Question

I am stuck on the following homework problem: Any help is appreciated! Thank you. Please Note: Financial statements are formal documents, so they must be

I am stuck on the following homework problem: Any help is appreciated! Thank you.

Please Note: Financial statements are formal documents, so they must be typed for this assignment. Any hand-written financial statement will receive a score of zero. Also, presentation matters for financial statements. For example, acronyms and abbreviations are not allowed on financial statements. The statements are required to be neat, organized, easy-to-read, and easy-to-follow. The formats presented in class are good ones to follow (but are by no means the only acceptable format).

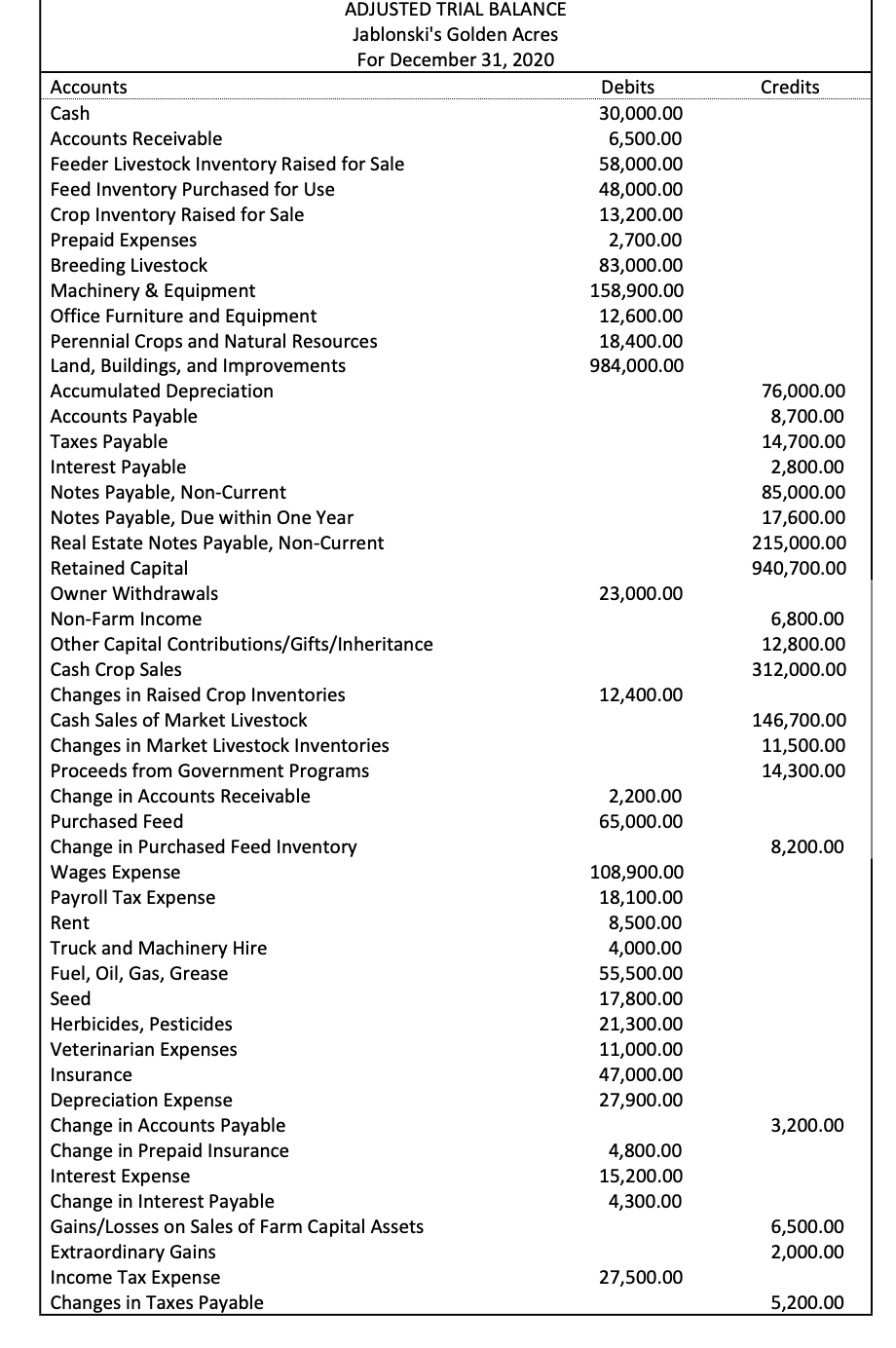

Using the attached Adjusted Trial Balance, prepare Jablonskis Golden Acres financial statements for the end of the year. Complete each on a separate page in the following order:

A) Income Statement for 2020 (38 points)

B) Statement of Owner Equity for 2020 (27 points)

C) Balance Sheet for December 31, 2020 (49 points)It is expected that proper formatting will be used in regard to the document title, headings, sub-totals, etc. Improper formatting will lose points. You are to put together financial statements, not just determine net income or owner equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started