Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i cant figure out this managerial accounting practice problem. can someone help me. tho boxes with arrows need to be filled please structure answer liks

i cant figure out this managerial accounting practice problem. can someone help me. tho boxes with arrows need to be filled please structure answer liks the boxes in the question. will gove thunbs up

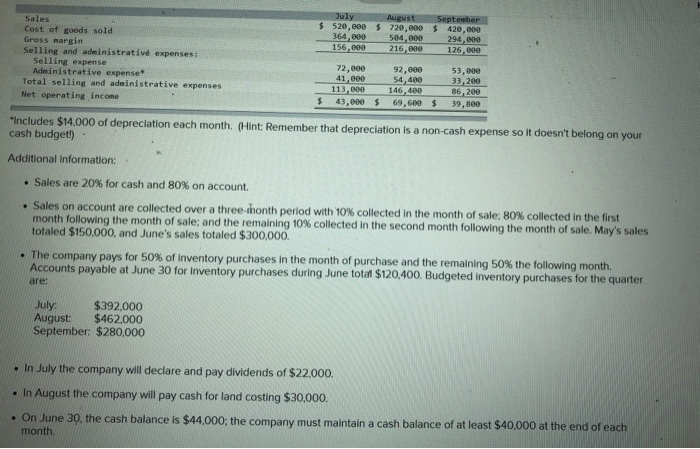

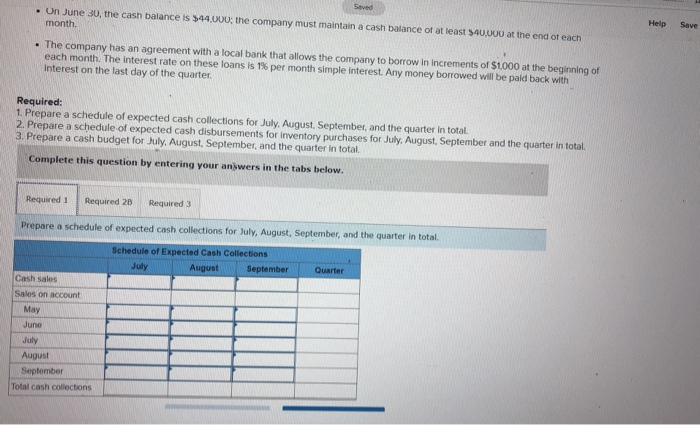

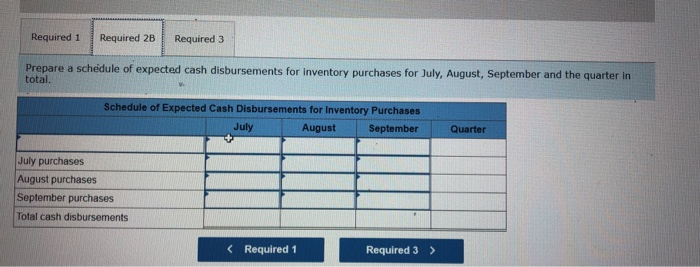

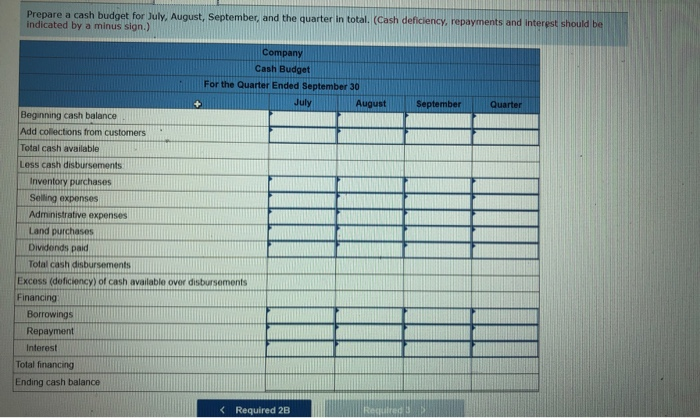

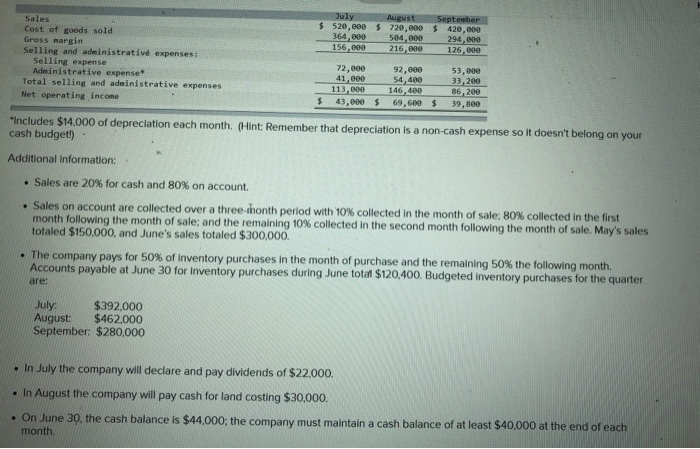

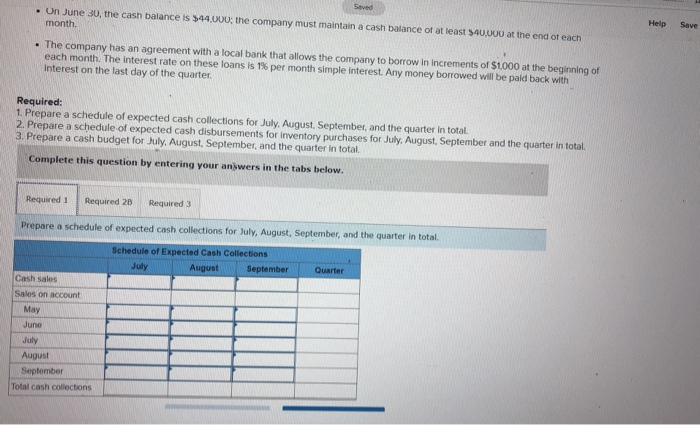

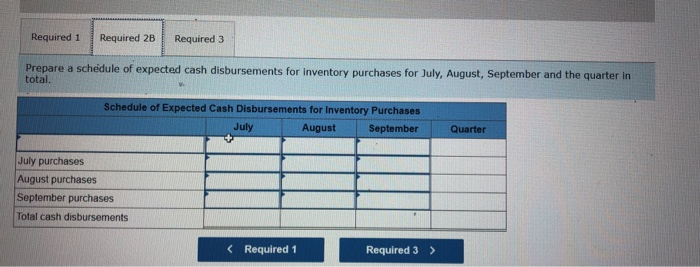

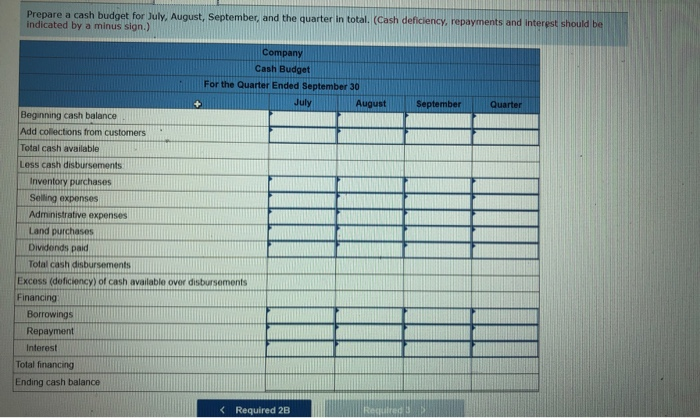

August September Sales $ 520,000 $ 720,000 $ 420,000 Cost of goods sold 364,000 504,000 294,000 Gross margin 156,000 216,000 126,000 Selling and administrative expenses: Selling expense 72,000 92,000 Administrative expense" 53,000 41,000 54,400 33,200 Total selling and administrative expenses 113,000 146,400 86,200 Net operating income 43,000 $ 69,600 $ 39,800 "Includes $14,000 of depreciation each month. (Hint: Remember that depreciation is a non-cash expense so it doesn't belong on your cash budget!) $ Additional Information: Sales are 20% for cash and 80% on account. Sales on account are collected over a three-thonth period with 10% collected in the month of sale; 80% collected in the first month following the month of sale, and the remaining 10% collected in the second month following the month of sale. May's sales totaled $150,000, and June's sales totaled $300,000 The company pays for 50% of inventory purchases in the month of purchase and the remaining 50% the following month. Accounts payable at June 30 for Inventory purchases during June total $120,400. Budgeted Inventory purchases for the quarter are: July $392,000 August: $462,000 September: $280,000 . In July the company will declare and pay dividends of $22.000. In August the company will pay cash for land costing $30,000. On June 