Answered step by step

Verified Expert Solution

Question

1 Approved Answer

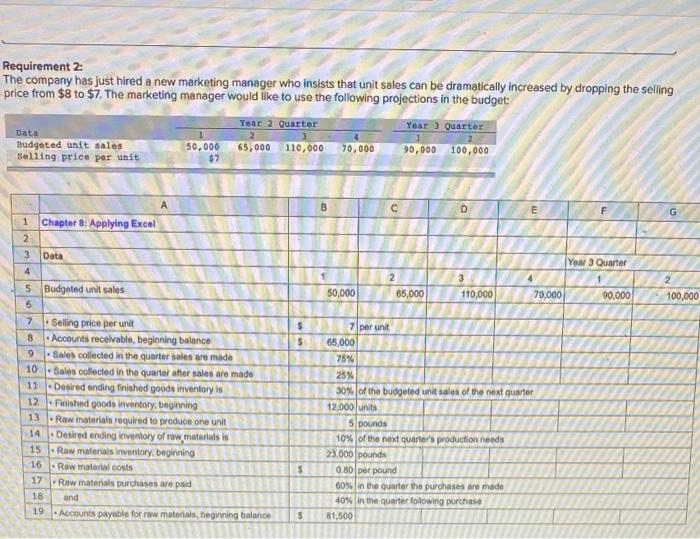

I attached worksheet on excel of where they want the new numbers plugged in at. Requirement 2: The company has just hired a new marketing

I attached worksheet on excel of where they want the new numbers plugged in at.

