Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i) Calculate departmental overhead rates and apply them to the product lines. (6 marks) Machine Overhead Rate Assembly Overhead Rate Application of Overheads Machine

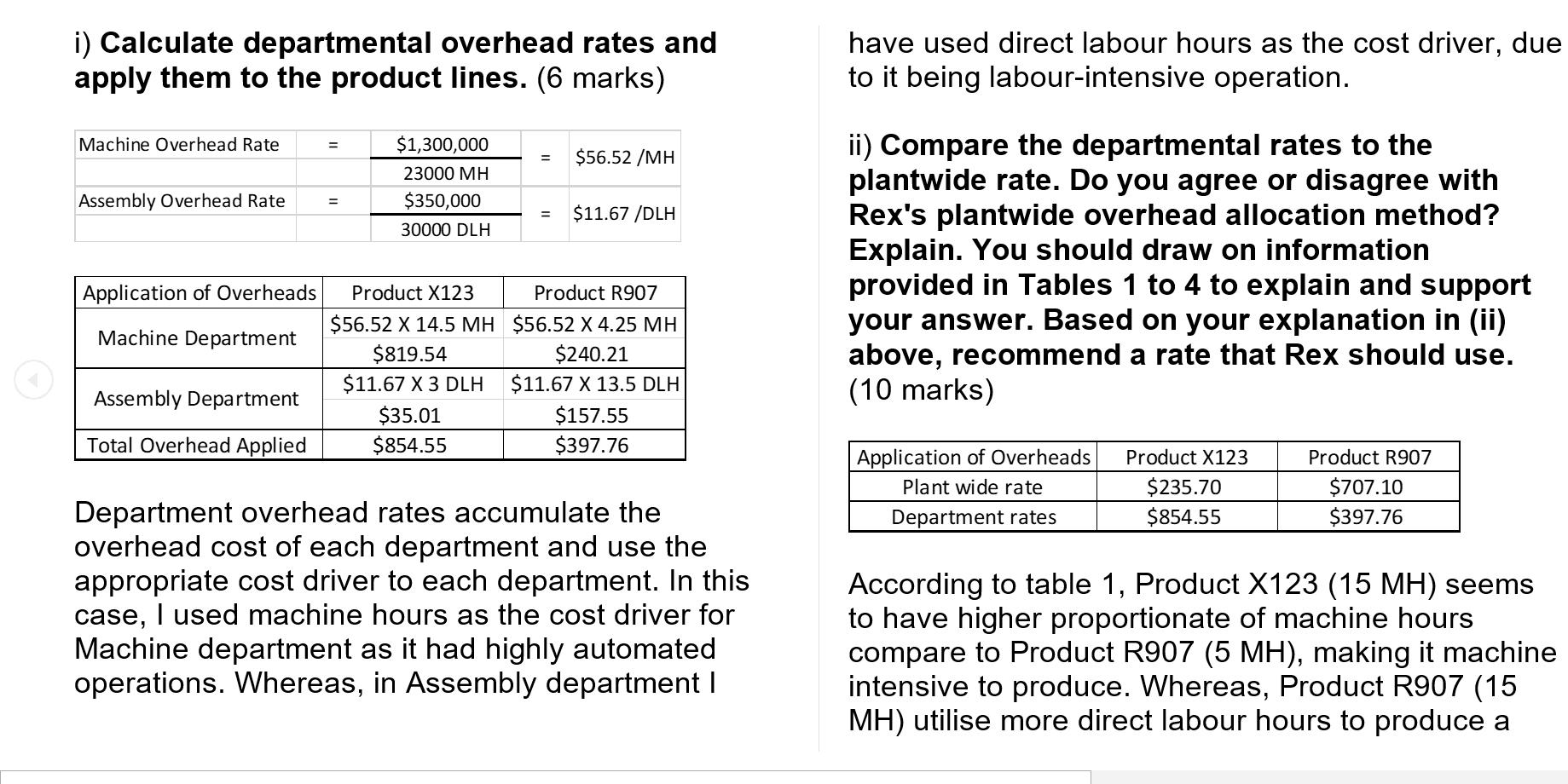

i) Calculate departmental overhead rates and apply them to the product lines. (6 marks) Machine Overhead Rate Assembly Overhead Rate Application of Overheads Machine Department Assembly Department Total Overhead Applied = $1,300,000 23000 MH $350,000 30000 DLH Product X123 $56.52 X 14.5 MH $819.54 $11.67 X 3 DLH $35.01 $854.55 = $56.52 /MH = $11.67 /DLH Product R907 $56.52 X 4.25 MH $240.21 $11.67 X 13.5 DLH $157.55 $397.76 Department overhead rates accumulate the overhead cost of each department and use the appropriate cost driver to each department. In this case, I used machine hours as the cost driver for Machine department as it had highly automated operations. Whereas, in Assembly department I have used direct labour hours as the cost driver, due to it being labour-intensive operation. ii) Compare the departmental rates to the plantwide rate. Do you agree or disagree with Rex's plantwide overhead allocation method? Explain. You should draw on information provided in Tables 1 to 4 to explain and support your answer. Based on your explanation in (ii) above, recommend a rate that Rex should use. (10 marks) Application of Overheads Plant wide rate Department rates Product X123 $235.70 $854.55 Product R907 $707.10 $397.76 According to table 1, Product X123 (15 MH) seems to have higher proportionate of machine hours compare to Product R907 (5 MH), making it machine intensive to produce. Whereas, Product R907 (15 MH) utilise more direct labour hours to produce a unit compare to Product X123, this proves that it is labour intensive to produce. Well, table 2 provides the information on the annual overhead cost and the production activity by the Machine department and Assembly department

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

i Calculation of Departmental Overhead Rates and Application to Product Lines To calculate the departmental overhead rates we need to divide the annual overhead cost by the cost driver for each depart...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started