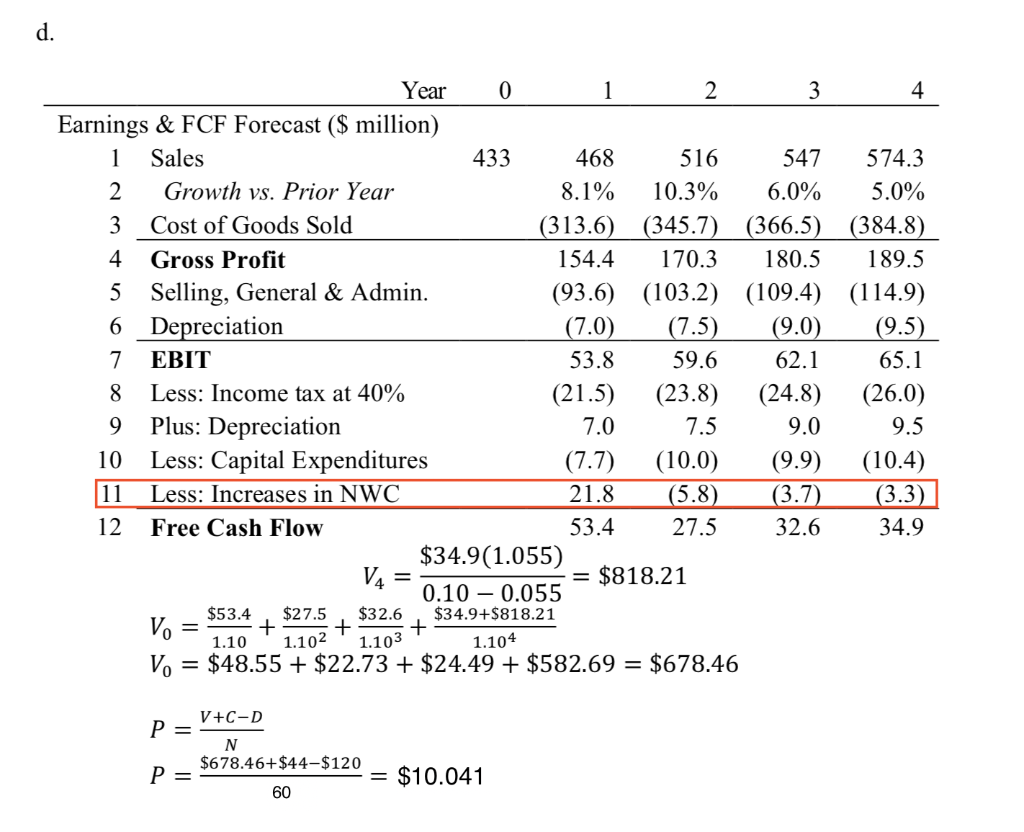

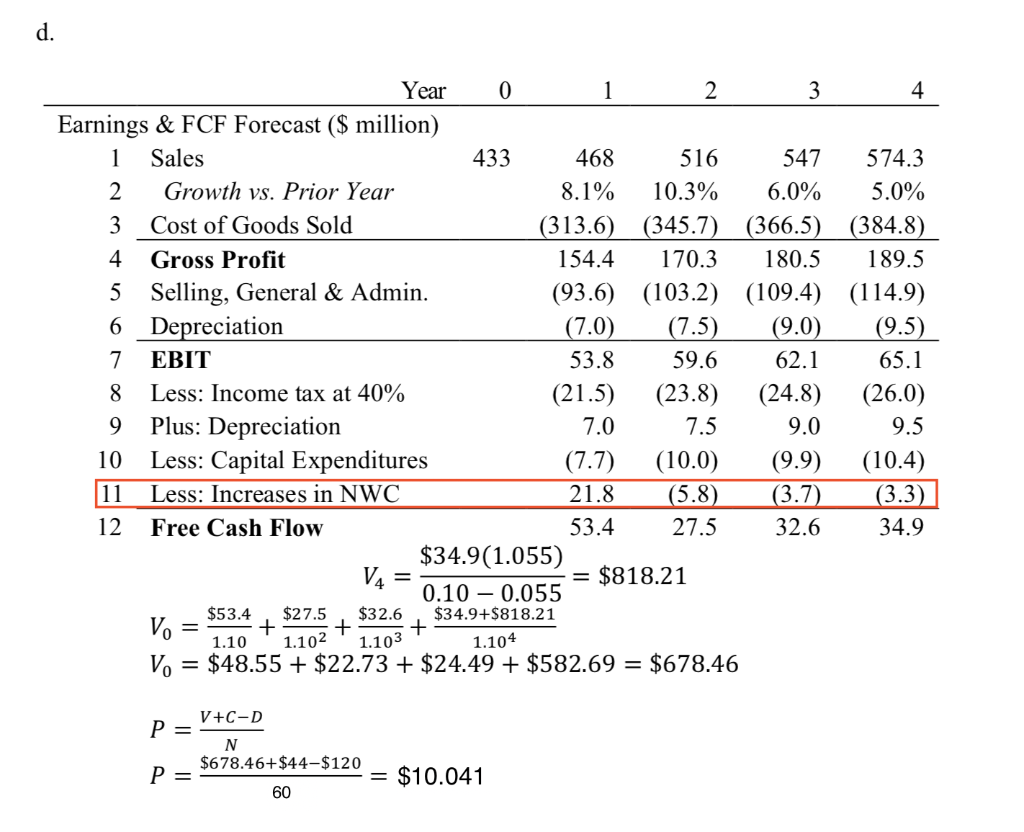

I can't understand how to calculate increase in nwc (year1 to 4, in a red box I marked) in answer of question d.

Here are the question a and d, and answers of them.

Please explain me how to calculate them.

Thanks:)

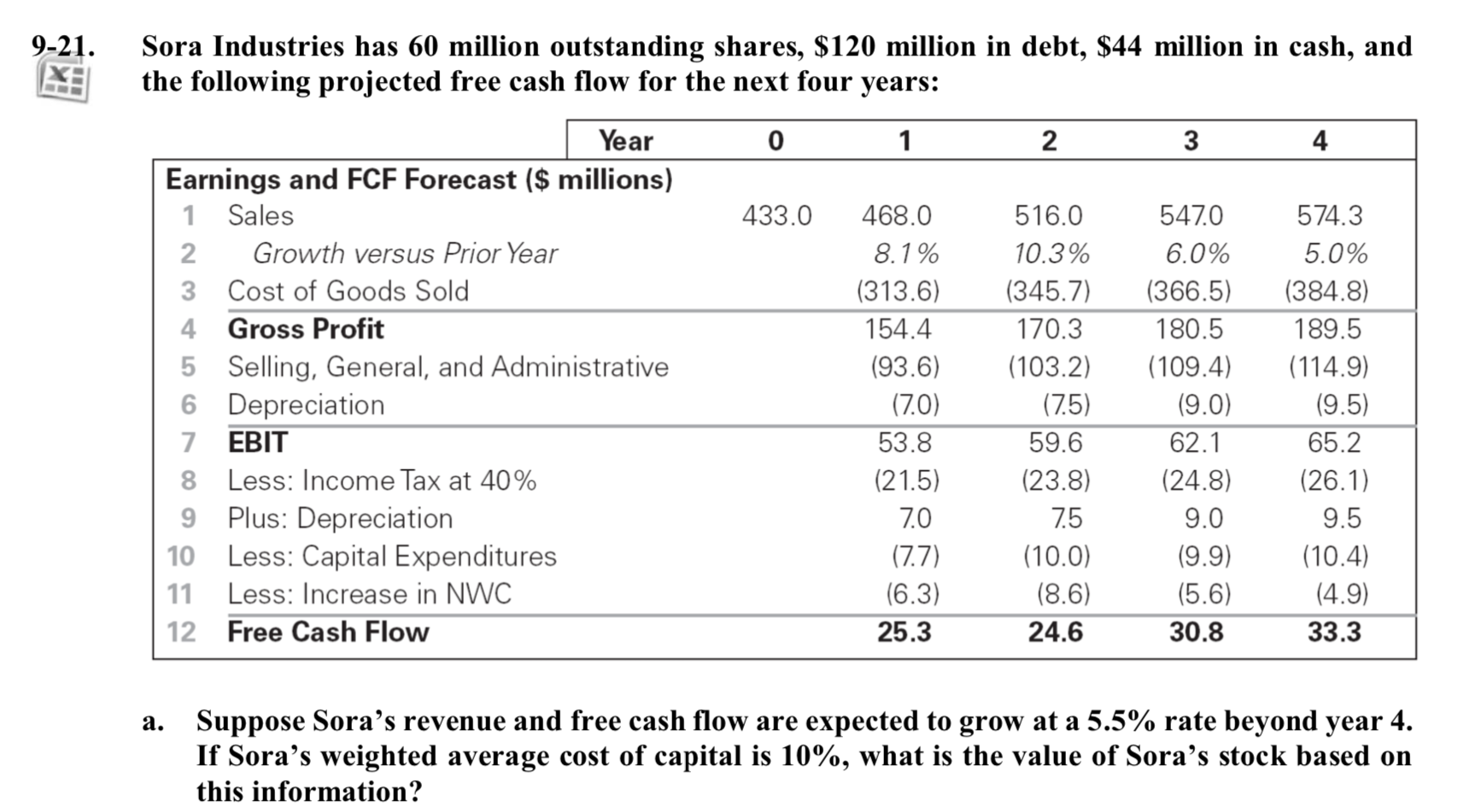

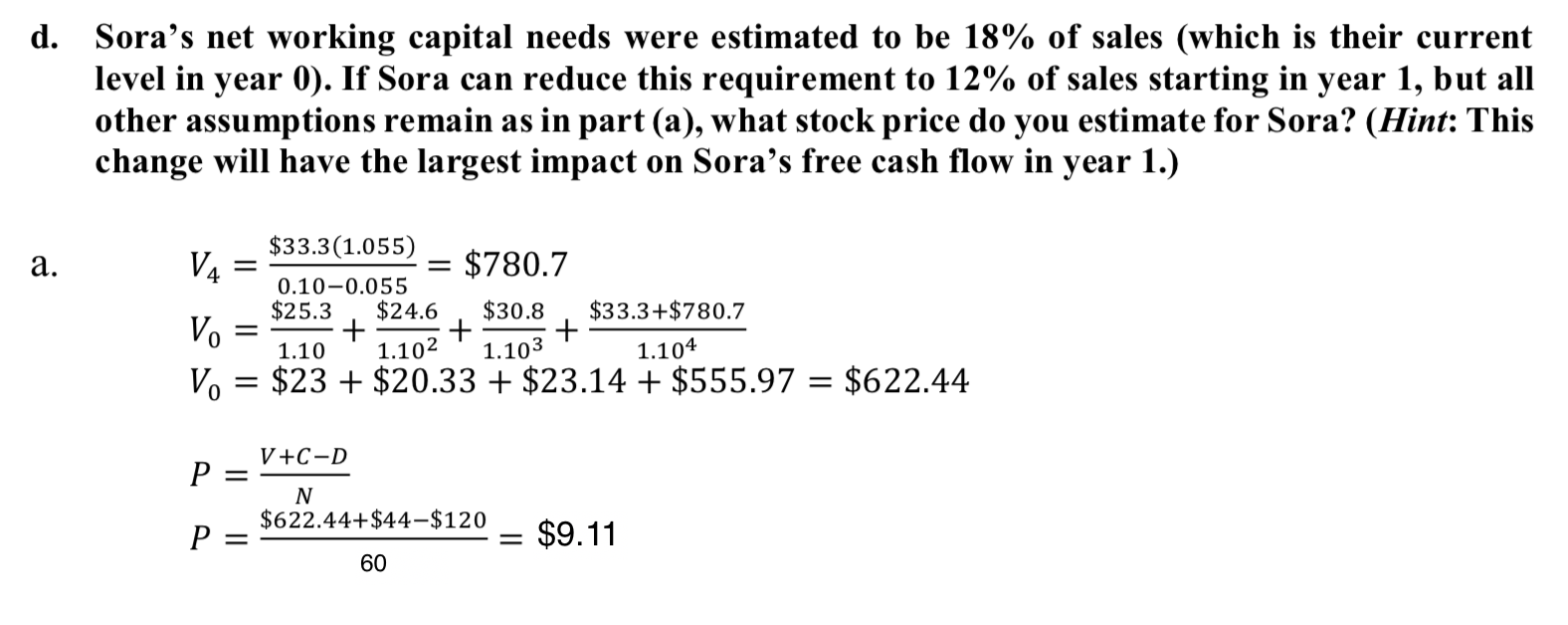

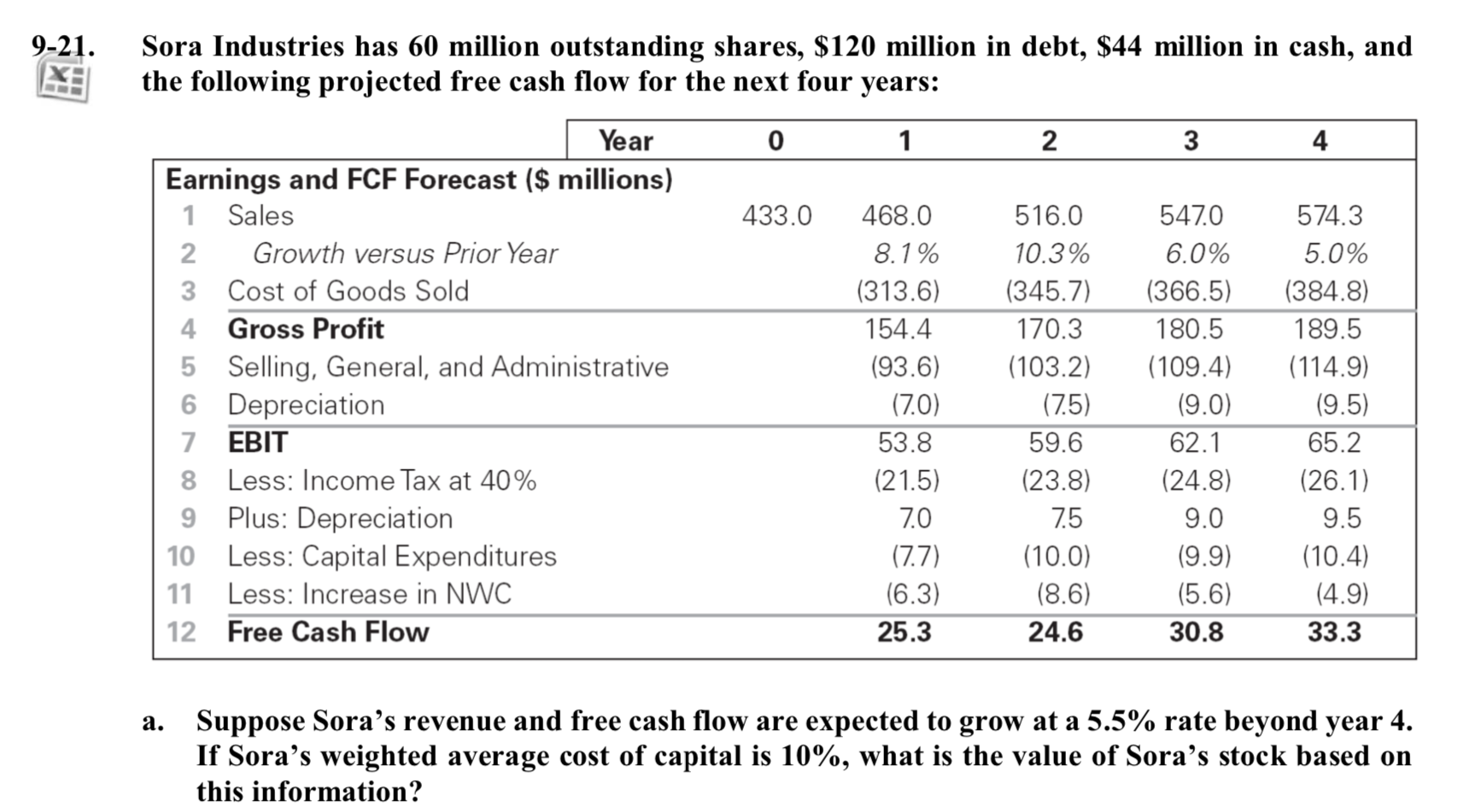

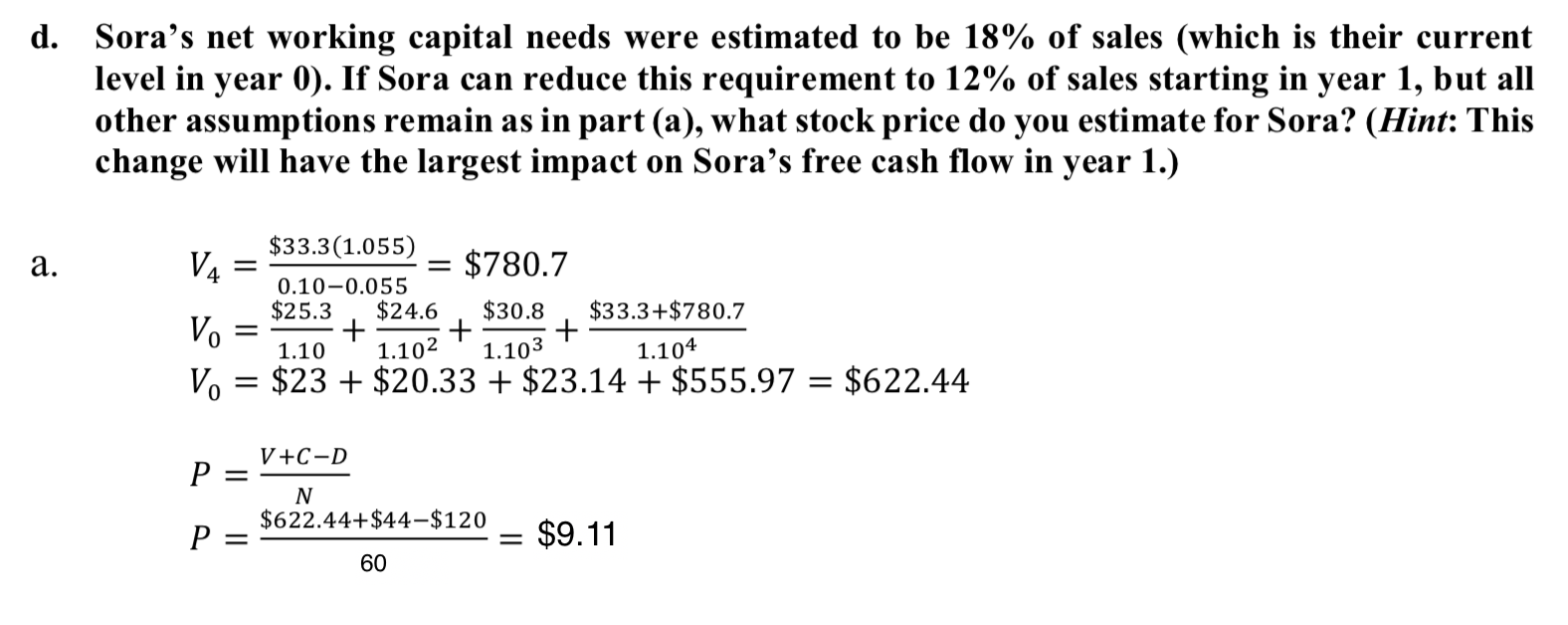

