I CANT GET ENTRY 6 RIGHT OR PART 2 THANK YOU (EFECT ON NET INCOME)

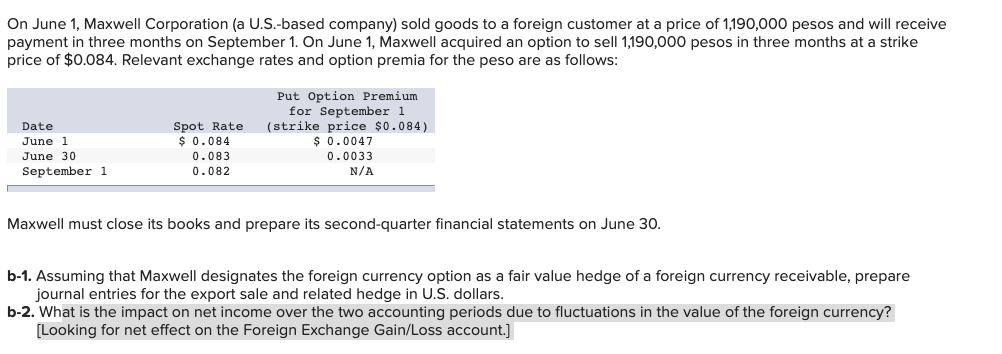

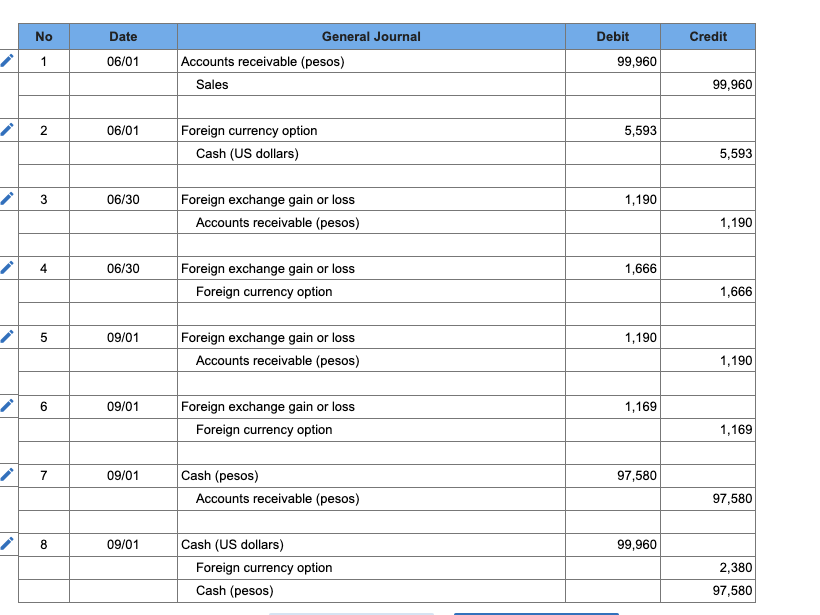

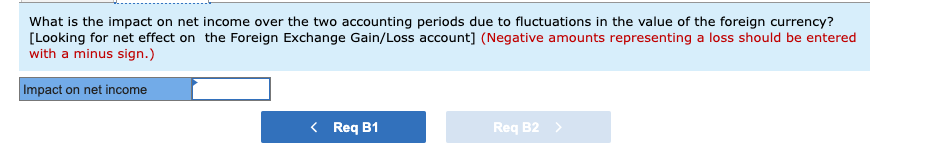

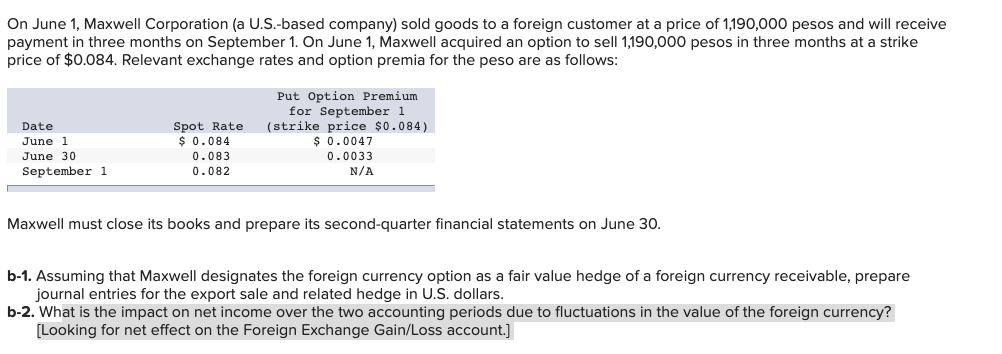

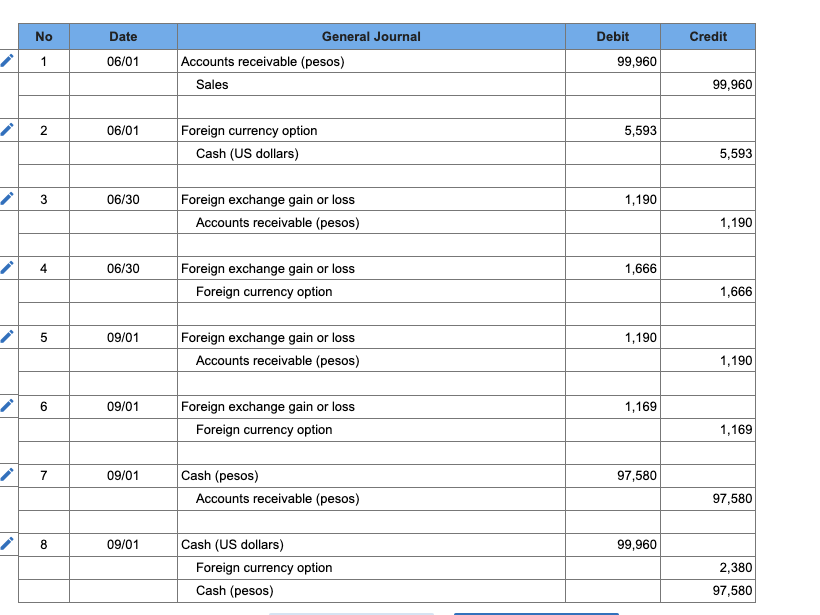

On June 1, Maxwell Corporation (a U.S.-based company) sold goods to a foreign customer at a price of 1,190,000 pesos and will receive payment in three months on September 1. On June 1, Maxwell acquired an option to sell 1,190,000 pesos in three months at a strike price of $0.084. Relevant exchange rates and option premia for the peso are as follows: Maxwell must close its books and prepare its second-quarter financial statements on June 30 . b-1. Assuming that Maxwell designates the foreign currency option as a fair value hedge of a foreign currency receivable, prepare journal entries for the export sale and related hedge in U.S. dollars. b-2. What is the impact on net income over the two accounting periods due to fluctuations in the value of the foreign currency? [Looking for net effect on the Foreign Exchange Gain/Loss account.] What is the impact on net income over the two accounting periods due to fluctuations in the value of the foreign currency? [Looking for net effect on the Foreign Exchange Gain/Loss account] (Negative amounts representing a loss should be entere with a minus sign.) On June 1, Maxwell Corporation (a U.S.-based company) sold goods to a foreign customer at a price of 1,190,000 pesos and will receive payment in three months on September 1. On June 1, Maxwell acquired an option to sell 1,190,000 pesos in three months at a strike price of $0.084. Relevant exchange rates and option premia for the peso are as follows: Maxwell must close its books and prepare its second-quarter financial statements on June 30 . b-1. Assuming that Maxwell designates the foreign currency option as a fair value hedge of a foreign currency receivable, prepare journal entries for the export sale and related hedge in U.S. dollars. b-2. What is the impact on net income over the two accounting periods due to fluctuations in the value of the foreign currency? [Looking for net effect on the Foreign Exchange Gain/Loss account.] What is the impact on net income over the two accounting periods due to fluctuations in the value of the foreign currency? [Looking for net effect on the Foreign Exchange Gain/Loss account] (Negative amounts representing a loss should be entere with a minus sign.)