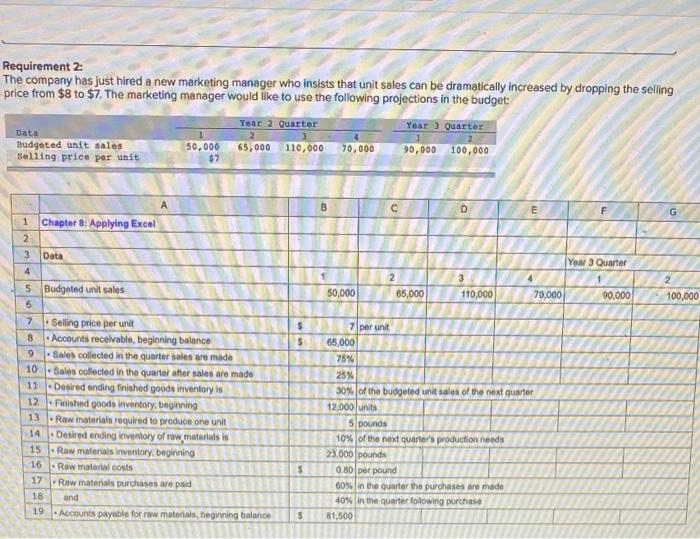

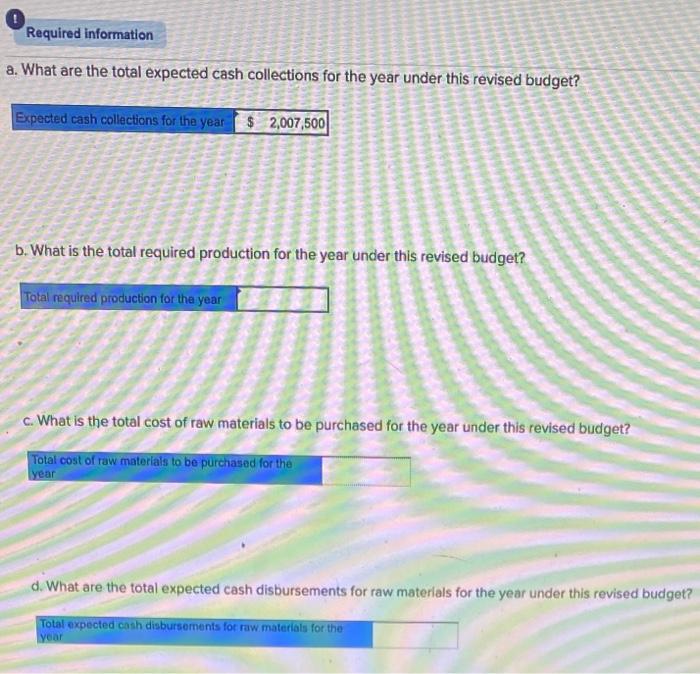

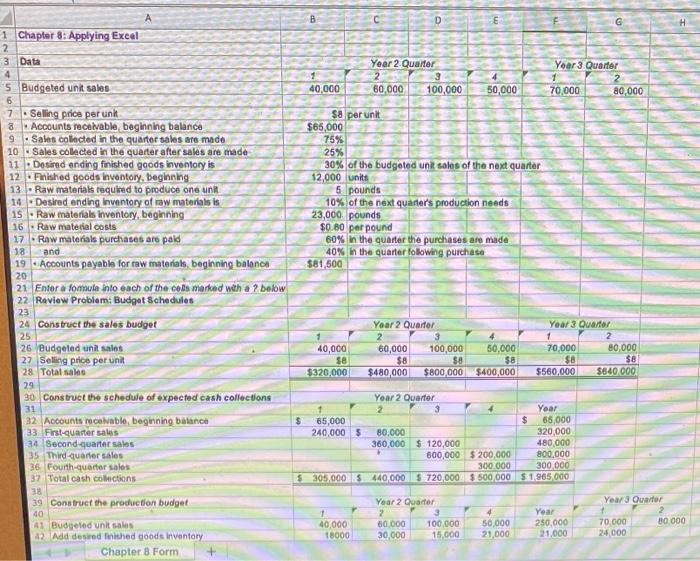

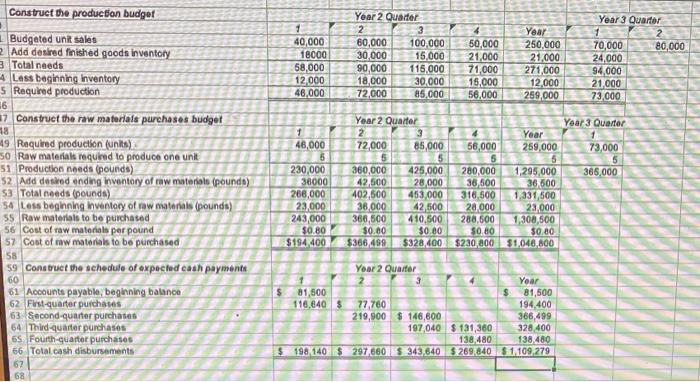

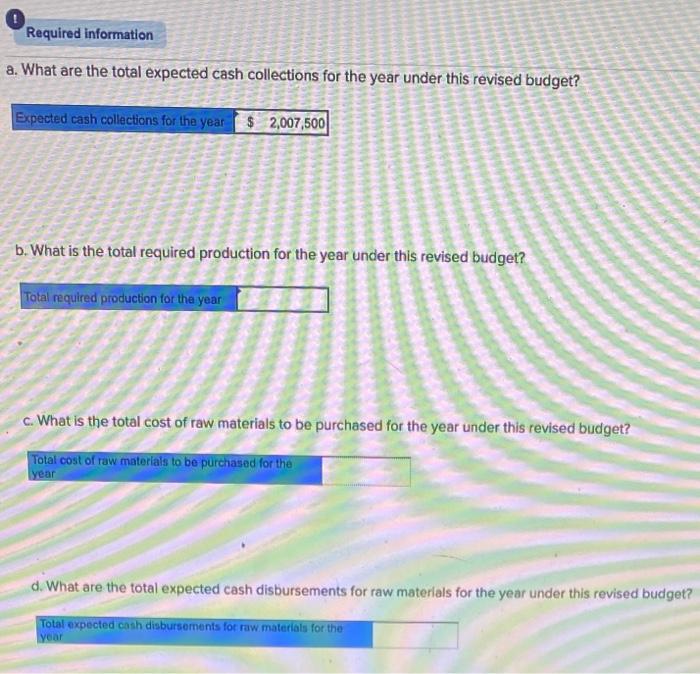

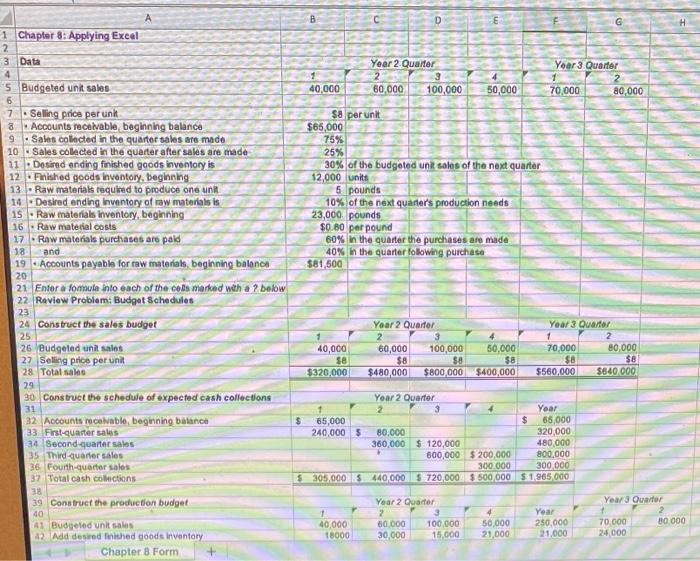

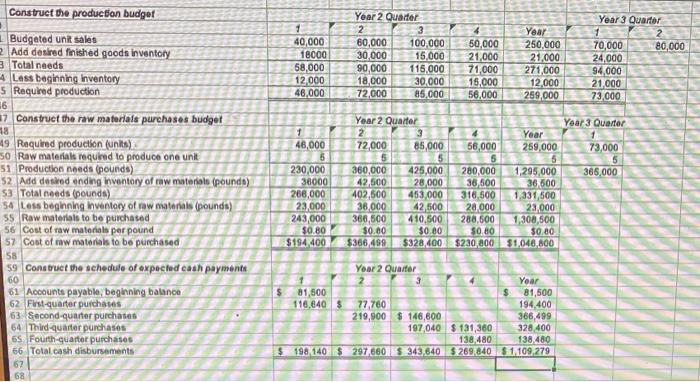

Requirement 2: The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget Year 2 Quarter Year 3 Quarter Data 2 1 Budgeted unit sales 50,000 65,000 110,000 70,000 90,000 100,000 Selling price per unst $7 B E F G 1 Chapter 8: Applying Excel 2 3 Data 4 5 Budgeted unit sales 6 Your 3 Quarter 2 2 3 110,000 50,000 65,000 70,000 90,000 100,000 $ $ 7 Selling price per unit 8 Accounts receivable, beginning balance 9 Sales collected in the quarter sales are made 103ales collected in the quarter ahor sales are made 11 Desired ending finished goods inventory is 12 Finished goods Inventory, beginning 13 Raw inaterials required to produce one unit 14 Desired ending inventory of raw materials in 15 Raw materials inventory beginning 16 - Raw material costs 17 Raw materials purchases are paid 18 and 19 Accounts payable for raw materials, beginning balance 7 per unit 65,000 75% 25% 30% of the budgeted unit sales of the next quarter 12,000 5 pounds 10% of the next quarter's production needs 23,000 pounds 0.80 per pound 60% in the quarter the purchases are made 40% in the quarter following purchase 81,500 $ $ Required information a. What are the total expected cash collections for the year under this revised budget? Expected cash collections for the year $ 2,007,500 b. What is the total required production for the year under this revised budget? Total required production for the year c. What is the total cost of raw materials to be purchased for the year under this revised budget? Total cost of raw materials to be purchased for the year d. What are the total expected cash