Answered step by step

Verified Expert Solution

Question

1 Approved Answer

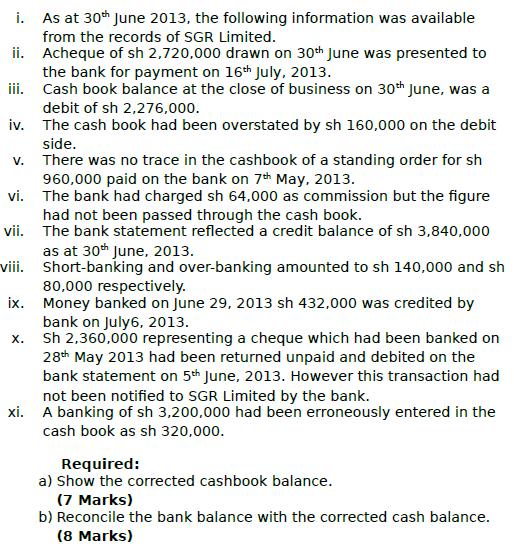

i. As at 30th June 2013, the following information was available from the records of SGR Limited. ii. Acheque of sh 2,720,000 drawn on

i. As at 30th June 2013, the following information was available from the records of SGR Limited. ii. Acheque of sh 2,720,000 drawn on 30th June was presented to the bank for payment on 16th July, 2013. iii. Cash book balance at the close of business on 30th June, was a debit of sh 2,276,000. iv. The cash book had been overstated by sh 160,000 on the debit side. v. There was no trace in the cashbook of a standing order for sh 960,000 paid on the bank on 7th May, 2013. vi. The bank had charged sh 64,000 as commission but the figure had not been passed through the cash book. vii. The bank statement reflected a credit balance of sh 3,840,000 as at 30th June, 2013. viii. Short-banking and over-banking amounted to sh 140,000 and sh 80,000 respectively. ix. Money banked on June 29, 2013 sh 432,000 was credited by bank on July 6, 2013. x. Sh 2,360,000 representing a cheque which had been banked on 28th May 2013 had been returned unpaid and debited on the bank statement on 5th June, 2013. However this transaction had not been notified to SGR Limited by the bank. xi. A banking of sh 3,200,000 had been erroneously entered in the cash book as sh 320,000. Required: a) Show the corrected cashbook balance. (7 Marks) b) Reconcile the bank balance with the corrected cash balance. (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To correct the cash book balance and reconcile it with the bank balance we need to analyze the given information and make adjustments accordingly Lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started