Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i cannot understand how to do this practice problem Sora Industries has 69 million outstanding shares $127 milion in debt, $49 million in cash, and

i cannot understand how to do this practice problem

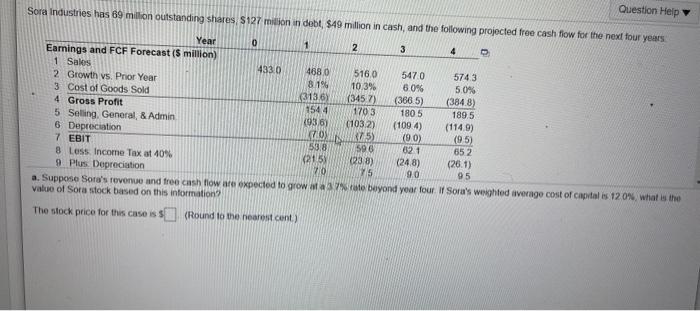

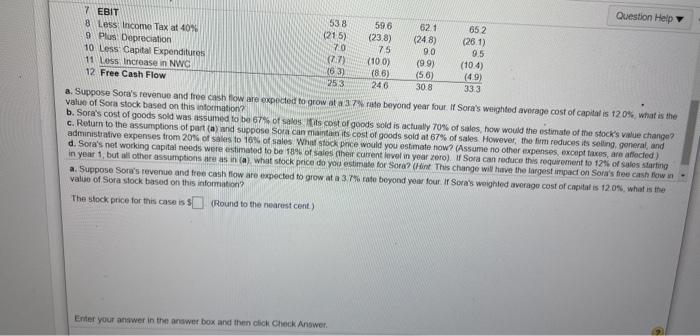

Sora Industries has 69 million outstanding shares $127 milion in debt, $49 million in cash, and the following projected free cash flow for the next four years Question Help Year 0 1 2 3 4 Earnings and FCF Forecast (5 million) 1 Sales 433.0 4880 5160 5470 5743 2 Growth vs. Prior Year 81% 10.3% 60% 5.0% 3 Cost of Goods Sold (3136) (3457) (3665) (384.8) 4 Gross Profit 1544 1703 180 5 1895 5 Seling, General, & Admin (036) (1032) (1094) (1149) 6 Depreciation ON 75) (90) (9.5) 7 EBIT 53.8 596 621 652 8 Less Income Tax at 40% 215) (238) (24.8) (26.1) 9 Plus Depreciation 20 75 90 95 a. Suppose Sora's revenue and free cash flow inte expected to grow ata 37% to beyond year four i Sora's weighted average cost of capital is 120%, what is the value of Sora stock based on this information The stock price for this case is (Round to the nearest cent) Question Help 7 EBIT 538 596 621 652 8 Less Income Tax at 40% (215) (238) 9 Plus Depreciation (248) (261) 70 75 90 9.5 10 Less Capital Expenditures (77) (100) (99) (104) 11 Less Increase in NWC (63) (8.6) (5,6) (49) 12 Free Cash Flow 253 246 308 333 a. Suppose Sora's revenue and free cash flow are expected to grow at a 37% rate beyond year fout If Sora's weighted average cost of capital is 120%, what is the value of Sora stock based on this information? b. Sora's cost of goods sold was assumed to be 67% of sales is cost of goods sold is actually 70% of sales, how would the estimate of the stock's value change? c. Return to the assumptions of part (a) and suppose Sora can mantan its cost of goods sold at 67% of sales However, the firm reduces its seling, general and administrative expenses from 20% of sales to 16% of sales Whal stock price would you estimate how? (Assume no other expenses, exceptes are affected) d. Sora's net working capital needs were estimated to be 18% of sales the current level in your zero) Sora can reduce this requirement to 12 of sales starting in year 1, but all other assumptions areas in (a) what stock price do you estimate for Sora? (Hint. This change will have the largest impact on Soru's free cash flow in a. Suppose Sora's revenue and free cash flow are expected to grow at a 375 rate beyond year four I Sora's weighted average cost of capital is 120%, what is the value of Sora stock based on this information? The stock price for this case is Round to the nearest cont) Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started