disbursements for raw materials for the year under this revised budget? Total expected cash disbursements for raw materials for the year B D Yoar 3 Quarter Year 2 Quarter 2 60,000 100,000 40,000 50,000 70,000 80,000 Sa per unit $65,000 75% 25% 30% of the budgeted unit sales of the next quarter 12,000 units 5 pounds 10% of the next quarter's production needs 23,000 pounds $0.80 per pound 60% in the quarter the purchases are made 40% in the quarter following purchase $81,500 A 1 Chapter 8: Applying Excel 2 3 Data 4 5 Budgeted unt sales 6 7 Selling price per unit a Accounts receivable beginning balance 9 Sales collected in the quarter sales are made 10 Sales collected in the quarter after sales are made 11 Dosired ending finished goods inventory is 12 Finished goods inventory, beginning 13. Raw materials required to produce one unit 14 Desired ending Inventory of raw materials is 1s Raw materials inventory beginning 16 Raw material costs 17 Raw materials purchases are paid 18 and 19 Accounts payable for raw materials, beginning balanon 20 21 Enter a fomula into each of the cols marked with a ? below 22 Review Problem: Budget Schedules 23 24 Construct the sales budget 25 26 Budgeted unit salos 27 Selling price per unit 28 Total sales 29 30 Construct the schedule of expected cash collections 31 32 Accounts receivable, beginning balance 33 First quarter sales 24 Second quarter sales 35 Third-quarter sales 36 Fourth quarter sales 37 Total cash coinctions 39 Construct the production budget 40 41 Budgeted unit salos 42 Add desired finished goods Inventory Chapter 8 Form 40,000 se $320,000 Yoar 2 Quarter 2 3 60,000 100,000 $8 $ $480,000 $800,000 50,000 $8 $400,000 Year 3 Quarter 1 2 70,000 80,000 $8 $8 $560,000 $640.000 Yoar 2 Quarter + 2 3 + Year $ 65,000 $ 65,000 240,000 $ 80,000 320,000 360,000 $ 120,000 480,000 800,000 $200,000 800,000 300.000 