Answered step by step

Verified Expert Solution

Question

1 Approved Answer

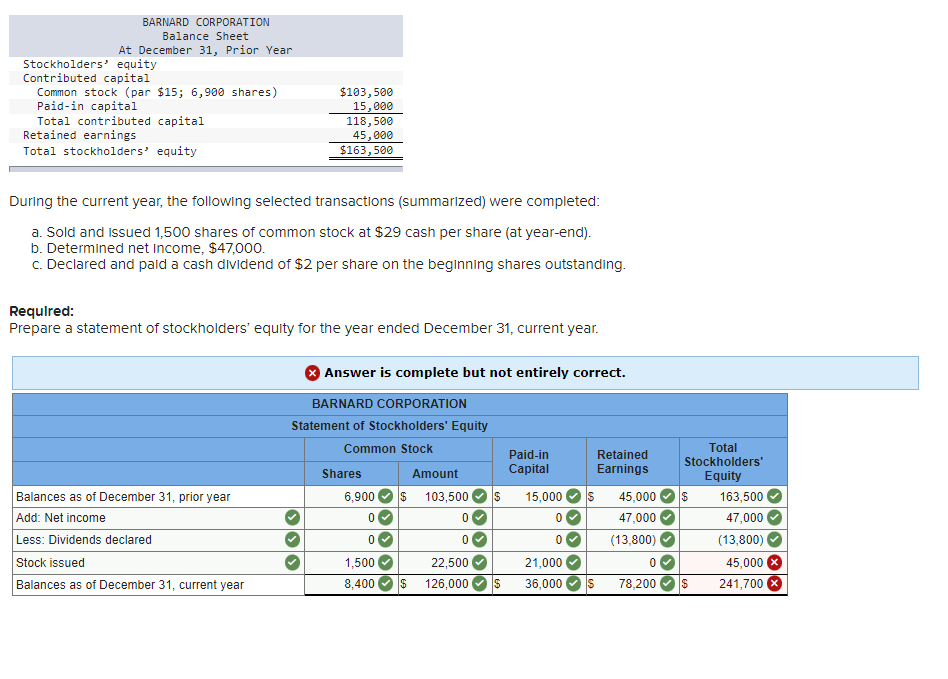

**I can't find the mistake for these two Questions. Please Help!! BARNARD CORPORATION Balance Sheet At December 31, Prior Year Stockholders' equity Contributed capital Common

**I can't find the mistake for these two Questions. Please Help!!

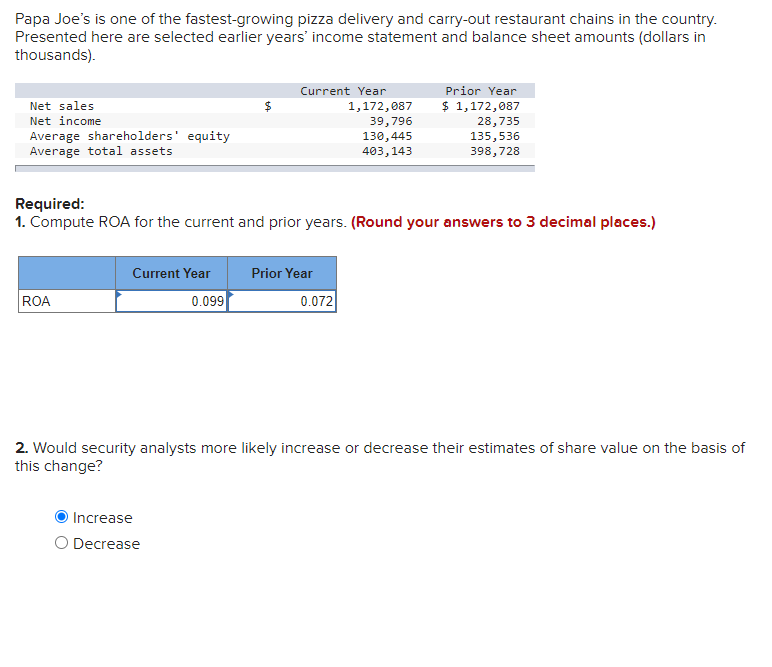

BARNARD CORPORATION Balance Sheet At December 31, Prior Year Stockholders' equity Contributed capital Common stock (par $15; 6,900 shares) Paid-in capital Total contributed capital Retained earnings Total stockholders' equity $103,500 15,000 118,500 45,000 $163,500 During the current year, the following selected transactions (summarized) were completed: a. Sold and issued 1,500 shares of common stock at $29 cash per share (at year-end). b. Determined net income, $47,000. c. Declared and paid a cash dividend of $2 per share on the beginning shares outstanding. Required: Prepare a statement of stockholders' equity for the year ended December 31, current year. Answer is complete but not entirely correct. BARNARD CORPORATION Statement of Stockholders' Equity Common Stock Paid-in Retained Shares Amount Capital Earnings 6,900 $ 103,500 $ 15,000 s 45,000 0 0 0 47,000 0 0 0 (13,800) 1,500 22,500 21,000 0 8,400 $ 126,000 $ 36,000 s 78,200 Balances as of December 31, prior year Add: Net income Less: Dividends declared Stock issued Balances as of December 31, current year Total Stockholders' Equity $ 163,500 47,000 (13,800) 45,000 X $ 241,700 Papa Joe's is one of the fastest-growing pizza delivery and carry-out restaurant chains in the country. Presented here are selected earlier years' income statement and balance sheet amounts (dollars in thousands). Net sales Net income Average shareholders' equity Average total assets Current Year 1,172,087 39,796 130,445 403, 143 Prior Year $ 1,172,087 28,735 135,536 398,728 Required: 1. Compute ROA for the current and prior years. (Round your answers to 3 decimal places.) Current Year 0.099 Prior Year 0.072 ROA 2. Would security analysts more likely increase or decrease their estimates of share value on the basis of this change? Increase O DecreaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started