Answered step by step

Verified Expert Solution

Question

1 Approved Answer

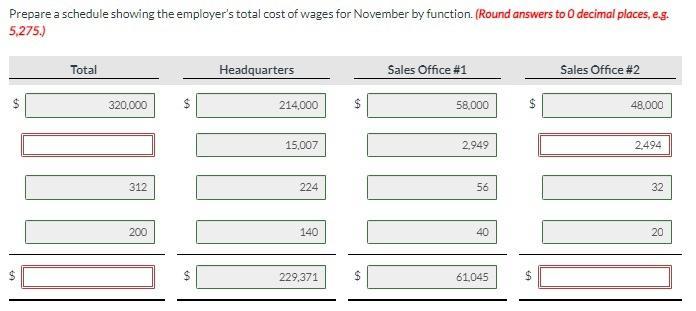

Sunland Company's payroll for December 2017 is summarized below. The far left column is Wages FICA Federal UT State UT Total cost Sunland Company's payroll

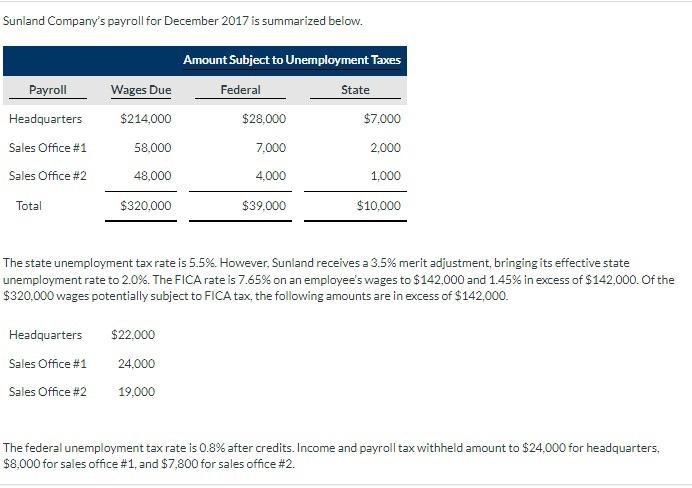

Sunland Company's payroll for December 2017 is summarized below.

The far left column is

Wages

FICA

Federal UT

State UT

Total cost

Sunland Company's payroll for December 2017 is summarized below. Amount Subject to Unemployment Taxes Payroll Wages Due Federal State Headquarters $214,000 $28,000 $7,000 Sales Office #1 58.000 7,000 2,000 Sales Office #2 48,000 4,000 1,000 Total $320,000 $39,000 $10,000 The state unemployment tax rate is 5.5%. However, Sunland receives a 3.5% merit adjustment, bringing its effective state unemployment rate to 2.0%. The FICA rate is 7.65% on an employee's wages to $142,000 and 1.45% in excess of $142,000. Of the $320,000 wages potentially subject to FICA tax, the following amounts are in excess of $142,000. Headquarters $22,000 Sales Office #1 24,000 Sales Office #2 19,000 The federal unemployment tax rate is 0.8% after credits. Income and payroll tax withheld amount to $24,000 for headquarters, $8.000 for sales office #1, and $7,800 for sales office #2.

Step by Step Solution

★★★★★

3.48 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

A B D E F 1 2 Subject to Unemployment Tax 3 Wages Due 214000 58...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started