Question

You, CPA, are employed at Beaulieu & Beauregard, Chartered Professional Accountants. On November 20, 2013, Dominic Jones, a partner in your firm, sends you the

You, CPA, are employed at Beaulieu & Beauregard, Chartered Professional Accountants. On November

20, 2013, Dominic Jones, a partner in your firm, sends you the following e-mail:

"Our firm has been reappointed auditors of Floral Impressions Ltd. (FIL) for the year ending

December 31, 2013. I met with the president and major shareholder of FIL, Liz Holtby, last week, and I

toured the Vancouver warehouse and head office. I have prepared some background information on FIL

for you to review, including the company's October 31, 2013 internal non-consolidated financial

statements (Exhibit I). FIL is increasing the amount of business it does on the Internet, and Liz would like

us to provide comments on the direction in which FIL is moving. I made notes on her plans for FIL's

increasing use of the Internet (Exhibit II). I also met with Craig Albertson, the controller, and I made

notes from that meeting (Exhibit III).

"Once you have reviewed the material, I would like you to draft an audit planning memo identifying the

new accounting and audit issues for the 2013 audit. I would also like the memo to address Liz's specific

requests.

"I'd like to receive something by next week. Let me know if you have any questions.

EXHIBIT I

BACKGROUND INFORMATION

FIL, a small public company listed on a Canadian stock exchange, is a wholesaler of silk plants with three

warehouses located in Ontario, Alberta, and British Columbia. It imports its inventory of silk flowers and

accessories from Indonesia. FIL employees arrange bouquets, trees, wreaths, and decorative floral

products for sale in Canada to flower shops, grocery stores, and other retailers.

The silk-plant concept was novel when FIL was incorporated in 1992. For the first three fiscal years, sales

grew at approximately 40% per year, and FIL expanded to meet the demand. However, increased

competition resulted in declining sales and operating losses over the next six years. Liz inherited the

shares of the company in 2011. She had just completed a marketing course and was very excited about

becoming involved in the business and applying her new skills. The fiscal year ended December 31, 2012,

brought a return to higher sales levels and a modest net income. Liz's management contract, which was

renegotiated in 2012, provides for stock options to be granted to her each year based on the percentage

increase of FIL's revenue from one year to the next. On October 31, 2013, Liz was granted stock options

for the first time. She received 4,500 stock options at $2.25 each, the market price on that date.

On January 15, 2013, when shares were trading at $4 each, FIL announced an agreement with the

shareholders of Rest-EZE Wreath Corporation (RWC) whereby FIL would acquire 100% of the voting

shares of RWC by issuing 200,000 FIL common shares. The acquisition of RWC was completed on

October 31, 2013. The market value of FIL's shares has declined significantly since the announcement.

RWC, a small private Canadian corporation, sells funeral wreaths, made with fresh flowers, on the

Internet. The suppliers, florists throughout Canada, advertise their wreath models on RWC's website,

which is targeted at funeral homes and their customers. These clients order their flowers through RWC's

website. RWC records 100% of the sale, invoices the clients for the same amount, and remits 85% of the

proceeds to the supplier. RWC absorbs any bad debts. RWC is in the process of installing a billing

system on its website that would allow customers to pay by credit card, but is still working out some

bugs.

RWC's assets (mainly accounts receivable and office equipment) less the liabilities assumed have a fair

value of $150,000, as established by an independent evaluator. RWC has never been audited and its year

end is November 30.

EXHIBIT II

NOTES FROM DOMINIC JONES' CONVERSATION WITH LIZ HOLTBY

Liz believes the acquisition of RWC provides an opportunity to expand into a less cyclical market and to

sell on the Internet. RWC has well-established relationships with two major funeral-home chains. Liz is

excited about benefiting from RWC's website because the site fits perfectly with FIL's new direction and

allows FIL to gain access to the Internet immediately. So far, the site has not generated significant new

business for FIL, but Liz is confident that, with time, sales will increase. As soon as RWC's billing

system allows payments by credit card, FIL also intends to link directly into RWC's accounting system to

invoice its own clients. Liz anticipates that RWC will account for about 40% of FIL's consolidated

revenue this year. Liz expects that the share price of FIL will increase substantially with the acquisition of

RWC and plans to exercise her stock options and sell the shares acquired as soon as the share price

reaches $9 or more.

