Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I calculated Expected Return for part A as 10% for project A, 14.4% for Project B, and 15% for market return. I also calculated variance

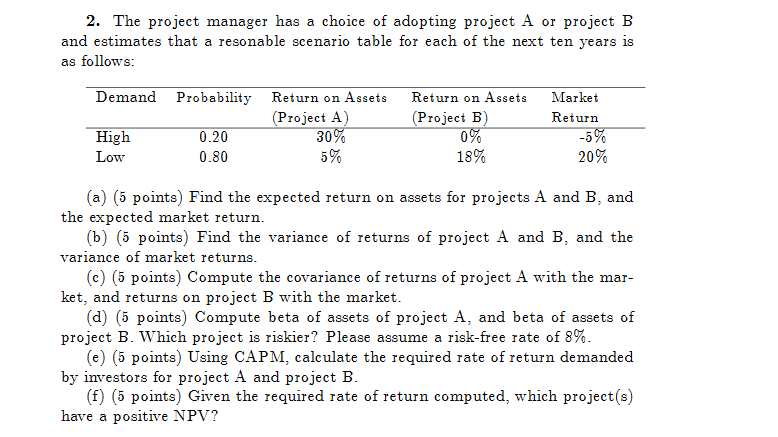

I calculated Expected Return for part A as 10% for project A, 14.4% for Project B, and 15% for market return. I also calculated variance as .01 for Project A, .005184 for Project B, and .01 for market return. I am confused with how to do the rest of the problem parts C-F and if you could confirm I calculated parts A and B correctly that would be appreciated and if I got them wrong if you could explain where I may have made a mistake. Any help is appreciated

2. The proiect manager has a choice of adopting proiect A or proiect B and estimates that a resonable scenario table for each of the next ten years is as follows Demand Probability Return on Assets Return on Assets Market Return (Proiect A) 30% (Project B) High 0.20 0.80 -5 20% 18% the expected market return. variance of market returns ket, and returns on project B with the market project B. Which project is riskier? Please assume a risk-free rate of 8% by investors for project A and project B Low (a) (5 points) Find the expected return on assets for projects A and B, and b) (5 points) Find the variance of returns of project A and B, and the (c) (5 points) Compute the covariance of returns of project A with the mar- (d) (5 points) Compute beta of assets of project A, and beta of assets of (e) (5 points) Using CAPM, calculate the required rate of return demanded (5 points) Given the required rate of return computed, which project(s) have a positive NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started