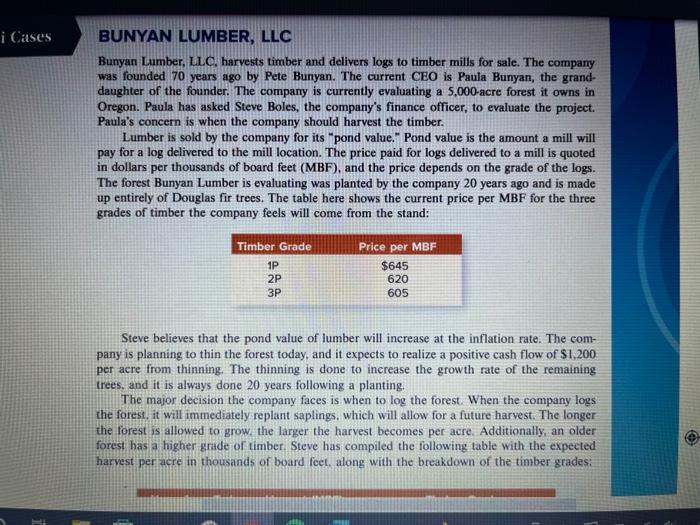

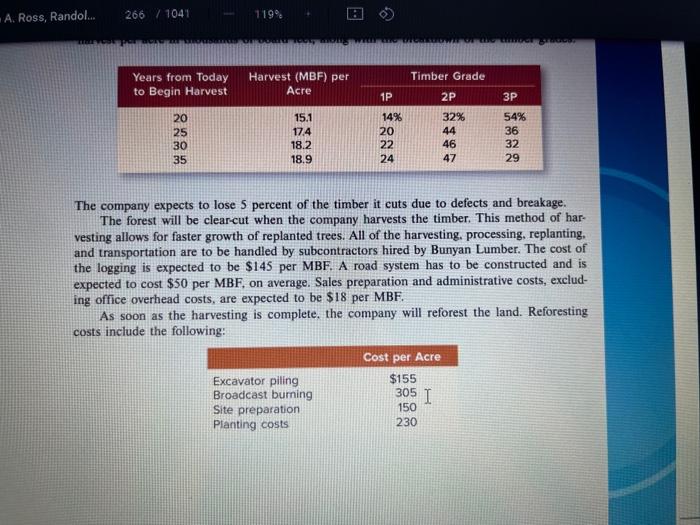

i Cases BUNYAN LUMBER, LLC Bunyan Lumber, LLC, harvests timber and delivers logs to timber mills for sale. The company was founded 70 years ago by Pete Bunyan. The current CEO is Paula Bunyan, the grand- daughter of the founder. The company is currently evaluating a 5.000-acre forest it owns in Oregon. Paula has asked Steve Boles, the company's finance officer, to evaluate the project. Paula's concern is when the company should harvest the timber. Lumber is sold by the company for its "pond value." Pond value is the amount a mill will pay for a log delivered to the mill location. The price paid for logs delivered to a mill is quoted in dollars per thousands of board feet (MBF), and the price depends on the grade of the logs. The forest Bunyan Lumber is evaluating was planted by the company 20 years ago and is made up entirely of Douglas fir trees. The table here shows the current price per MBF for the three grades of timber the company feels will come from the stand: Timber Grade 1P 2P 3P Price per MBF $645 620 605 Steve believes that the pond value of lumber will increase at the inflation rate. The com- pany is planning to thin the forest today, and it expects to realize a positive cash flow of $1,200 per acre from thinning. The thinning is done to increase the growth rate of the remaining trees, and it is always done 20 years following a planting. The major decision the company faces is when to log the forest. When the company logs the forest, it will immediately replant saplings, which will allow for a future harvest. The longer the forest is allowed to grow, the larger the harvest becomes per acre. Additionally, an older forest has a higher grade of timber. Steve has compiled the following table with the expected harvest per acre in thousands of board feet, along with the breakdown of the timber grades: A. Ross, Randol... 266 / 1041 119% CALL LICO Timber Grade Years from Today to Begin Harvest Harvest (MBF) per Acre 1P 2P 20 25 30 35 15.1 17.4 18.2 18.9 14% 20 22 24 32% 44 46 47 54% 36 32 29 The company expects to lose 5 percent of the timber it cuts due to defects and breakage. The forest will be clear-cut when the company harvests the timber. This method of har- vesting allows for faster growth of replanted trees. All of the harvesting, processing, replanting, and transportation are to be handled by subcontractors hired by Bunyan Lumber. The cost of the logging is expected to be $145 per MBF. A road system has to be constructed and is expected to cost $50 per MBF, on average. Sales preparation and administrative costs, exclud- ing office overhead costs, are expected to be $18 per MBF. As soon as the harvesting is complete, the company will reforest the land. Reforesting costs include the following: Cost per Acre $155 305 1 Excavator piling Broadcast burning Site preparation Planting costs 150 230 PART | Valuation and Capital Budgeting All costs are expected to increase at the inflation rate. Assume all cash flows occur at the year of harvest. For example, if the company begins harvesting the timber 20 years from today, the cash flow from the harvest will be received 20 years from today. When the company logs the land, it will immediately replant the land with new saplings. The harvest period chosen will be repeated for the foreseeable future. The com- pany's nominal required return is 10 percent and the inflation rate is expected to be 3.7 percent per year. Bunyan Lumber has a 21 percent tax rate. Clear-cutting is a controversial method of forest management. To obtain the necessary permits, Bunyan Lumber has agreed to contribute to a conservation fund every time it harvests the lumber. If the company harvested the forest today, the required contribution would be $500,000. The company has agreed that the required contribution will grow by 3.2 percent per year. When should the company harvest the forest