Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am taking a test right now. Please answer asap! Thank u Epiphany Industries is considering a new capital budgeting project that will last for

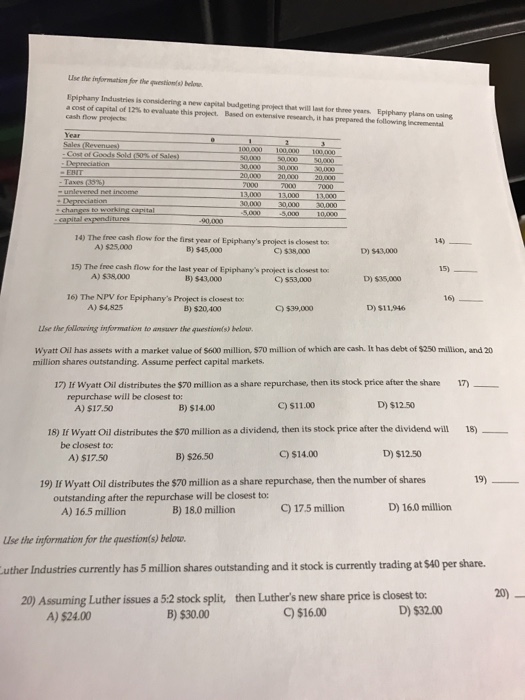

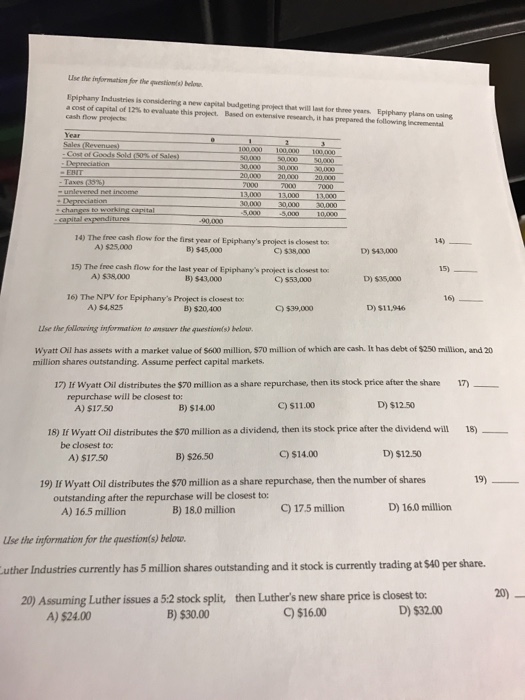

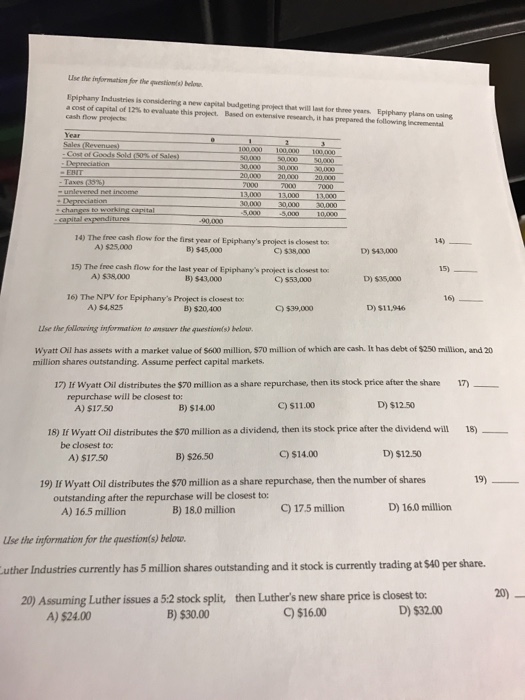

I am taking a test right now. Please answer asap! Thank u  Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental. The free cash flow for the first year of Epiphany's project is closest to; A) $25,000 B)$45,000 C) $38,000 D) $43,000 The free cash flow for the first year of Epiphany's project is closest to; A) $38,000 B) $43,000 C) $53,000 D) $35,000 The NPV for Epiphany's Project is closest to; A)$4, 825 B)$20, 400 C)$39,000 D) $11, 946 Use the following information to answer the question(s) below. Wyatt Oil has assets with a market value of $600 million, 570 million of which are cash, It has debt of $250 million, and 20 million shares outstanding. Assume perfect capital markets. If Wyatt Oil distributes the $70 million as a share repurchase, then its stock price after the share A)$17.50 B)$14.00 C)$511.00 D)$12.50 If Wyatt Oil distributes the $70 million as a dividend, then its stock price after the dividend will A)$17.50 B) $26.50 C)$14.00 D)$12.50 If Wyatt Oil distributes the 70 million as a share repurchase, then the number of shares outstanding after the repurchase will be closest to; A) 16.5 million B)18.0 million C) 17.5 million C)17.5 million D)16.0 million Luther Industries currently has 5 million shares outstanding and it stock is currently trading at $40 per share. Assuming Luther issues a 5:2 stock split, then Luther's new share price is closest to A) $24.00 B)$30.00 C) $16.00 D) $32.00

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental. The free cash flow for the first year of Epiphany's project is closest to; A) $25,000 B)$45,000 C) $38,000 D) $43,000 The free cash flow for the first year of Epiphany's project is closest to; A) $38,000 B) $43,000 C) $53,000 D) $35,000 The NPV for Epiphany's Project is closest to; A)$4, 825 B)$20, 400 C)$39,000 D) $11, 946 Use the following information to answer the question(s) below. Wyatt Oil has assets with a market value of $600 million, 570 million of which are cash, It has debt of $250 million, and 20 million shares outstanding. Assume perfect capital markets. If Wyatt Oil distributes the $70 million as a share repurchase, then its stock price after the share A)$17.50 B)$14.00 C)$511.00 D)$12.50 If Wyatt Oil distributes the $70 million as a dividend, then its stock price after the dividend will A)$17.50 B) $26.50 C)$14.00 D)$12.50 If Wyatt Oil distributes the 70 million as a share repurchase, then the number of shares outstanding after the repurchase will be closest to; A) 16.5 million B)18.0 million C) 17.5 million C)17.5 million D)16.0 million Luther Industries currently has 5 million shares outstanding and it stock is currently trading at $40 per share. Assuming Luther issues a 5:2 stock split, then Luther's new share price is closest to A) $24.00 B)$30.00 C) $16.00 D) $32.00

I am taking a test right now. Please answer asap! Thank u

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started