Question: I am working in accounting assignment this assignment provide the questions and the narrative as I attached... I answered the first 6 question and struggling

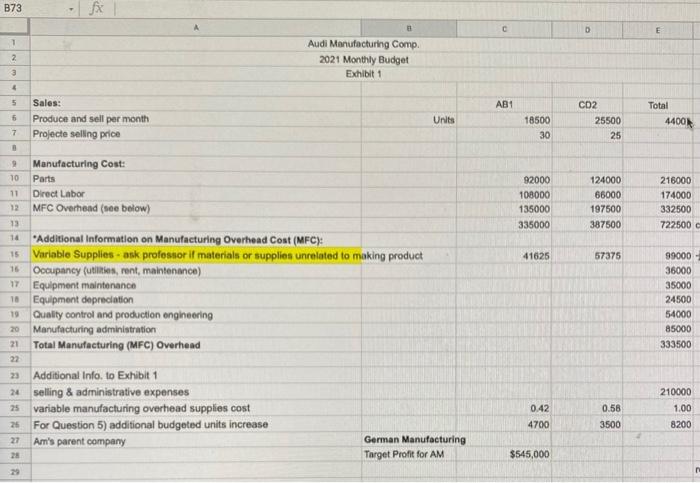

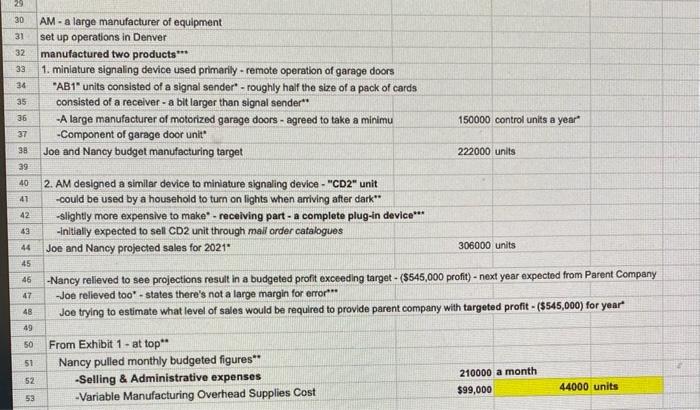

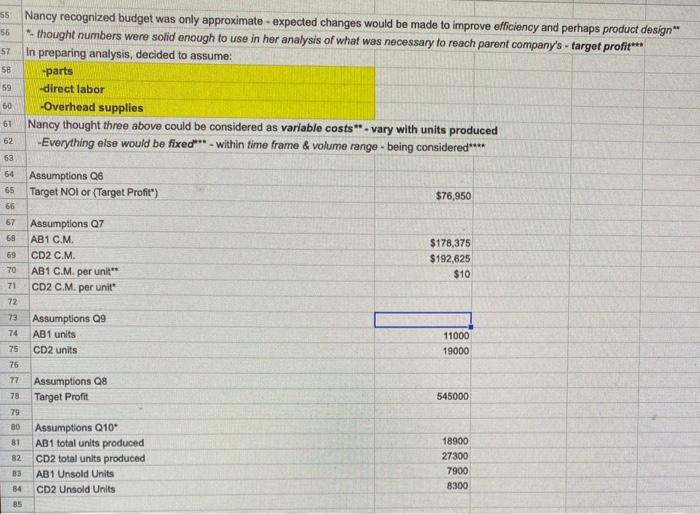

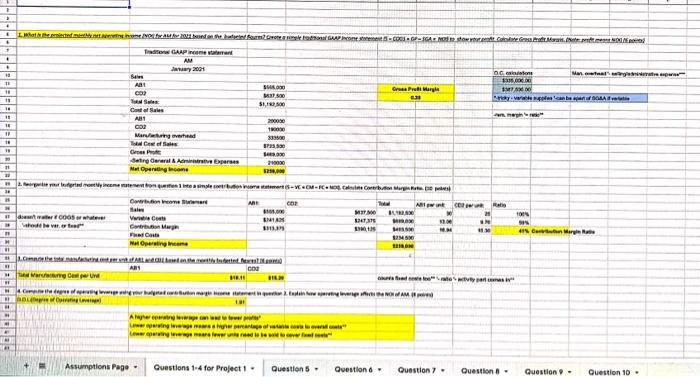

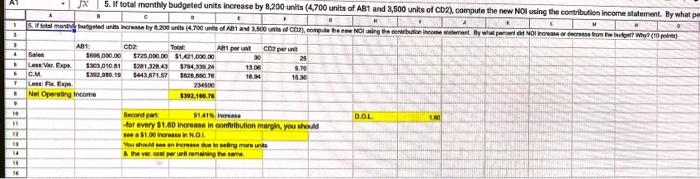

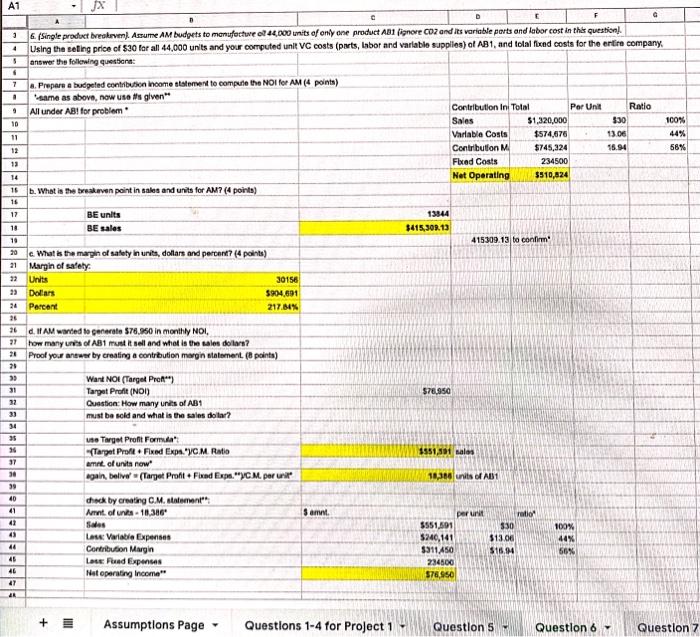

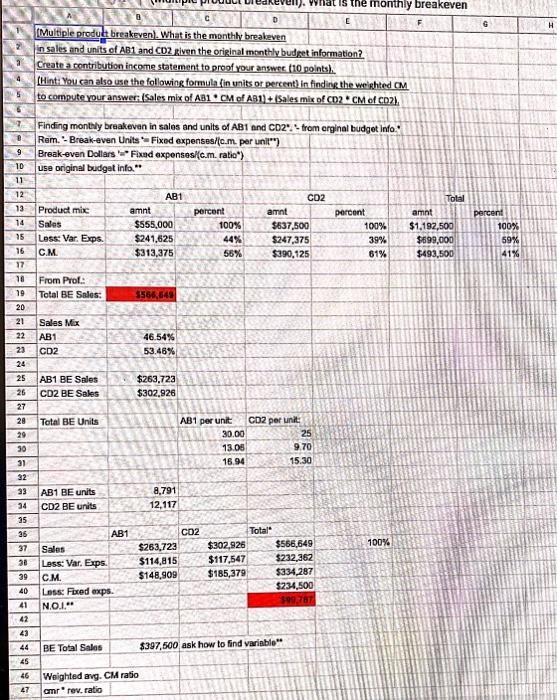

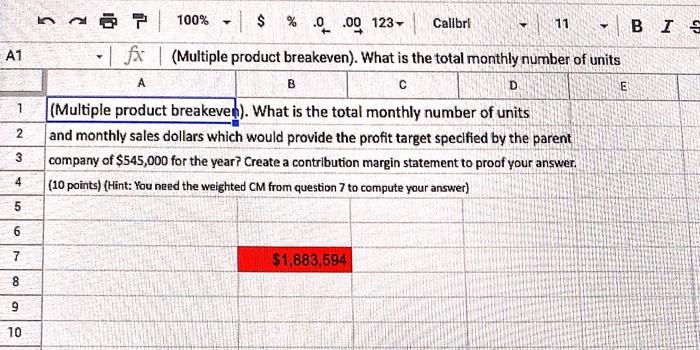

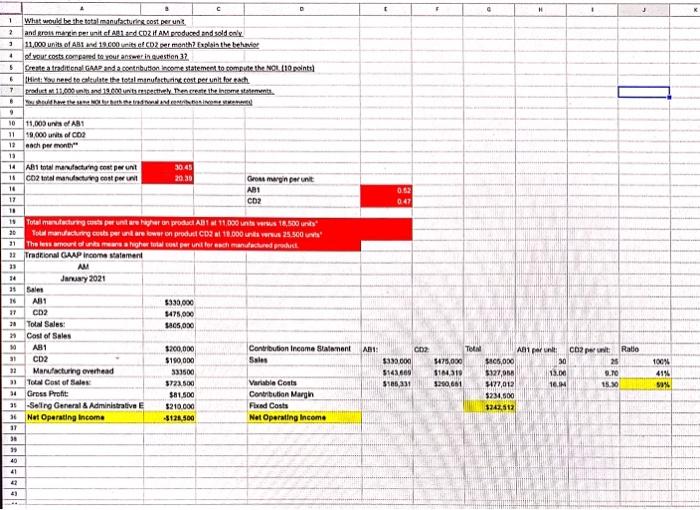

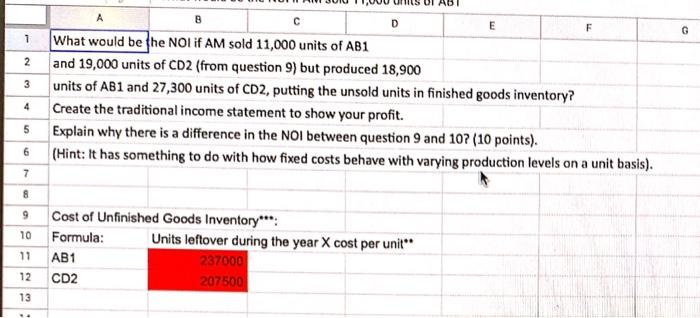

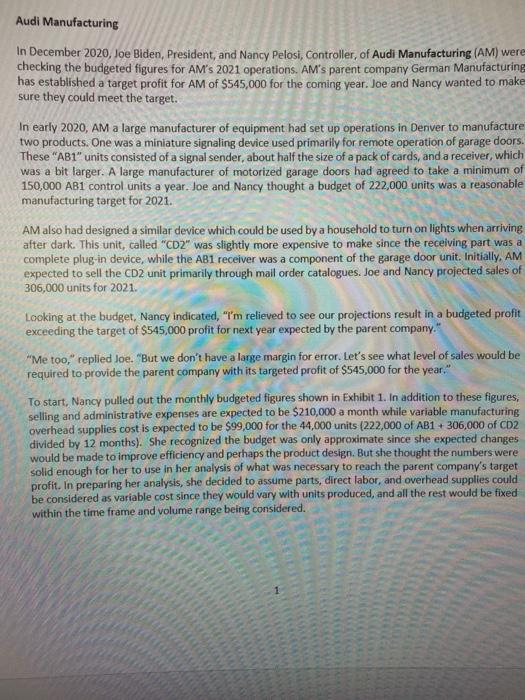

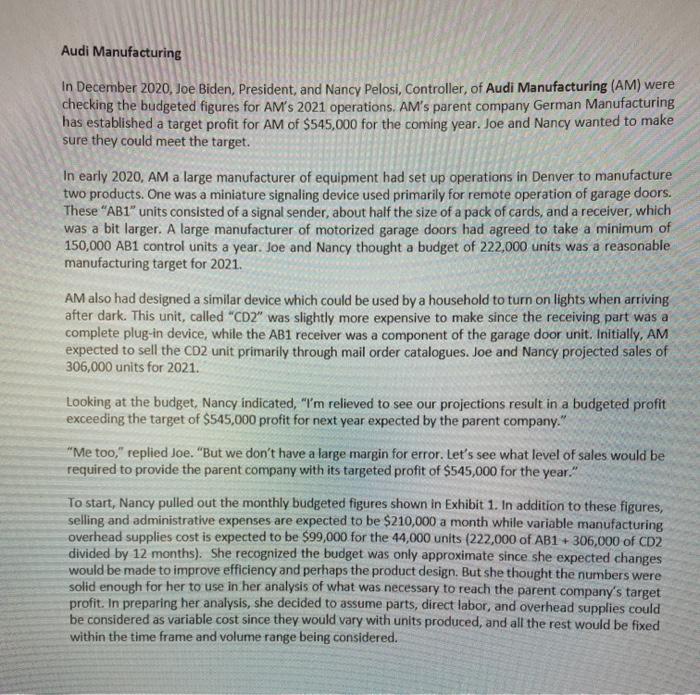

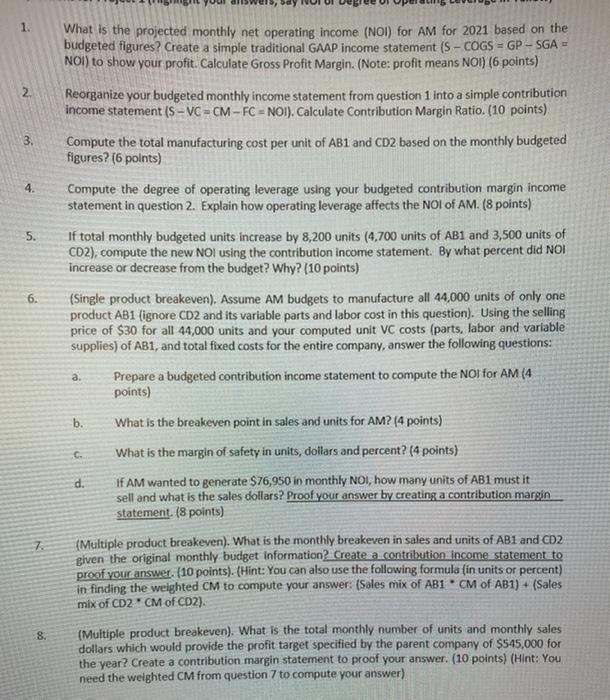

B73 D 1 2 a Audi Manufacturing Comp. 2021 Monthly Budget Exhibit 1 4 5 AB1 5 Sales: Produce and sell per month Projecte selling price Total 4400 Units CD2 25500 25 18500 30 7 10 Manufacturing Cost: Parts Direct Labor MFC Overhead (see below) 11 92000 108000 135000 335000 124000 66000 197500 387500 216000 174000 332500 722500 C 12 13 14 15 41625 57375 16 "Additional Information on Manufacturing Overhead Cost (MFC): Variable Supplies - ask professor il materials or supplies unrelated to making product Occupancy (utilities, rent, maintenance) 17 Equipment maintenance 16 Equipment depreciation 19 Quality control and production engineering 20 Manufacturing administration 21 Total Manufacturing (MFC) Overhead 22 23 Additional Info to Exhibit 1 24 seling & administrative expenses 75 variable manufacturing overhead supplies cost 25 For Question 5) additional budgeted units increase Am's parent company German Manufacturing Target Profit for AM 99000 36000 35000 24500 54000 85000 333500 0.42 0.58 3500 210000 1.00 8200 4700 27 $545,000 29 30 31 32 38 34 AM - a large manufacturer of equipment set up operations in Denver manufactured two products*** 1. miniature signaling device used primarily - remote operation of garage doors "AB1" units consisted of a signal sender* - roughly half the size of a pack of cards consisted of a receiver - a bit larger than signal sender** -A large manufacturer of motorized garage doors - agreed to take a minimu -Component of garage door unit Joe and Nancy budget manufacturing target 35 36 150000 control units a year 37 222000 units 38 39 40 47 42 2. AM designed a similar device to miniature signaling device - "CD2 unit -could be used by a household to turn on lights when arriving after dark" -slightly more expensive to make" - receiving part - a complete plug-in device *** -initially expected to sell CD2 unit through mall order catalogues Joe and Nancy projected sales for 2021* 44 306000 units 45 46 47 -Nancy relieved to see projections result in a budgeted profit exceeding target - ($545,000 profit) - next year expected from Parent Company -Joe relieved too - states there's not a large margin for error*** Joe trying to estimate what level of sales would be required to provide parent company with targeted profit - ($545,000) for year 48 49 50 51 From Exhibit 1. at top ** Nancy pulled monthly budgeted figures** -Selling & Administrative expenses -Variable Manufacturing Overhead Supplies Cost 52 210000 a month $99,000 44000 units 53 56 57 58 55 Nancy recognized budget was only approximate - expected changes would be made to improve efficiency and perhaps product design** thought numbers were solid enough to use in her analysis of what was necessary to reach parent company's - target profit*** In preparing analysis, decided to assume: -parts -direct labor -Overhead supplies 61 Nancy thought three above could be considered as variable costs" - vary with units produced 62 -Everything else would be fixed" - within time frame & volume range - being considered**** 59 60 63 64 65 Assumptions Q6 Target NOI or (Target Profit) $76,950 66 67 68 Assumptions Q7 AB1 C.M CD2 C.M. AB1 C.M. per unit CD2 C.M. per unit $178,375 $192,625 $10 69 70 71 72 73 74 Assumptions 29 AB1 units CD2 units 11000 19000 75 76 77 Assumptions Q8 Target Profit 78 545000 79 BO 81 82 Assumptions Q10" AB1 total units produced CD2 total units produced AB1 Unsold Units CD2 Unsold Units 18900 27300 7900 8300 B3 84 85 Lithother. NOLAMA. A GANG. M. Tradition GAAP content 13 2011 Se OG Manager 1. AD1 SG 18 CBD Groer war 11 The Sie de pe can be 13 $1,200 Candles 11 AB Anne 790000 1 GOR Marga 333 www effe SP3 Gm SON Setry General Active Expres Mat Operating come 20,00 . put ured one online marti-CMR Calle Generbr. ME COR Ant CC . MIMO do C009 whe 004 Www Cost BURDA 247,378 MAS IN Share SI Car Mary PC 411 urarea Mal Operating A.C.ML. ART GO Margard www.twitter wwwwwwwwww OIAM SOLO salt Awwwww wwwwwwwwwwwwwwww worter unterstwo Assumptions Page Questions 1-4 for Project 1 Question 5 - Question Question Question Question Question 10- AT Ja 5. If total monthly budgeted units increase by 8,200 units (4.700 units of AB1 and 3,500 units of CD2), compute the new Nol using the contribution income statement By what pe 1 1 5 bugsted units name by 8.200 (4.700 units of A1 M 3.0 CD2), onde her Nolig ha enribution in want By what Noir brome? Why (10 points) 3 1 25 ART CO2 Toen Al por Bale $69.000.00 S725000.00 $141.000.00 Las V. Exp 130001011 $281.228.4 1794,339.24 CM 12.10 5443671.57 1625.00 Lam Nel Operating Income 122.180.0 Copa MO 13.08 10.94 5 9 18.30 . . DOL Secondo 51415 W for every $1.00 increase in contribution margin, you should 031.00 increase in NOI Yhden hengere A recorrenting the same 18 14 18 A1 G 3 JX D 6. (Single product breakeven). Assume AM budgets to manufactwe 44,000 units of only one product AB1 (ignore CO2 and its variable parts and labor cost in the question Using the selling price of $30 for all 44,000 units and your computed unit VC costs (parts, Labor and variable supplies) of AB1, and total fixed costs for the entire company, answer the following questions: 4 5 . 