To gain greater exposure on the Internet, FIL is also developing its own website. FIL will pay for the

costs of running the site by selling advertising spots on the site to home decorating companies. Liz

believes she can generate $80,000 in advertising revenue over a 12-month period once the site is up and

running. So far, FIL has pre-sold ten spots for $200 each. The advertisements are to run for one month.

Unfortunately, the site delays have caused some advertisers to cancel their contracts. Others are

threatening to cancel their contracts unless FIL gets the site up and running within the next month. The

controller has recorded the advertising revenue as sales.

FIL has two technicians working in its computer department. Most of their time is spent keeping the

network up and running. Since developing an Intranet two months ago to give all employees access to the

Internet, the network has been bombarded with junk mail and has slowed down or crashed regularly. As a

result, the two technicians have not had time to develop the website or to upgrade the firewall as planned.

Liz wants the website up and running right away and has threatened to hire RWC's programmers to

develop the website if FIL's technicians don't do it quickly enough.

Very recently, Liz spoke to a representative from a company offering to perform all of FIL's accounting

over the Internet. Now Liz's new vision for FIL is to do everything on the Internet. The representative

says that his company will maintain, on its own website, the latest version of whatever standard

accounting package FIL uses. FIL would access the site and post the transactions (accounts receivable,

accounts payable, and payroll). His company would generate the accounting books and records and would

generate FIL's monthly financial statements. Liz likes this plan because she could reduce both

administrative staffing costs and the amount of time she spends managing the administration group. It

would allow Liz to better focus her efforts on developing FIL's Internet site and related sales.

EXHIBIT III

NOTES FROM DOMINIC JONES' CONVERSATION WITH CRAIG ALBERTSON

Craig Albertson was hired by FIL in September 2013 as the controller. FIL's previous controller resigned

in June 2013 due to illness, and the position was temporarily filled by the accounts payable clerk. Craig

anticipates that he will have all year-end information ready for our audit team by March 15, 2014.

In February 2013, Liz outsourced FIL's payroll function to a service bureau that offered an exceptional

price if FIL signed a five-year contract. The payroll consists of fifty employees. Craig has heard rumours

that the service bureau is experiencing financial difficulties.

Historically, FIL's sales are highest during February and March, and August to October. Accounts

receivable consist of a large number of small-dollar-value accounts, with the exception of five large chain

store customers that account for approximately 40% of the total accounts receivable. The allowance for

returns typically has been 1% of fourth quarter sales.

Management counts inventory at the end of each quarter and cost of goods sold is adjusted accordingly.

At September 30, 2013, inventories held at each location were as follows: 55% of the total dollar value in

British Columbia, 35% in Alberta, and 10% in Ontario. By year end, Craig expects inventory at all sites

to be at much lower levels. While visiting the warehouse, I observed that physical security over inventory

was tight. Craig commented that FIL has never written down inventory in the past but that he estimates

about 2% of the current inventory is obsolete because it is out of style.

During the year, management negotiated an operating line of credit with a new financial institution. The

amount authorized is limited to 75% of accounts receivable under 90 days old and 50% of inventory, to a

maximum of $2 million. The loan bears interest at prime plus 3%. Under this agreement, FIL is required

to provide audited financial statements within 90 days of its fiscal year end.

Craig did not record the investment in RWC, since the only change was in the number of common shares

issued.

On October 1, 2013, FIL purchased a customer list for $20,000 from a former competitor that was going

out of business. FIL has not yet determined an amortization policy for this purchase.

Some employees and board members have questioned FIL's sudden focus on the Internet when other

companies seem to be moving away from it and back to traditional sales methods. Craig raised the same

concern. He doesn't understand why FIL is changing direction when the new management's marketing

changes produced such good results in 2012.

