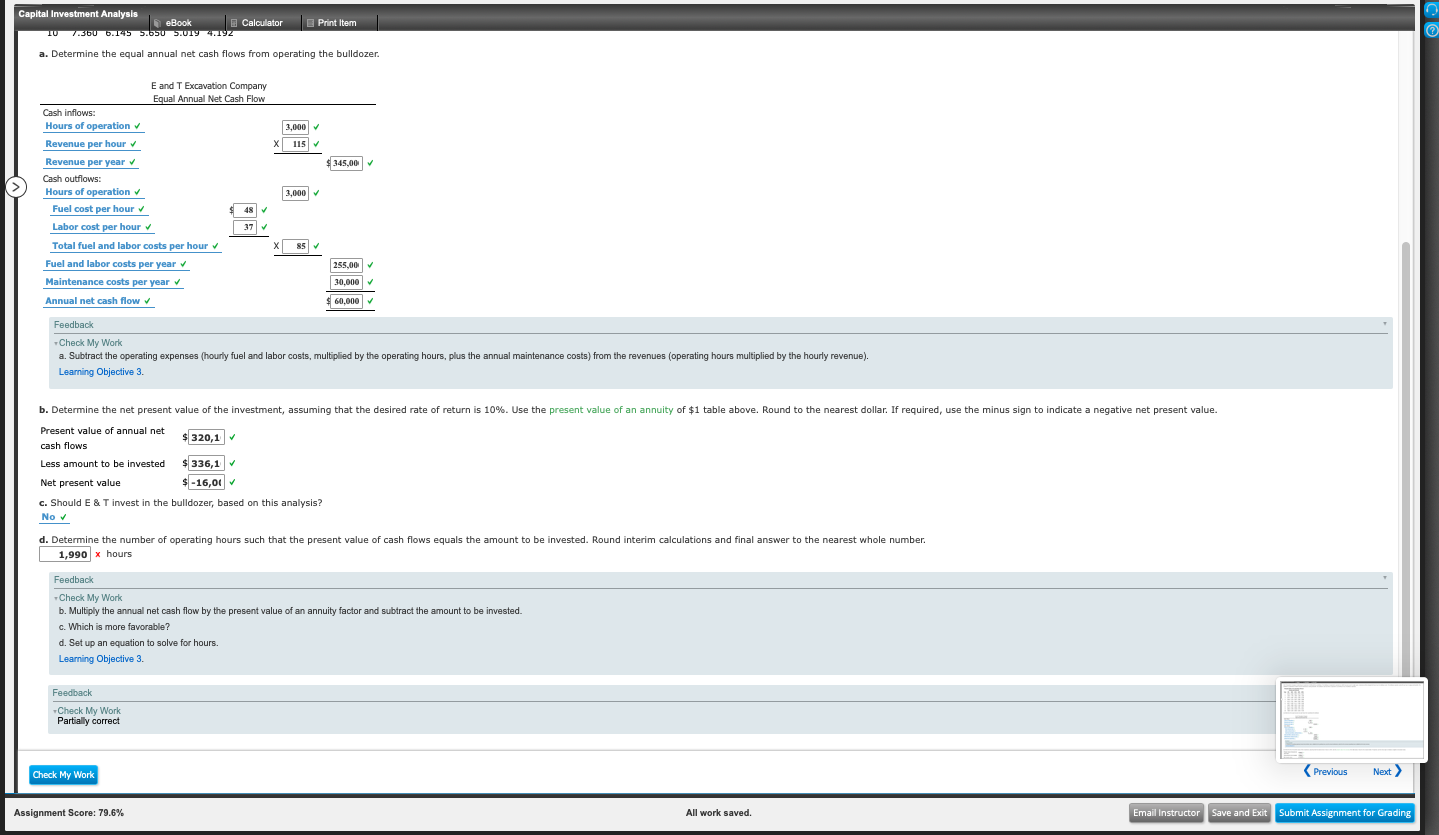

I can not get the right answer for D.

I can not get the right answer for D.

