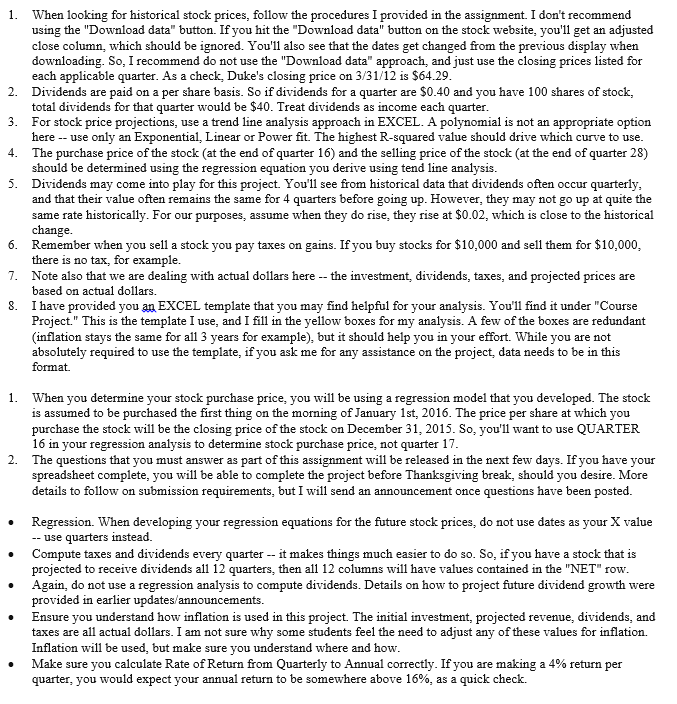

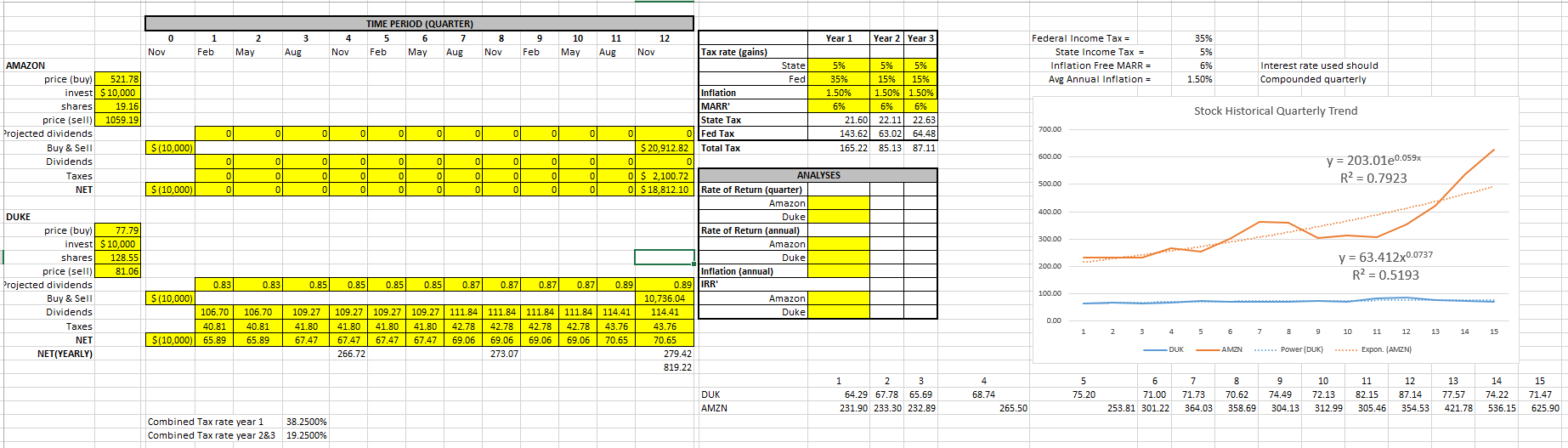

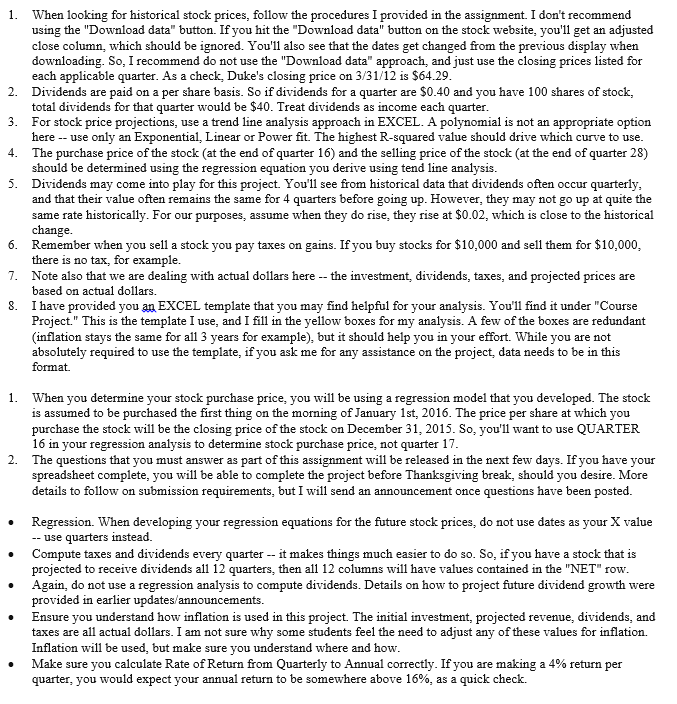

I am trying to figure out where the inflation rate applies in this project. All money is given in actuall dollars so I am not sure where inflation rate comes into play. I have posted all information pertaining to this problem in the images below.

