Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am trying to check my answers before the assignment is due. thanks 01. Alex Fergusson is 45 years old and has a high risk

I am trying to check my answers before the assignment is due. thanks

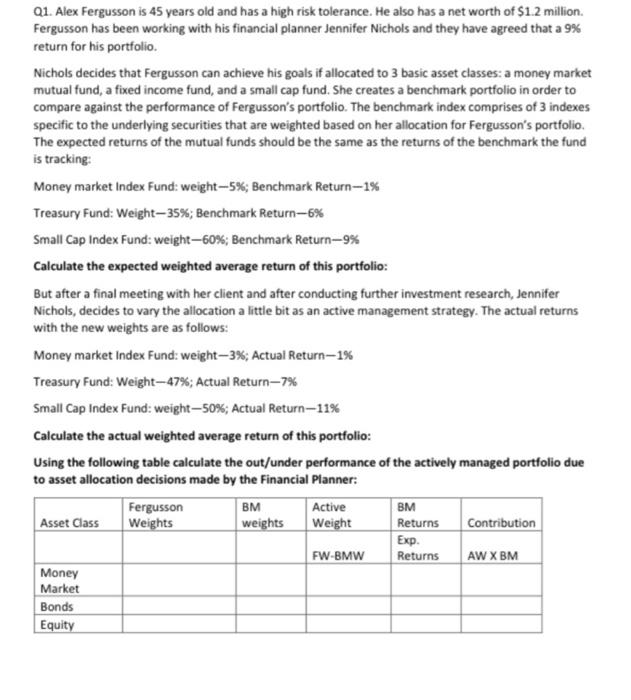

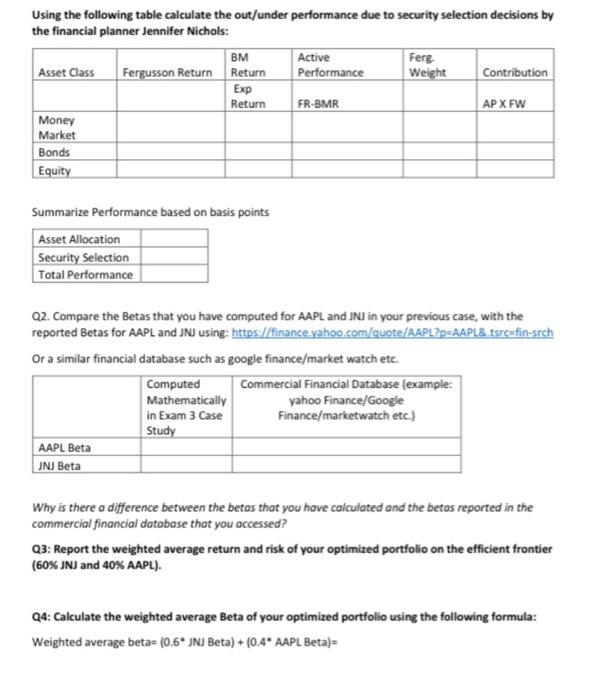

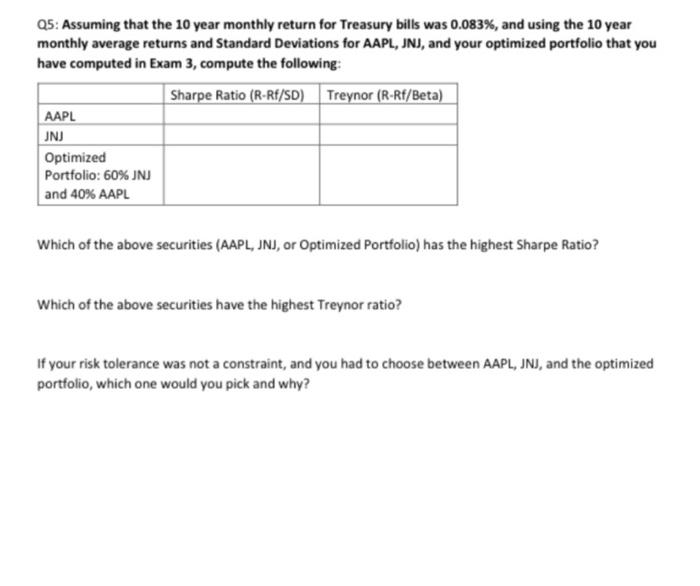

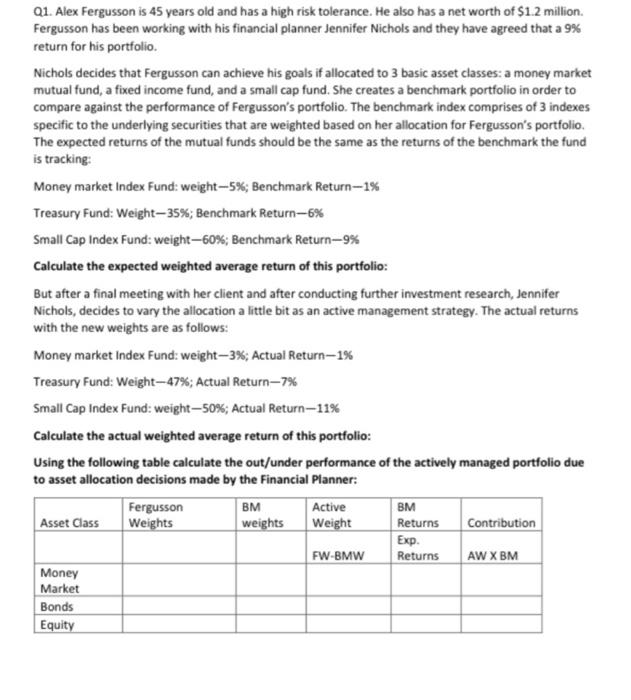

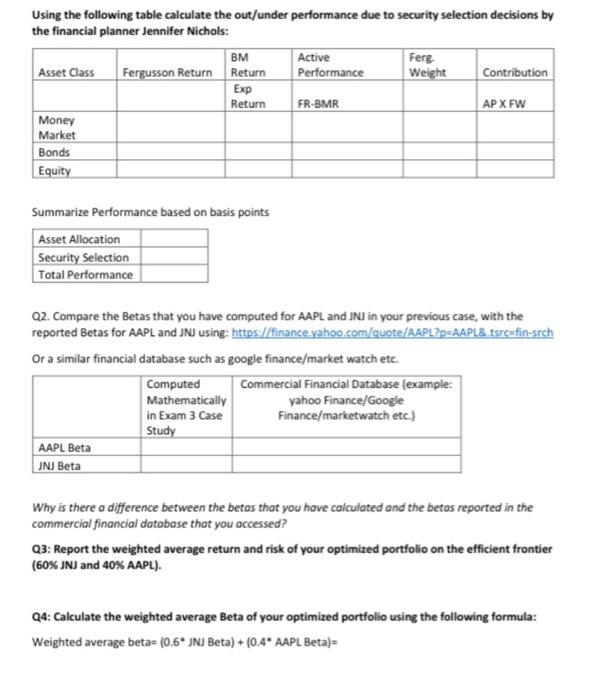

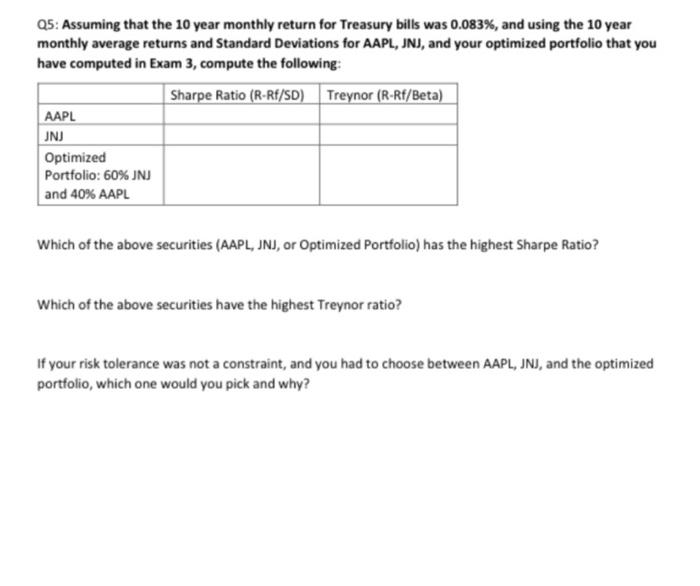

01. Alex Fergusson is 45 years old and has a high risk tolerance. He also has a net worth of $1.2 million. Fergusson has been working with his financial planner Jennifer Nichols and they have agreed that a 9% return for his portfolio. Nichols decides that Fergusson can achieve his goals if allocated to 3 basic asset classes: a money market mutual fund, a fixed income fund, and a small cap fund. She creates a benchmark portfolio in order to compare against the performance of Fergusson's portfolio. The benchmark index comprises of 3 indexes specific to the underlying securities that are weighted based on her allocation for Fergusson's portfolio The expected returns of the mutual funds should be the same as the returns of the benchmark the fund is tracking: Money market Index Fund: weight-5%; Benchmark Return-1% Treasury Fund: Weight -35%; Benchmark Return-6% Small Cap Index Fund: weight-60%; Benchmark Return-9% Calculate the expected weighted average return of this portfolio: But after a final meeting with her client and after conducting further investment research, Jennifer Nichols, decides to vary the allocation a little bit as an active management strategy. The actual returns with the new weights are as follows: Money market Index Fund: weight-3%; Actual Return-1% Treasury Fund: Weight-47%; Actual Return-7% Small Cap Index Fund: weight-50%; Actual Return-11% Calculate the actual weighted average return of this portfolio: Using the following table calculate the out/under performance of the actively managed portfolio due to asset allocation decisions made by the Financial Planner: Fergusson BM Active BM Asset Class Weights weights Weight Returns Contribution . FW-BMW Returns AW X BM Money Market Bonds Equity BM Using the following table calculate the out/under performance due to security selection decisions by the financial planner Jennifer Nichols: Active Ferg Asset Class Fergusson Return Return Performance Weight Contribution Exp FR-BMR AP XFW Money Market Bonds Equity Return Summarize Performance based on basis points Asset Allocation Security Selection