Answered step by step

Verified Expert Solution

Question

1 Approved Answer

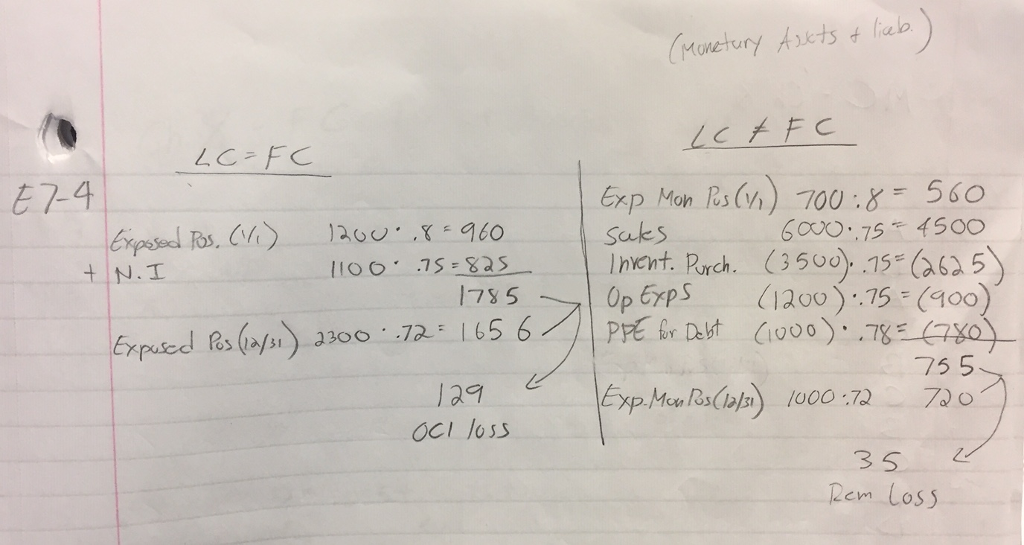

I cannot figure out how the Exposed Position was calculated for the translation gain (loss) - 1,200. All of my work is correct and has

I cannot figure out how the Exposed Position was calculated for the translation gain (loss) - 1,200. All of my work is correct and has been confirmed by instructor. Please advise.

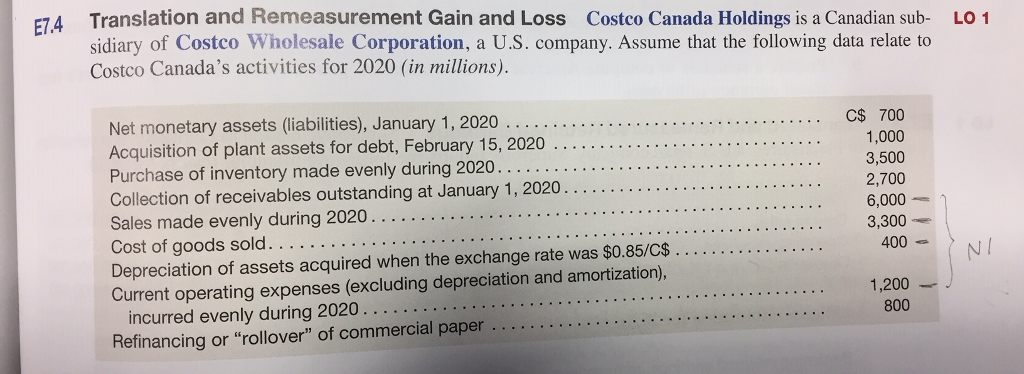

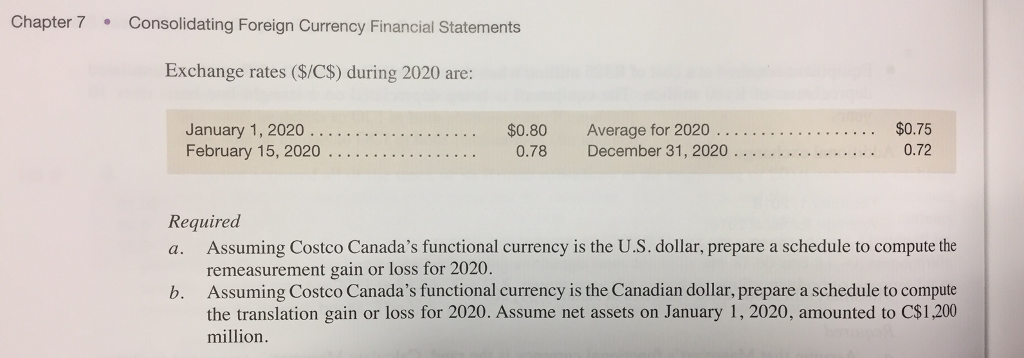

74 Translation and Remeasurement Gain and Loss Costco Canada Holdings is a Canadian sub- L0 1 sidiary of Costco Wholesale Corporation, a U.S. company. Assume that the following data relate to Costco Canada's activities for 2020 (in millions). C$ 700 1,000 3,500 2,700 6,000 3,300 400 . .. . . . Net monetary assets (liabilities), January 1, 2020 . Acquisition of plant assets for debt, February 15, 2020. . Purchase of inventory made evenly during 2020. Collection of receivables outstanding at January 1, 2020 Sales made evenly during 2020..... . Depreciation of assets acquired when the exchange rate was $0.85/C$ . . . . . . . . .. . . Current operating expenses (excluding depreciation and amortization), 1,200 800 Refinancing or "rollover" of commercial paper

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started