Answered step by step

Verified Expert Solution

Question

1 Approved Answer

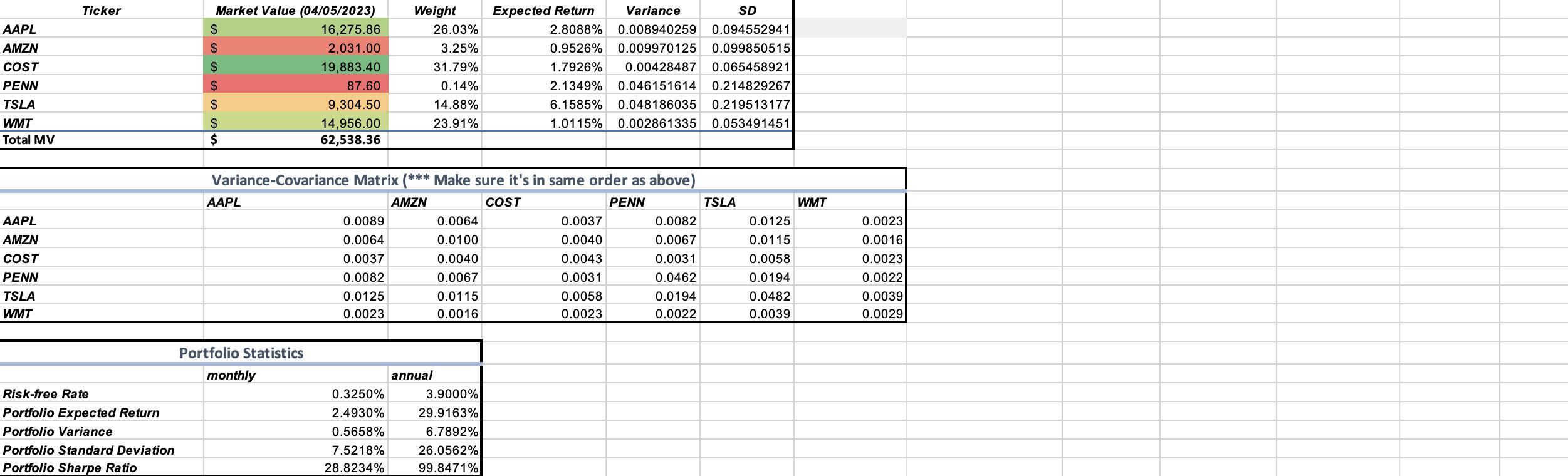

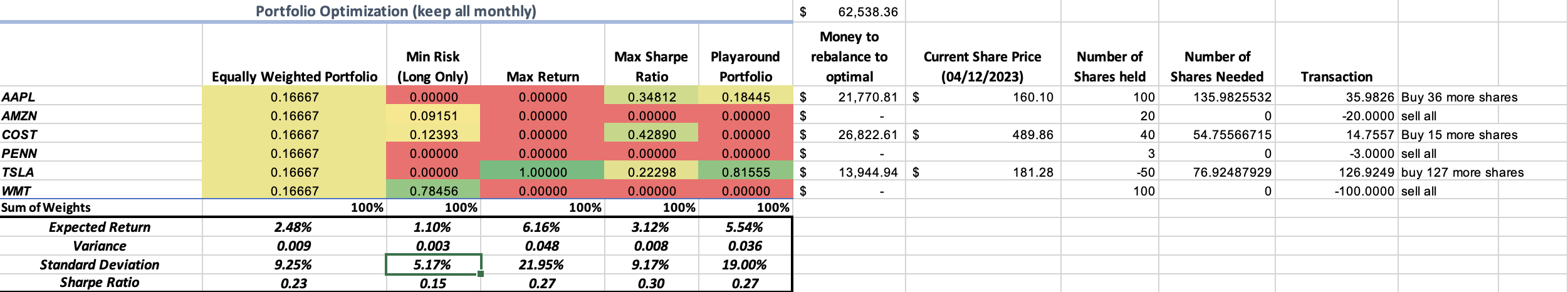

I am trying to calculate the optimal portfolio in Excel and we were told to use the Solver Add-In. My stocks are different, but could

I am trying to calculate the optimal portfolio in Excel and we were told to use the Solver Add-In. My stocks are different, but could someone just explain how the values were calculated in the following picture under the chart "Portfolio Optimization (keep all monthly)"

AAPL AMZN COST PENN TSLA WMT Total MV AAPL AMZN COST PENN TSLA WMT Ticker Risk-free Rate Portfolio Expected Return Portfolio Variance Portfolio Standard Deviation Portfolio Sharpe Ratio Market Value (04/05/2023) 16,275.86 2,031.00 19,883.40 87.60 9,304.50 14,956.00 62,538.36 $ $ $ $ $ $ $ AAPL Variance-Covariance Matrix (*** Make sure it's in same order as above) AMZN COST PENN Portfolio Statistics monthly 0.0089 0.0064 0.0037 0.0082 0.0125 0.0023 Weight 26.03% 3.25% 31.79% 0.14% 14.88% 23.91% 0.3250% 2.4930% 0.5658% 7.5218% 28.8234% annual 0.0064 0.0100 0.0040 0.0067 0.0115 0.0016 Expected Return Variance SD 2.8088% 0.008940259 0.094552941 0.9526% 0.009970125 0.099850515 1.7926% 0.00428487 0.065458921 2.1349% 0.046151614 0.214829267 6.1585% 0.048186035 0.219513177 1.0115% 0.002861335 0.053491451 3.9000% 29.9163% 6.7892% 26.0562% 99.8471% 0.0037 0.0040 0.0043 0.0031 0.0058 0.0023 0.0082 0.0067 0.0031 0.0462 0.0194 0.0022 TSLA 0.0125 0.0115 0.0058 0.0194 0.0482 0.0039 WMT 0.0023 0.0016 0.0023 0.0022 0.0039 0.0029

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is how the values were calculated in the Portfolio Optimization keep all monthly section of the chart Ticker This column lists the tickers of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started