I am struggling with this question. please help me check if I am correct or not and help me fill in the blanks. I need detailed steps and calculations so I understand the problem. thanks a lot

here is the instructions

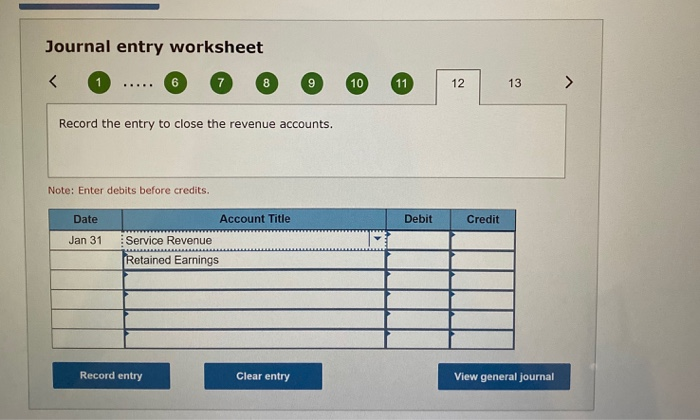

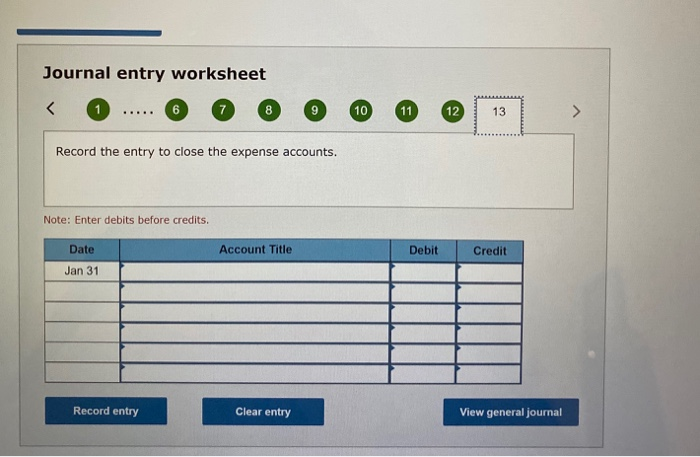

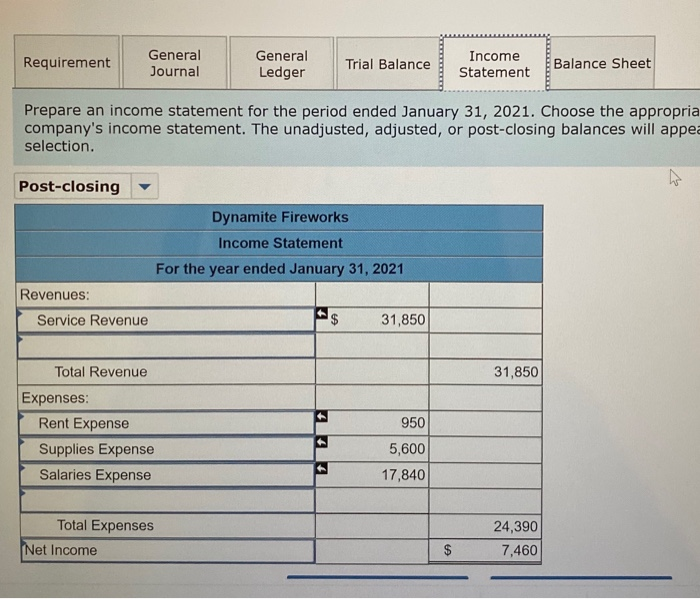

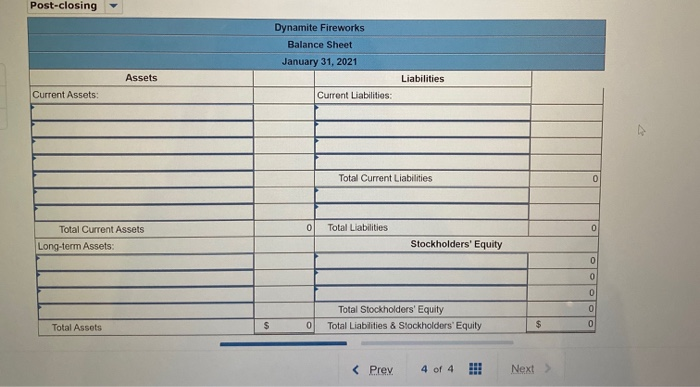

I believe I added figure below

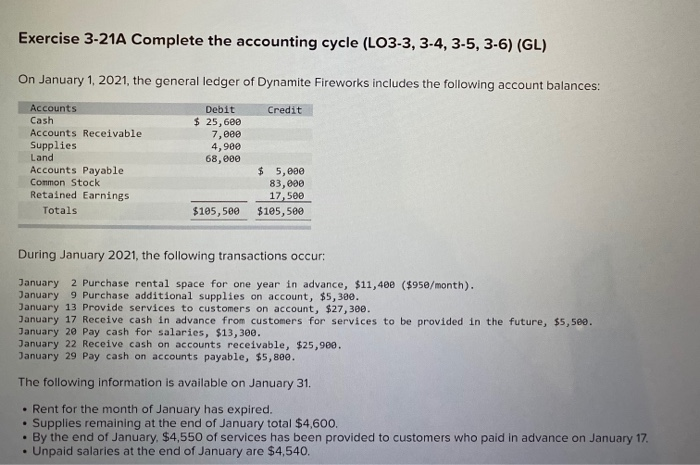

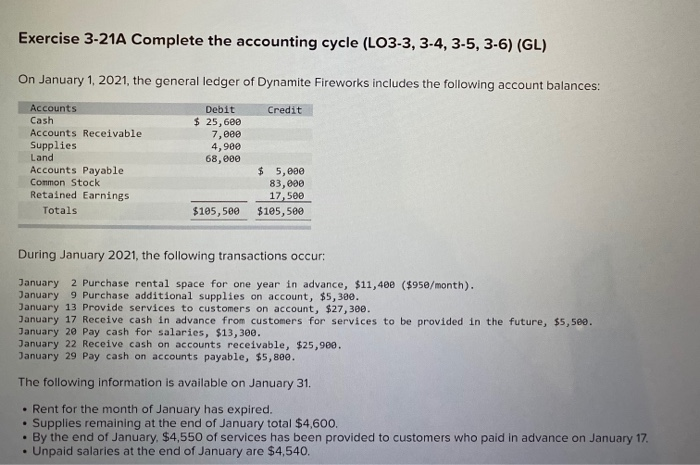

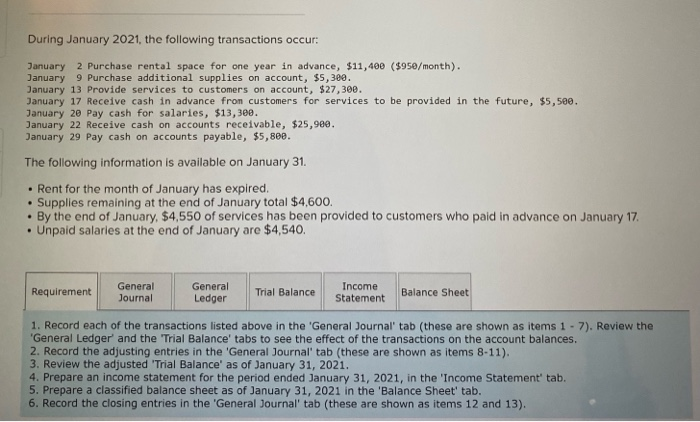

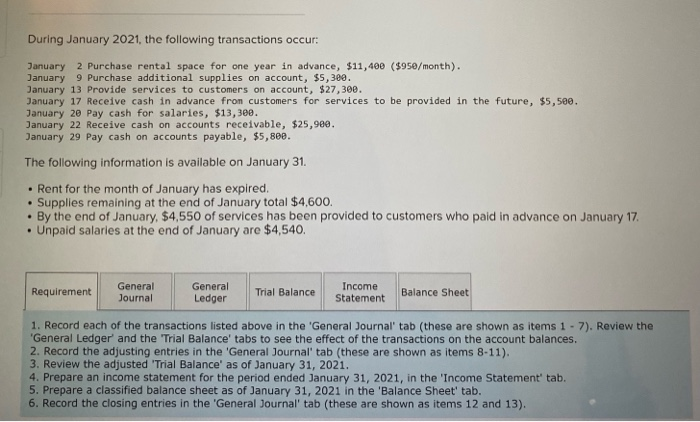

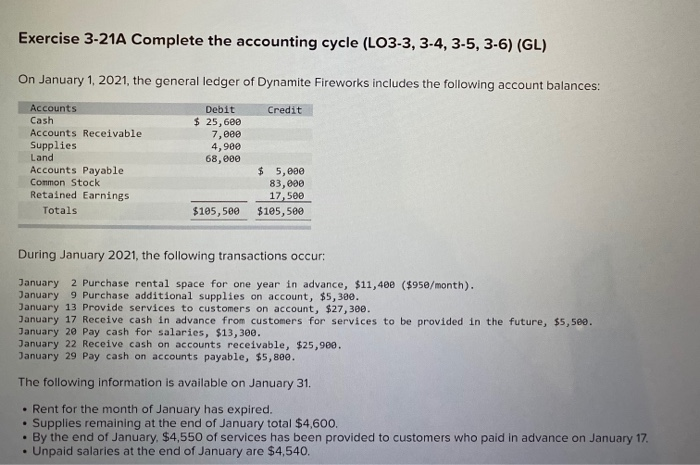

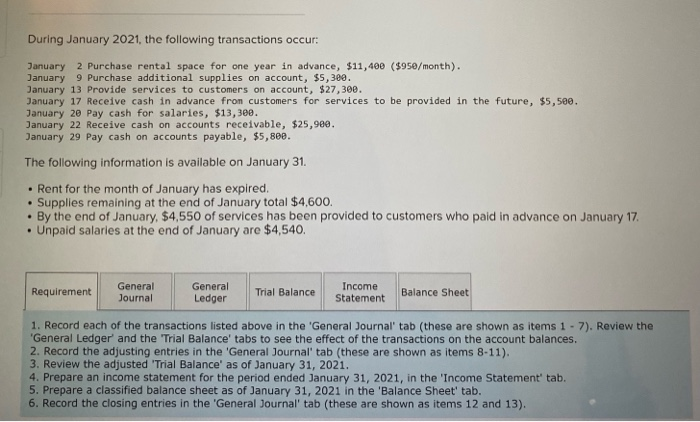

Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. Date Debit Credit Jan 31 Account Title Service Revenue Retained Earnings Record entry Clear entry View general journal Journal entry worksheet Exercise 3-21A Complete the accounting cycle (LO3-3, 3-4, 3-5, 3-6) (GL) On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: Credit Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $ 25,600 7,080 