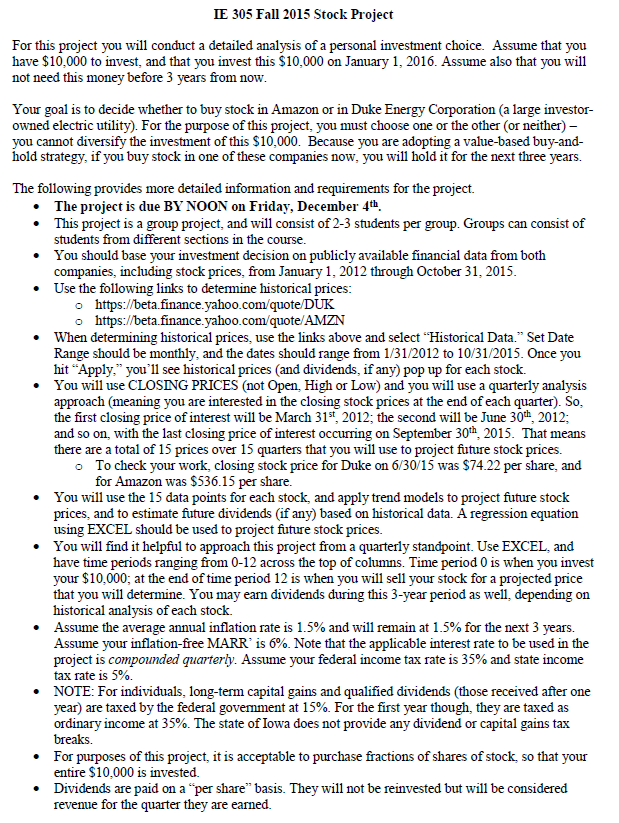

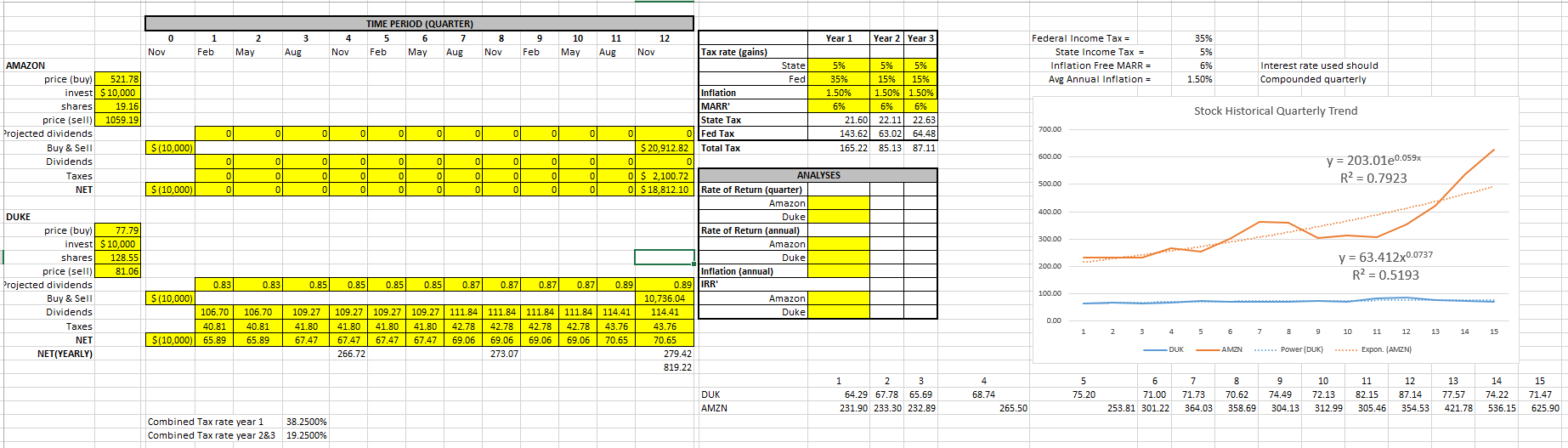

IE 305 Fall 2015 Stock Project For this project you will conduct a detailed analysis of a personal investment choice. Assume that you have $10,000 to invest, and that you invest this $10,000 on January 1, 2016. Assume also that you will not need this money before 3 years from now Your goal is to decide whether to buy stock in Amazon or in Duke Energy Corporation (a large investor owned electric utility). For the purpose of this project, you must choose one or the other (or neither) you cannot diversify the investment of this S$10,000. Because you are adopting a value-based buy-and- hold strategy, if you buy stock in one of these companies now, you will hold it for the next three years. The following provides more detailed information and requirements for the project. .The project is due BY NOON on Friday, December 4th .This project is a group project, and will consist of 2-3 students per group. Groups can consist of students from different sections in the course. You should base your investment decision on publicly available financial data from both companies, including stock prices, from January 1, 2012 through October 31, 2015 Use the following links to determine historical prices . . o https://beta.finance.yahoo.com/quote/DUK https://beta.finance.yahoo.com/quoteAMZN . When de termining historical p 1 prices, use the links above and select "Historical Data." Set Date Range should be monthly, and the dates should range from 1/31/2012 to 10/31/2015. Once you hit "Apply," you'l1 see historical prices (and dividends, if any) pop up for each stock. You will use CLOSING PRICES (not Open, High or Low) and you will use a quarterly analysis approach (meaning you are interested in the closing stock prices at the end of each quarte). So the first closing price of interest will be March 