I atached the way I responded to first atampt but all answers was wrobg I dont understand why . This is diffent numbers diffrent statement hope somebody can help me.

thank you

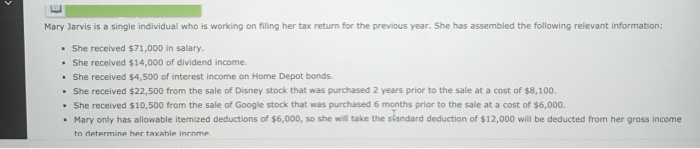

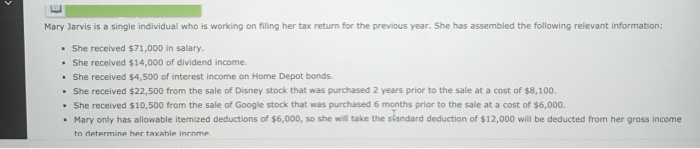

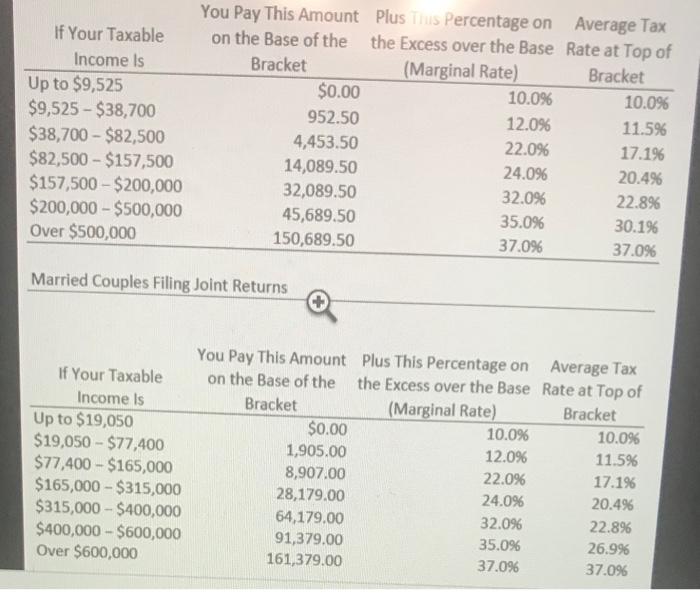

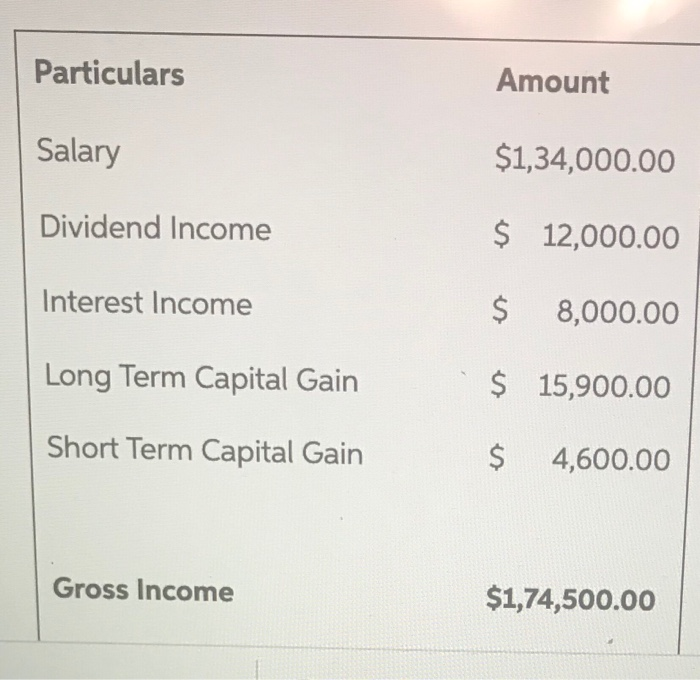

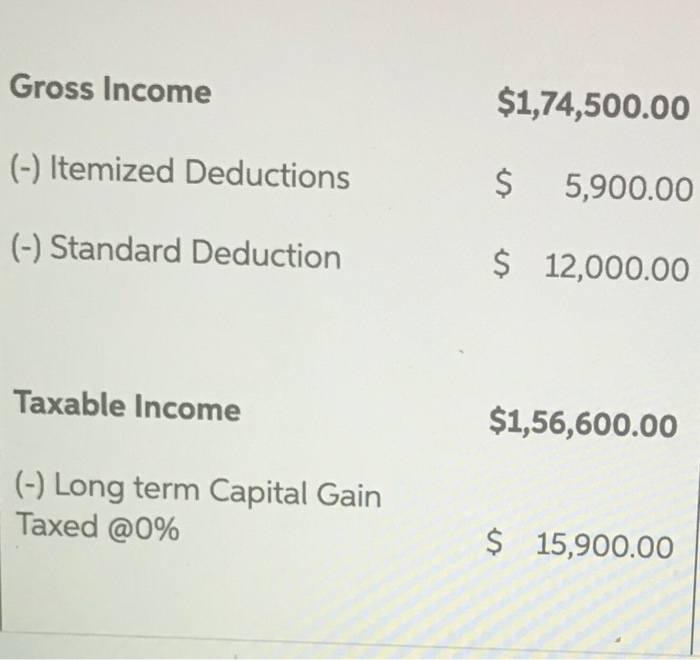

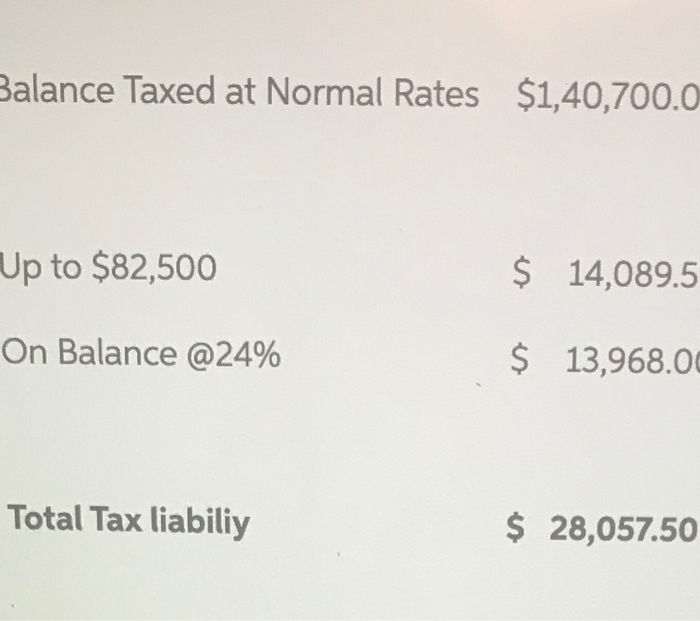

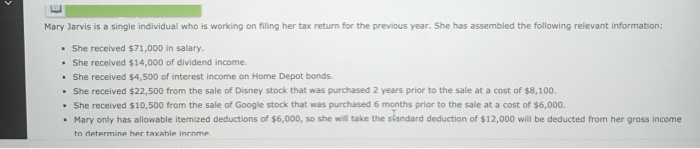

Mary Jarvis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevant information: She received $71,000 in salary. She received $14,000 of dividend income. She received $4,500 of interest income on Home Depot bonds. She received $22,500 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $8,100. . She received $10,500 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $6,000. Mary only has allowable itemized deductions of $6,000, so she will take the standard deduction of $12,000 will be deducted from her gross income to determine her taxable income If Your Taxable Income is Up to $9,525 $9,525 - $38,700 $38,700 - $82,500 $82,500 - $157,500 $157,500 - $200,000 $200,000 - $500,000 Over $500,000 You Pay This Amount Plus This Percentage on Average Tax on the Base of the the Excess over the Base Rate at Top of Bracket (Marginal Rate) Bracket $0.00 10.0% 10.0% 952.50 12.0% 11.5% 4,453.50 22.0% 17.1% 