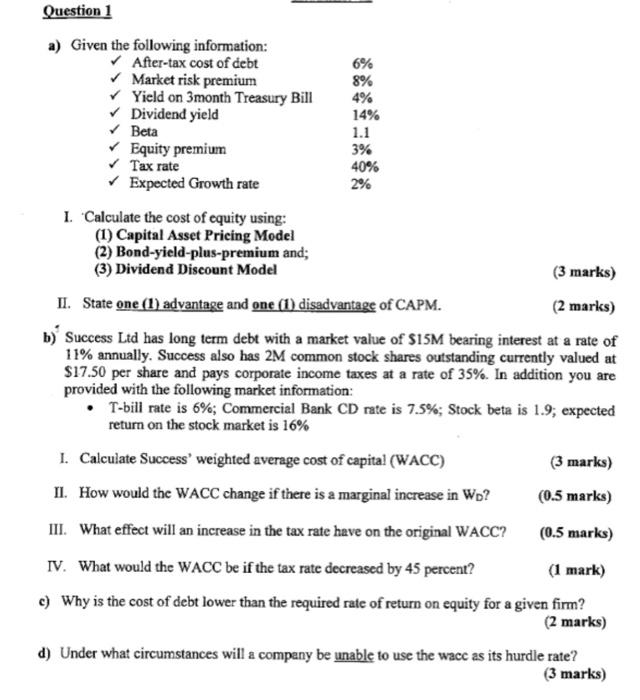

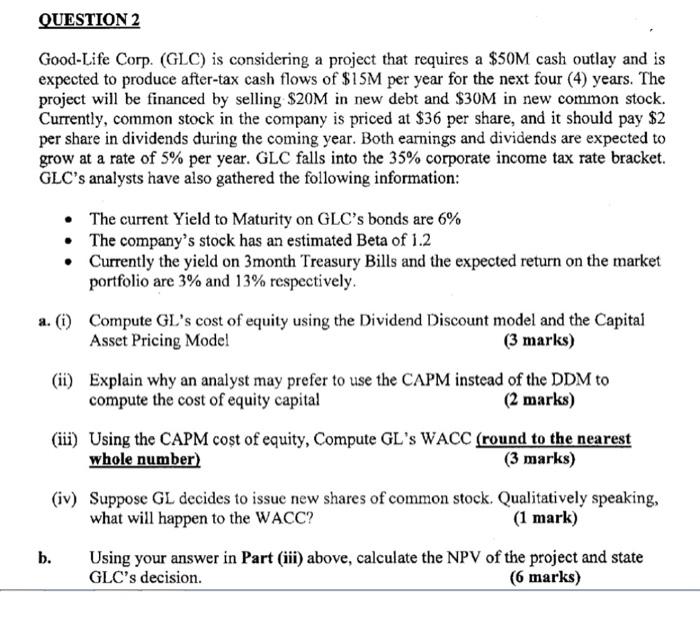

I. Calculate the cost of equity using: (1) Capital Asset Pricing Model (2) Bond-yield-plus-premium and; (3) Dividend Discount Model (3 marks) II. State one (1) advantage and one (1) disadvantage of CAPM. (2 marks) b) Success Ltd has long term debt with a market value of 515M bearing interest at a rate of 11% annually. Success also has 2M common stock shares outstanding currently valued at $17.50 per share and pays corporate income taxes at a rate of 35%. In addition you are provided with the following market information: - T-bill rate is 6\%; Commercial Bank CD rate is 7.5\%; Stock beta is 1.9; expected return on the stock market is 16% I. Calculate Success' weighted average cost of capital (WACC) II. How would the WACC change if there is a marginal increase in WD ? III. What effect will an increase in the tax rate have on the original WACC? IV. What would the WACC be if the tax rate decreased by 45 percent? (3 marks) (0.5 marks) (0.5 marks) (1 mark) Good-Life Corp. (GLC) is considering a project that requires a $50M cash outlay and is expected to produce after-tax cash flows of $15M per year for the next four (4) years. The project will be financed by selling $20M in new debt and $30M in new common stock. Currently, common stock in the company is priced at $36 per share, and it should pay $2 per share in dividends during the coming year. Both earnings and dividends are expected to grow at a rate of 5% per year. GLC falls into the 35% corporate income tax rate bracket. GLC's analysts have also gathered the following information: - The current Yield to Maturity on GLC's bonds are 6\% - The company's stock has an estimated Beta of 1.2 - Currently the yield on 3month Treasury Bills and the expected return on the market portfolio are 3% and 13% respectively. a. (i) Compute GL's cost of equity using the Dividend Discount model and the Capital Asset Pricing Mode! (3 marks) (ii) Explain why an analyst may prefer to use the CAPM instead of the DDM to compute the cost of equity capital (2 marks) (iii) Using the CAPM cost of equity, Compute GL's WACC (round to the nearest whole number) (3 marks) (iv) Suppose GL decides to issue new shares of common stock. Qualitatively speaking, what will happen to the WACC? (1 mark) b. Using your answer in Part (iii) above, calculate the NPV of the project and state GLC's decision. (6 marks)