Answered step by step

Verified Expert Solution

Question

1 Approved Answer

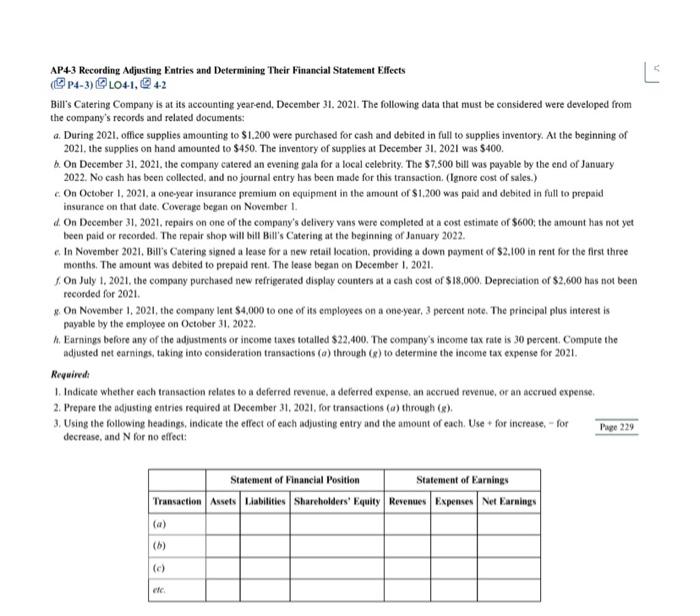

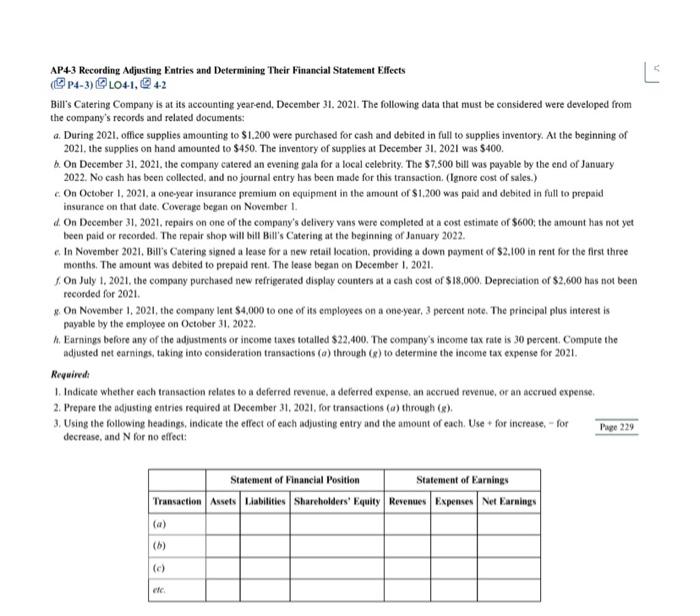

I cannot see the whole answer in the given previous solution. L AP43 Recording Adjusting Entries and Determining Their Financial Statement Effects P4-3) 1041,42 Bill's

I cannot see the whole answer in the given previous solution.

L AP43 Recording Adjusting Entries and Determining Their Financial Statement Effects P4-3) 1041,42 Bill's Catering Company is at its accounting yearend, December 31, 2021. The following data that must be considered were developed from the company's records and related documents: 4. During 2021, office supplies amounting to $1.200 were purchased for cash and debited in full to supplies inventory. At the beginning of 2021, the supplies on hand amounted to $450. The inventory of supplies at December 31, 2021 was $400. 6. On December 31, 2021, the company catered an evening gala for a local celebrity. The $7.500 bill was payable by the end of January 2022. No cash has been collected, and no journal entry has been made for this transaction. (Ignore cost of sales.) On October 1, 2021, a one-year insurance premium on equipment in the amount of $1.200 was paid and debited in full to prepaid insurance on that date. Coverage began on November I. 4. On December 31, 2021, repairs on one of the company's delivery vans were completed at a cost estimate of $600; the amount has not yet been paid or recorded. The repair shop will bill Bill's Catering at the beginning of January 2022. c. In November 2021. Bill's Catering signed a lease for a new retail location, providing a down payment or $2.100 in rent for the first three months. The amount was debited to prepaid rent. The lease began on December 1, 2021. On July 1, 2021, the company purchased new refrigerated display counters at a cash cost of $18,000. Depreciation of $2,600 has not been recorded for 2021 On November 1, 2021, the company lent $4,000 to one of its employees on a one-year, 3 percent note. The principal plus interest is payable by the employee on October 31, 2022. M. Earnings before any of the adjustments or income taxes totalled $22,400. The company's income tax rate is 30 percent. Compute the adjusted net earnings, taking into consideration transactions (a) through (r) to determine the income tax expense for 2021. Required 1. Indicate whether each transaction relates to a deferred revenue, a deferred expense, an accrued revenue, or an accrued expense. 2. Prepare the adjusting entries required at December 31, 2021. for transactions (a) through(s) 3. Using the following headings, indicate the effect of each adjusting entry and the amount of each. Use + for increase. - for Page 229 decrease, and N for no effect: Statement of Financial Position Statement of Earnings Transaction Assets Liabilities Shareholders' Equity Revenues Expenses Net Earnings (6) (c)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started