7 . 6. Prepare a budgeted contribution Income statement to compare the NOI for AM (4 points) same as above, now use is given All under ABI for problem Ratla 9 330 10 Contribution in Total Por Unit Sales $1,320,000 Variable Costs $574,676 Contribution $745,324 Fbed Costs 234500 Net Operating $510,624 11 100% 44% 56% 13.00 15.94 12 13 14 16 b. What is the break even point in sales and units for AM? (4 points) 16 17 13844 BE units BE sales 10 $415,309.13 10 415309.13 to contin 20 c. What is the map of safety in units, dollars and percent? (4 points) 21 Margin of safety 32 Units 30156 Dollars $904.691 24 Percent 217,84% 26 26 d. I AM wanted to generate 576.960 in monthly NOI 77 how many of A81 must sell and what is the sales dollars? 21 Proof your answer by creating a contribution margin statement. (points) 29 59 Want NO! (Targed Pro) 31 Target Profit (NOI) 32 Question: How many units of AB1 must be sold and what is the sales dotar? $76.950 33 34 35 96 1951,31 malas 30 10,300 units of Al 1 19 40 41 42 Trgot Profit Formula Target Prof. Fired Expe. "YCM Ratio armat. of unita now again, belive (Target Profit + Fixed Expo. "YC.M. per unit dick by creating C.M.statements Arant of its - 18,386 ses Los: Variable Expenses Contribution Margin Las Fund Expenses Not operating Income" amt 43 perunt $551.591 $240,141 $311 450 234800 576950 ratio 330 $13.06 $16.99 100% 44% 50% 44 45 46 47 AR + Assumptions Page Questions 1-4 for Project 1 Question 5 Question 6 Question 7 4 B 10 the monthly breakeven E (Multiple product breakeven). What is the monthly breakeven in sales and units of AB1 and CD2 given the original monthly budget information? 2 Create a contribution income statement to proof your answer. (10 points) (Hint: You can also use the following formula in units or percent) in finding the weighted CM 5 to compute your answer: (Sales mix of AB1 CM of A81) + Sales mix of CD2 CM of CO2), 12 Finding monthly breakeven in sales and units of AB1 and CD2".Strom orginal budget Info. Rem.- Break-even Units Fixed expenses/fc.m. per unit) 9 Break-even Dollars Fixad expenses/fc.m. ratio) use original budget info." 11 12 AB1 CO2 Total 13 Product mix amnt percent amnt percent amnt 14 Sales $555,000 100% $637,500 100% $1,192,500 75 Less: Var. Exps. $241,625 44% $247,375 39% $699,000 16 C.M. $313,375 55% $390,125 61% $493,500 17 18 From Prof. Total BE Sales: $566,849 20 21 Sales Mix 22 AB1 46.54% 23 CD2 53.48% 24 25 AB1 BE Sales $263,723 26 CD2 BE Sales $302.926 27 Total BE Units AB1 per unit CD2 per unit 30.00 25 13.08 9.70 16.94 percent 100% 59% 41% 19 29 30 31 15.30 32 33 AB1 BE units CD2 BE units 8,791 12,117 34 25 35 100% 37 30 AB1 Sales Less: Var. Exps. . Loss: Fored exps. Noi CO2 $263,723 $114,815 $148,909 Total $302.926 $566,649 $117,547 $232,362 $185,379 $334,287 $234,500 39 40 41 42 43 BE Total Sales $397,500 ask how to find variable 44 45 46 Weighted avg. CM ratio amrrev, ratio 47 2 A1 A D E 1 @ 100% | $ % .0 .00 123- Callbri - 11 - BI - fx (Multiple product breakeven). What is the total monthly number of units B (Multiple product breakever). What is the total monthly number of units and monthly sales dollars which would provide the profit target specified by the parent company of $545,000 for the year? Create a contribution margin statement to proof your answer. (10 points) (Hint: You need the weighted CM from question to compute your answer) ND 3 4 5 6 6 7 $1,883,594 8 9 10 N J 1 2 3 4 What would be the staloufacturing cost per un and grens manca per unit of Aland COZ I AM produced and sold only 11.000 units of ABI and 19.000 units ECD per month? Explain the behavio od your costs compared to your answer in question 32 Crente a traditional GAAP anda.button income statement to compute the NCL points) Huned to the total manufacturing cost per unit for each dict 11.000 and 10 meter. Then create the neemt She these this 5 T 8 0.62 047 30 11,000 US AB 11 19.000 units of CO2 12 each per month 13 14 AB1 to ung cost perunt 30.48 16 CO2many cost per unit 20.30 Grown perunt 14 ABI 17 CD2 11 11 Total manufacturing perheron product ABT 11.000 18.500 units 20 Toll manufacturing cuts per un are wron product C2 18.000 25.500 11 The fessur olunmaliger til performance Traditional GAAP income Matament AM 14 Jary 2021 35 ales A81 $330.000 37 CD2 $475,000 30 Total Sales: 1405,000 Cost of Sales 10 AS1 1.200,000 Contribution Income Statement AB 31 CD2 $150,000 Sales 13 Manufacturing overhead 333500 To Cost of Sales 3723.500 Variable Costa 34 Gross Profit $81.500 Contribution Margin 31 Selling General Administrative 1210.000 Pared Costs Net Operating Income -$121.500 Net Operating Income 11 CO2 $333.000 $168609 $185,331 TO 5475,000 $144319 3200,681 Afin CO2 per un Ratio M165,000 30 25 5127,98 13.00 9.TO $177,012 16. 15.30 $234,600 $243,512 100% 41% 50% 38 35 40 4 43 D E F G 1 2 3 What would be the NOI if AM sold 11,000 units of AB1 and 19,000 units of CD2 (from question 9) but produced 18,900 units of AB1 and 27,300 units of CD2, putting the unsold units in finished goods inventory? Create the traditional income statement to show your profit. Explain why there is a difference in the NOI between question 9 and 10? (10 points). (Hint: It has something to do with how fixed costs behave with varying production levels on a unit basis). 