315t, 2012; the second will be June 30h, 2012; and so on, with the last closing price of interest occurring on September 302015. That means there are a total of 15 prices over 15 quarters that you will use to project future stock prices. . o To check your work, closing stock price for Duke on 6/30/15 was $74.22 per share, and for Amazon was S536.15 per share. . You will use the 15 data points for each stock, and apply trend models to project future stock prices, and to estimate future dividends (if any) based on historical data. A regression equation using EXCEL should be used to project future stock prices. You will find it helpful to approach this project from a quarterly standpoint. Use EXCEL, and have time periods ranging from 0-12 across the top of columns. Time period 0 is when you invest your $10,000; at the end of time period 12 is when you will sell your stock for a projected price that you will determine. You may earn dividends during this 3-year period as well, depending on historical analysis of each stock. Assume the average annual inflation rate is 1.5% and will remain at 1.5% for the next 3 years. Assume your inflation-free MARR' is 6%. Note that the applicable interest rate to be used in the project is compounded quarterly. Assume your federal income tax rate is 35% and state income tax rate is 5%. NOTE: For individuals, long-term capital gains and qualified dividends (those received after one year) are taxed by the federal govemment at 15%. For the first year though, they are taxed as ordinary income at 35%. The state of Iowa does not provide any dividend or capital gains tax breaks * .For purposes of this project, it is acceptable to purchase fractions of shares of stock, so that your entire $10,000 is invested. Dividends are paid on a "per share" basis. They will not be reinvested but will be considered revenue for the quarter they are earned