Total Performance Q2. Compare the Betas that you have computed for AAPL and JNJ in your previous case, with the reported Betas for AAPL and JNA using: https://finance.yahoo.com/quote/AAPL?p=AAPL&.tsrc=fin-srch Or a similar financial database such as google finance/market watch etc. Computed Commercial Financial Database (example: Mathematically yahoo Finance/Google in Exam 3 Case Finance/marketwatch etc.) Study AAPL Beta JNJ Beta Why is there a difference between the betos that you have calculated and the betas reported in the commercial financial database that you accessed? Q3: Report the weighted average return and risk of your optimized portfolio on the efficient frontier (60% JNJ and 40% AAPL). Q4: Calculate the weighted average Beta of your optimized portfolio using the following formula: Weighted average beta= (0.6* JNJ Beta) + (0.4* AAPL Beta) Q5: Assuming that the 10 year monthly return for Treasury bills was 0.083%, and using the 10 year monthly average returns and Standard Deviations for AAPL, JNJ, and your optimized portfolio that you have computed in Exam 3, compute the following: Sharpe Ratio (R-Rf/SD) Treynor (R-Rf/Beta) AAPL JNJ Optimized Portfolio: 60% JNJ and 40% AAPL Which of the above securities (AAPL, JNJ, or Optimized Portfolio) has the highest Sharpe Ratio? Which of the above securities have the highest Treynor ratio? If your risk tolerance was not a constraint, and you had to choose between AAPL, JNJ, and the optimized portfolio, which one would you pick and why? 01. Alex Fergusson is 45 years old and has a high risk tolerance. He also has a net worth of $1.2 million. Fergusson has been working with his financial planner Jennifer Nichols and they have agreed that a 9% return for his portfolio. Nichols decides that Fergusson can achieve his goals if allocated to 3 basic asset classes: a money market mutual fund, a fixed income fund, and a small cap fund. She creates a benchmark portfolio in order to compare against the performance of Fergusson's portfolio. The benchmark index comprises of 3 indexes specific to the underlying securities that are weighted based on her allocation for Fergusson's portfolio The expected returns of the mutual funds should be the same as the returns of the benchmark the fund is tracking: Money market Index Fund: weight-5%; Benchmark Return-1% Treasury Fund: Weight -35%; Benchmark Return-6% Small Cap Index Fund: weight-60%; Benchmark Return-9% Calculate the expected weighted average return of this portfolio: But after a final meeting with her client and after conducting further investment