9-21. Sora Industries has 60 million outstanding shares, $120 million in debt, $44 million in cash, and E the following projected free cash flow for the next four years: Year 0 1 2 3 4 Earnings and FCF Forecast ($ millions) 1 Sales 433.0 468.0 516.0 547.0 574.3 2 Growth versus Prior Year 8.1% 10.3% 6.0% 5.0% 3 Cost of Goods Sold (313.6) (345.7) (366.5) (384.8) 4 Gross Profit 154.4 170.3 180.5 189.5 5 Selling, General, and Administrative (93.6) (103.2) (109.4) (114.9) 6 Depreciation (7.0) (7.5) (9.0) (9.5) 7 EBIT 8 Less: Income Tax at 40% 9 Plus: Depreciation 10 Less: Capital Expenditures 11 Less: Increase in NWC 12 Free Cash Flow 25.3 24.6 30.8 33.3 a. Suppose Sora's revenue and free cash flow are expected to grow at a 5.5% rate beyond year 4. If Sora's weighted average cost of capital is 10%, what is the value of Sora's stock based on this information? 53.8 (21.5) 7.0 (7.7) (6.3) 59.6 (23.8) 7.5 (10.0) (8.6) 62.1 (24.8) 9.0 (9.9) (5.6) 65.2 (26.1) 9.5 (10.4) (4.9) d. Sora's net working capital needs were estimated to be 18% of sales (which is their current level in year 0). If Sora can reduce this requirement to 12% of sales starting in year 1, but all other assumptions remain as in part (a), what stock price do you estimate for Sora? (Hint: This change will have the largest impact on Sora's free cash flow in year 1.) $33.3 (1.055) a. V4 = = : $780.7 0.10 0.055 $33.3+$780.7 Vo = $25.3 $24.6 $30.8 + + 1.10 1.10 1.103 + 1.104 Vo = $23+$20.33 + $23.14 + $555.97 = $622.44 V+C-D P = N $622.44+$44-$120 P = = $9.11 60 d. Year 1 2 3 4 Earnings & FCF Forecast ($ million) 1 Sales 468 516 547 574.3 2 Growth vs. Prior Year 8.1% 10.3% 6.0% 5.0% 3 Cost of Goods Sold (313.6) (345.7) (366.5) (384.8) 180.5 189.5 4 Gross Profit 154.4 170.3 5 Selling, General & Admin. (93.6) (103.2) (109.4) (114.9) 6 Depreciation (7.0) (7.5) (9.0) (9.5) 7 EBIT 53.8 59.6 62.1 65.1 8 Less: Income tax at 40% (21.5) (23.8) (24.8) (26.0) 9 Plus: Depreciation 7.0 7.5 9.0 9.5 10 Less: Capital xpenditures (7.7) (10.0) (9.9) (10.4) 11 Less: Increases in NWC 21.8 (5.8) (3.7) (3.3) 12 Free Cash Flow 53.4 27.5 32.6 34.9 $34.9(1.055) V4= = = $818.21 0.10 0.055 $34.9+$818.21 Vo $53.4 $27.5 $32.6 + + = + 1.10 1.10 1.103 1.104 Vo = $48.55 +$22.73 + $24.49 + $582.69 = $678.46 V+C-D P = N $678.46+$44-$120 P = $10.041 60 - 0 433