300.000 $ 305,000 440,000 5 720,000 $ 500 000 $ 1.965 000 38 Year 3 Quarter 1 40,000 18000 Year 2 Quarter 2 60,000 100,000 30,000 15.000 Year 250,000 21.000 50,000 21,000 80 000 70.000 24,000 40,000 18000 68,000 12,000 46,000 Year 2 Quarter 2 3 60,000 100,000 30,000 15,000 90,000 115,000 18,000 30,000 72.000 85.000 50,000 21,000 71.000 15,000 56,000 Year 250,000 21,000 271,000 12,000 269,000 Year 3 Quarter 1 70,000 80,000 24,000 94,000 21,000 73,000 Yoar 3 Quarter 73,000 5 366.000 Construct de production budget Budgated unit sales Add desired finished goods Inventory 3 Total needs A Less beginning inventory 5 Required production 36 17 Construct the raw materials purchases budget 18 49 Required production (unkts) SO Raw materials required to produce one unit 51 Production needs (pounds) 52 Add denied ending inventory of raw materials (pound) 53 Total needs (pounds) 54 Less beginning inventory of raw materials (pounds) 55 Raw materials to be purchased 56 Cost of raw materials per pound 57 Cost of uw materials to be purchased 58 59 Construct the schedule of expected cash payments 60 61 Accounts payable, beginning balance 62 First quarter purchases 63. Second quarter purchases 64 Third quarter purchases 65 Fourth quarter purchases 66 Total cash disbursements 67 68 1 48,000 5 230,000 38000 268,000 23,000 243,000 $0.80 $194.400 Year 2 Quarter 2 3 72,000 85,000 56,000 5 5 5 360,000 425,000 280,000 42.500 28.000 36,500 402 500 453,000 318,500 38,000 42,500 28.000 368,500 410,500 280,500 $0.00 $0.80 $0.80 $366 499 $328 400 $230,000 Year 259,000 5 1,295,000 36,500 1,331,500 23.000 1,300,500 $0.80 $1,046,800 Year 2 Quarter 2 3 Year $ 81,500 $ 81,500 116,640 $ 77 760 194,400 219,900 $ 146,600 366,499 197,040 $ 131,360 328.400 138,480 138.480 $ 198,140 $ 297,660 $ 343,640 $269,840 $ 1,109,279

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started