4,980 68,000 $ 5,000 83,000 17,500 $105,500 $195,500 During January 2021, the following transactions occur: January 2 Purchase rental space for one year in advance, $11,400 ($950/month). January 9 Purchase additional supplies on account, $5,300. January 13 Provide services to customers on account, $27,300. January 17 Receive cash in advance from customers for services to be provided in the future, $5,500. January 20 Pay cash for salaries, $13,300. January 22 Receive cash on accounts receivable, $25,900. January 29 Pay cash on accounts payable, $5,800. The following information is available on January 31. Rent for the month of January has expired. Supplies remaining at the end of January total $4,600. . By the end of January, $4,550 of services has been provided to customers who paid in advance on January 17 Unpaid salaries at the end of January are $4,540. During January 2021, the following transactions occur: January 2 Purchase rental space for one year in advance, $11,400 ($950/month). January 9 Purchase additional supplies on account, $5,300. January 13 Provide services to customers on account, $27,300. January 17 Receive cash in advance from customers for services to be provided in the future, $5,500. January 20 Pay cash for salaries, $13,300. January 22 Receive cash on accounts receivable, $25,980. January 29 Pay cash on accounts payable, $5,808. The following information is available on January 31. Rent for the month of January has expired. Supplies remaining at the end of January total $4,600. . By the end of January, $4,550 of services has been provided to customers who paid in advance on January 17. Unpaid salaries at the end of January are $4,540. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 - 7). Review the "General Ledger and the Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8-11). 3. Review the adjusted 'Trial Balance' as of January 31, 2021. 4. Prepare an income statement for the period ended January 31, 2021, in the 'Income Statement' tab. 5. Prepare a classified balance sheet as of January 31, 2021 in the 'Balance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 12 and 13)