Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am stuck on the question, i will upvote the correct answer The budgct committee of Concord Company collects the following data for its 5

I am stuck on the question, i will upvote the correct answer

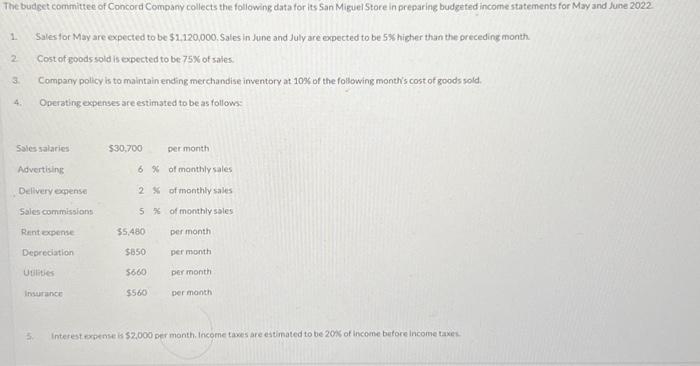

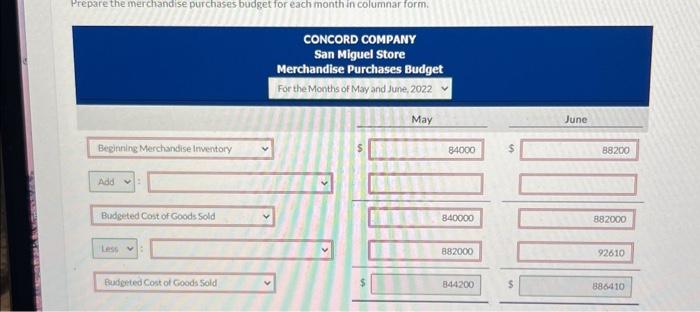

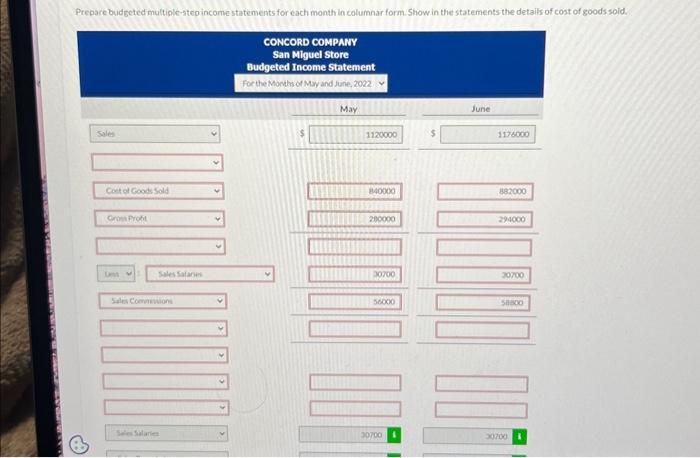

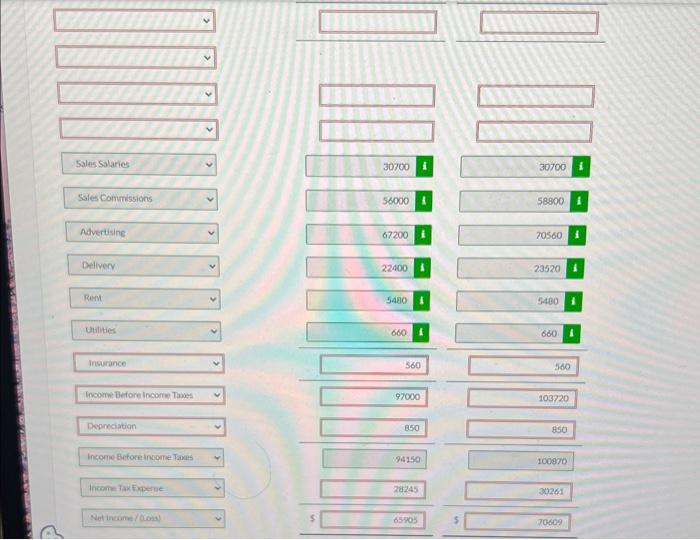

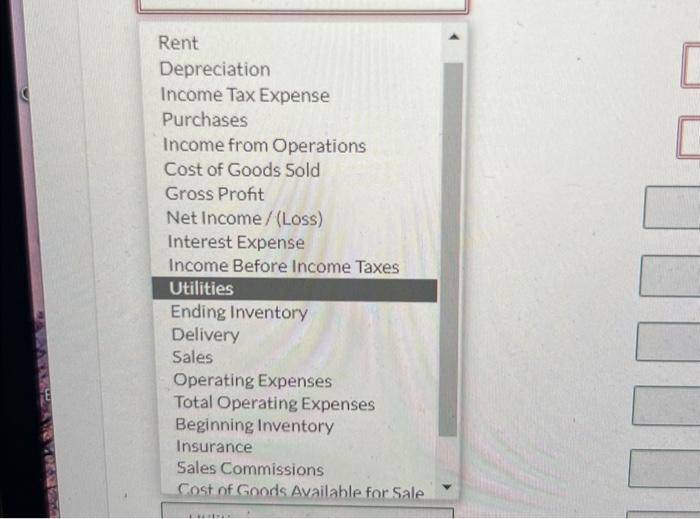

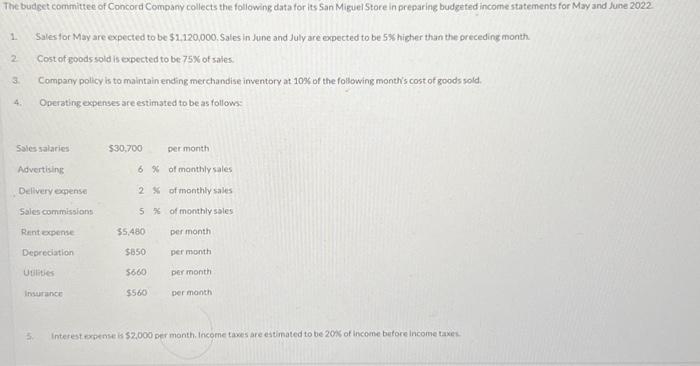

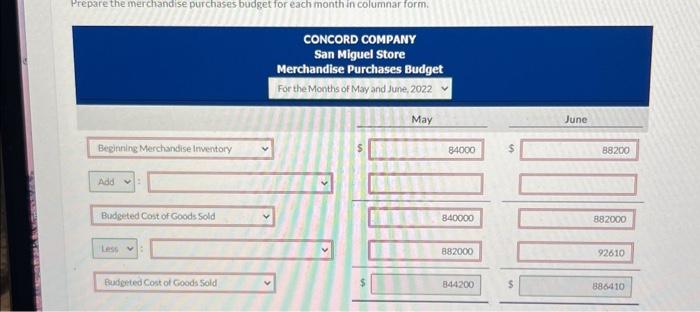

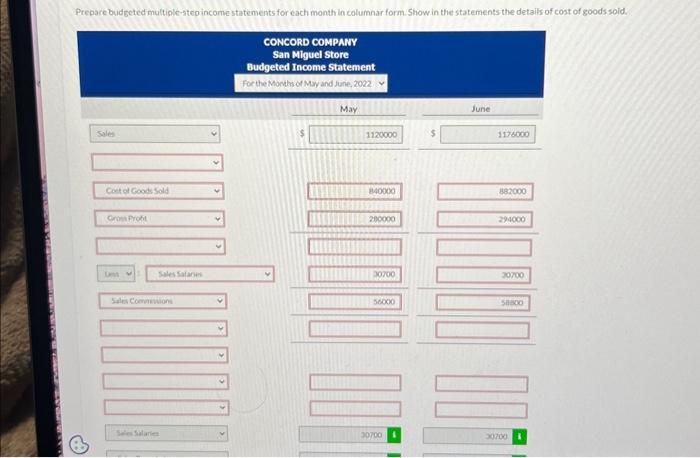

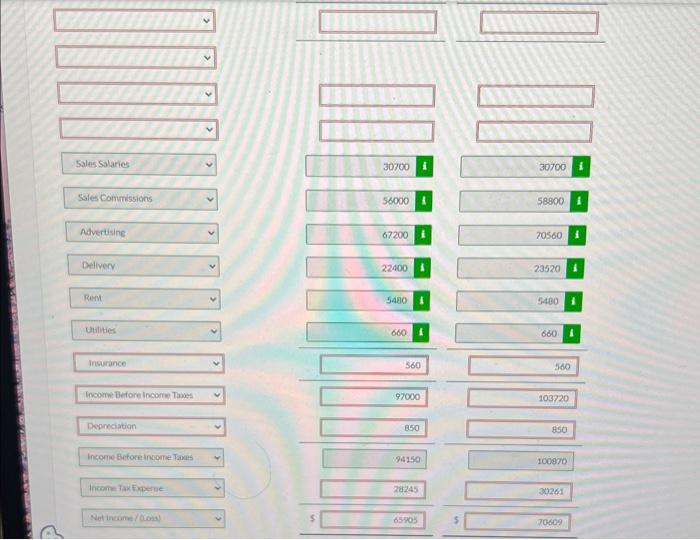

The budgct committee of Concord Company collects the following data for its 5 an MiguelStore in preparing budzeted income statements for May and June 2022 1. Sales lor Mayy are expected to be $1,120,000. Sales in June and July are expected to be 5 . higher than the orecedins month. 2. Cost of goods sold is expected to be 75W of sales: 3. Company pollcy is to maintain ending merchandise inventory at 10 of the following month's cost of goods sold. 4. Operating expenses are estimated to be as follows: 3. Interest exptme is $2,000 per month. Income tawes are estimated to be 20 S of income betore lncome taxes. CONCORD COMPANY San Miguel store Merchandise Purchases Budget For the Months of May and June, 2022 Prepare budseted multiple-steo income statements for each month ln columnar form. Show in the statements the details-of cost of goods soid. Rent Depreciation Income Tax Expense Purchases Income from Operations Cost of Goods Sold Gross Profit Net Income / (Loss) Interest Expense Income Before Income Taxes Utilities Ending Inventory Delivery Sales Operating Expenses Total Operating Expenses Beginning Inventory Insurance Sales Commissions Cost of Gonds Available for Sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started