4 5 6 7 8 9 10 Cost of Unfinished Goods Inventory": Formula: Units leftover during the year X cost per unit" AB1 237000 CD2 207500 11 12 13 Audi Manufacturing In December 2020, Joe Biden, President, and Nancy Pelosi, Controller, of Audi Manufacturing (AM) were checking the budgeted figures for AM's 2021 operations. AM's parent company German Manufacturing has established a target profit for AM of $545,000 for the coming year. Joe and Nancy wanted to make sure they could meet the target. In early 2020, AM a large manufacturer of equipment had set up operations in Denver to manufacture two products. One was a miniature signaling device used primarily for remote operation of garage doors. These "AB1" units consisted of a signal sender, about half the size of a pack of cards, and a receiver, which was a bit larger. A large manufacturer of motorized garage doors had agreed to take a minimum of 150,000 AB1 control units a year. Joe and Nancy thought a budget of 222,000 units was a reasonable manufacturing target for 2021. AM also had designed a similar device which could be used by a household to turn on lights when arriving after dark. This unit, called "CD2" was slightly more expensive to make since the receiving part was a complete plug-in device, while the AB1 receiver was a component of the garage door unit. Initially, AM expected to sell the CD2 unit primarily through mail order catalogues. Joe and Nancy projected sales of 306,000 units for 2021. Looking at the budget, Nancy indicated, "I'm relieved to see our projections result in a budgeted profit exceeding the target of $545,000 profit for next year expected by the parent company." "Me too." replied Joe. "But we don't have a large margin for error. Let's see what level of sales would be required to provide the parent company with its targeted profit of $545,000 for the year." To start, Nancy pulled out the monthly budgeted figures shown in Exhibit 1. In addition to these figures, selling and administrative expenses are expected to be $210,000 a month while variable manufacturing overhead supplies cost is expected to be $99,000 for the 44,000 units (222,000 of AB1 + 306,000 of CD2 divided by 12 months). She recognized the budget was only approximate since she expected changes would be made to improve efficiency and perhaps the product design. But she thought the numbers were solid enough for her to use in her analysis of what was necessary to reach the parent company's target profit. In preparing her analysis, she decided to assume parts, direct labor, and overhead supplies could be considered as variable cost since they would vary with units produced, and all the rest would be fixed within the time frame and volume range being considered. Audi Manufacturing In December 2020, Joe Biden, President, and Nancy Pelosi, Controller, of Audi Manufacturing (AM) were checking the budgeted figures for AM's 2021 operations. AM's parent company German Manufacturing has established a target profit for AM of $545,000 for the coming year. Joe and Nancy wanted to make sure they could meet the target. In early 2020, AM a large manufacturer of equipment had set up operations in Denver to manufacture two products. One was a miniature signaling device used primarily for remote operation of garage doors. These AB1" units consisted of a signal sender, about half the size of a pack of cards, and a receiver, which was a bit larger. A large manufacturer of motorized garage doors had agreed to take a minimum of 150,000 AB1 control units a year. Joe and Nancy thought a budget of 222,000 units was a reasonable manufacturing target for 2021. AM also had designed a similar device which could be used by a household to turn on lights when arriving after dark. This unit, called "CD2" was slightly more expensive to make since the receiving part was a complete plug-in device, while the AB1 receiver was a component of the garage door unit. Initially, AM expected to sell the CD2 unit primarily through mail order catalogues. Joe and Nancy projected sales of 306,000 units for 2021. Looking at the budget. Nancy indicated, "I'm relieved to see our projections result in a budgeted profit exceeding the target of $545,000 profit for next year expected by the parent company." "Me too," replied Joe. "But we don't have a large margin for error. Let's see what level of sales would be required to provide the parent company with its targeted profit of $545,000 for the year." To start, Nancy pulled out the monthly budgeted figures shown in Exhibit 1. In addition to these figures, selling and administrative expenses are expected to be $210,000 a month while variable manufacturing overhead supplies cost is expected to be $99,000 for the 44,000 units (222,000 of AB1+306,000 of CD2 divided by 12 months). She recognized the budget was only approximate since she expected changes would be made to improve efficiency and perhaps the product design. But she thought the numbers were solid enough for her to use in her analysis of what was necessary to reach the parent company's target profit. In preparing her analysis, she decided to assume parts, direct labor, and overhead supplies could be considered as variable cost since they would vary with units produced, and all the rest would be fixed within the time frame and volume range being considered. 