I cannot figure out what i am doing wrong here. Please help!!!

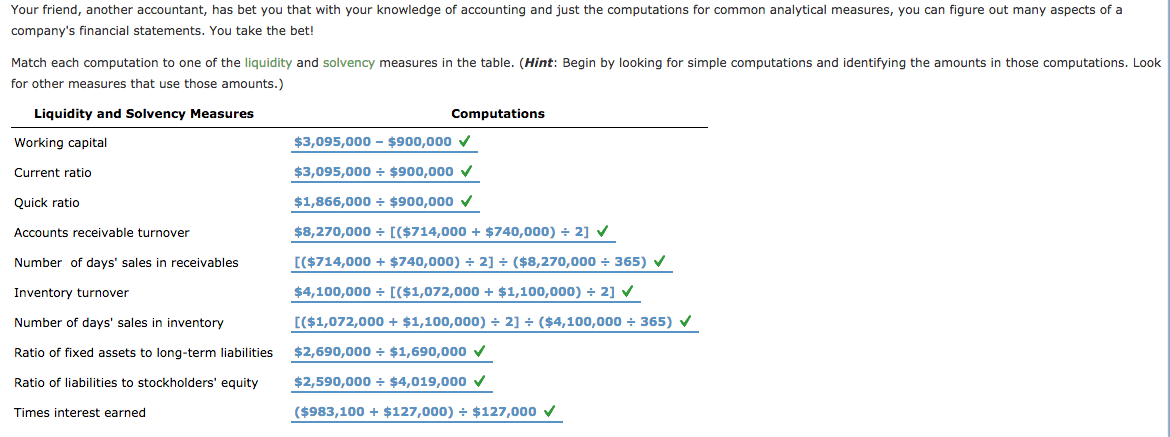

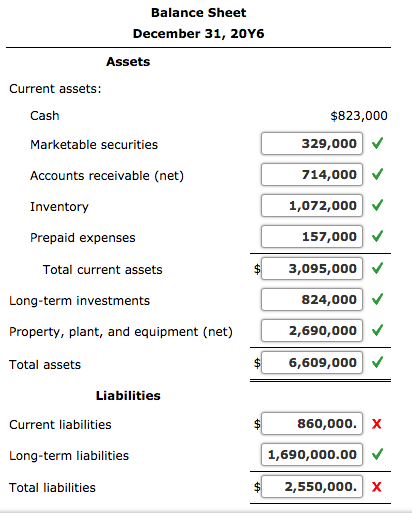

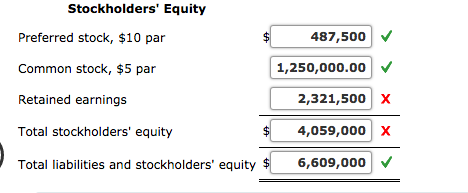

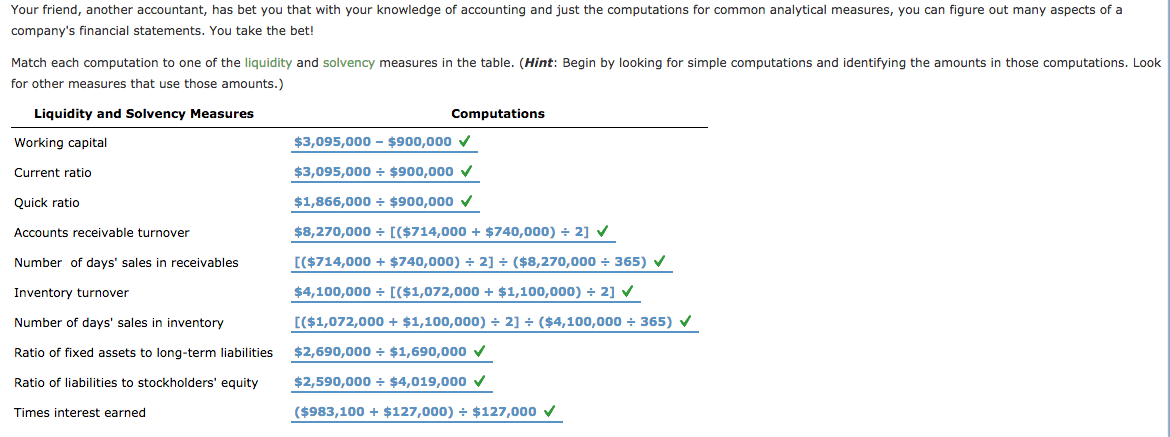

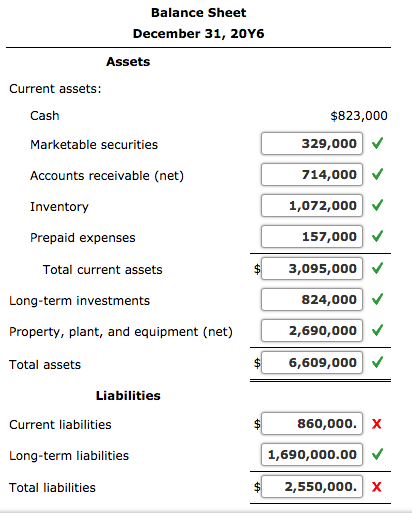

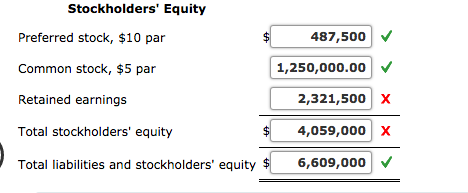

Your friend, another accountant, has bet you that with your knowledge of accounting and just the computations for common analytical measures, you can figure out many aspects of a company's financial statements. You take the bet! Match each computation to one of the liquidity and solvency measures in the table. (Hint: Begin by looking for simple computations and identifying the amounts in those computations. Look for other measures that use those amounts.) Liquidity and Solvency Measures Computations Working capital $3,095,000 - $900,000 Current ratio $3,095,000 = $900,000 $1,866,000 = $900,000 V Quick ratio Accounts receivable turnover Number of days' sales in receivables Inventory turnover $8,270,000 = [($714,000 + $740,000) = 2] [($714,000 + $740,000) = 2] = ($8,270,000 = 365) $4,100,000 = [($1,072,000 + $1,100,000) + 2] [($1,072,000 + $1,100,000) = 2] = ($4,100,000 = 365) $2,690,000 = $1,690,000 $2,590,000 - $4,019,000 Number of days' sales in inventory Ratio of fixed assets to long-term liabilities Ratio of liabilities to stockholders' equity Times interest earned ($983,100 + $127,000) = $127,000 Balance Sheet December 31, 2016 Assets Current assets: Cash Marketable securities $823,000 329,000 714,000 1,072,000 Accounts receivable (net) Inventory Prepaid expenses Total current assets $ Long-term investments 157,000 3,095,000 824,000 2,690,000 6,609,000 Property, plant, and equipment (net) Total assets $ Liabilities Current liabilities $ 860,000. x Long-term liabilities 1,690,000.00 2,550,000. x Total liabilities $ Stockholders' Equity Preferred stock, $10 par $ 487,500 