research, Jennifer Nichols, decides to vary the allocation a little bit as an active management strategy. The actual returns with the new weights are as follows: Money market Index Fund: weight-3%; Actual Return-1% Treasury Fund: Weight-47%; Actual Return-7% Small Cap Index Fund: weight-50%; Actual Return-11% Calculate the actual weighted average return of this portfolio: Using the following table calculate the out/under performance of the actively managed portfolio due to asset allocation decisions made by the Financial Planner: Fergusson BM Active BM Asset Class Weights weights Weight Returns Contribution . FW-BMW Returns AW X BM Money Market Bonds Equity BM Using the following table calculate the out/under performance due to security selection decisions by the financial planner Jennifer Nichols: Active Ferg Asset Class Fergusson Return Return Performance Weight Contribution Exp FR-BMR AP XFW Money Market Bonds Equity Return Summarize Performance based on basis points Asset Allocation Security Selection Total Performance Q2. Compare the Betas that you have computed for AAPL and JNJ in your previous case, with the reported Betas for AAPL and JNA using: https://finance.yahoo.com/quote/AAPL?p=AAPL&.tsrc=fin-srch Or a similar financial database such as google finance/market watch etc. Computed Commercial Financial Database (example: Mathematically yahoo Finance/Google in Exam 3 Case Finance/marketwatch etc.) Study AAPL Beta JNJ Beta Why is there a difference between the betos that you have calculated and the betas reported in the commercial financial database that you accessed? Q3: Report the weighted average return and risk of your optimized portfolio on the efficient frontier (60% JNJ and 40% AAPL). Q4: Calculate the weighted average Beta of your optimized portfolio using the following formula: Weighted average beta= (0.6* JNJ Beta) + (0.4* AAPL Beta) Q5: Assuming that the 10 year monthly return for Treasury bills was 0.083%, and using the 10 year monthly average returns and Standard Deviations for AAPL, JNJ, and your optimized portfolio that you have computed in Exam 3, compute the following: Sharpe Ratio (R-Rf/SD) Treynor (R-Rf/Beta) AAPL JNJ Optimized Portfolio: 60% JNJ and 40% AAPL Which of the above securities (AAPL, JNJ, or Optimized Portfolio) has the highest Sharpe Ratio? Which of the above securities have the highest Treynor ratio? If your risk tolerance was not a constraint, and you had to choose between AAPL, JNJ, and the optimized portfolio, which one would you pick and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started