Question

I am trying to find the correct way to answer this question, so far when re-creating the formulas from the examples on this site, it

I am trying to find the correct way to answer this question, so far when re-creating the formulas from the examples on this site, it has not produced the correct answer. I'm not sure where I am going wrong.

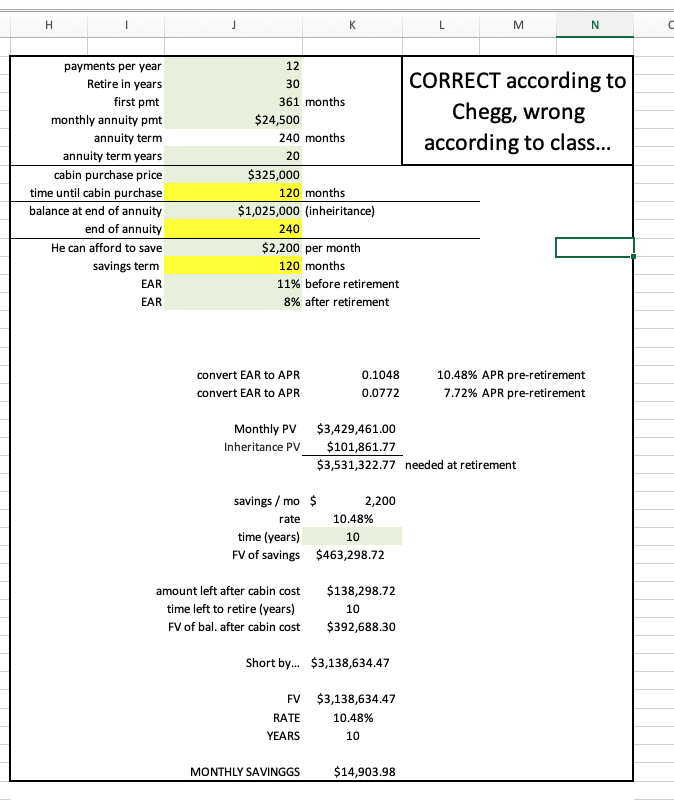

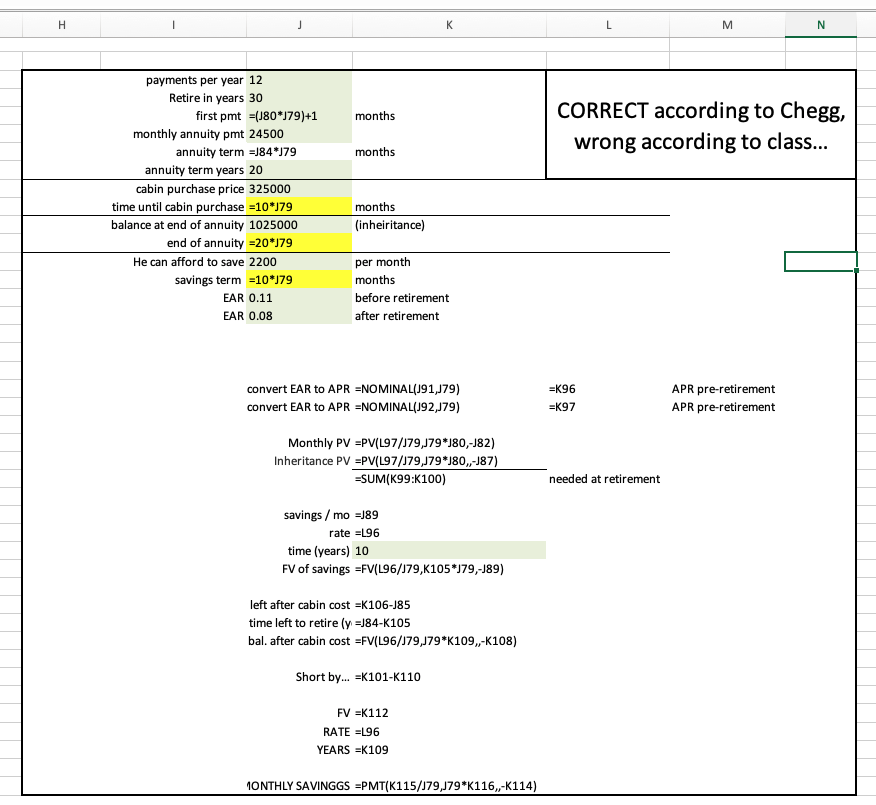

"Bilbo Baggins wants to save money to meet three objectives. First, he would like to be able to retire 30 years from now with a retirement income of $24,500 per month for 20 years, with the first payment received 30 years and 1 month from now. Second, he would like to purchase a cabin in Rivendell in 10 years at an estimated cost of $325,000. Third, after he passes on at the end of the 20 years of withdrawals, he would like to leave an inheritance of $1,025,000 to his nephew Frodo. He can afford to save $2,200 per month for the next 10 years. If he can earn an EAR of 11 percent before he retires and an EAR of 8 percent after he retires, how much will he have to save each month in Years 11 through 30? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Monthly savings $ "

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started