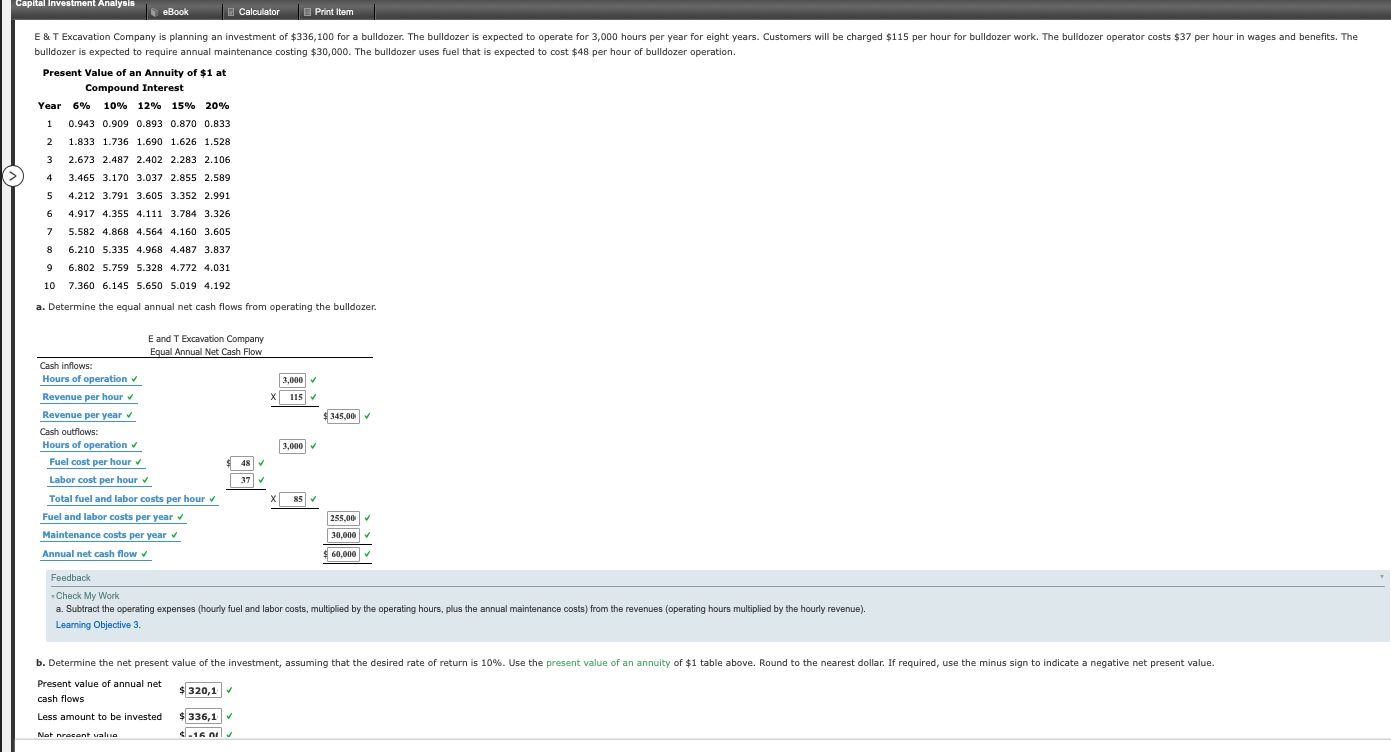

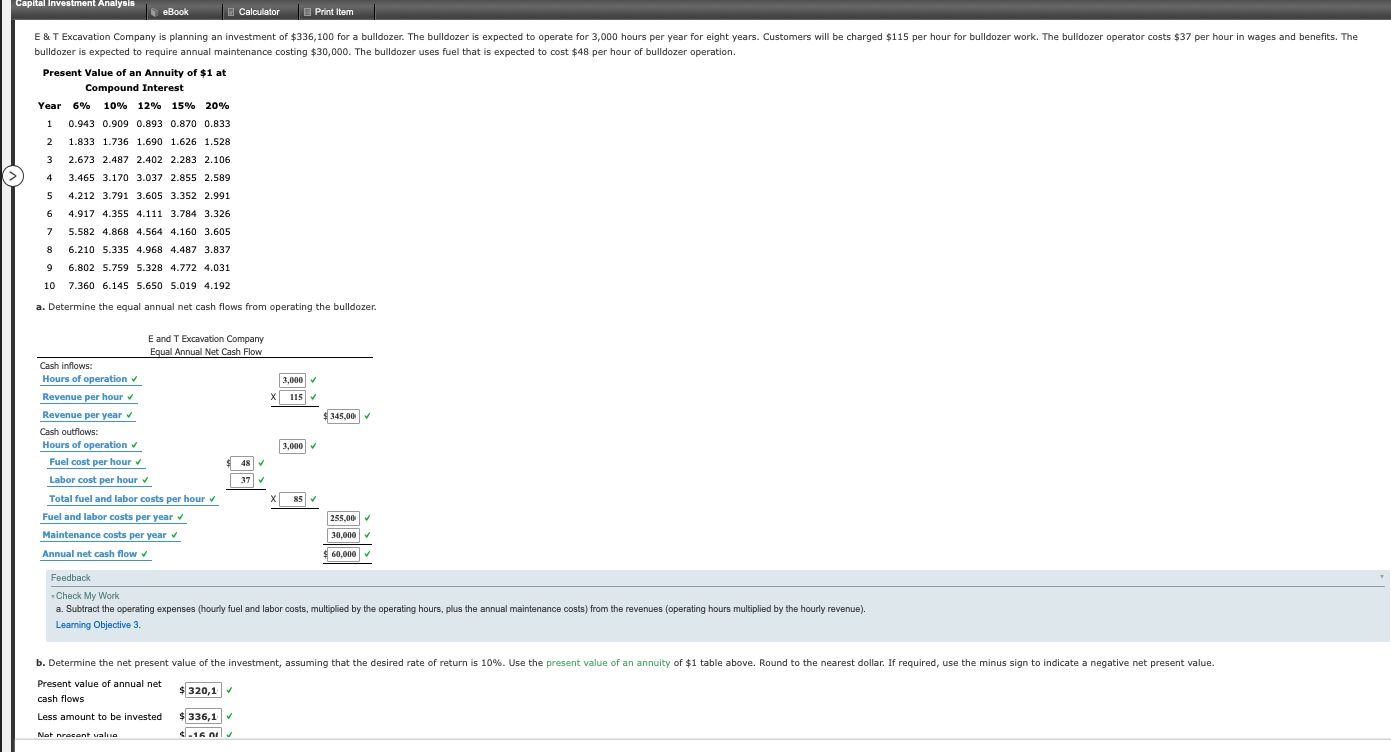

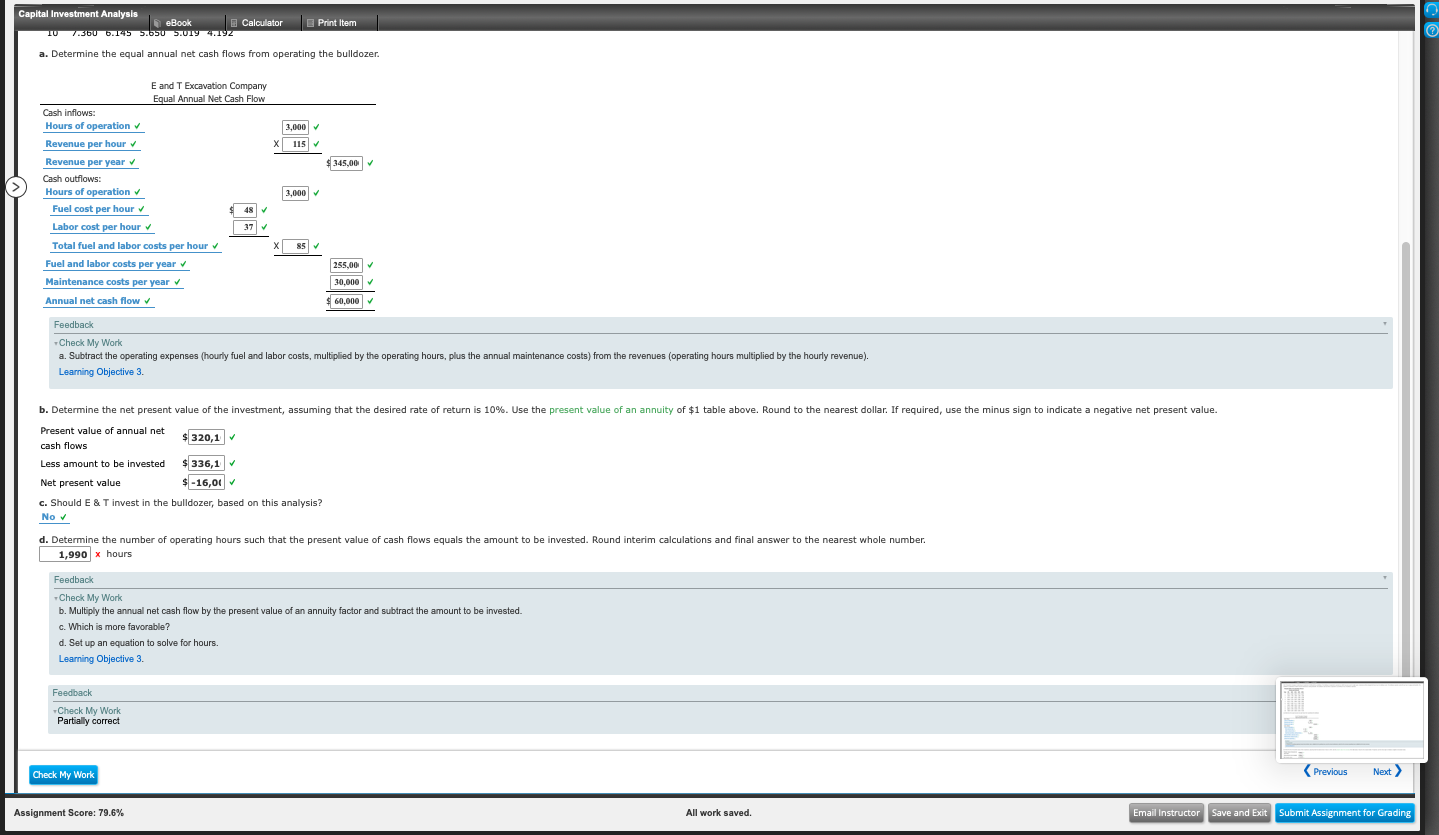

Capital Investment Analysis eBook Calculator Print Item E &T Excavation Company is planning an investment of $336,100 for a bulldozer. The bulldozer is expected to operate for 3,000 hours per year for eight years. Customers will be charged $115 per hour for bulldozer work. The bulldozer operator costs $37 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $30,000. The bulldozer uses fuel that is expected to cost $48 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the equal annual net cash flows from operating the bulldozer. E and T Excavation Company Equal Annual Net Cash Flow Cash inflows: Hours of operation Revenue per hour 9345,00 Revenue per year Cash outflows: Hours of operation Fuel cost per hour Labor cost per hour Total fuel and labor costs per hour Fuel and labor costs per year Maintenance costs per year Annual net cash flow Feedback Check My Work a. Subtract the operating expenses (hourly fuel and labor costs, multiplied by the