Answered step by step

Verified Expert Solution

Question

1 Approved Answer

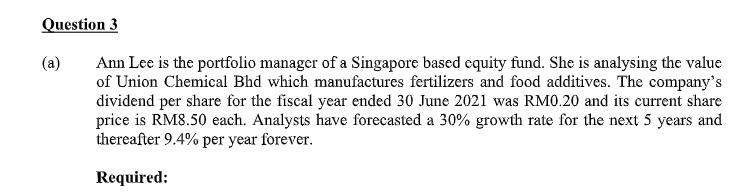

(i) Assuming a 13.9% discount rate, estimate the value of Union Chemical Bhd. (ii) Determine whether Union Chemical Bhd is undervalued or overvalued. (iii) The

(i) Assuming a 13.9% discount rate, estimate the value of Union Chemical Bhd. (ii) Determine whether Union Chemical Bhd is undervalued or overvalued. (iii) The constant-growth model should not be used with just any stock. Explain with reasons the assumptions used by analysts when using the constant- growth dividend model.

Question 3 (a) Ann Lee is the portfolio manager of a Singapore based equity fund. She is analysing the value of Union Chemical Bhd which manufactures fertilizers and food additives. The company's dividend per share for the fiscal year ended 30 June 2021 was RM0.20 and its current share price is RM8.50 each. Analysts have forecasted a 30% growth rate for the next 5 years and thereafter 9.4% per year forever. RequiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started