Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I can't understand how to calculate P0 in the question C. can you give me more detail? Especially, r-g. Orange Tartan Inc. recently paid a

I can't understand how to calculate P0 in the question C. can you give me more detail? Especially, r-g.

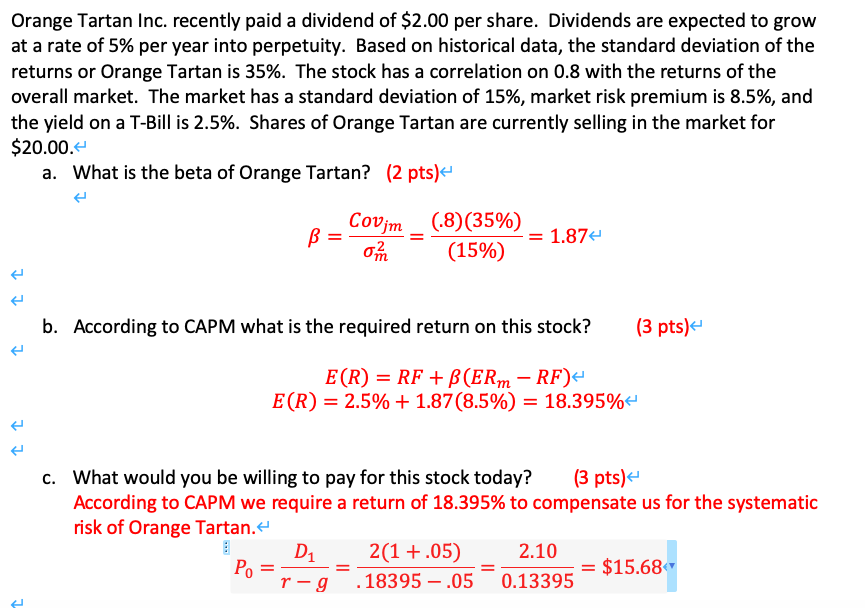

Orange Tartan Inc. recently paid a dividend of $2.00 per share. Dividends are expected to grow at a rate of 5% per year into perpetuity. Based on historical data, the standard deviation of the returns or Orange Tartan is 35%. The stock has a correlation on 0.8 with the returns of the overall market. The market has a standard deviation of 15%, market risk premium is 8.5%, and the yield on a T-Bill is 2.5%. Shares of Orange Tartan are currently selling in the market for $20.00.- a. What is the beta of Orange Tartan? (2 pts) B =- Covim om (.8)(35%) -= 1.87 (15%) I b. According to CAPM what is the required return on this stock? (3 pts) E(R) = RF + B(ERM - RF) E(R) = 2.5% + 1.87(8.5%) = 18.395% C. What would you be willing to pay for this stock today? (3 pts) According to CAPM we require a return of 18.395% to compensate us for the systematic risk of Orange Tartan. Di2 (1 +.05) 2.10 r-g-.18395 .05 = 0.13395 = $15.686 Po =)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started