operating hours, plus the annual maintenance costs) from the revenues (operating hours multiplied by the hourly revenue). Learning Objective 3. b. Determine the net present value of the investment, assuming that the desired rate of return is 10%. Use the present value of an annuity of $1 table above. Round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flows $ 320,1 720 $ 336,1 Less amount to be invested Not racont value $ 16 mil Capital Investment Analysis eBook TU 1.360 0.145 5.650 194.192 Calculator Print Item a. Determine the equal annual net cash flows from operating the bulldozer. E and T Excavation Company Equal Annual Net Cash Flow Cash inflows: Hours of operation 3,000 115 Revenue per hour X Revenue per year $ 345,00 3,000 Cash outflows: Hours of operation Fuel cost per hour Labor cost per hour Total fuel and labor costs per hour Fuel and labor costs per year Maintenance costs per year Annual net cash flow Feedback Check My Work a. Subtract the operating expenses (hourly fuel and labor costs, multiplied by the operating hours, plus the annual maintenance costs) from the revenues (operating hours multiplied by the hourly revenue). Learning Objective 3. b. Determine the net present value of the investment, assuming that the desired rate of return is 10%. Use the present value of an annuity of $1 table above. Round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net 2011 cash flows Less amount to be invested $336,1 Net present value $ -16,00 c. Should E & T invest in the bulldozer, based on this analysis? No d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested. Round interim calculations and final answer to the nearest whole number 1,990 x hours Feedback Check My Work b. Multiply the annual net cash flow by the present value of an annuity factor and subtract the amount to be invested. c. Which is more favorable? d. Set up an equation to solve for hours. Learning Objective 3. Feedback -Check My Work Partially correct Check My Work Previous Next > Assignment Score: 79.6% All work saved. Email Instructor Save and Exit Submit Assignment for Grading

I can not get the right answer for D.

I can not get the right answer for D.