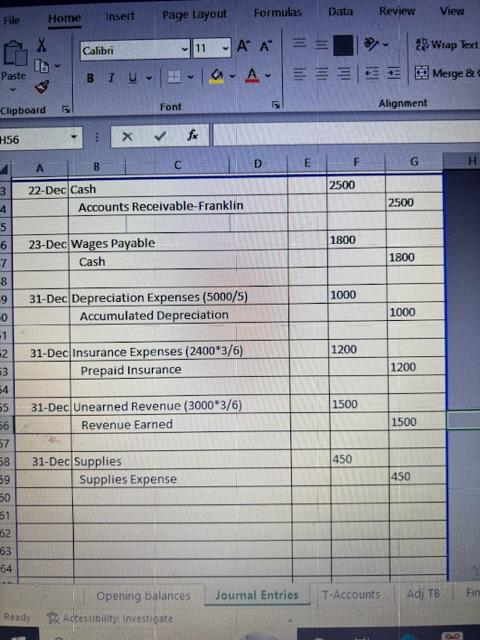

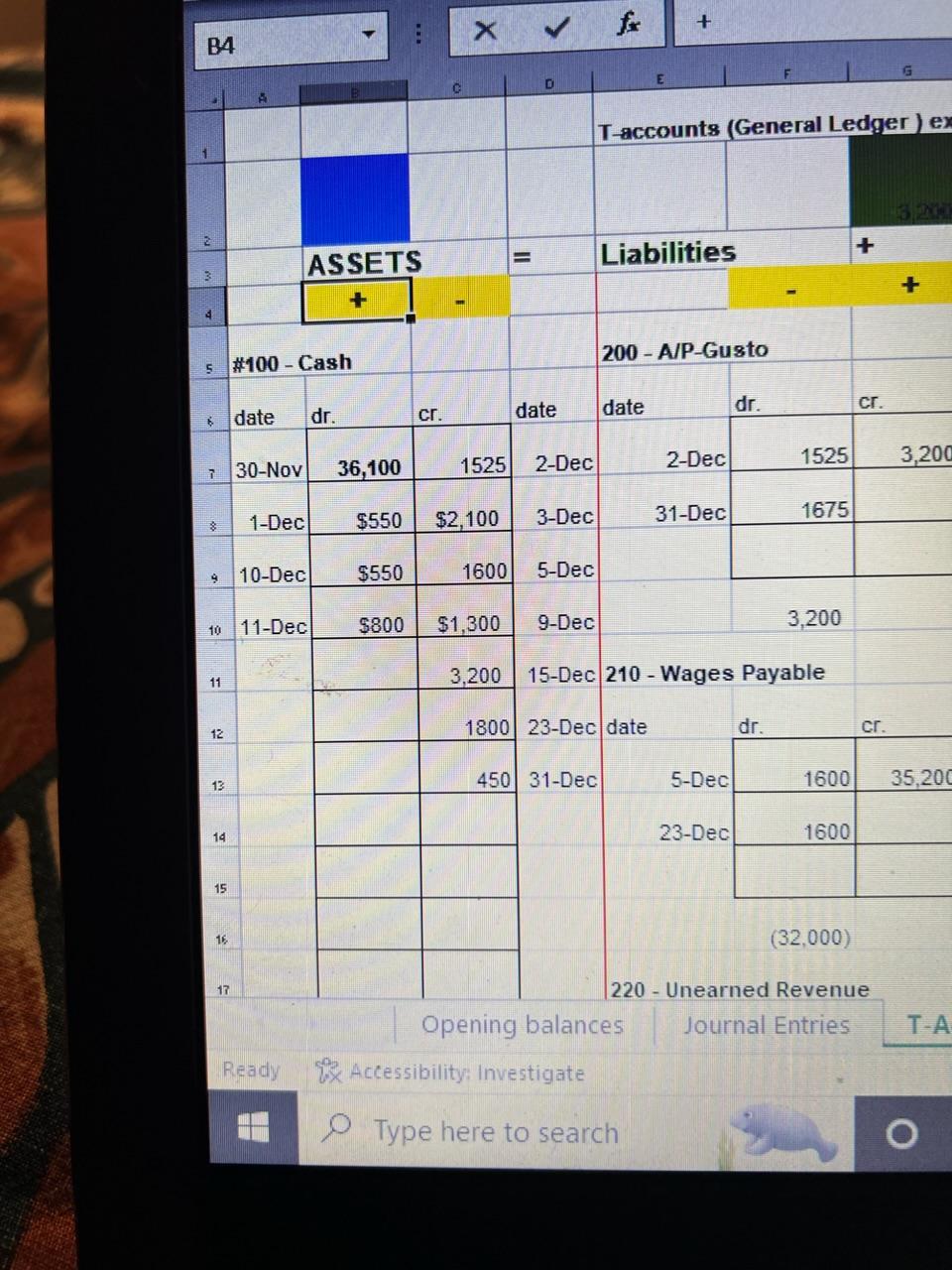

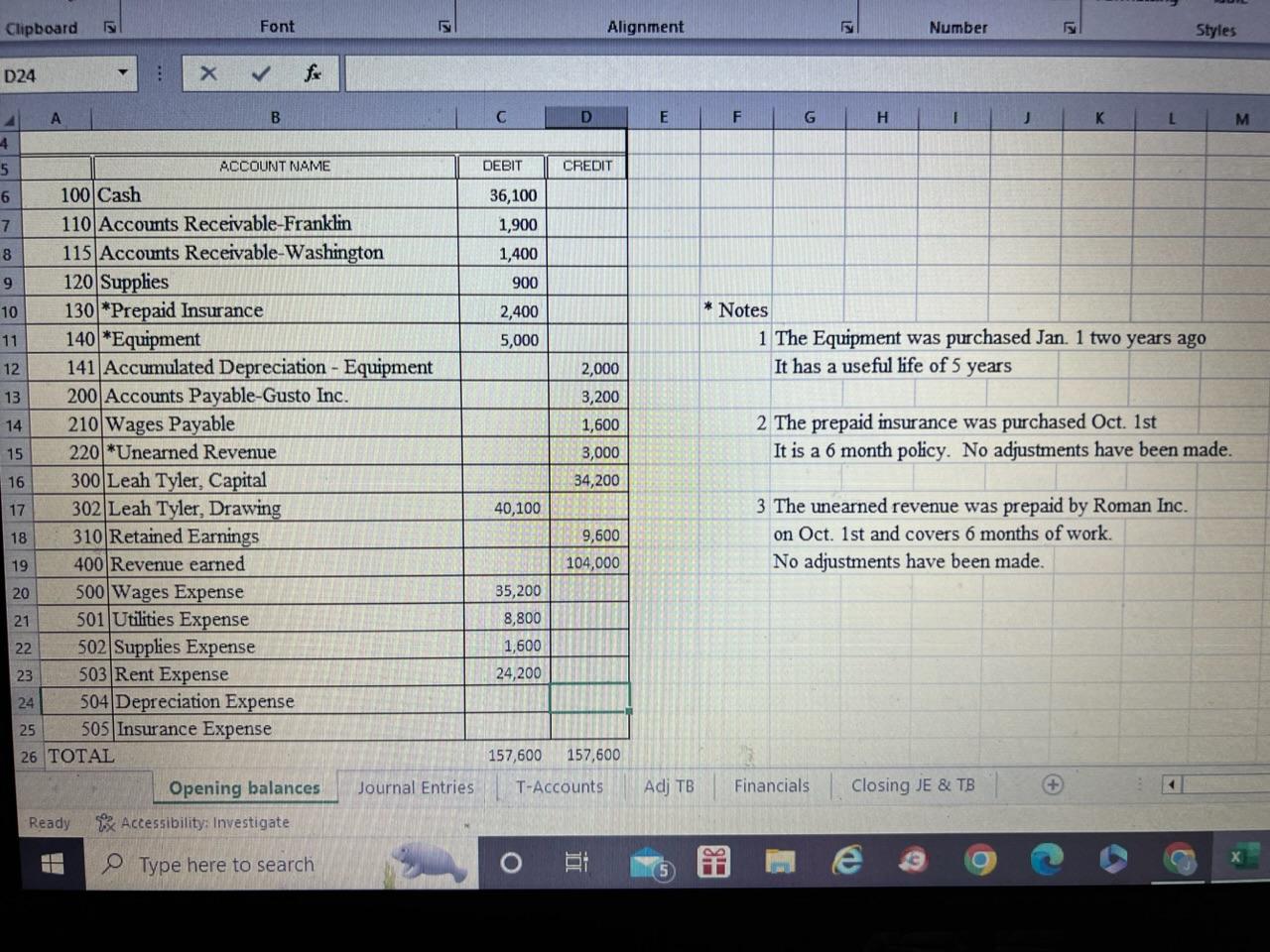

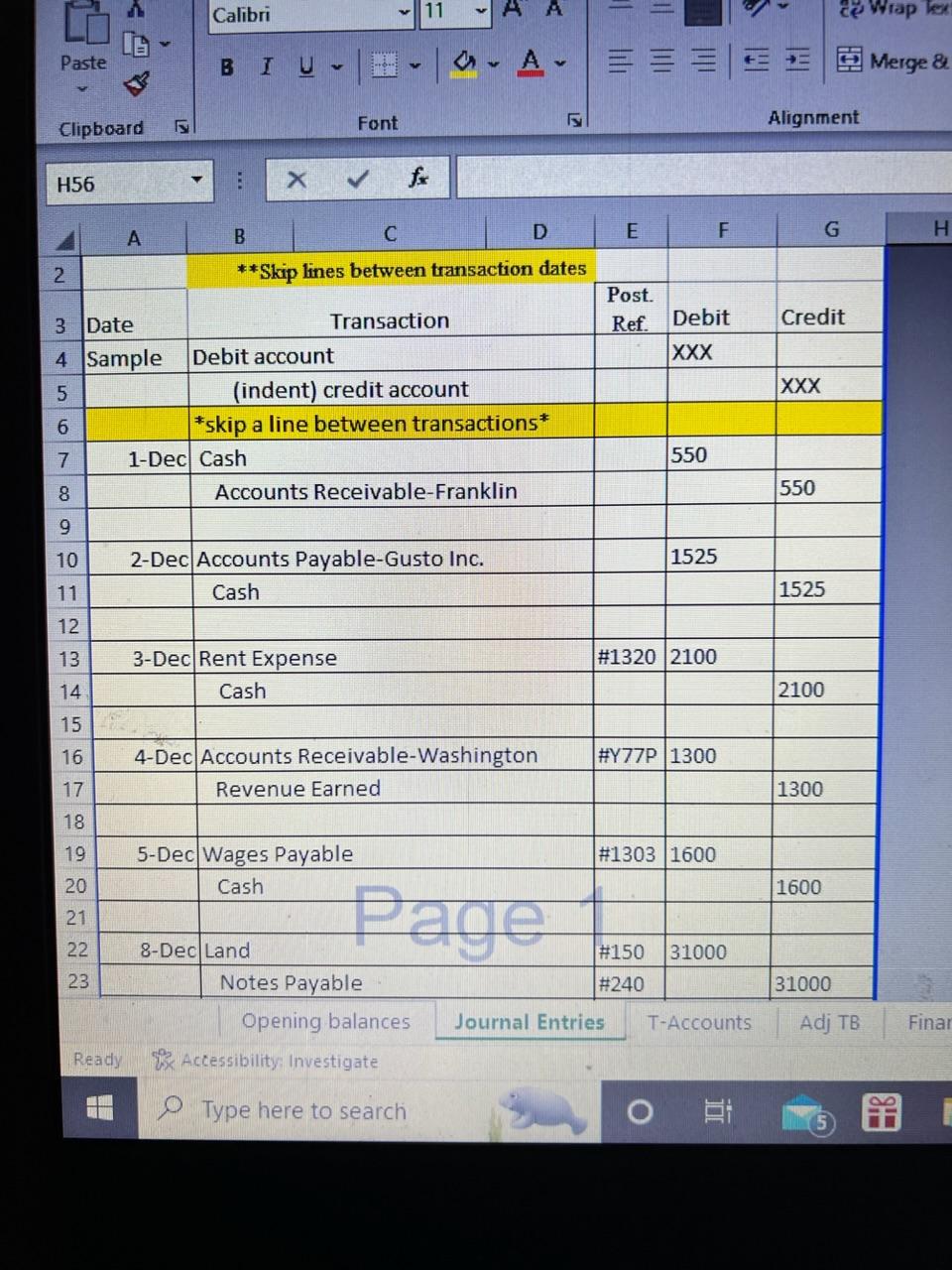

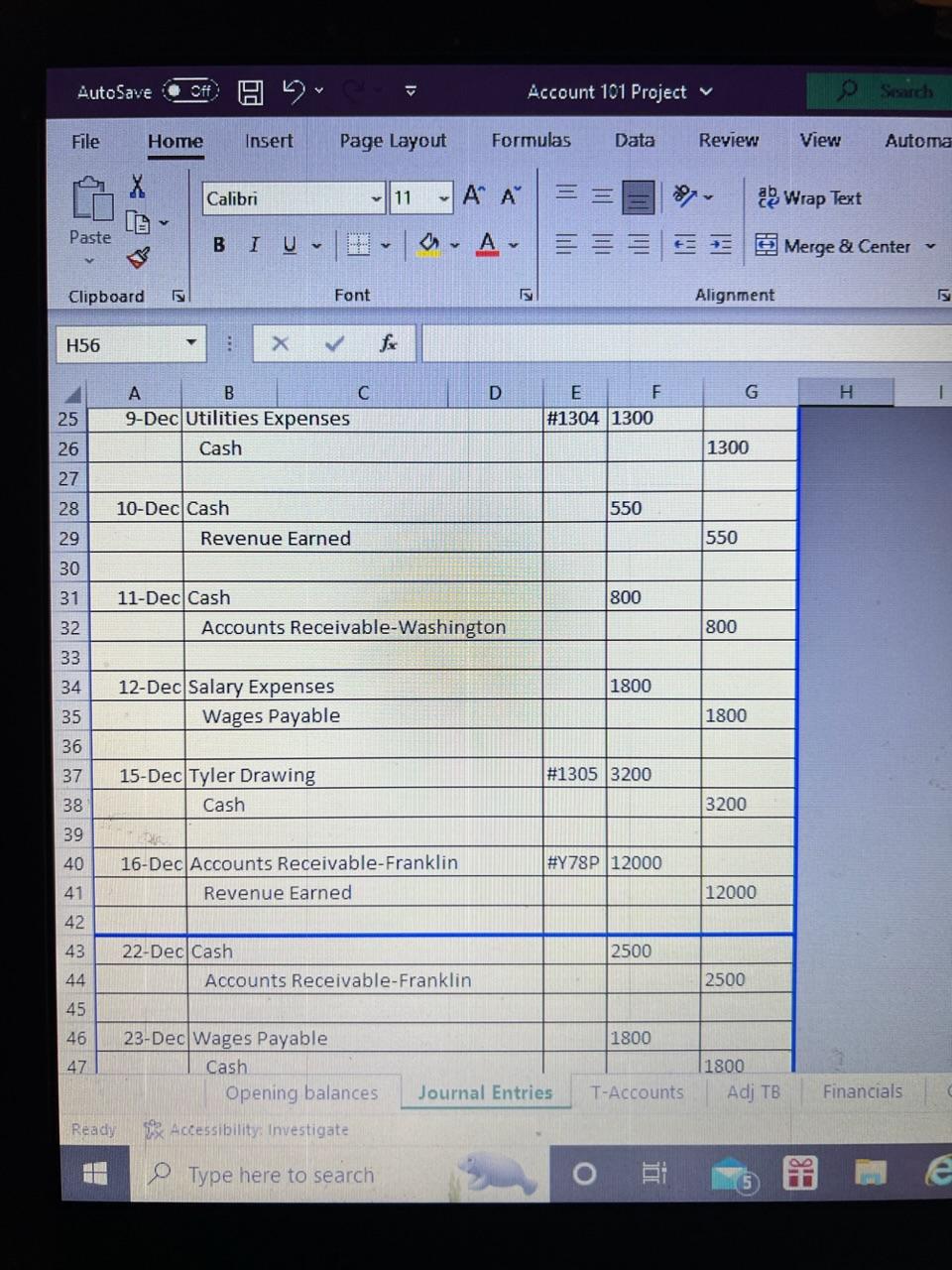

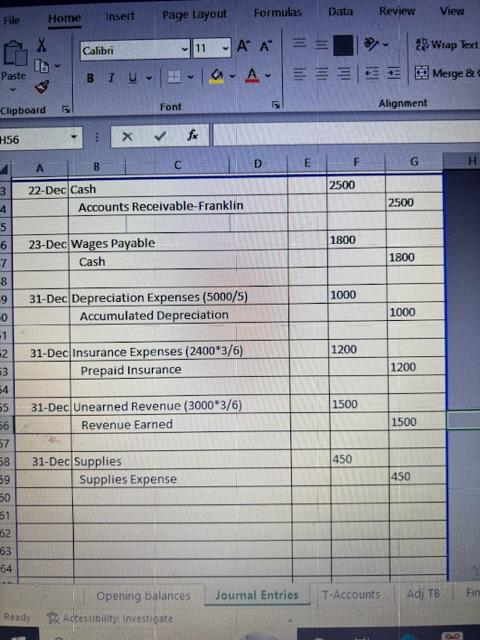

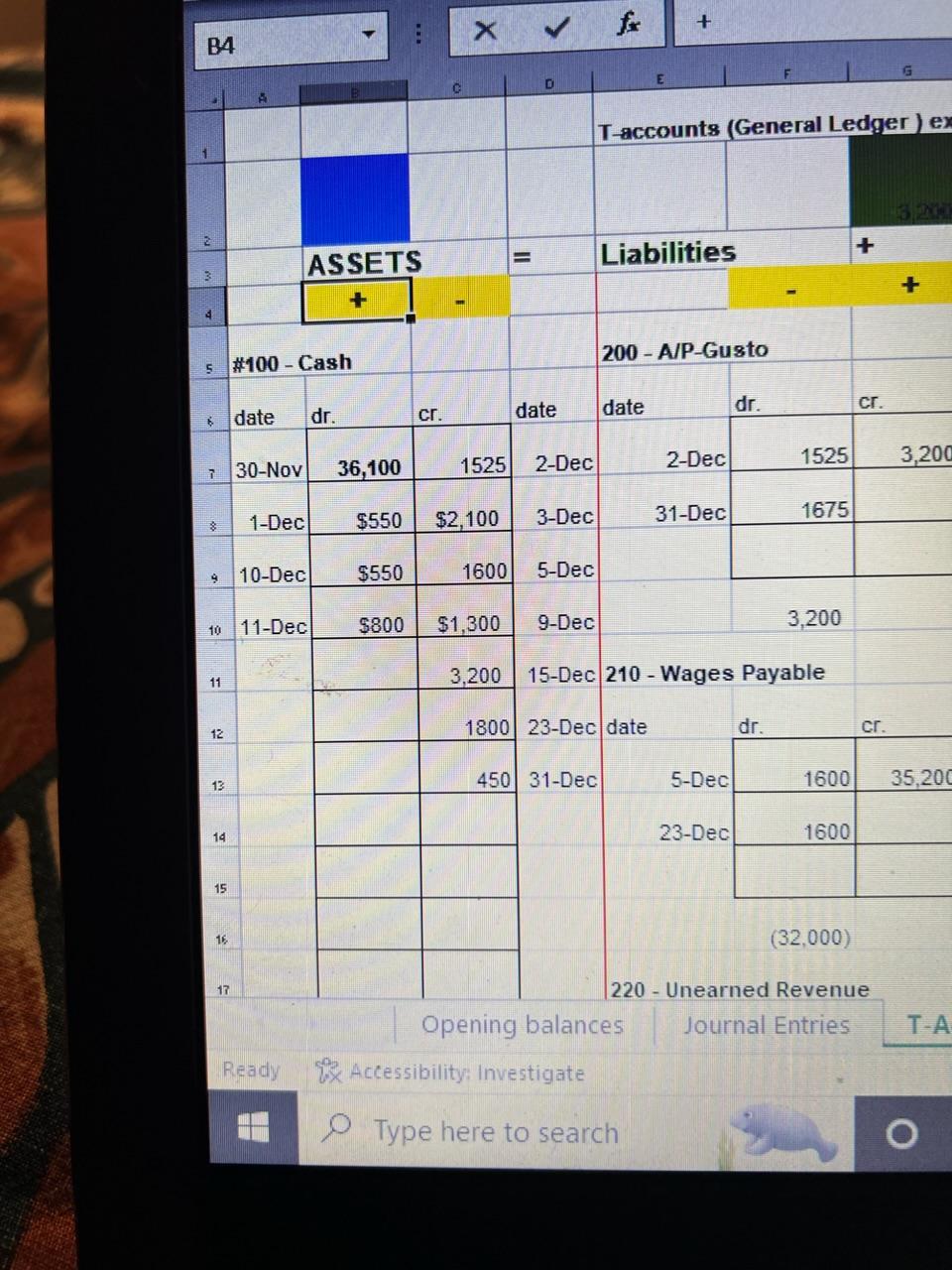

I cant figure out why the Cash in the T-Account isnt balancing out. It must total $19375.

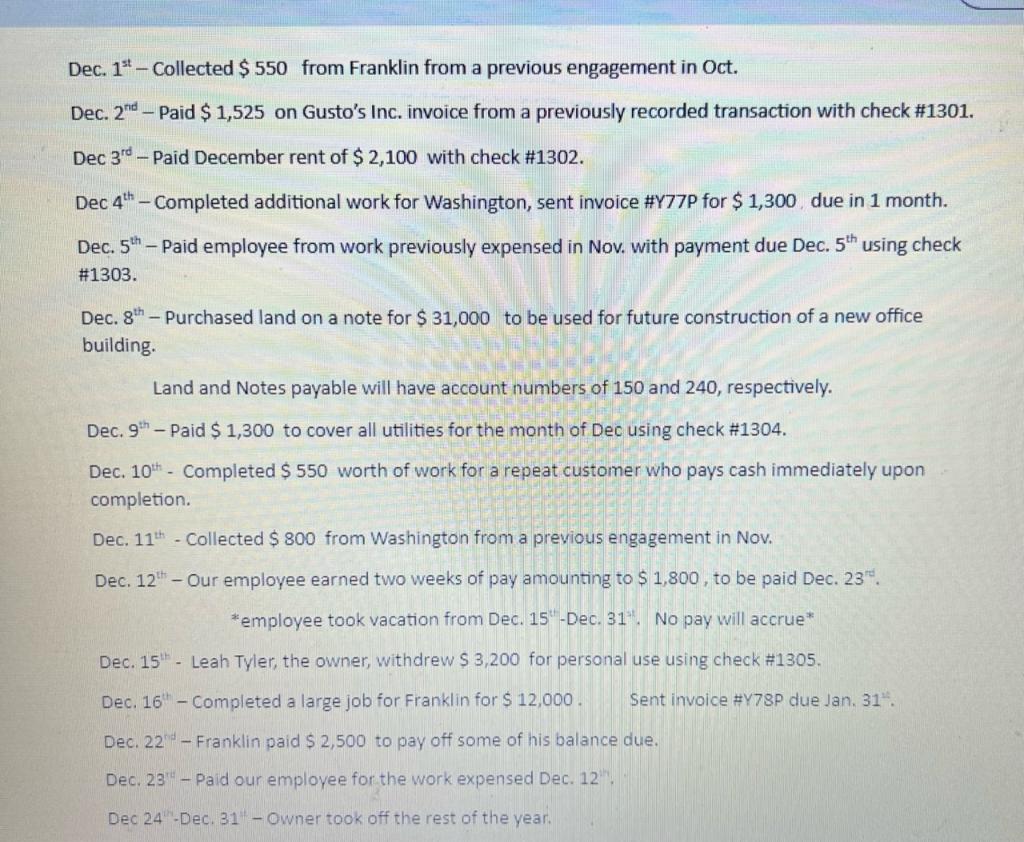

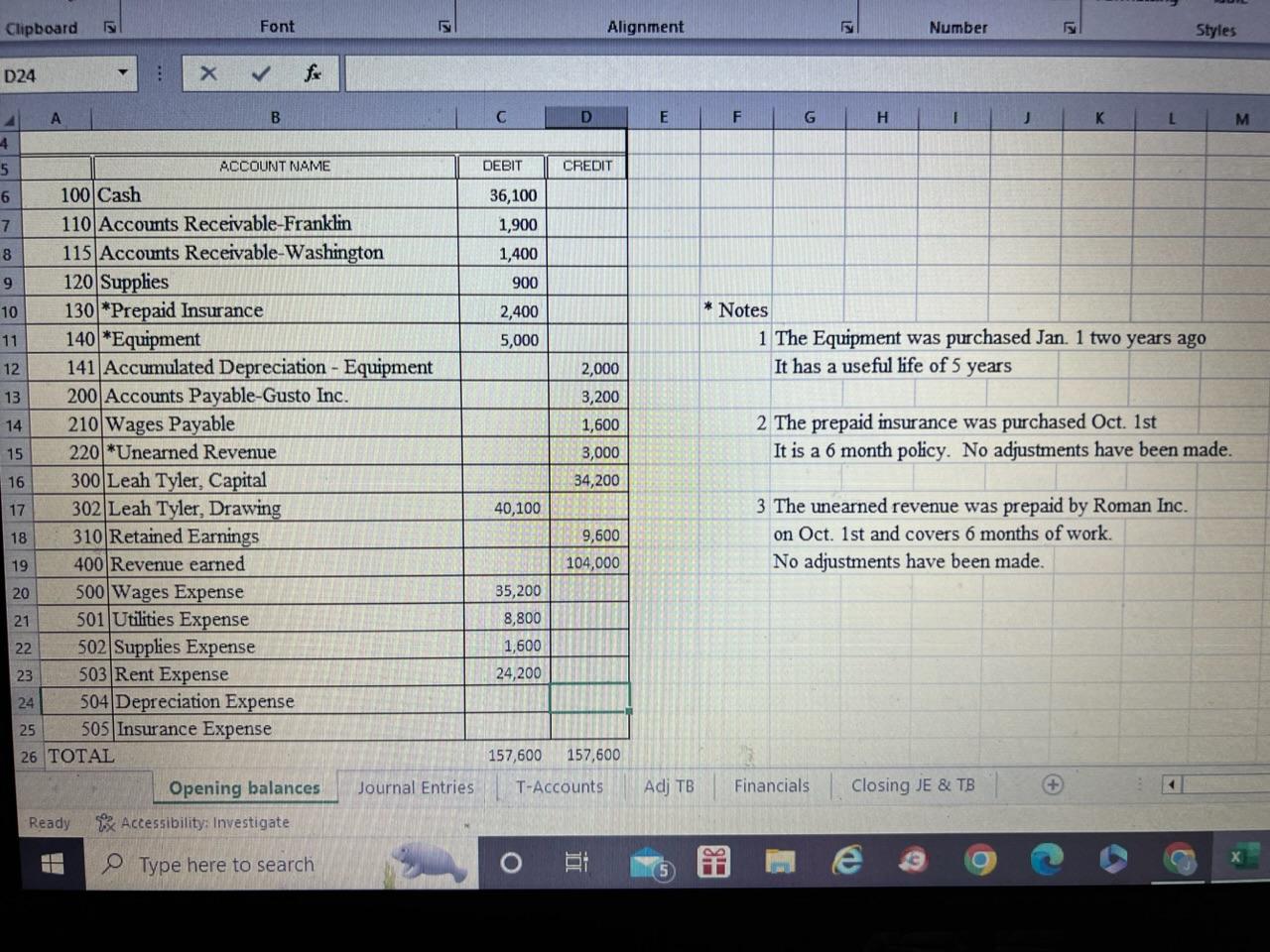