1,250,000.00 Common stock, $5 par Retained earnings 2,321,500 x 4,059,000 x Total stockholders' equity $ Total liabilities and stockholders' equity $ 6,609,000 Your friend, another accountant, has bet you that with your knowledge of accounting and just the computations for common analytical measures, you can figure out many aspects of a company's financial statements. You take the bet! Match each computation to one of the liquidity and solvency measures in the table. (Hint: Begin by looking for simple computations and identifying the amounts in those computations. Look for other measures that use those amounts.) Liquidity and Solvency Measures Computations Working capital $3,095,000 - $900,000 Current ratio $3,095,000 = $900,000 $1,866,000 = $900,000 V Quick ratio Accounts receivable turnover Number of days' sales in receivables Inventory turnover $8,270,000 = [($714,000 + $740,000) = 2] [($714,000 + $740,000) = 2] = ($8,270,000 = 365) $4,100,000 = [($1,072,000 + $1,100,000) + 2] [($1,072,000 + $1,100,000) = 2] = ($4,100,000 = 365) $2,690,000 = $1,690,000 $2,590,000 - $4,019,000 Number of days' sales in inventory Ratio of fixed assets to long-term liabilities Ratio of liabilities to stockholders' equity Times interest earned ($983,100 + $127,000) = $127,000 Balance Sheet December 31, 2016 Assets Current assets: Cash Marketable securities $823,000 329,000 714,000 1,072,000 Accounts receivable (net) Inventory Prepaid expenses Total current assets $ Long-term investments 157,000 3,095,000 824,000 2,690,000 6,609,000 Property, plant, and equipment (net) Total assets $ Liabilities Current liabilities $ 860,000. x Long-term liabilities 1,690,000.00 2,550,000. x Total liabilities $ Stockholders' Equity Preferred stock, $10 par $ 487,500 1,250,000.00 Common stock, $5 par Retained earnings 2,321,500 x 4,059,000 x Total stockholders' equity $ Total liabilities and stockholders' equity $ 6,609,000