Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( ( I attached a picture of table to use ) ) Question 1 : Monthly Payments Calculate the monthly payment for both the new

I attached a picture of table to use

Question : Monthly Payments

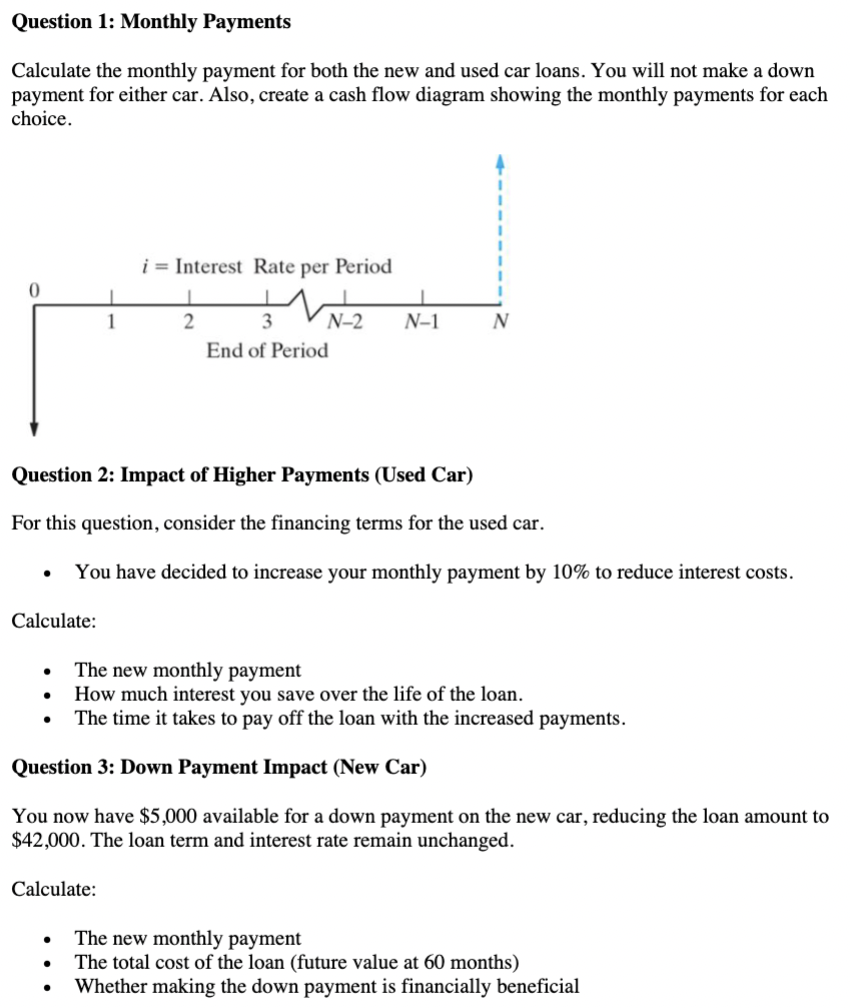

Calculate the monthly payment for both the new and used car loans. You will not make a down payment for either car. Also, create a cash flow diagram showing the monthly payments for each choice.

Question : Impact of Higher Payments Used Car

For this question, consider the financing terms for the used car.

You have decided to increase your monthly payment by to reduce interest costs.

Calculate: square

The new monthly payment

How much interest you save over the life of the loan.

The time it takes to pay off the loan with the increased payments.

Question : Down Payment Impact New Car

You now have $ available for a down payment on the new car, reducing the loan amount to $ The loan term and interest rate remain unchanged.

Calculate:

The new monthly payment

The total cost of the loan future value at months

Whether making the down payment is financially beneficial

New Car:

Principal loan: $

Interest rate:

Loan term: months years

Used Car:

Principal loan: $

Interest rate:

Loan term: months years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started