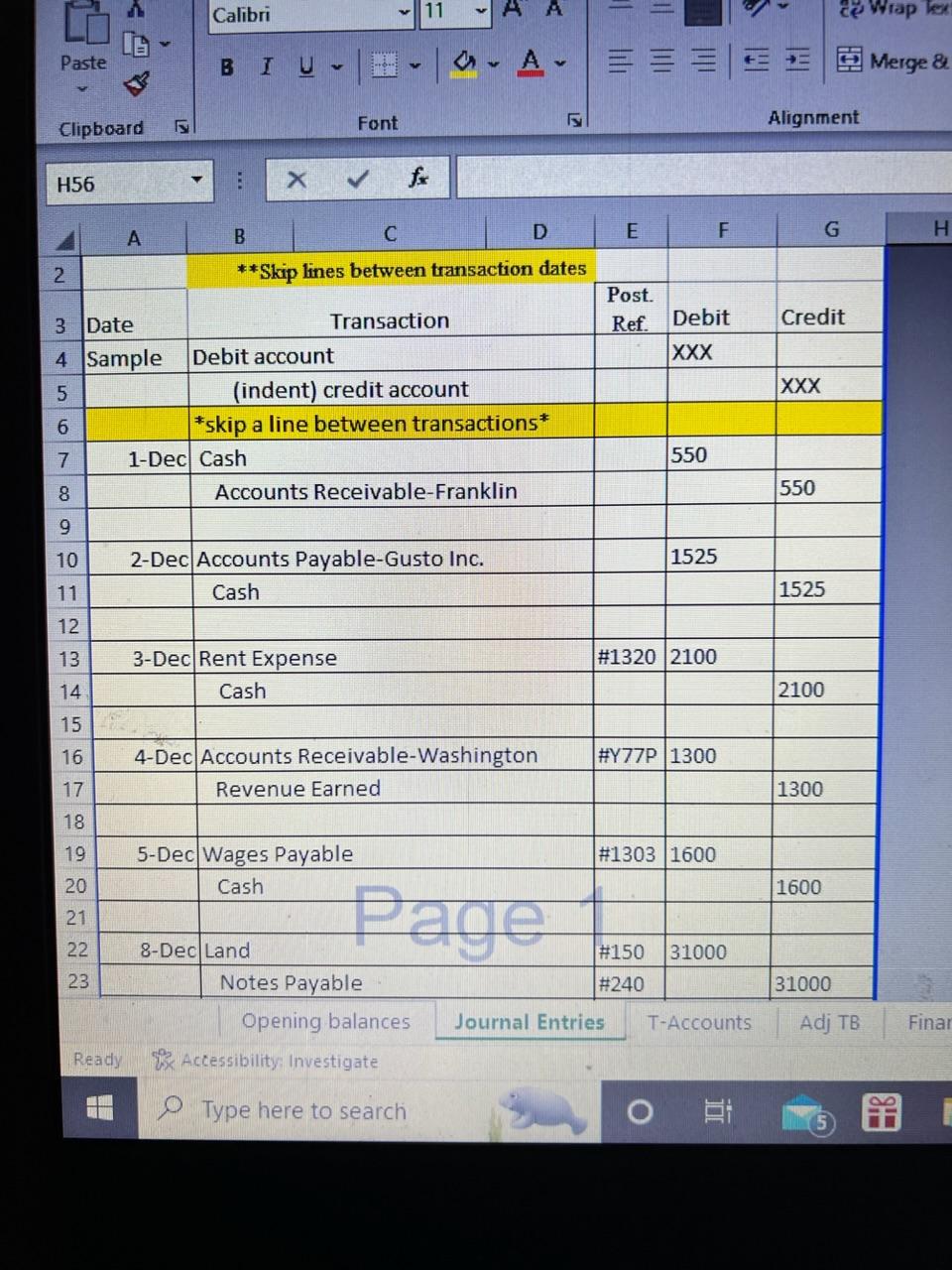

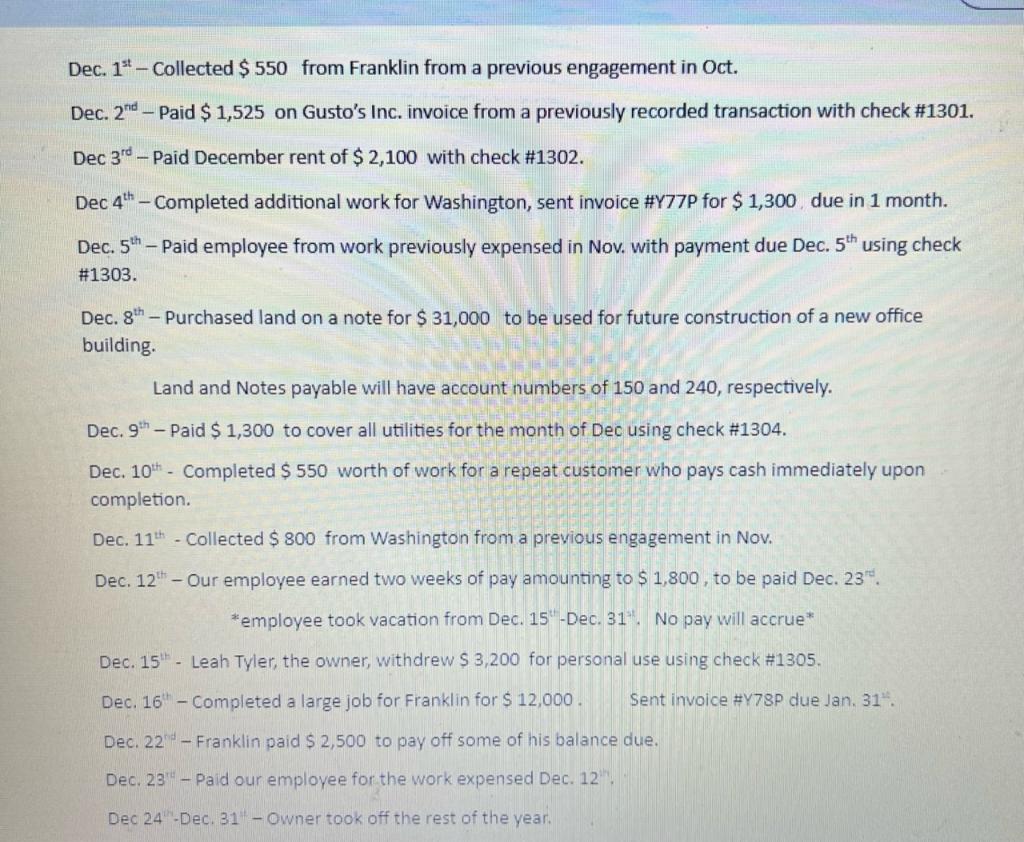

Dec. 1st - Collected $550 from Franklin from a previous engagement in Oct. Dec. 2nd - Paid $1,525 on Gusto's Inc. invoice from a previously recorded transaction with check \#1301. Dec 3rd - Paid December rent of $2,100 with check #1302. Dec 4th - Completed additional work for Washington, sent invoice \#Y77P for $1,300, due in 1 month. Dec. 5th - Paid employee from work