I cant get my numbers to match up in the new Trial Balance and need help with the T Charts. Thanks

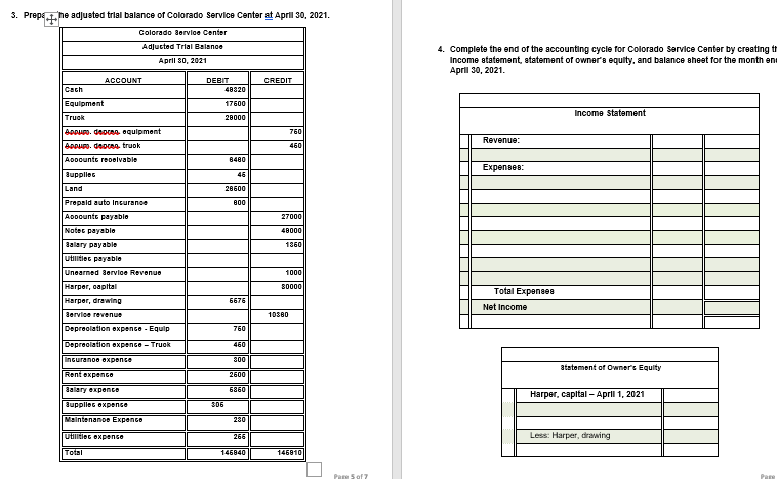

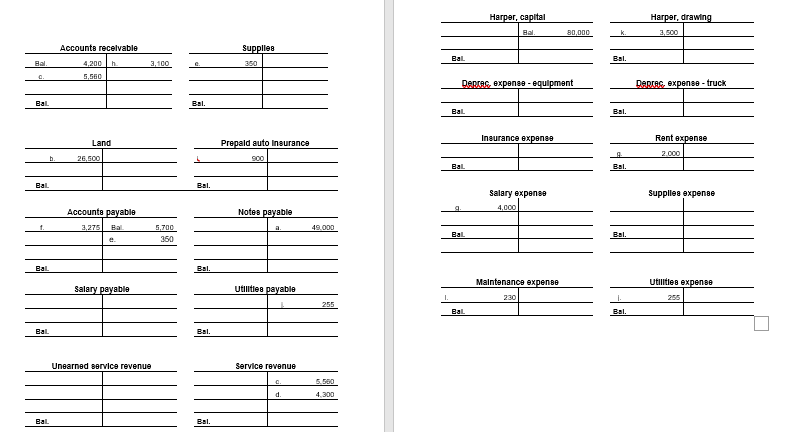

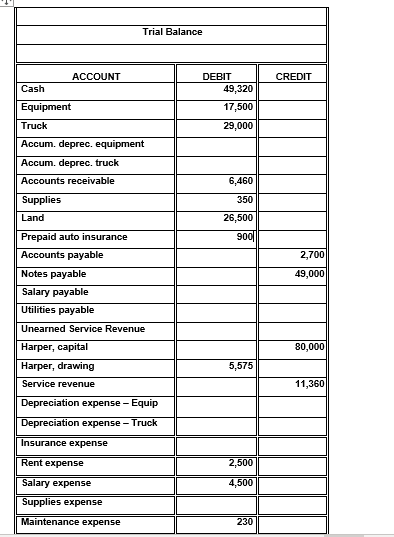

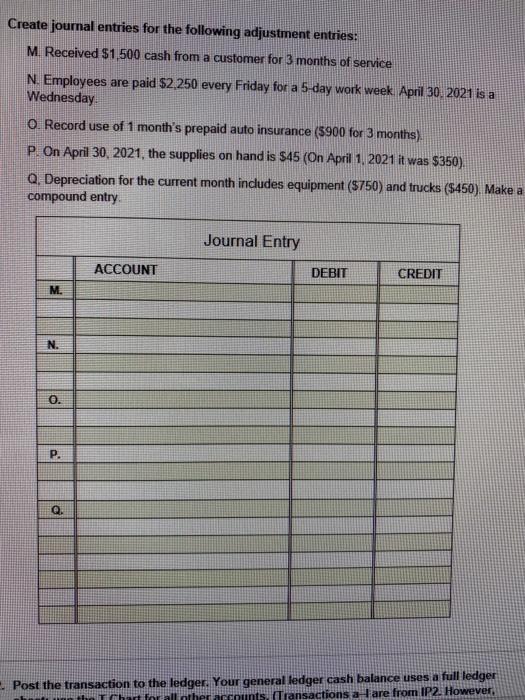

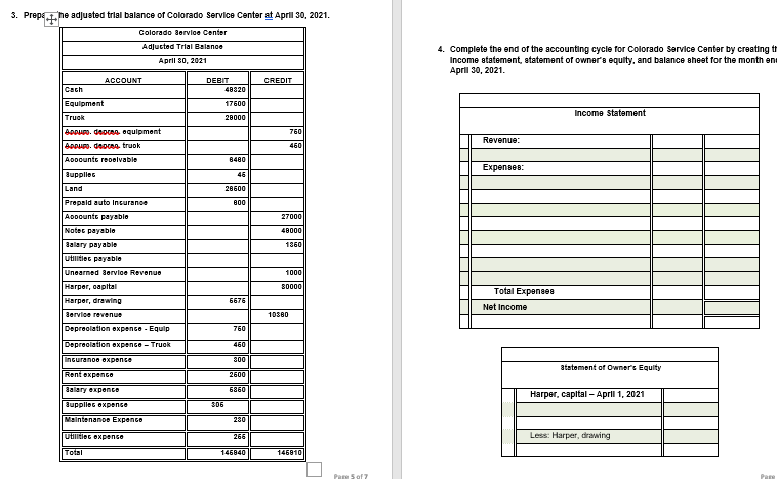

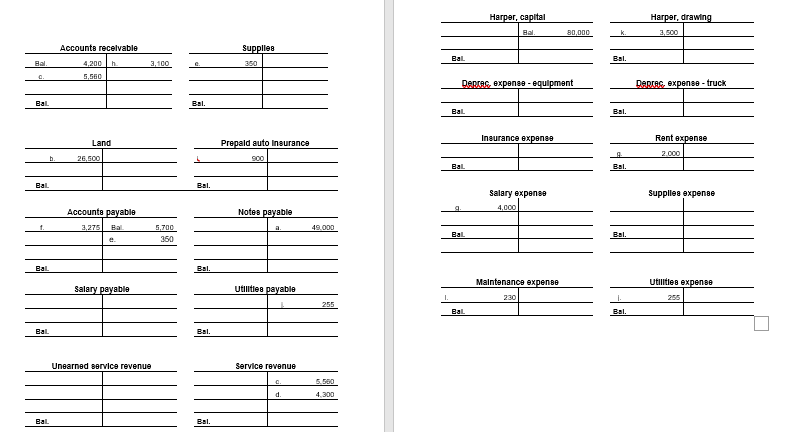

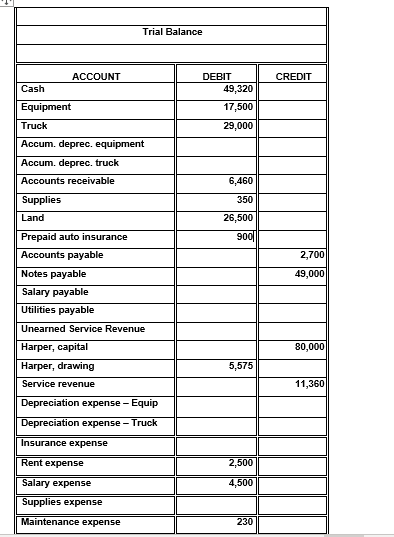

3. Prepe + he adjusted trial balance of Colorado Service Center at April 30, 2021. Colorado Service Center Adjucted Trial Balance April 30, 2021 4. Complete the end of the accounting cycle for Colorado Service Center by creating to Income statement, statement of owner's equity, and balance sheet for the month en April 30, 2021. ACCOUNT CREDIT DEBIT 48820 Cach 17600 Income Statement 28000 Equipment Truok 4. ROAD Oquipment Appupo. A trunk 760 Revenue: 460 Appounto resolvable B480 Expenses: Supplies Land 28600 800 27000 Prapald auto Incurance Adoounts payable Notec payable Salary pay able utilities payable 48000 1860 1000 Unearned Service Revenue Harper, capital 80000 Total Expenses Harper, drawing 6676 Net Income Service revenue 10380 Depreciation expense - Equip 760 Depreciation expence - Truck 460 Inguranos axpense 800 statement of Owner's Equity Rent expengo 2600 Salary expance 6860 Harper, capital - April 1, 2021 306 Supplier oxpense Maintenance Expense 230 UHOG Ox pensa 266 Less: Harper, drawing Total 146840 146810 Pare so Harper, capital Harper, drawing 80.000 k. Accounts receivable Supplies Bal 4,200 Bal h 3,100 5.560 Depes, expense - equipment Darias, exponee-truck Bal Bal. Bal Bal. Insurance expense Land Prepaid auto insurance 900 Rent expense 2.000 9 b 26.500 Bal Bal. Bal Bal. Salary expense Supplies expense 4,000 Accounts payable Notes payable 3,275 49.000 5,700 360 Bal Bal Bal. Maintenance expense Utilities expenso Salary payable Utilities payable 1. 230 255 1 Bal. Bal Bal. Unearned service revenue Service revenue 5.580 4.300 Bal Bal. Trial Balance ACCOUNT CREDIT Cash DEBIT 49,320 17,500 Equipment Truck 29,000 Accum. deprec. equipment Accum. deprec. truck Accounts receivable Supplies Land 6,460 350 26,500 900 2,700 49,000 Prepaid auto insurance Accounts payable Notes payable Salary payable Utilities payable Unearned Service Revenue Harper, capital Harper, drawing Service revenue 80,000 5,575 11,360 Depreciation expense - Equip Depreciation expense - Truck Insurance expense Rent expense 2,500 4,500 Salary expense Supplies expense Maintenance expense 230 Create journal entries for the following adjustment entries: M. Received $1,500 cash from a customer for 3 months of service N. Employees are paid $2,250 every Friday for a 5-day work week, April 30. 2021 is a Wednesday o. Record use of 1 month's prepaid auto insurance (5900 for 3 months) P. On April 30, 2021, the supplies on hand is $45 (On April 1, 2021 it was $350) Q. Depreciation for the current month includes equipment ($750) and trucks ($450). Make a compound entry Journal Entry ACCOUNT DEBIT CREDIT M. N. 0. P. Q. Post the transaction to the ledger. Your general ledger cash balance uses a full ledger the Chart for all other accounts. Transactions a are from IP2. However