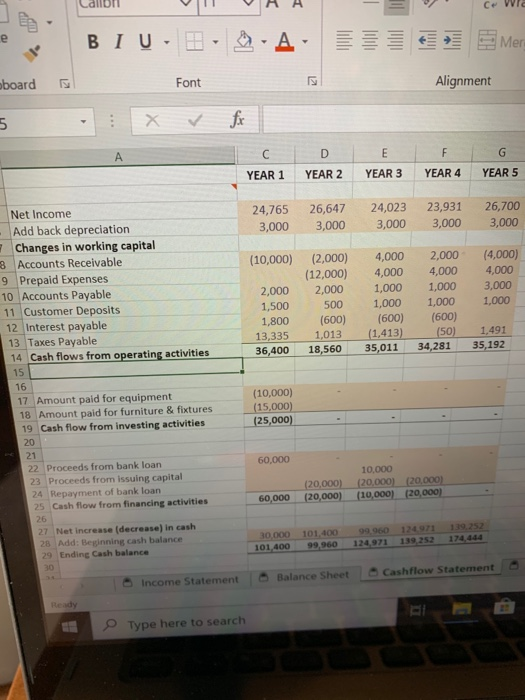

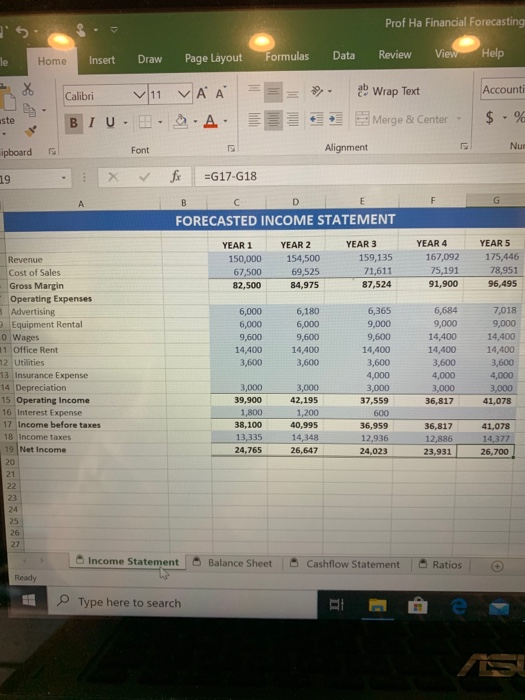

i am working on my ratios and am stuck on the average collection formula and payables turnover

i know the formula for ACF is acct receivable/ annual sales / by 365 days but the figure i get is wrong