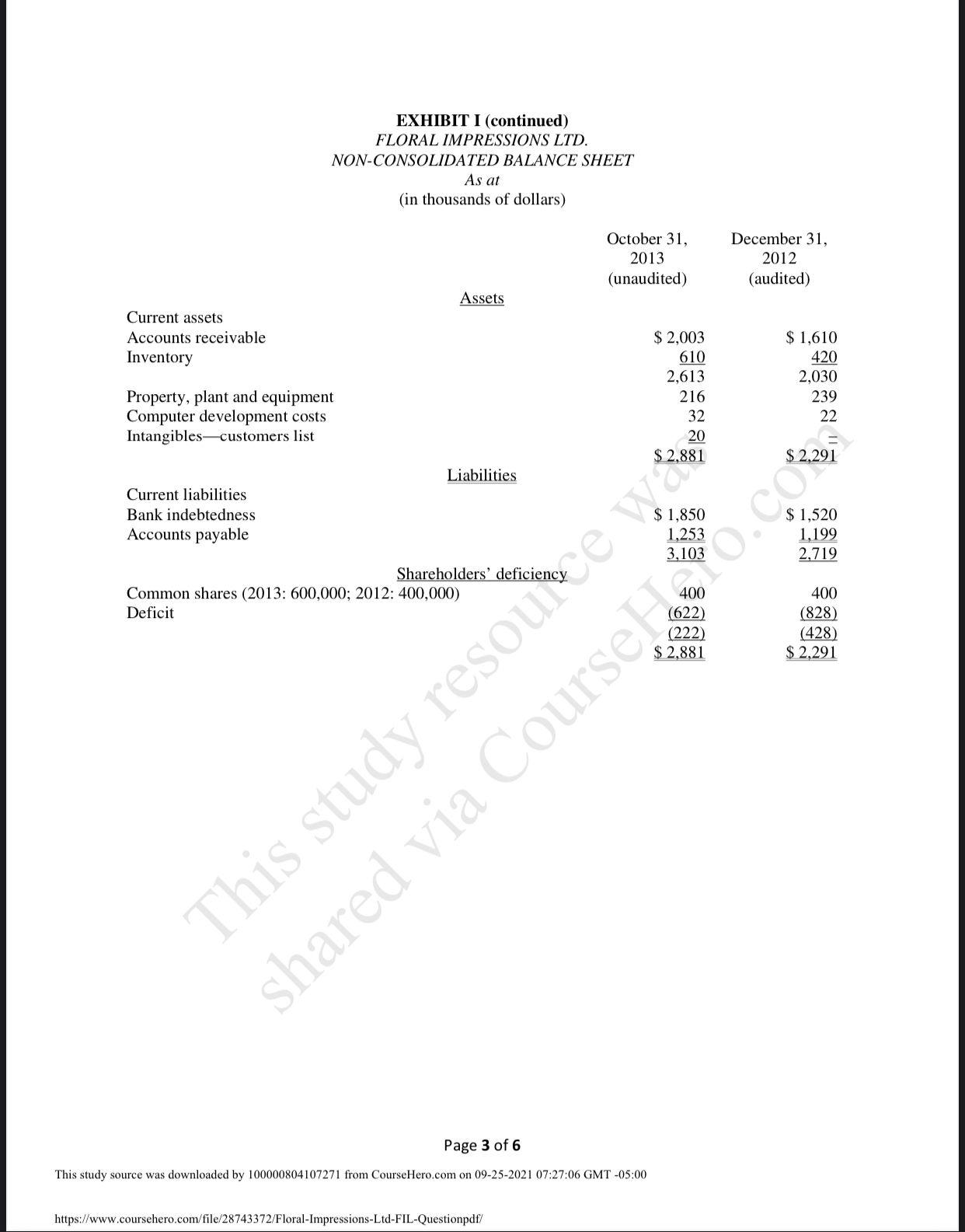

Current assets Accounts receivable Inventory EXHIBIT I (continued) FLORAL IMPRESSIONS LTD. NON-CONSOLIDATED BALANCE SHEET Property, plant and equipment Computer development costs Intangibles customers list Current liabilities. Bank indebtedness Accounts payable As at (in thousands of dollars) Assets Liabilities Shareholders' deficiency Common shares (2013: 600,000; 2012: 400,000) Deficit October 31, 2013 (unaudited) Page 3 of 6 This study source was downloaded by 100000804107271 from CourseHero.com on 09-25-2021 07:27:06 GMT -05:00 https://www.coursehero.com/file/28743372/Floral-Impressions-Ltd-FIL-Questionpdf/ $2,003 610 2,613 216 32 December 31, 2012 (audited) This study resource wa shared via Courseo.co $1,610 420 2,030 239 22

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To Dominic Jones From CPA Subject Floral Impressions Ltd Date April 1 2014A FIL has become more and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e3e69e85c6_183089.pdf

180 KBs PDF File

635e3e69e85c6_183089.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started