previously expensed in Nov. with payment due Dec. 5th using check \#1303. Dec. 8th - Purchased land on a note for $31,000 to be used for future construction of a new office building. Land and Notes payable will have account numbers of 150 and 240 , respectively. Dec. 9th - Paid $1,300 to cover all utilities for the month of Dec using check \#1304. Dec. 10th - Completed $550 worth of work for a repeat customer who pays cash immediately upon completion. Dec. 11th - Collected $800 from Washington from a previous engagement in Nov. Dec. 12th - Our employee earned two weeks of pay amounting to $1,800, to be paid Dec. 23th. *employee took vacation from Dec. 15*Dec.31.Nopaywillaccrue Dec. 15# - Leah Tyler, the owner, withdrew $3,200 for personal use using check #1305. Dec. 16H - Completed a large job for Franklin for $12,000. Sent invoice \#Y78P due Jan, 31.. Dec. 221 - Franklin paid $2,500 to pay off some of his balance due. Dec. 23TH - Paid our employee for the work expensed Dec. 12 . Dec 24-Dec. 31- Owner took off the rest of the year. Ready Zx Accessibility: Investigate Type here to search Opening balances Journal Entrios T-Accounts Adj TB Ready if Accessibility: Investigate Type here to search Dec. 1st - Collected $550 from Franklin from a previous engagement in Oct. Dec. 2nd - Paid $1,525 on Gusto's Inc. invoice from a previously recorded transaction with check \#1301. Dec 3rd - Paid December rent of $2,100 with check #1302. Dec 4th - Completed additional work for Washington, sent invoice \#Y77P for $1,300, due in 1 month. Dec. 5th - Paid employee from work previously expensed in Nov. with payment due Dec. 5th using check \#1303. Dec. 8th - Purchased land on a note for $31,000 to be used for future construction of a new office building. Land and Notes payable will have account numbers of 150 and 240 , respectively. Dec. 9th - Paid $1,300 to cover all utilities for the month of Dec using check \#1304. Dec. 10th - Completed $550 worth of work for a repeat customer who pays cash immediately upon completion. Dec. 11th - Collected $800 from Washington from a previous engagement in Nov. Dec. 12th - Our employee earned two weeks of pay amounting to $1,800, to be paid Dec. 23th. *employee took vacation from Dec. 15*Dec.31.Nopaywillaccrue Dec. 15# - Leah Tyler, the owner, withdrew $3,200 for personal use using check #1305. Dec. 16H - Completed a large job for Franklin for $12,000. Sent invoice \#Y78P due Jan, 31.. Dec. 221 - Franklin paid $2,500 to pay off some of his balance due. Dec. 23TH - Paid our employee for the work expensed Dec. 12 . Dec 24-Dec. 31- Owner took off the rest of the year. Ready Zx Accessibility: Investigate Type here to search Opening balances Journal Entrios T-Accounts Adj TB Ready if Accessibility: Investigate Type here to search