1. 2 3. 4. What is the projected monthly net operating income (NOI) for AM for 2021 based on the budgeted figures? Create a simple traditional GAAP income statement (S - COGS = GP - SGA - NOI) to show your profit. Calculate Gross Profit Margin. (Note: profit means NOI) (6 points) Reorganize your budgeted monthly income statement from question 1 into a simple contribution income statement (S-VC = CM - FC = NOI). Calculate Contribution Margin Ratio. (10 points) Compute the total manufacturing cost per unit of AB1 and CD2 based on the monthly budgeted figures? (6 points) Compute the degree of operating leverage using your budgeted contribution margin income statement in question 2. Explain how operating leverage affects the NOI of AM. (8 points) If total monthly budgeted units increase by 8,200 units (4,700 units of AB1 and 3,500 units of CD2), compute the new NOI using the contribution income statement. By what percent did NOI increase or decrease from the budget? Why? (10 points) (Single product breakeven). Assume AM budgets to manufacture all 44,000 units of only one product AB1 (ignore CD2 and its variable parts and labor cost in this question). Using the selling price of $30 for all 44,000 units and your computed unit VC costs (parts, labor and variable supplies) of AB1, and total fixed costs for the entire company, answer the following questions: Prepare a budgeted contribution income statement to compute the NOI for AM (4 points) 5. 6. a. c b. What is the breakeven point in sales and units for AM? (4 points) What is the margin of safety in units, dollars and percent? (4 points) d. If AM wanted to generate $76,950 in monthly NOI, how many units of AB1 must it sell and what is the sales dollars? Proof your answer by creating a contribution margin statement. (8 points) (Multiple product breakeven). What is the monthly breakeven in sales and units of AB1 and CD2 given the original monthly budget information? Create a contribution Income statement to proof your answer. (10 points). (Hint: You can also use the following formula (in units or percent) in finding the weighted CM to compute your answer: (Sales mix of AB1 CM of AB1) + (Sales mix of CD2 CM of CD2). 7 8. (Multiple product breakeven). What is the total monthly number of units and monthly sales dollars which would provide the profit target specified by the parent company of $545,000 for the year? Create a contribution margin statement to proof your answer. (10 points) (Hint: You need the weighted CM from question 7 to compute your answer) 9. What would be the total manufacturing cost per unit and gross margin per unit of AB1 and CD2 if AM produced and sold only 11,000 units of AB1 and 19,000 units of CD2 per month? Explain the behavior of your costs compared to your answer in question 3? Create a traditional GAAP and a contribution income statement to compute the NOI. (10 points) (Hint: You need to calculate the total manufacturing cost per unit for each product at 11,000 units and 19,000 units respectively. Then create the income statements. You should have the same Nol for both the traditional and contribution income statements) 10. What would be the NOI if AM sold 11,000 units of AB1 and 19,000 units of CD2 (from question 9) but produced 18,900 units of AB1 and 27,300 units of CD2, putting the unsold units in finished goods inventory? Create the traditional income statement to show your profit. Explain why there is a difference in the Nol between question 9 and 10? (10 points). (Hint: It has something to do with how fixed costs behave with varying production levels on a unit basis). Project Requirements: 1. The Project must be prepared using an Excel spreadsheet. The first worksheet in the spreadsheet should be labeled "Assumptions". This sheet is used to enter all of the data from the project description from Exhibit 1. Thereafter, enter each questions' data assumptions and label it with the question number. These assumptions are to be used in the tabs which follow for each question. Next, create seven more worksheet tabs. The first tab is for Questions 1-4 and the remaining questions (questions 5-10) should be answered on separate worksheet tabs and numbered accordingly, i.e. Q1-4, 25, 26, and so on. Only the data assumptions needed for each question should be entered and no answers should be calculated in the Assumptions page. The Assumptions page should not use more than 50 rows of data. 2. 3. All computations and solutions must be linked to the assumptions page by links or formulas. Formulas can also be linked to other worksheets or within worksheets. You are not allowed to type any number in any formula in any worksheet except on the Assumptions page. You must label each question on each spreadsheet. Submit the project (as one document) per team in Canvas/Projects by the due date and time. The project file should be named with the team number as follows, Team #_Project 1.xlsx Students are cautioned not to use any file or template from previous quarters or courses. All files must be created by students during the quarter on their respective group member computers. All files will be scanned to ensure compliance. Any student with files or templates from previous quarters or unknown computers will automatically receive a zero for the project and referred to the Office of Student conduct for further disciplinary action including receiving a failing grade for the course. You are advised to begin early on the project to avoid problems with group members as well as to have any questions, concerns or issued addressed by the instructor well in advance of the due date. Students are hereby warned working on the project on the day before it is due is unlikely to result in the submission of a project which receives a passing grade. 