14,089.50 24.0% 20.4% 32,089.50 32.0% 22.8% 45,689.50 35.0% 30.1% 150,689.50 37.0% 37.0% Married couples Filing Joint Returns If Your Taxable Income is Up to $19,050 $19,050 - $77,400 $77,400 - $165,000 $165,000 - $315,000 $315,000 - $400,000 $400,000 - $600,000 Over $600,000 You Pay This Amount Plus This Percentage on Average Tax on the Base of the the Excess over the Base Rate at Top of Bracket (Marginal Rate) Bracket $0.00 10.0% 10.0% 1,905.00 12.0% 11.5% 8,907.00 22.0% 17.1% 28,179.00 24.0% 20.4% 64,179.00 32.0% 22.8% 91,379.00 35.0% 26.9% 161,379.00 37.0% 37.0% a. What is Mary's federal tax liability? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent. $ b. What is her marginal tax rate? Do not round intermediate calculations. Round your answer to one decimal place. % c. What is her average tax rate? Do not round intermediate calculations. Round your answer to two decimal places. % Particulars Amount Salary $1,34,000.00 Dividend Income $ 12,000.00 Interest Income $ 8,000.00 Long Term Capital Gain $ 15,900.00 Short Term Capital Gain $ 4,600.00 Gross Income $1,74,500.00 Gross Income $1,74,500.00 (-) Itemized Deductions $ 5,900.00 (-) Standard Deduction $ 12,000.00 Taxable Income $1,56,600.00 (-) Long term Capital Gain Taxed @0% $ 15,900.00 Balance Taxed at Normal Rates $1,40,700.0 Up to $82,500 $ 14,089.5 On Balance @24% $ 13,968.00 Total Tax liabiliy $ 28,057.50