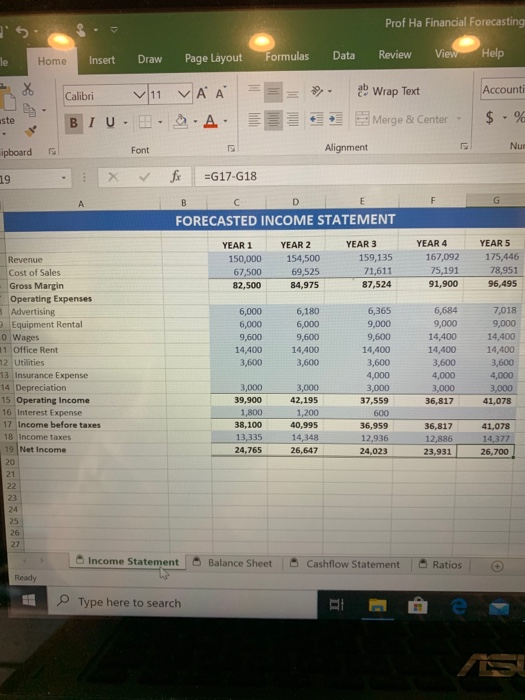

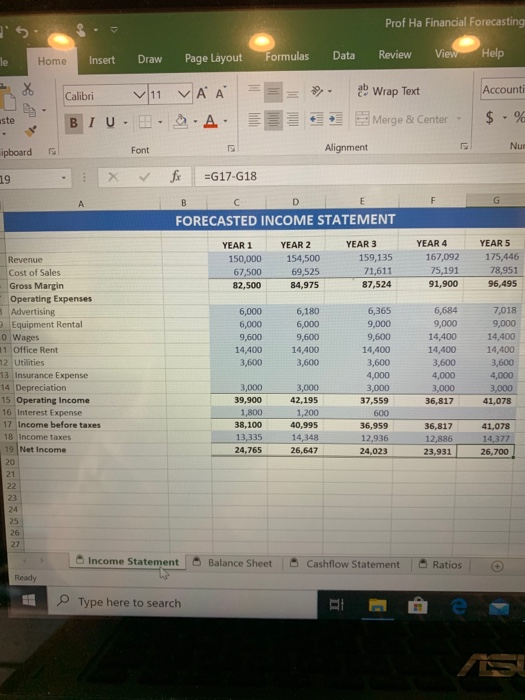

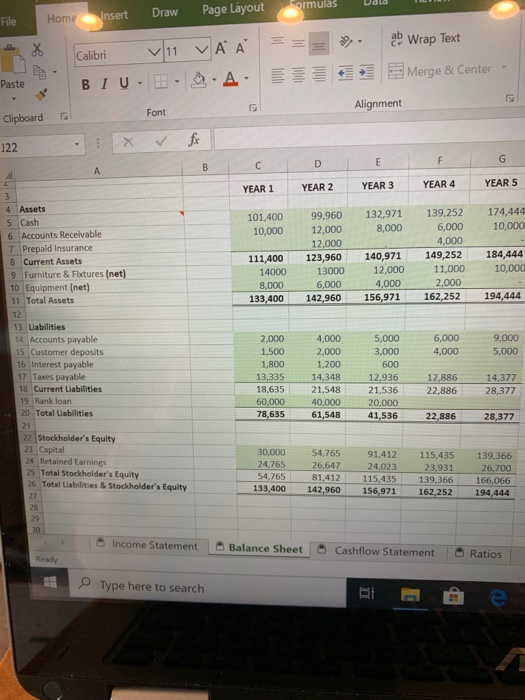

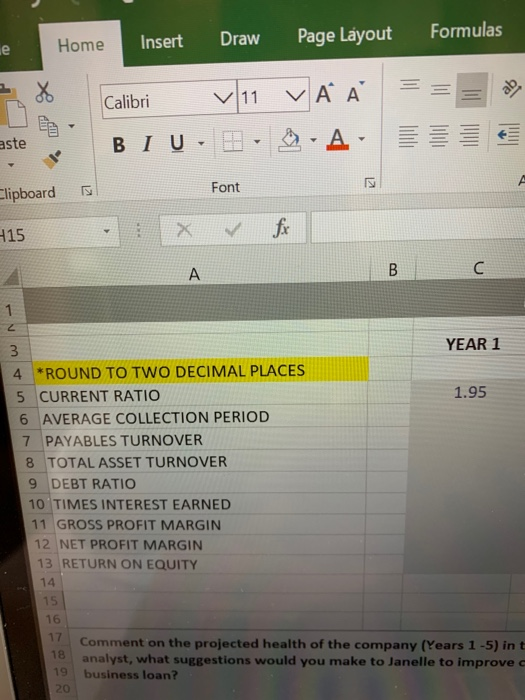

Prof Ha Financial Forecasting Draw Formulas Data Review Page Layout le Home Insert View Help Accounti Calibri v11 VA BIU A. ab Wrap Text Merge & Center aste $ % ipboard Font Alignment Nur 19 X fx =G17-G18 A B D F FORECASTED INCOME STATEMENT YEAR 1 150,000 67,500 82,500 YEAR 2 154,500 69,525 84,975 YEAR 3 159,135 71,611 87,524 YEAR 4 167,092 75,191 91,900 YEAR 5 175,446 78,951 96,495 Revenue Cost of Sales Gross Margin Operating Expenses Advertising Equipment Rental 0 Wages 11 Office Rent 12 Utilities 13 Insurance Expense 14 Depreciation 15 Operating Income 16 Interest Expense 17 Income before taxes 18 Income taxes 19 Net Income 20 6,000 6,000 9,600 14,400 3,600 6,180 6,000 9,600 14,400 3,600 6,365 9,000 9,600 14,400 3,600 4,000 3,000 37,559 600 36,959 12,936 24,023 6,684 9,000 14,400 14,400 3,600 4,000 3,000 36,817 7,018 9,000 14,400 14,400 3,600 4,000 3,000 41,078 3,000 39,900 1,800 38,100 3,000 42,195 1,200 40,995 14,348 26,647 36,817 12,886 23,931 41,078 14,377 26,700 24,765 21 22 23 24 26 27 Income Statement Balance Sheet Cashflow Statement Ratios Ready Type here to search E Formulas Insert Page Layout Home Draw File X VAA Calibri V 11 ab Wrap Text 3Merge & Center Paste BIU- Alignment Font Clipboard fx J22 E F G D B A YEAR 2 YEAR 3 YEAR 4 YEAR 1 YEAR 5 101,400 10,000 132,971 8,000 174,444 10,000 99,960 12,000 12,000 123,960 13000 6,000 142,960 111,400 14000 8,000 133,400 184,444 10,000 139,252 6,000 4,000 149,252 11,000 2,000 162,252 140,971 12,000 4,000 156,971 194,444 6,000 4,000 9,000 5,000 4 Assets 5 Cash 6 Accounts Receivable 7 Prepaid Insurance 8 Current Assets 9 Furniture & Fixtures (net) 10 Equipment (net) 11 Total Assets 12 13 Liabilities 14 Accounts payable 15 Customer deposits 16 Interest payable 17 Taxes payable 18 Current Liabilities 19 Rank loan 20 Total Liabilities 21 22 Stockholder's Equity 23 Capital 24 Retained Earnings 25 Total Stockholder's Equity 26 Total Liabilities & Stockholder's Equity 