Answered step by step

Verified Expert Solution

Question

1 Approved Answer

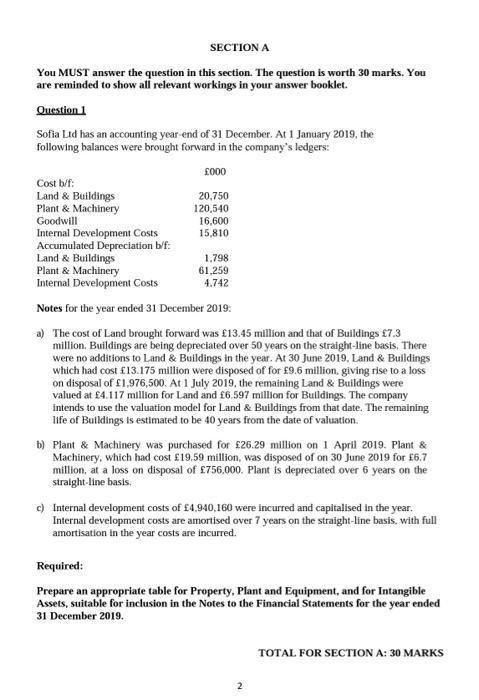

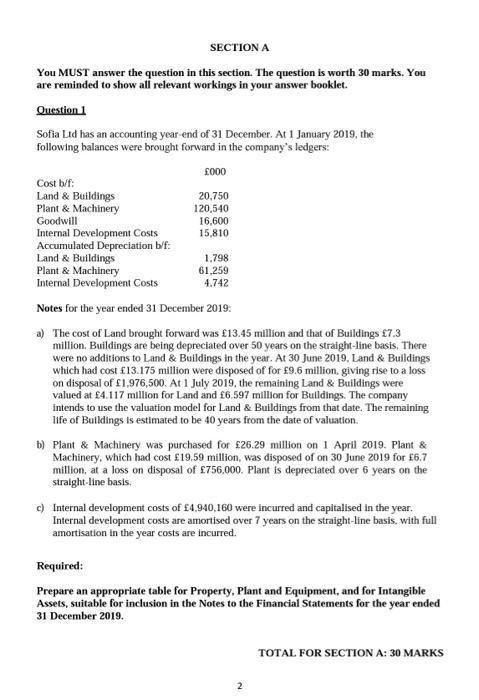

I badly need the whole solution of this 16,600 SECTION A You MUST answer the question in this section. The question is worth 30 marks.

I badly need the whole solution of this

16,600 SECTION A You MUST answer the question in this section. The question is worth 30 marks. You are reminded to show all relevant workings in your answer booklet. Question 1 Sofia Ltd has an accounting year-end of 31 December. At 1 January 2019, the following balances were brought forward in the company's ledgers: 000 Cost b/f: Land & Buildings 20.750 Plant & Machinery 120,540 Goodwill Internal Development Costs 15,810 Accumulated Depreciation b/f: Land & Buildings 1.798 Plant & Machinery 61,259 Internal Development Costs 4.742 Notes for the year ended 31 December 2019 a) The cost of Land brought forward was 13.45 million and that of Buildings 17.3 million Buildings are being depreciated over 50 years on the straight-line basis. There were no additions to Land & Buildings in the year. At 30 June 2019. Land & Buildings which had cost 13.175 million were disposed of for 9.6 million, giving rise to a loss on disposal of 1,976,500. At 1 July 2019, the remaining Land & Buildings were valued at 4.117 million for Land and 6.597 million for Buildings. The company intends to use the valuation model for Land & Buildings from that date. The remaining life of Buildings is estimated to be 40 years from the date of valuation. b) Plant & Machinery was purchased for 26.29 million on 1 April 2019. Plant & Machinery, which had cost 19.59 million, was disposed of on 30 June 2019 for 6.7 million, at a loss on disposal of 756,000. Plant is depreciated over 6 years on the straight line basis. c) Internal development costs of 4,940,160 were incurred and capitalised in the year. Internal development costs are amortised over 7 years on the straight-line basis with full amortisation in the year costs are incurred. Required: Prepare an appropriate table for Property, Plant and Equipment, and for Intangible Assets, suitable for inclusion in the Notes to the Financial Statements for the year ended 31 December 2019 TOTAL FOR SECTION A: 30 MARKS 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started