30, the cash balance is $44.000; the company must maintain a cash balance of at least $40,000 at the end of each month. Seved On June 30, the cash balance is $44.000, the company must maintain a cash balance of at least $40,000 at the end of each month. Help Save . The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month simple interest. Any money borrowed will be paid back with Interest on the last day of the quarter Required: 1. Prepare a schedule of expected cash collections for July August September, and the quarter in total 2. Prepare a schedule of expected cash disbursements for inventory purchases for July, August, September and the quarter in total 3. Prepare a cash budget for July August September, and the quarter in total Complete this question by entering your answers in the tabs below. Required 1 Required 2B Required 3 Prepare a schedule of expected cash collections for July, August, September, and the quarter in total Schedule of Expected Cash Collections July August September Quarter Cash sales Salos on account May June July August September Total cash collections Required 1 Required 2B Required 3 Prepare a schedule of expected cash disbursements for inventory purchases for July, August, September and the quarter in total. Schedule of Expected Cash Disbursements for Inventory Purchases July August September Quarter July purchases August purchases September purchases Total cash disbursements Prepare a cash budget for July, August, September, and the quarter in total. (Cash deficiency, repayments and interest should be indicated by a minus sign.) September Quarter Company Cash Budget For the Quarter Ended September 30 July August Beginning cash balance Add collections from customers Total cash available Less cash disbursements Inventory purchases Selling expenses Administrative expenses Land purchases Dividends paid Total cash disbursements Excess (deficiency) of cash available over disbursements Financing Borrowings Repayment Interest Total financing Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started