i can send the excel file. not sure how to upload it.

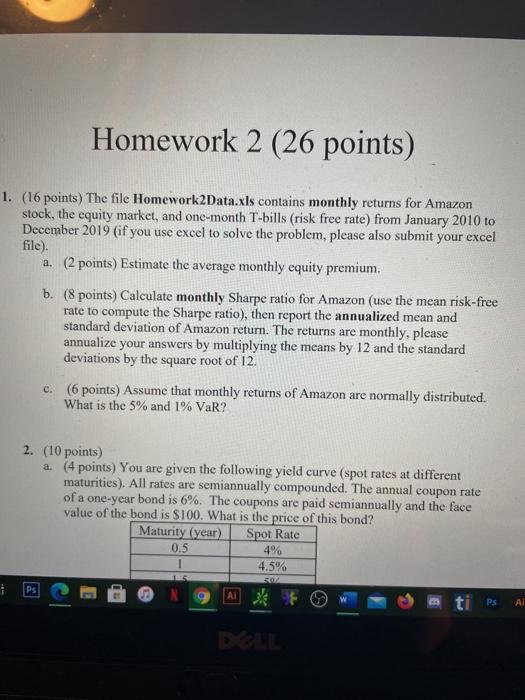

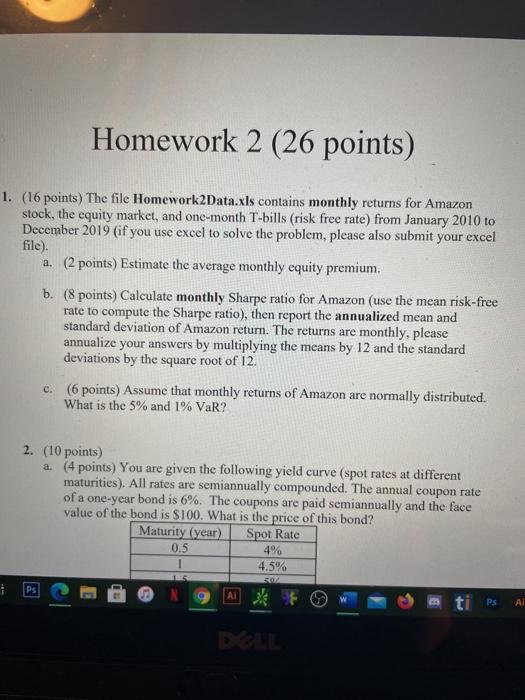

Homework 2 (26 points) 1. (16 points) The file Homework2Data.xls contains monthly returns for Amazon stock, the equity market, and one-month T-bills (risk free rate) from January 2010 to December 2019 (if you use excel to solve the problem, please also submit your excel file). a. (2 points) Estimate the average monthly equity premium. b. (8 points) Calculate monthly Sharpe ratio for Amazon (use the mean risk-free rate to compute the Sharpe ratio), then report the annualized mean and standard deviation of Amazon return. The returns are monthly, please annualize your answers by multiplying the means by 12 and the standard deviations by the square root of 12. c. (6 points) Assume that monthly returns of Amazon are normally distributed. What is the 5% and 1% VaR? 2. (10 points) a. (4 points) You are given the following yield curve (spot rates at different maturities). All rates are semiannually compounded. The annual coupon rate of a one-year bond is 6%. The coupons are paid semiannually and the face value of the bond is $100. What is the price of this bond? Maturity (year) Spot Rate 0.5 4% 4.5% Ps AT Ps Homework 2 (26 points) 1. (16 points) The file Homework2Data.xls contains monthly returns for Amazon stock, the equity market, and one-month T-bills (risk free rate) from January 2010 to December 2019 (if you use excel to solve the problem, please also submit your excel file). a. (2 points) Estimate the average monthly equity premium. b. (8 points) Calculate monthly Sharpe ratio for Amazon (use the mean risk-free rate to compute the Sharpe ratio), then report the annualized mean and standard deviation of Amazon return. The returns are monthly, please annualize your answers by multiplying the means by 12 and the standard deviations by the square root of 12. c. (6 points) Assume that monthly returns of Amazon are normally distributed. What is the 5% and 1% VaR? 2. (10 points) a. (4 points) You are given the following yield curve (spot rates at different maturities). All rates are semiannually compounded. The annual coupon rate of a one-year bond is 6%. The coupons are paid semiannually and the face value of the bond is $100. What is the price of this bond? Maturity (year) Spot Rate 0.5 4% 4.5% Ps AT Ps

i can send the excel file. not sure how to upload it.

i can send the excel file. not sure how to upload it.