4. 3 B73 D 1 2 a Audi Manufacturing Comp. 2021 Monthly Budget Exhibit 1 4 5 AB1 5 Sales: Produce and sell per month Projecte selling price Total 4400 Units CD2 25500 25 18500 30 7 10 Manufacturing Cost: Parts Direct Labor MFC Overhead (see below) 11 92000 108000 135000 335000 124000 66000 197500 387500 216000 174000 332500 722500 C 12 13 14 15 41625 57375 16 "Additional Information on Manufacturing Overhead Cost (MFC): Variable Supplies - ask professor il materials or supplies unrelated to making product Occupancy (utilities, rent, maintenance) 17 Equipment maintenance 16 Equipment depreciation 19 Quality control and production engineering 20 Manufacturing administration 21 Total Manufacturing (MFC) Overhead 22 23 Additional Info to Exhibit 1 24 seling & administrative expenses 75 variable manufacturing overhead supplies cost 25 For Question 5) additional budgeted units increase Am's parent company German Manufacturing Target Profit for AM 99000 36000 35000 24500 54000 85000 333500 0.42 0.58 3500 210000 1.00 8200 4700 27 $545,000 29 30 31 32 38 34 AM - a large manufacturer of equipment set up operations in Denver manufactured two products*** 1. miniature signaling device used primarily - remote operation of garage doors "AB1" units consisted of a signal sender* - roughly half the size of a pack of cards consisted of a receiver - a bit larger than signal sender** -A large manufacturer of motorized garage doors - agreed to take a minimu -Component of garage door unit Joe and Nancy budget manufacturing target 35 36 150000 control units a year 37 222000 units 38 39 40 47 42 2. AM designed a similar device to miniature signaling device - "CD2 unit -could be used by a household to turn on lights when arriving after dark" -slightly more expensive to make" - receiving part - a complete plug-in device *** -initially expected to sell CD2 unit through mall order catalogues Joe and Nancy projected sales for 2021* 44 306000 units 45 46 47 -Nancy relieved to see projections result in a budgeted profit exceeding target - ($545,000 profit) - next year expected from Parent Company -Joe relieved too - states there's not a large margin for error*** Joe trying to estimate what level of sales would be required to provide parent company with targeted profit - ($545,000) for year 48 49 50 51 From Exhibit 1. at top ** Nancy pulled monthly budgeted figures** -Selling & Administrative expenses -Variable Manufacturing Overhead Supplies Cost 52 210000 a month $99,000 44000 units 53 56 57 58 55 Nancy recognized budget was only approximate - expected changes would be made to improve efficiency and perhaps product design** thought numbers were solid enough to use in her analysis of what was necessary to reach parent company's - target profit*** In preparing analysis, decided to assume: -parts -direct labor -Overhead supplies 61 Nancy thought three above could be considered as variable costs" - vary with units produced 62 -Everything else would be fixed" - within time frame & volume range - being considered**** 59 60 63 64 65 Assumptions Q6 Target NOI or (Target Profit) $76,950 66 67 68 Assumptions Q7 AB1 C.M CD2 C.M. AB1 C.M. per unit CD2 C.M. per unit $178,375 $192,625 $10 69 70 71 72 73 74 Assumptions 29 AB1 units CD2 units 11000 19000 75 76 77 Assumptions Q8 Target Profit 78 545000 79 BO 81 82 Assumptions Q10" AB1 total units produced CD2 total units produced AB1 Unsold Units CD2 Unsold Units 18900 27300 7900 8300 B3 84 85 Lithother. NOLAMA. A GANG. M. Tradition GAAP content 13 2011 Se OG Manager 1. AD1 SG 18 CBD Groer war 11 The Sie de pe can be 13 $1,200 Candles 11 AB Anne 790000 1 GOR Marga 333 www effe SP3 Gm SON Setry General Active Expres Mat Operating come 20,00 . put ured one online marti-CMR Calle Generbr. ME COR Ant CC . MIMO do C009 whe 004 Www Cost BURDA 247,378 MAS IN Share SI Car Mary PC 411 urarea Mal Operating A.C.ML. ART GO Margard www.twitter wwwwwwwwww OIAM SOLO salt Awwwww wwwwwwwwwwwwwwww worter unterstwo Assumptions Page Questions 1-4 for Project 1 Question 5 - Question Question Question Question Question 10- AT Ja 5. If total monthly budgeted units increase by 8,200 units (4.700 units of AB1 and 3,500 units of CD2), compute the new Nol using the contribution income statement By what pe 1 1 5 bugsted units name by 8.200 (4.700 units of A1 M 3.0 CD2), onde her Nolig ha enribution in want By what Noir brome? Why (10 points) 3 1 25 ART CO2 Toen Al por Bale $69.000.00 S725000.00 $141.000.00 Las V. Exp 130001011 $281.228.4 1794,339.24 CM 12.10 5443671.57 1625.00 Lam Nel Operating Income 122.180.0 Copa MO 13.08 10.94 5 9 18.30 . . DOL Secondo 51415 W for every $1.00 increase in contribution margin, you should 031.00 increase in NOI Yhden hengere A recorrenting the same 18 14 18 A1 G 3 JX D 6. (Single product breakeven). Assume AM budgets to manufactwe 44,000 units of only one product AB1 (ignore CO2 and its variable parts and labor cost in the question Using the selling price of $30 for all 44,000 units and your computed unit VC costs (parts, Labor and variable supplies) of AB1, and total fixed costs for the entire company, answer the following questions: 4 5 . 7 . 