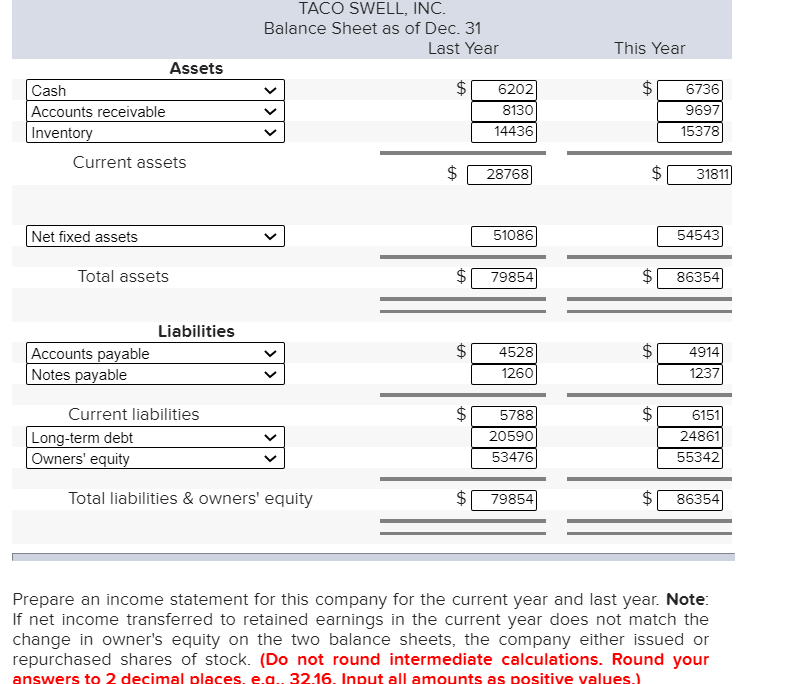

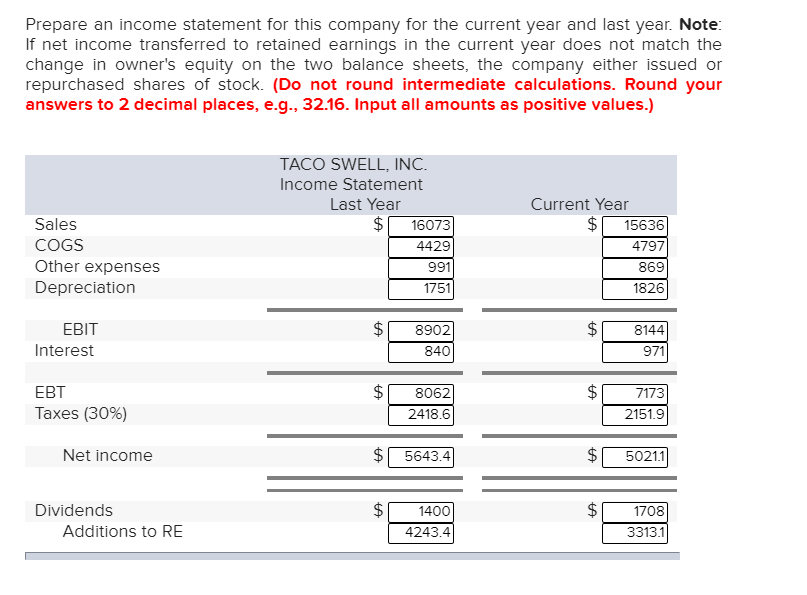

Use the following information for Taco Swell, Inc., (assume the tax rate is 30 percent): 2015 $ 15,636 1,826 4,797 869 971 6,736 9,697 Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends Common & Paid-In Equity 2014 $ 16,073 1,751 4,429 991 840 6,202 8,130 1,260 20,590 51,086 4,528 14,436 1,400 Info Not Provided 1,237 24,861 54,543 4,914 15,378 1,708 Info Not Provided Prepare a balance sheet of this company for the current year and past year. Note: You must use the balance sheet identity to determine owner's equity. For the exam, you must know which accounts belong on the balance sheet and income statement, and in what order. (Do not round intermediate calculations. Be sure to list the accounts in order of their liquidity.) TACO SWELL, INC. Balance Sheet as of Dec. 31 Last Year This Year $ $ Assets Cash Accounts receivable Inventory Current assets 6202 8130 14436 6736 9697 15378 $ 28768 $ 31811 Net fixed assets 51086) 54543 Total assets 79854 $ 86354 Liabilities $ $ Accounts payable Notes payable 4528 1260 4914 1237 $ $ Current liabilities Long-term debt Owners' equity 5788 20590 53476 6151 24861 55342 Total liabilities & owners' equity $ 79854 $ 86354 Prepare an income statement for this company for the current year and last year. Note: If net income transferred to retained earnings in the current year does not match the change in owner's equity on the two balance sheets, the company either issued or repurchased shares of stock. (Do not round intermediate calculations. Round your answers to 2 decimal places. e.g 32.16. Input all amounts as positive values.) Prepare an income statement for this company for the current year and last year. Note: If net income transferred to retained earnings in the current year does not match the change in owner's equity on the two balance sheets, the company either issued or repurchased shares of stock. (Do not round intermediate calculations. Round your answers to 2 decimal places, e.g., 32.16. Input all amounts as positive values.) Sales COGS Other expenses Depreciation TACO SWELL, INC. Income Statement Last Year $ 16073 4429 991 1751 Current Year 15636 4797 869 1826 $ EBIT Interest 8902 8401 8144 971 $ EBT Taxes (30%) 8062 2418.6 7173 2151.91 Net income HA 5643.4 $ 50211 $ Dividends Additions to RE 1400 4243.4 1708 3313.11