Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I cannot figure out project year 2 all the way to project year 11. I need to figure out each nunber to project year 11.

I cannot figure out project year 2 all the way to project year 11. I need to figure out each nunber to project year 11. (If the picture of the problem is blurry, here is what it says: "Migletti Resturants is looking at a project with the following forecasted sales: first year sales quantitt of 31,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $42.00 and will grown at 2.00% per year. The production costs are expected to be 55% of the current years sales price. The manufacturinf equipment to aid this project will have a total cost (including installation) of 2,500,000. It will be depreciated using MARCS, and has a seven year MARCS life classification. Fixed cosgs will be $350,000 per year. Migletti Resturants has a tax rate of 38%. What is tbe operating cash flow for this project over these ten years? Find fhe NPV of the project for Migletti Resturants if the manufacturing equipment can be sold for $160,000 at the end of the ten tear project and the cost of capital for this project is 9%.

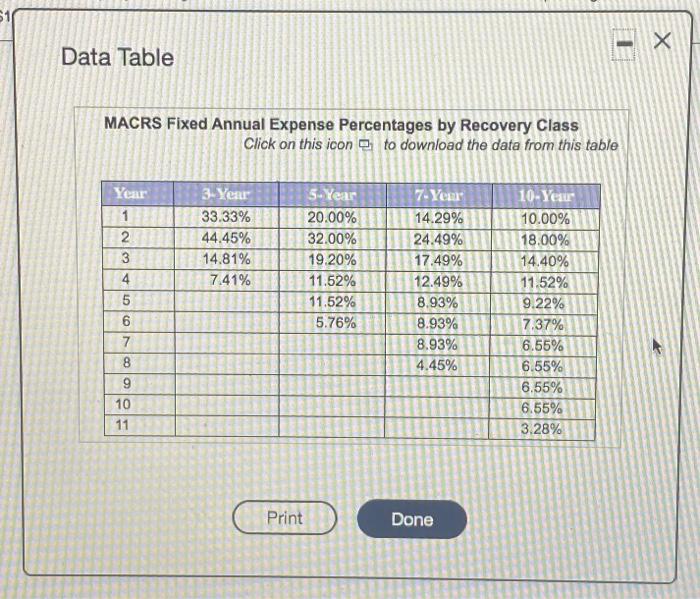

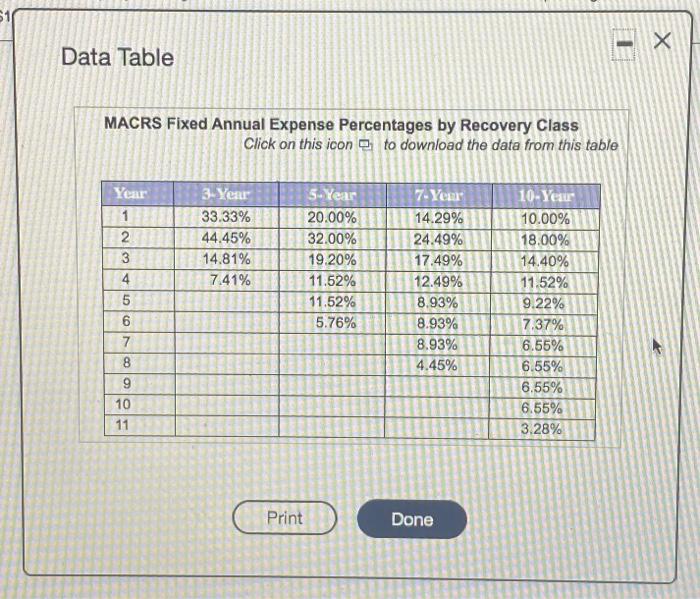

- Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table 3-Year 33.33% 44.45% 14.81% 7.41% Year 1 2 3 4 5 6 7 8 9 10 11 5-Year 20.00% 32.00% 19,20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Yesu 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% Print Done NPV Migel Rosas long the wing for sale fratyard 1000 2004 year. The production costs saipadda of ' i The und vya MACRS, ecco Miga Rasathematurgement for $160.000 your project del cap for precis ht. The price $4200 and we ndng 2.500.000 Mio. pred vores pratos Watcerating cash fow for this role 17 32001 Round torto What is a cering cash flower pop yor and to the Help Me Solve This View an Example Get More Help

- Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table 3-Year 33.33% 44.45% 14.81% 7.41% Year 1 2 3 4 5 6 7 8 9 10 11 5-Year 20.00% 32.00% 19,20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Yesu 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% Print Done NPV Migel Rosas long the wing for sale fratyard 1000 2004 year. The production costs saipadda of ' i The und vya MACRS, ecco Miga Rasathematurgement for $160.000 your project del cap for precis ht. The price $4200 and we ndng 2.500.000 Mio. pred vores pratos Watcerating cash fow for this role 17 32001 Round torto What is a cering cash flower pop yor and to the Help Me Solve This View an Example Get More Help

(If the picture of the problem is blurry, here is what it says: "Migletti Resturants is looking at a project with the following forecasted sales: first year sales quantitt of 31,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $42.00 and will grown at 2.00% per year. The production costs are expected to be 55% of the current years sales price. The manufacturinf equipment to aid this project will have a total cost (including installation) of 2,500,000. It will be depreciated using MARCS, and has a seven year MARCS life classification. Fixed cosgs will be $350,000 per year. Migletti Resturants has a tax rate of 38%. What is tbe operating cash flow for this project over these ten years? Find fhe NPV of the project for Migletti Resturants if the manufacturing equipment can be sold for $160,000 at the end of the ten tear project and the cost of capital for this project is 9%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started