27 28 29 30 Income Statement 2,000 1,500 1,800 13,335 18,635 60,000 78,635 4,000 2,000 1,200 14,348 21,548 40.000 61,548 5,000 3,000 600 12,936 21,536 20,000 41,536 12,886 22.886 14,377 28,377 22,886 28,377 30,000 24,765 54,765 133,400 54,765 26,647 81,412 142,960 91,412 24,023 115,435 156,971 115,435 23,931 139,366 162,252 139,366 26.700 166,066 194,444 Balance Sheet Cashflow Statement Ratios Ready Type here to search TI E H Ce vre e BIU G-A- A. 3 Mer 2 oboard Font Alignment 5 fx A D E F YEAR 4 YEAR 1 YEAR 2 YEAR 3 YEAR 5 24,765 3,000 26,647 3,000 24,023 3,000 23,931 3,000 26,700 3,000 (10,000) (2,000) (12,000) 2,000 500 (600) 1,013 18,560 2,000 1,500 1,800 13,335 36,400 4,000 4,000 1,000 1,000 (600) (1,413) 35,011 2,000 4,000 1,000 1,000 (600) (50) 34,281 (4,000) 4,000 3,000 1,000 1,491 35,192 Net Income Add back depreciation Changes in working capital 3 Accounts Receivable 9 Prepaid Expenses 10 Accounts Payable 11 Customer Deposits 12 Interest payable 13 Taxes Payable 14 Cash flows from operating activities 15 16 17 Amount paid for equipment 18 Amount paid for furniture & fixtures 19 Cash flow from investing activities 20 21 22 Proceeds from bank loan 23 Proceeds from Issuing capital 24 Repayment of bank loan 25 Cash flow from financing activities (10,000) (15,000) (25,000) 60,000 (20,000) (20,000) 10.000 (20,000) 20,000) (10,000) (20,000) 60,000 99.00 124.971 30.000 101.400 101,400 99,960 139 252 27 Net Increase (decrease) in cash 28 Add: Beginning cash balance 29 Ending Cash balance 30 174.444 Balance Sheet Cashflow Statement Income Statement Ready Type here to search Home Insert Draw Formulas Page Layout le = al Calibri V11 VA A aste BIU. A. A Z Font Clipboard ** H15 X fx A B 1 2 YEAR 1 1.95 3 4 *ROUND TO TWO DECIMAL PLACES 5 CURRENT RATIO 6 AVERAGE COLLECTION PERIOD 7 PAYABLES TURNOVER 8 TOTAL ASSET TURNOVER 9 DEBT RATIO 10 TIMES INTEREST EARNED 11 GROSS PROFIT MARGIN 12 NET PROFIT MARGIN 13 RETURN ON EQUITY 14 15 16 17 18 19 20 Comment on the projected health of the company (Years 1-5) int analyst, what suggestions would you make to Janelle to improvec business loan