i am unsure what to do, any help will be greatly appreciated.

this is for the cost potion of the excel sheet. other then that, calculations are needed to be done for the other portions.

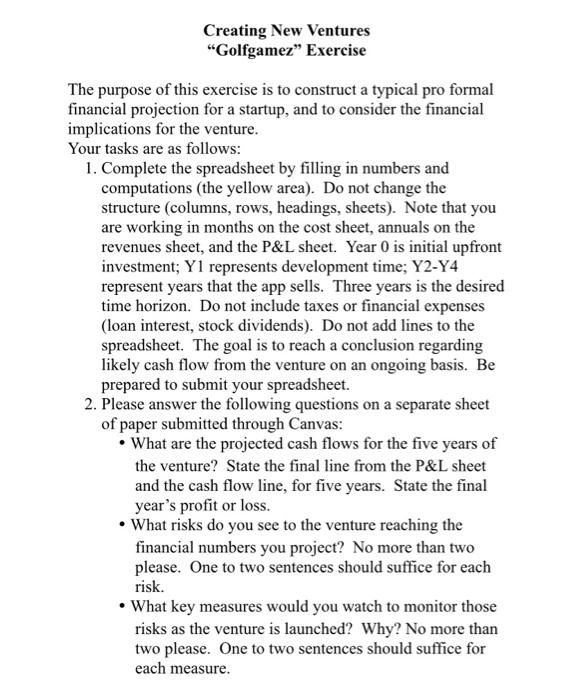

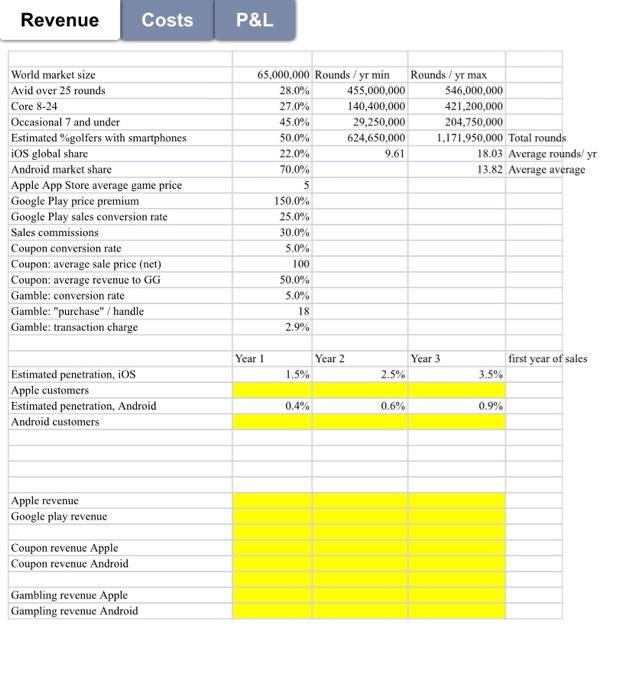

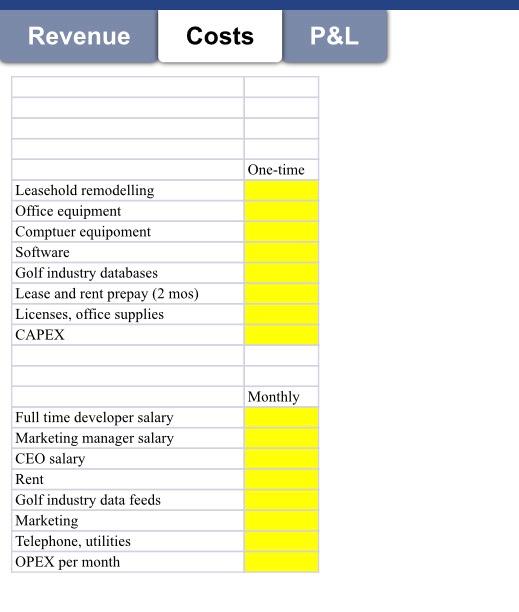

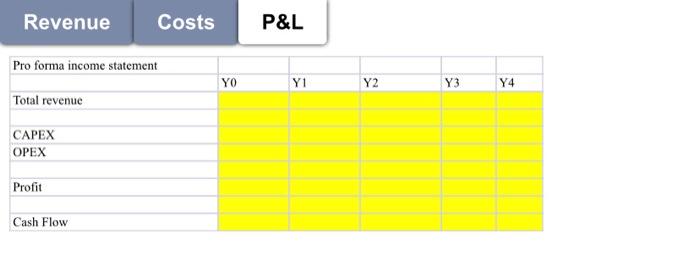

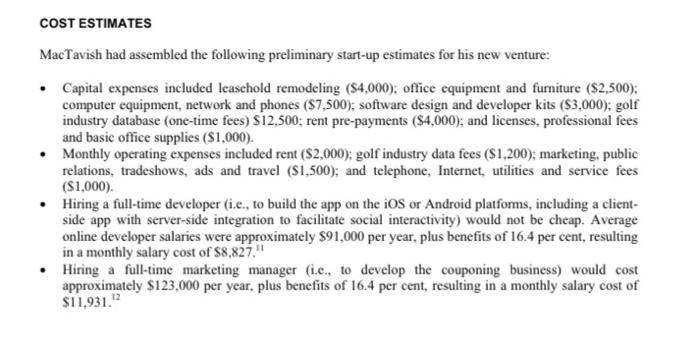

Creating New Ventures "Golfgamez" Exercise The purpose of this exercise is to construct a typical pro formal financial projection for a startup, and to consider the financial implications for the venture. Your tasks are as follows: 1. Complete the spreadsheet by filling in numbers and computations (the yellow area). Do not change the structure (columns, rows, headings, sheets). Note that you are working in months on the cost sheet, annuals on the revenues sheet, and the P&L sheet. Year O is initial upfront investment; Y1 represents development time; Y2-Y4 represent years that the app sells. Three years is the desired time horizon. Do not include taxes or financial expenses (loan interest, stock dividends). Do not add lines to the spreadsheet. The goal is to reach a conclusion regarding likely cash flow from the venture on an ongoing basis. Be prepared to submit your spreadsheet. 2. Please answer the following questions on a separate sheet of paper submitted through Canvas: What are the projected cash flows for the five years of the venture? State the final line from the P&L sheet and the cash flow line, for five years. State the final year's profit or loss. What risks do you see to the venture reaching the financial numbers you project? No more than two please. One to two sentences should suffice for each risk. What key measures would you watch to monitor those risks as the venture is launched? Why? No more than two please. One to two sentences should suffice for each measure. Revenue Costs P&L World market size Avid over 25 rounds Core 8-24 Occasional 7 and under Estimated golfers with smartphones iOS global share Android market share Apple App Store average game price Google Play price premium Google Play sales conversion rate Sales commissions Coupon conversion rate Coupon: average sale price (net) Coupon: average revenue to GG Gamble: conversion rate Gamble: "purchase"/handle Gamble: transaction charge 65,000,000 Rounds/yr min Rounds/yr max 28.0% 455,000,000 546,000,000 27.0% 140,400,000 421,200,000 45.0% 29,250,000 204,750,000 50.0% 624,650,000 1,171,950,000 Total rounds 22.0% 9.61 18.03 Average rounds/ yr 70.0% 13.82 Average average 5 150.0% 25.0% 30,0% 5.0% 100 50.0% 5.0% 18 2.9% Year 1 Year 2 first year of sales Year 3 2.5% 1.5% 3.5% Estimated penetration, ios Apple customers Estimated penetration, Android Android customers 0.4% 0.6% 0.9% Apple revenue Google play revenue Coupon revenue Apple Coupon revenue Android Gambling revenue Apple Gampling