Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am stuck on this one, if you can please solve it and show your work you will be a lifesaver. Let's have some more

I am stuck on this one, if you can please solve it and show your work you will be a lifesaver.

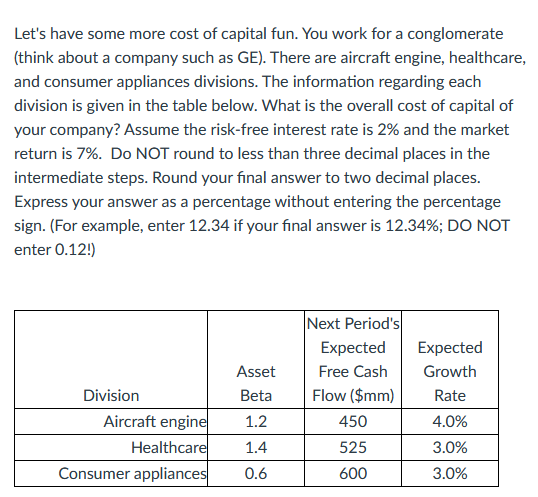

Let's have some more cost of capital fun. You work for a conglomerate (think about a company such as GE). There are aircraft engine, healthcare, and consumer appliances divisions. The information regarding each division is given in the table below. What is the overall cost of capital of your company? Assume the risk-free interest rate is 2% and the market return is 7%. Do NOT round to less than three decimal places in the intermediate steps. Round your final answer to two decimal places. Express your answer as a percentage without entering the percentage sign. (For example, enter 12.34 if your final answer is 12.34%; DO NOT enter 0.12.) Asset Beta 1.2 Division Aircraft engine Healthcare Consumer appliances Next Period's Expected Free Cash Flow ($mm) 450 525 600 Expected Growth Rate 4.0% 3.0% 3.0% 1.4 0.6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started