6. Prepare a budgeted contribution Income statement to compare the NOI for AM (4 points) same as above, now use is given All under ABI for problem Ratla 9 330 10 Contribution in Total Por Unit Sales $1,320,000 Variable Costs $574,676 Contribution $745,324 Fbed Costs 234500 Net Operating $510,624 11 100% 44% 56% 13.00 15.94 12 13 14 16 b. What is the break even point in sales and units for AM? (4 points) 16 17 13844 BE units BE sales 10 $415,309.13 10 415309.13 to contin 20 c. What is the map of safety in units, dollars and percent? (4 points) 21 Margin of safety 32 Units 30156 Dollars $904.691 24 Percent 217,84% 26 26 d. I AM wanted to generate 576.960 in monthly NOI 77 how many of A81 must sell and what is the sales dollars? 21 Proof your answer by creating a contribution margin statement. (points) 29 59 Want NO! (Targed Pro) 31 Target Profit (NOI) 32 Question: How many units of AB1 must be sold and what is the sales dotar? $76.950 33 34 35 96 1951,31 malas 30 10,300 units of Al 1 19 40 41 42 Trgot Profit Formula Target Prof. Fired Expe. "YCM Ratio armat. of unita now again, belive (Target Profit + Fixed Expo. "YC.M. per unit dick by creating C.M.statements Arant of its - 18,386 ses Los: Variable Expenses Contribution Margin Las Fund Expenses Not operating Income" amt 43 perunt $551.591 $240,141 $311 450 234800 576950 ratio 330 $13.06 $16.99 100% 44% 50% 44 45 46 47 AR + Assumptions Page Questions 1-4 for Project 1 Question 5 Question 6 Question 7 4 B 10 the monthly breakeven E (Multiple product breakeven). What is the monthly breakeven in sales and units of AB1 and CD2 given the original monthly budget information? 2 Create a contribution income statement to proof your answer. (10 points) (Hint: You can also use the following formula in units or percent) in finding the weighted CM 5 to compute your answer: (Sales mix of AB1 CM of A81) + Sales mix of CD2 CM of CO2), 12 Finding monthly breakeven in sales and units of AB1 and CD2".Strom orginal budget Info. Rem.- Break-even Units Fixed expenses/fc.m. per unit) 9 Break-even Dollars Fixad expenses/fc.m. ratio) use original budget info." 11 12 AB1 CO2 Total 13 Product mix amnt percent amnt percent amnt 14 Sales $555,000 100% $637,500 100% $1,192,500 75 Less: Var. Exps. $241,625 44% $247,375 39% $699,000 16 C.M. $313,375 55% $390,125 61% $493,500 17 18 From Prof. Total BE Sales: $566,849 20 21 Sales Mix 22 AB1 46.54% 23 CD2 53.48% 24 25 AB1 BE Sales $263,723 26 CD2 BE Sales $302.926 27 Total BE Units AB1 per unit CD2 per unit 30.00 25 13.08 9.70 16.94 percent 100% 59% 41% 19 29 30 31 15.30 32 33 AB1 BE units CD2 BE units 8,791 12,117 34 25 35 100% 37 30 AB1 Sales Less: Var. Exps. . Loss: Fored exps. Noi CO2 $263,723 $114,815 $148,909 Total $302.926 $566,649 $117,547 $232,362 $185,379 $334,287 $234,500 39 40 41 42 43 BE Total Sales $397,500 ask how to find variable 44 45 46 Weighted avg. CM ratio amrrev, ratio 47 2 A1 A D E 1 @ 100% | $ % .0 .00 123- Callbri - 11 - BI - fx (Multiple product breakeven). What is the total monthly number of units B (Multiple product breakever). What is the total monthly number of units and monthly sales dollars which would provide the profit target specified by the parent company of $545,000 for the year? Create a contribution margin statement to proof your answer. (10 points) (Hint: You need the weighted CM from question to compute your answer) ND 3 4 5 6 6 7 $1,883,594 8 9 10 N J 1 2 3 4 What would be the staloufacturing cost per un and grens manca per unit of Aland COZ I AM produced and sold only 11.000 units of ABI and 19.000 units ECD per month? Explain the behavio od your costs compared to your answer in question 32 Crente a traditional GAAP anda.button income statement to compute the NCL points) Huned to the total manufacturing cost per unit for each dict 11.000 and 10 meter. Then create the neemt She these this 5 T 8 0.62 047 30 11,000 US AB 11 19.000 units of CO2 12 each per month 13 14 AB1 to ung cost perunt 30.48 16 CO2many cost per unit 20.30 Grown perunt 14 ABI 17 CD2 11 11 Total manufacturing perheron product ABT 11.000 18.500 units 20 Toll manufacturing cuts per un are wron product C2 18.000 25.500 11 The fessur olunmaliger til performance Traditional GAAP income Matament AM 14 Jary 2021 35 ales A81 $330.000 37 CD2 $475,000 30 Total Sales: 1405,000 Cost of Sales 10 AS1 1.200,000 Contribution Income Statement AB 31 CD2 $150,000 Sales 13 Manufacturing overhead 333500 To Cost of Sales 3723.500 Variable Costa 34 Gross Profit $81.500 Contribution Margin 31 Selling General Administrative 1210.000 Pared Costs Net Operating Income -$121.500 Net Operating Income 11 CO2 $333.000 $168609 $185,331 TO 5475,000 $144319 3200,681 Afin CO2 per un Ratio M165,000 30 25 5127,98 13.00 9.TO $177,012 16. 15.30 $234,600 $243,512 100% 41% 50% 38 35 40 4 43 D E F G 1 2 3 What would be the NOI if AM sold 11,000 units of AB1 and 19,000 units of CD2 (from question 9) but produced 18,900 units of AB1 and 27,300 units of CD2, putting the unsold units in finished goods inventory? Create the traditional income statement to show your profit. Explain why there is a difference in the NOI between question 9 and 10? (10 points). (Hint: It has something to do with how fixed costs behave with varying production levels on a unit basis). 