revenue Android Revenue Costs P&L P One-time Leasehold remodelling Office equipment Comptuer equipoment Software Golf industry databases Lease and rent prepay (2 mos) Licenses, office supplies CAPEX Monthly Full time developer salary Marketing manager salary CEO salary Rent Golf industry data feeds Marketing Telephone, utilities OPEX per month Revenue Costs P&L Pro forma income statement YO Y1 Y2 Y3 Y4 Total revenue CAPEX OPEX Profit Cash Flow COST ESTIMATES MacTavish had assembled the following preliminary start-up estimates for his new venture: Capital expenses included leasehold remodeling (54,000); office equipment and furniture ($2,500); computer equipment, network and phones ($7,500); software design and developer kits ($3,000); golf industry database (one-time fees) $12,500; rent pre-payments ($4,000); and licenses, professional fees and basic office supplies ($1,000). Monthly operating expenses included rent ($2,000); golf industry data fees ($1,200); marketing, public relations, tradeshows, ads and travel ($1,500); and telephone, Internet, utilities and service fees ($1,000). Hiring a full-time developer (i.c., to build the app on the iOS or Android platforms, including a client- side app with server-side integration to facilitate social interactivity) would not be cheap. Average online developer salaries were approximately $91,000 per year, plus benefits of 16.4 per cent, resulting in a monthly salary cost of $8,827. Hiring a full-time marketing manager (i.e., to develop the couponing business) would cost approximately $123,000 per year, plus benefits of 16.4 per cent, resulting in a monthly salary cost of $11.931." Creating New Ventures "Golfgamez" Exercise The purpose of this exercise is to construct a typical pro formal financial projection for a startup, and to consider the financial implications for the venture. Your tasks are as follows: 1. Complete the spreadsheet by filling in numbers and computations (the yellow area). Do not change the structure (columns, rows, headings, sheets). Note that you are working in months on the cost sheet, annuals on the revenues sheet, and the P&L sheet. Year O is initial upfront investment; Y1 represents development time; Y2-Y4 represent years that the app sells. Three years is the desired time horizon. Do not include taxes or financial expenses (loan interest, stock dividends). Do not add lines to the spreadsheet. The goal is to reach a conclusion regarding likely cash flow from the venture on an ongoing basis. Be prepared to submit your spreadsheet. 