Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I beed the formulas for each answer. need* the spread sheet needs to have 4 differwnt tabs. A-D. A is Baseline (plug chug) B was

I beed the formulas for each answer.

need*

the spread sheet needs to have 4 differwnt tabs. A-D. A is Baseline (plug chug) B was 10% better (best) C was 10% worse (worse case) and D was the break even point.

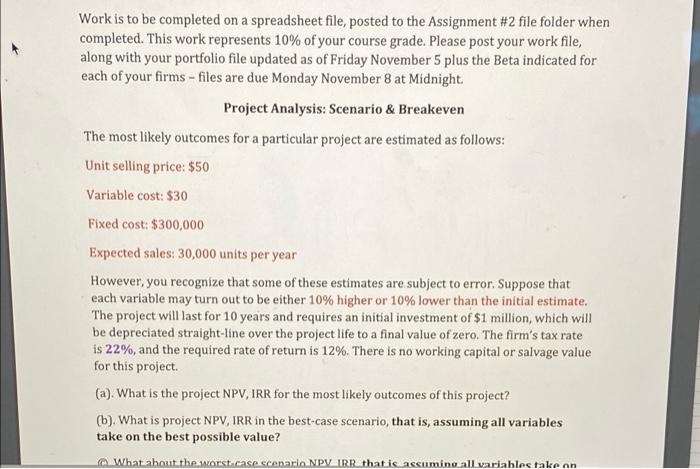

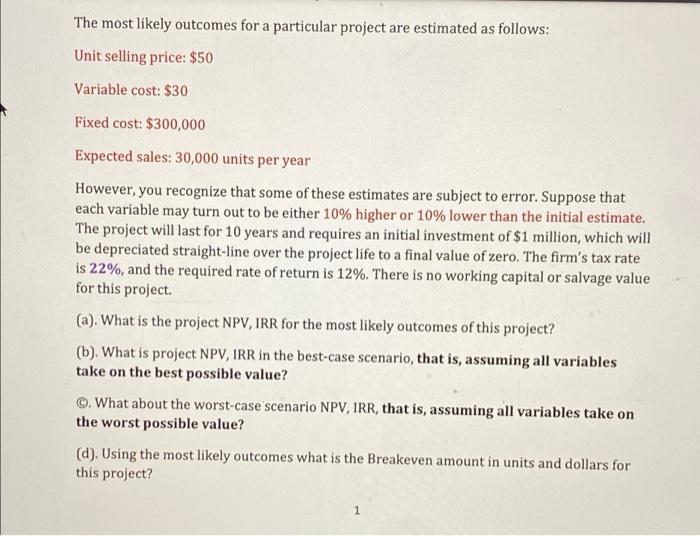

Work is to be completed on a spreadsheet file, posted to the Assignment #2 file folder when completed. This work represents 10% of your course grade. Please post your work file, along with your portfolio file updated as of Friday November 5 plus the Beta indicated for each of your firms - files are due Monday November 8 at Midnight Project Analysis: Scenario & Breakeven The most likely outcomes for a particular project are estimated as follows: Unit selling price: $50 Variable cost: $30 Fixed cost: $300,000 Expected sales: 30,000 units per year However, you recognize that some of these estimates are subject to error. Suppose that each variable may turn out to be either 10% higher or 10% lower than the initial estimate. The project will last for 10 years and requires an initial investment of $1 million, which will be depreciated straight-line over the project life to a final value of zero. The firm's tax rate is 22%, and the required rate of return is 12%. There is no working capital or salvage value for this project. (a). What is the project NPV, IRR for the most likely outcomes of this project? (b). What is project NPV, IRR in the best-case scenario, that is, assuming all variables take on the best possible value? What about the worst case scenario NPV IRR that is assuming all variables take on The most likely outcomes for a particular project are estimated as follows: Unit selling price: $50 Variable cost: $30 Fixed cost: $300,000 Expected sales: 30,000 units per year However, you recognize that some of these estimates are subject to error. Suppose that each variable may turn out to be either 10% higher or 10% lower than the initial estimate. The project will last for 10 years and requires an initial investment of $1 million, which will be depreciated straight-line over the project life to a final value of zero. The firm's tax rate is 22%, and the required rate of return is 12%. There is no working capital or salvage value for this project. (a). What is the project NPV, IRR for the most likely outcomes of this project? (b). What is project NPV, IRR in the best-case scenario, that is, assuming all variables take on the best possible value? . What about the worst-case scenario NPV, IRR, that is, assuming all variables take on the worst possible value? (d). Using the most likely outcomes what is the Breakeven amount in units and dollars for this project? 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started