4 5 6 7 8 9 10 Cost of Unfinished Goods Inventory": Formula: Units leftover during the year X cost per unit" AB1 237000 CD2 207500 11 12 13 Audi Manufacturing In December 2020, Joe Biden, President, and Nancy Pelosi, Controller, of Audi Manufacturing (AM) were checking the budgeted figures for AM's 2021 operations. AM's parent company German Manufacturing has established a target profit for AM of $545,000 for the coming year. Joe and Nancy wanted to make sure they could meet the target. In early 2020, AM a large manufacturer of equipment had set up operations in Denver to manufacture two products. One was a miniature signaling device used primarily for remote operation of garage doors. These "AB1" units consisted of a signal sender, about half the size of a pack of cards, and a receiver, which was a bit larger. A large manufacturer of motorized garage doors had agreed to take a minimum of 150,000 AB1 control units a year. Joe and Nancy thought a budget of 222,000 units was a reasonable manufacturing target for 2021. AM also had designed a similar device which could be used by a household to turn on lights when arriving after dark. This unit, called "CD2" was slightly more expensive to make since the receiving part was a complete plug-in device, while the AB1 receiver was a component of the garage door unit. Initially, AM expected to sell the CD2 unit primarily through mail order catalogues. Joe and Nancy projected sales of 306,000 units for 2021. Looking at the budget, Nancy indicated, "I'm relieved to see our projections result in a budgeted profit exceeding the target of $545,000 profit for next year expected by the parent company." "Me too." replied Joe. "But we don't have a large margin for error. Let's see what level of sales would be required to provide the parent company with its targeted profit of $545,000 for the year." To start, Nancy pulled out the monthly budgeted figures shown in Exhibit 1. In addition to these figures, selling and administrative expenses are expected to be $210,000 a month while variable manufacturing overhead supplies cost is expected to be $99,000 for the 44,000 units (222,000 of AB1 + 306,000 of CD2 divided by 12 months). She recognized the budget was only approximate since she expected changes would be made to improve efficiency and perhaps the product design. But she thought the numbers were solid enough for her to use in her analysis of what was necessary to reach the parent company's target profit. In preparing her analysis, she decided to assume parts, direct labor, and overhead supplies could be considered as variable cost since they would vary with units produced, and all the rest would be fixed within the time frame and volume range being considered. Audi Manufacturing In December 2020, Joe Biden, President, and Nancy Pelosi, Controller, of Audi Manufacturing (AM) were checking the budgeted figures for AM's 2021 operations. AM's parent company German Manufacturing has established a target profit for AM of $545,000 for the coming year. Joe and Nancy wanted to make sure they could meet the target. In early 2020, AM a large manufacturer of equipment had set up operations in Denver to manufacture two products. One was a miniature signaling device used primarily for remote operation of garage doors. These AB1" units consisted of a signal sender, about half the size of a pack of cards, and a receiver, which was a bit larger. A large manufacturer of motorized garage doors had agreed to take a minimum of 150,000 AB1 control units a year. Joe and Nancy thought a budget of 222,000 units was a reasonable manufacturing target for 2021. AM also had designed a similar device which could be used by a household to turn on lights when arriving after dark. This unit, called "CD2" was slightly more expensive to make since the receiving part was a complete plug-in device, while the AB1 receiver was a component of the garage door unit. Initially, AM expected to sell the CD2 unit primarily through mail order catalogues. Joe and Nancy projected sales of 306,000 units for 2021. Looking at the budget. Nancy indicated, "I'm relieved to see our projections result in a budgeted profit exceeding the target of $545,000 profit for next year expected by the parent company." "Me too," replied Joe. "But we don't have a large margin for error. Let's see what level of sales would be required to provide the parent company with its targeted profit of $545,000 for the year." To start, Nancy pulled out the monthly budgeted figures shown in Exhibit 1. In addition to these figures, selling and administrative expenses are expected to be $210,000 a month while variable manufacturing overhead supplies cost is expected to be $99,000 for the 44,000 units (222,000 of AB1+306,000 of CD2 divided by 12 months). She recognized the budget was only approximate since she expected changes would be made to improve efficiency and perhaps the product design. But she thought the numbers were solid enough for her to use in her analysis of what was necessary to reach the parent company's target profit. In preparing her analysis, she decided to assume parts, direct labor, and overhead supplies could be considered as variable cost since they would vary with units produced, and all the rest would be fixed within the time frame and volume range being considered. 1. 2 3. 