2. Please answer the following questions on a separate sheet of paper submitted through Canvas: What are the projected cash flows for the five years of the venture? State the final line from the P&L sheet and the cash flow line, for five years. State the final year's profit or loss. What risks do you see to the venture reaching the financial numbers you project? No more than two please. One to two sentences should suffice for each risk. What key measures would you watch to monitor those risks as the venture is launched? Why? No more than two please. One to two sentences should suffice for each measure. Revenue Costs P&L World market size Avid over 25 rounds Core 8-24 Occasional 7 and under Estimated golfers with smartphones iOS global share Android market share Apple App Store average game price Google Play price premium Google Play sales conversion rate Sales commissions Coupon conversion rate Coupon: average sale price (net) Coupon: average revenue to GG Gamble: conversion rate Gamble: "purchase"/handle Gamble: transaction charge 65,000,000 Rounds/yr min Rounds/yr max 28.0% 455,000,000 546,000,000 27.0% 140,400,000 421,200,000 45.0% 29,250,000 204,750,000 50.0% 624,650,000 1,171,950,000 Total rounds 22.0% 9.61 18.03 Average rounds/ yr 70.0% 13.82 Average average 5 150.0% 25.0% 30,0% 5.0% 100 50.0% 5.0% 18 2.9% Year 1 Year 2 first year of sales Year 3 2.5% 1.5% 3.5% Estimated penetration, ios Apple customers Estimated penetration, Android Android customers 0.4% 0.6% 0.9% Apple revenue Google play revenue Coupon revenue Apple Coupon revenue Android Gambling revenue Apple Gampling revenue Android Revenue Costs P&L P One-time Leasehold remodelling Office equipment Comptuer equipoment Software Golf industry databases Lease and rent prepay (2 mos) Licenses, office supplies CAPEX Monthly Full time developer salary Marketing manager salary CEO salary Rent Golf industry data feeds Marketing Telephone, utilities OPEX per month Revenue Costs P&L Pro forma income statement YO Y1 Y2 Y3 Y4 Total revenue CAPEX OPEX Profit Cash Flow COST ESTIMATES MacTavish had assembled the following preliminary start-up estimates for his new venture: Capital expenses included leasehold remodeling (54,000); office equipment and furniture ($2,500); computer equipment, network and phones ($7,500); software design and developer kits ($3,000); golf industry database (one-time fees) $12,500; rent pre-payments ($4,000); and licenses, professional fees and basic office supplies ($1,000). Monthly operating expenses included rent ($2,000); golf industry data fees ($1,200); marketing, public relations, tradeshows, ads and travel ($1,500); and telephone, Internet, utilities and service fees ($1,000). Hiring a full-time developer (i.c., to build the app on the iOS or Android platforms, including a client- side app with server-side integration to facilitate social interactivity) would not be cheap. Average online developer salaries were approximately $91,000 per year, plus benefits of 16.4 per cent, resulting in a monthly salary cost of $8,827. Hiring a full-time marketing manager (i.e., to develop the couponing business) would cost approximately $123,000 per year, plus benefits of 16.4 per cent, resulting in a monthly salary cost of $11.931