Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am trying to solve problem, and somebody has solved it on your site, but I am coming up with different answers. For example the

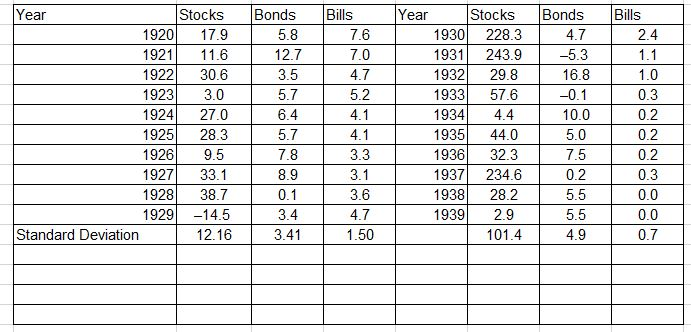

I am trying to solve problem, and somebody has solved it on your site, but I am coming up with different answers. For example the stocks in the 20s I used this formula =STDEV(C22:C31) but I come up with 12.6 and the expert comes up with 19.6.

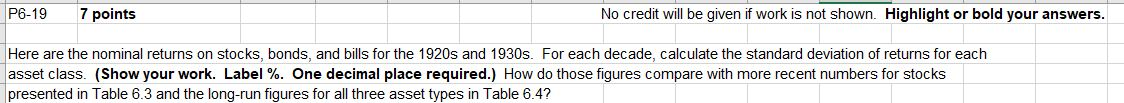

P6-197 points No credit will be given if work is not shown. Highlight or bold your answers. Here are the nominal returns on stocks, bonds, and bills for the 1920s and 1930s. For each decade, calculate the standard deviation of returns for each asset class. (Show your work. Label %. One decimal place required.) How do those figures compare with more recent numbers for stocks presented in Table 6.3 and the long-run figures for all three asset types in Table 6.4? Year Bills 7.6 7.0 4.7 5.2 4.1 1923 Stocks 1920 17.9 1921 11.6 1922 30.6 3.0 924 27.0 1925 28.3 1926 9.5 1927 33.1 1928 38.7 1929 -14.5 Standard Deviation 12.16 Bonds 5.8 127 3.5 5.7 6.4 5.7 l 7.8 8.9 0.1 3.4 3.41 Year Stocks Bonds Bills 1930 228.3 | 4.7 2.4 1931 243.9 -5.3 1.1 1932 29.8 16.8 1.0 1933) 57.6 -0.1 0.3 1934 4.4 | 10.0 0.2 1935 44.0 5.0 0.2 1936 32. 317.5 10.2 1937 234.6 0.3 1938 28.2 5.5 1 0.0 1939 2.9 0.0 101.4 4.9 0.7 4.1 3.3 3.1 3.6 0.2 4.7 1.50 Expert Answer shweta answered this 8,703 answers Was this answer helpful? Nominal Returns (%) on Stocks, Bonds, and Bills 1920s 1930s Stocks Bills Bonds Bills Bonds 5.8 -17.9 24 Stocks 76. -28.3 -43.9 4.7 7 -5.3 1.1 11.6 30.6 127 3.5 57.6 44 oil 323 -34.6 0.3 38.7 0.1 282 -14.5 29 Computing Standard Deviation Using Standev Function in Excel Standard Deviation (%) 19.98 3.41 1.50 34.74 6 .02 0.75 In the 1920s, stocks were also volatile as their recent history and as their long-run average, but in the 30s they were much more volatile than that. Both bonds and bills were less volatile in the 20s and 30s than they were over the whole 20th century

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started