4. What is the projected monthly net operating income (NOI) for AM for 2021 based on the budgeted figures? Create a simple traditional GAAP income statement (S - COGS = GP - SGA - NOI) to show your profit. Calculate Gross Profit Margin. (Note: profit means NOI) (6 points) Reorganize your budgeted monthly income statement from question 1 into a simple contribution income statement (S-VC = CM - FC = NOI). Calculate Contribution Margin Ratio. (10 points) Compute the total manufacturing cost per unit of AB1 and CD2 based on the monthly budgeted figures? (6 points) Compute the degree of operating leverage using your budgeted contribution margin income statement in question 2. Explain how operating leverage affects the NOI of AM. (8 points) If total monthly budgeted units increase by 8,200 units (4,700 units of AB1 and 3,500 units of CD2), compute the new NOI using the contribution income statement. By what percent did NOI increase or decrease from the budget? Why? (10 points) (Single product breakeven). Assume AM budgets to manufacture all 44,000 units of only one product AB1 (ignore CD2 and its variable parts and labor cost in this question). Using the selling price of $30 for all 44,000 units and your computed unit VC costs (parts, labor and variable supplies) of AB1, and total fixed costs for the entire company, answer the following questions: Prepare a budgeted contribution income statement to compute the NOI for AM (4 points) 5. 6. a. c b. What is the breakeven point in sales and units for AM? (4 points) What is the margin of safety in units, dollars and percent? (4 points) d. If AM wanted to generate $76,950 in monthly NOI, how many units of AB1 must it sell and what is the sales dollars? Proof your answer by creating a contribution margin statement. (8 points) (Multiple product breakeven). What is the monthly breakeven in sales and units of AB1 and CD2 given the original monthly budget information? Create a contribution Income statement to proof your answer. (10 points). (Hint: You can also use the following formula (in units or percent) in finding the weighted CM to compute your answer: (Sales mix of AB1 CM of AB1) + (Sales mix of CD2 CM of CD2). 7 8. (Multiple product breakeven). What is the total monthly number of units and monthly sales dollars which would provide the profit target specified by the parent company of $545,000 for the year? Create a contribution margin statement to proof your answer. (10 points) (Hint: You need the weighted CM from question 7 to compute your answer) 9. What would be the total manufacturing cost per unit and gross margin per unit of AB1 and CD2 if AM produced and sold only 11,000 units of AB1 and 19,000 units of CD2 per month? Explain the behavior of your costs compared to your answer in question 3? Create a traditional GAAP and a contribution income statement to compute the NOI. (10 points) (Hint: You need to calculate the total manufacturing cost per unit for each product at 11,000 units and 19,000 units respectively. Then create the income statements. You should have the same Nol for both the traditional and contribution income statements) 10. What would be the NOI if AM sold 11,000 units of AB1 and 19,000 units of CD2 (from question 9) but produced 18,900 units of AB1 and 27,300 units of CD2, putting the unsold units in finished goods inventory? Create the traditional income statement to show your profit. Explain why there is a difference in the Nol between question 9 and 10? (10 points). (Hint: It has something to do with how fixed costs behave with varying production levels on a unit basis). Project Requirements: 1. The Project must be prepared using an Excel spreadsheet. The first worksheet in the spreadsheet should be labeled "Assumptions". This sheet is used to enter all of the data from the project description from Exhibit 1. Thereafter, enter each questions' data assumptions and label it with the question number. These assumptions are to be used in the tabs which follow for each question. Next, create seven more worksheet tabs. The first tab is for Questions 1-4 and the remaining questions (questions 5-10) should be answered on separate worksheet tabs and numbered accordingly, i.e. Q1-4, 25, 26, and so on. Only the data assumptions needed for each question should be entered and no answers should be calculated in the Assumptions page. The Assumptions page should not use more than 50 rows of data. 2. 3. All computations and solutions must be linked to the assumptions page by links or formulas. Formulas can also be linked to other worksheets or within worksheets. You are not allowed to type any number in any formula in any worksheet except on the Assumptions page. You must label each question on each spreadsheet. Submit the project (as one document) per team in Canvas/Projects by the due date and time. The project file should be named with the team number as follows, Team #_Project 1.xlsx Students are cautioned not to use any file or template from previous quarters or courses. All files must be created by students during the quarter on their respective group member computers. All files will be scanned to ensure compliance. Any student with files or templates from previous quarters or unknown computers will automatically receive a zero for the project and referred to the Office of Student conduct for further disciplinary action including receiving a failing grade for the course. You are advised to begin early on the project to avoid problems with group members as well as to have any questions, concerns or issued addressed by the instructor well in advance of the due date. Students are hereby warned working on the project on the day before it is due is unlikely to result in the submission of a project which receives a passing grade. 4. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts