Answered step by step

Verified Expert Solution

Question

1 Approved Answer

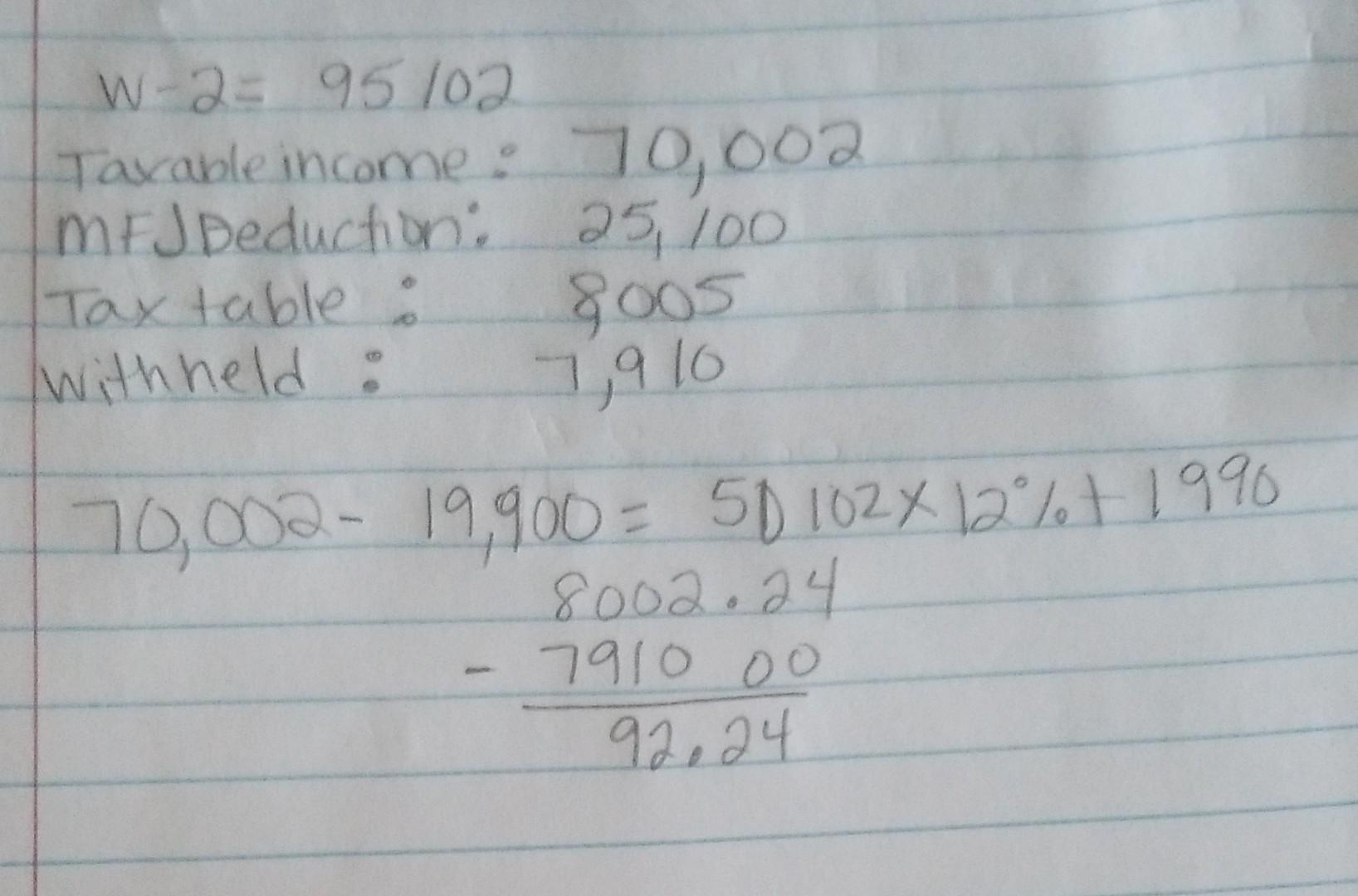

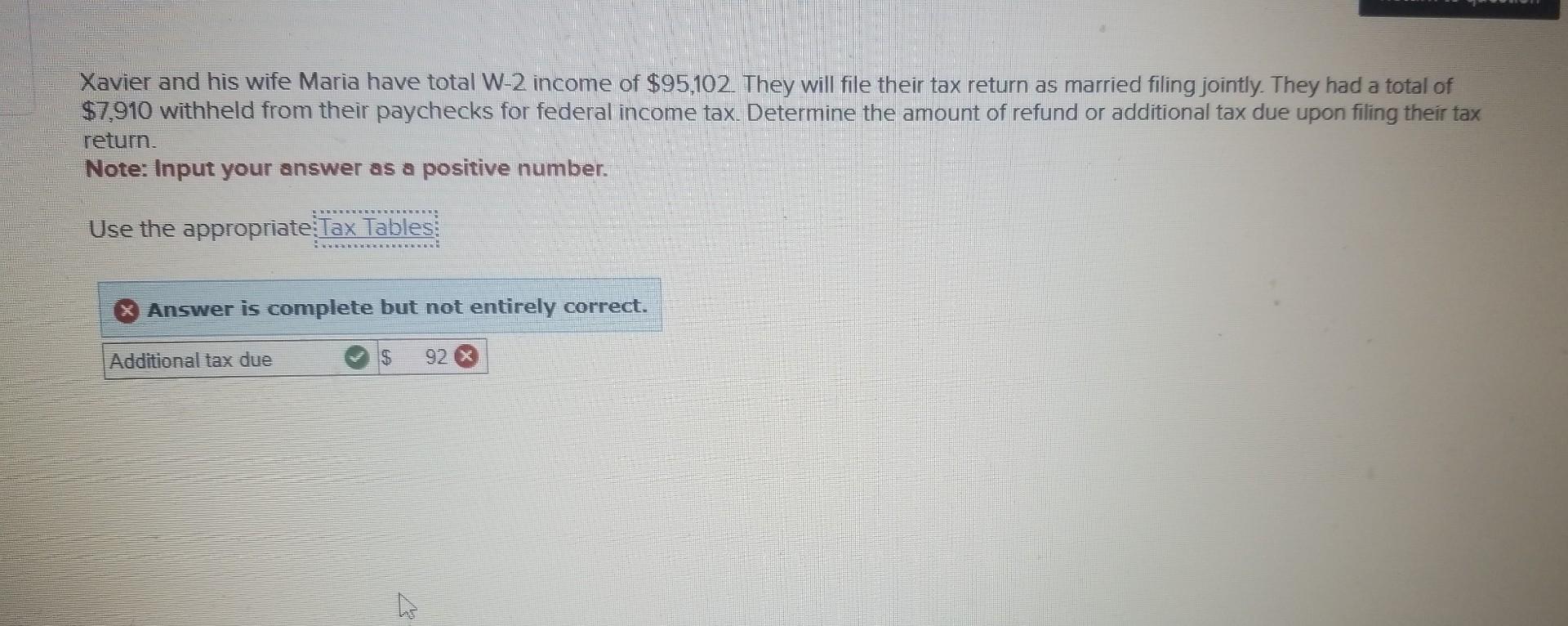

I am using TY 2021 charts. please explain what I am doing wrong w2=95102 Tavable income: 70,002 MFJDeduction: 25, 100 Taxtable: 8005 withneld: 7,910 70,00219,900=5010212%+19908002.2492.24791000

I am using TY 2021 charts. please explain what I am doing wrong

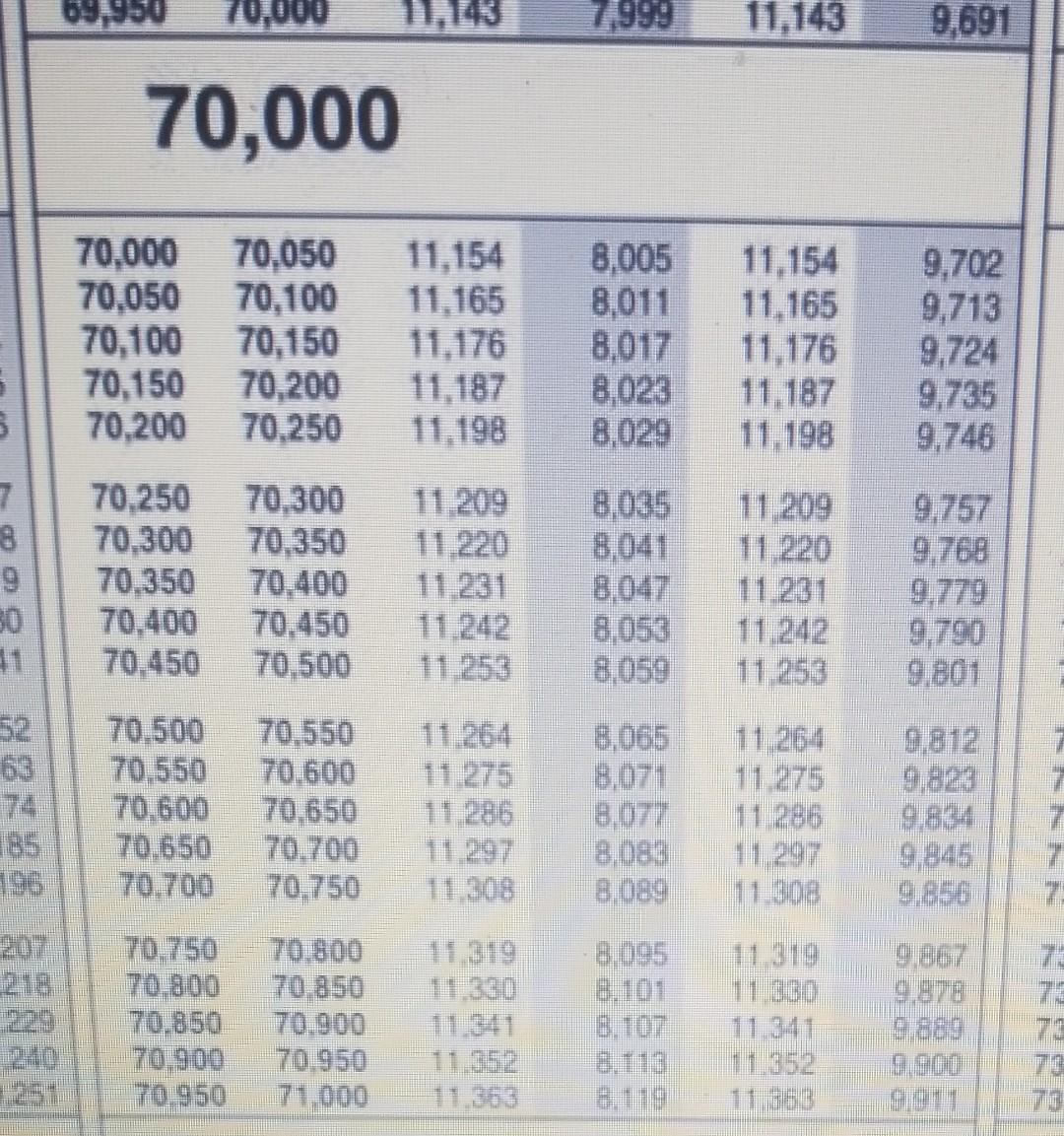

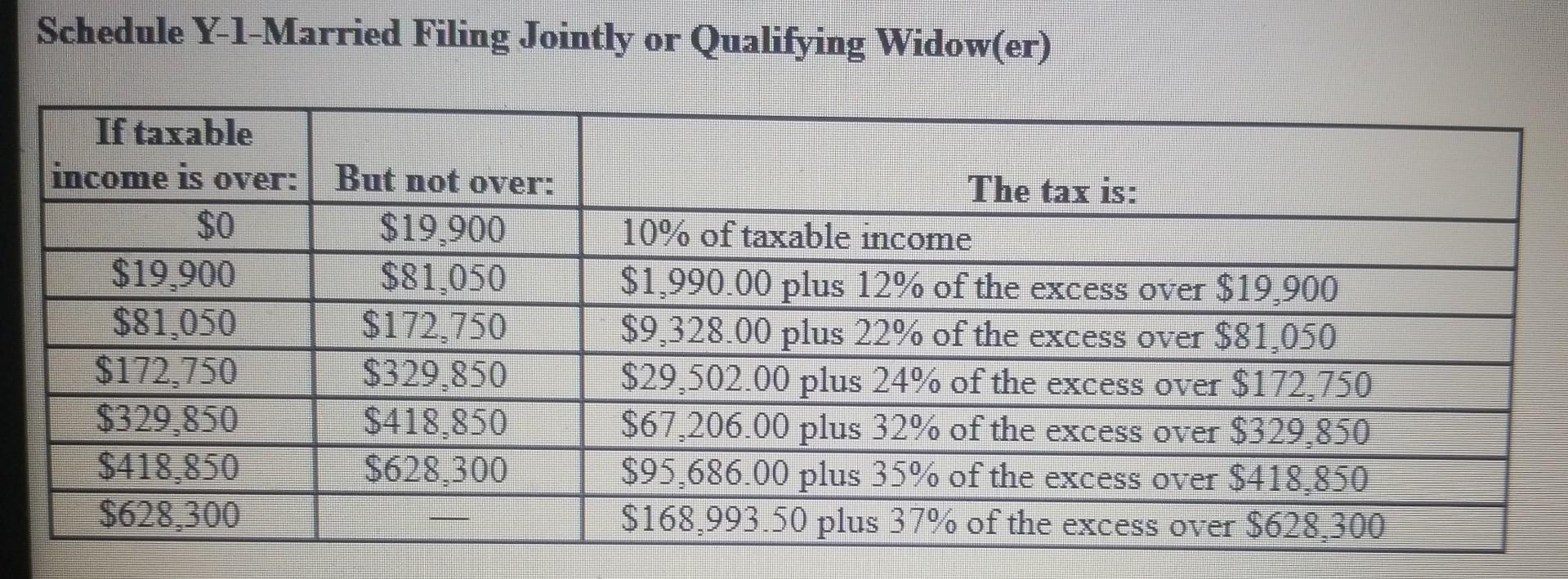

w2=95102 Tavable income: 70,002 MFJDeduction: 25, 100 Taxtable: 8005 withneld: 7,910 70,00219,900=5010212%+19908002.2492.24791000 70,000 \begin{tabular}{|llllll|} 70,000 & 70,050 & 11,154 & 8,005 & 11,154 & 9,702 \\ 70,050 & 70,100 & 11,165 & 8,011 & 11,165 & 9,713 \\ 70,100 & 70,150 & 11,176 & 8,017 & 11,176 & 9,724 \\ 70,150 & 70,200 & 11,187 & 8,023 & 11,187 & 9,735 \\ 70,200 & 70,250 & 11,198 & 8,029 & 11,198 & 9,746 \\ 70,250 & 70,300 & 11,209 & 8,035 & 11,209 & 9,757 \\ 70,300 & 70,350 & 11,220 & 8,041 & 11,220 & 9,768 \\ 70,350 & 70,400 & 11,231 & 8,047 & 11,231 & 9,779 \\ 70,400 & 70,450 & 11,242 & 8,053 & 11,242 & 9,790 \\ 70,450 & 70,500 & 11,253 & 8,059 & 11,253 & 9,801 \\ 70,500 & 70,550 & 11,264 & 8,065 & 11,264 & 9,812 \\ 70,550 & 70,600 & 11,275 & 8,071 & 11,275 & 9,823 \\ 70,600 & 70,650 & 11,286 & 8,077 & 11,286 & 9,834 \\ 70,650 & 70,700 & 11,297 & 8,083 & 11,297 & 9,845 \\ 70,700 & 70,750 & 11,308 & 8,089 & 11,308 & 9,856 \\ 70,750 & 70,800 & 11,319 & 8,095 & 11,319 & 9,867 \\ 70,800 & 70,850 & 11,330 & 8,101 & 11,330 & 9,878 \\ 70,850 & 70,900 & 11,341 & 8,107 & 11,341 & 9,889 \\ 70,900 & 70,950 & 11,352 & 8,113 & 11,352 & 9,900 \\ 70,950 & 71,000 & 11,363 & 8,119 & 11,353 & 9911 \\ \hline \end{tabular} Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) Xavier and his wife Maria have total W-2 income of $95,102. They will file their tax return as married filing jointly. They had a total of $7,910 withheld from their paychecks for federal income tax. Determine the amount of refund or additional tax due upon filing their tax return. Note: Input your answer as a positive number. Use the appropriate Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started