Answered step by step

Verified Expert Solution

Question

1 Approved Answer

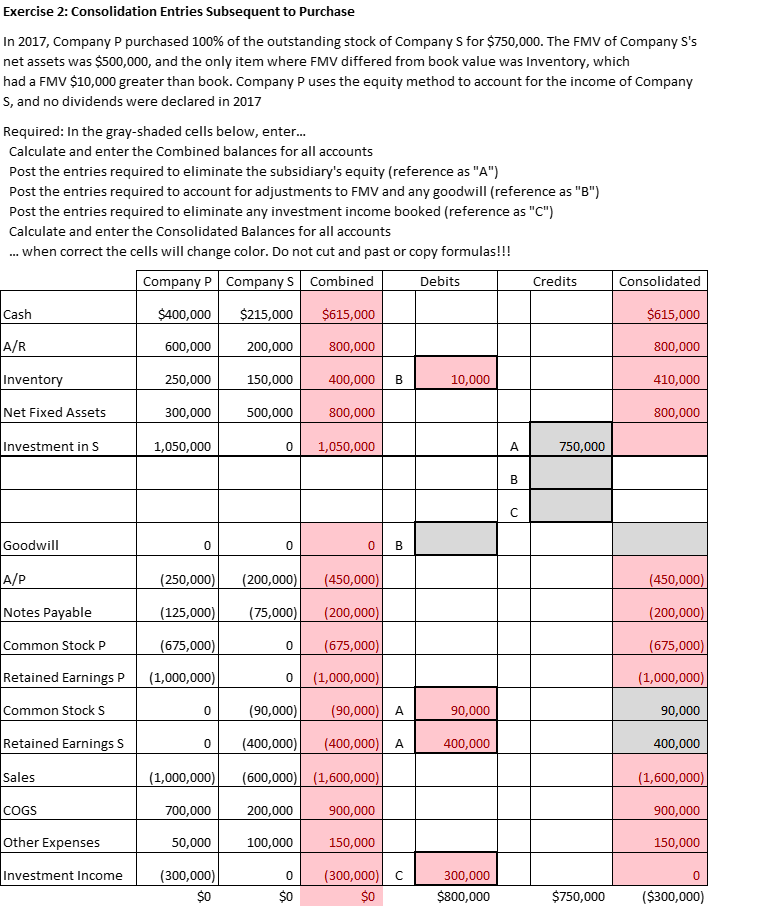

I can't seem to figure out how to calculate the pink and grey boxes for Investments and goodwill Exercise 2: Consolidation Entries Subsequent to Purchase

I can't seem to figure out how to calculate the pink and grey boxes for Investments and goodwill

Exercise 2: Consolidation Entries Subsequent to Purchase In 2017, Company P purchased 100% of the outstanding stock of Company S for $750,000. The FMV of Company S's net assets was $500,000, and the only item where FMV differed from book value was Inventory, which had a FMV $10,000 greater than book. Company P uses the equity method to account for the income of Company S, and no dividends were declared in 2017 Required: In the gray-shaded cells below, enter... Calculate and enter the Combined balances for all accounts Post the entries required to eliminate the subsidiary's equity (reference as "A") Post the entries required to account for adjustments to FMV and any goodwill (reference as "B") Post the entries required to eliminate any investment income booked (reference as "C") Calculate and enter the Consolidated Balances for all accounts when correct the cells will change color. Do not cut and past or copy formulas!!! Debits Credits Company P Company S Combined $400,000 $215,000 $615,000 800,000 Consolidated $615,000 800,000 410,000 800,000 Cash 600,000 250,000 300,000 1,050,000 200,000 150,000 500,000 Inventory 400,000 B 10,000 Net Fixed Assets 800,000 Investment in S 0 1,050,000 750,000 Goodwill 0 0 0 B 00(200,000(450 450,000 200,000 675,000 (1,000,000) 90,000 400,000 1,600,000 900,000 150,000 250,000 125,000 675,000 450,000 (75,000) (200,000) 675,000 0 (1,000,000 Notes Payable Common Stock P Retained Earnings P (1,000,000) Common Stock S Retained Earnings S Sales 0 0 (90,000)(90,000) A 90,000 0 (400,000)(400,000) A 400,000 (1,000,000 (600,000) (1,600,000) 900,000 150,000 COGS 200,000 700,000 50,000 Investment Income (300,000) Other Expenses 100,000 0 (300,000) C $0 300,000 $800,000 0 $0 $0 $750,000 (300,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started