Question

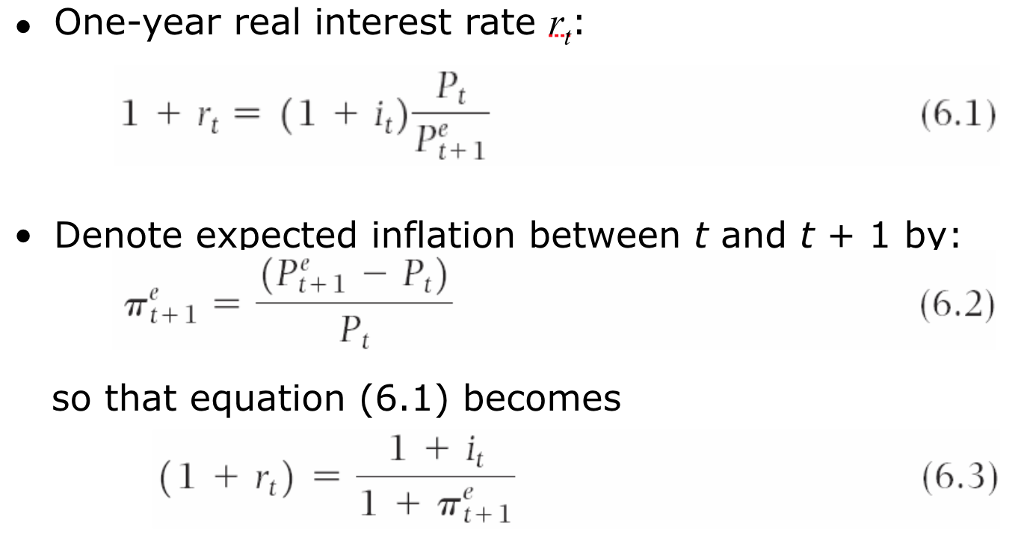

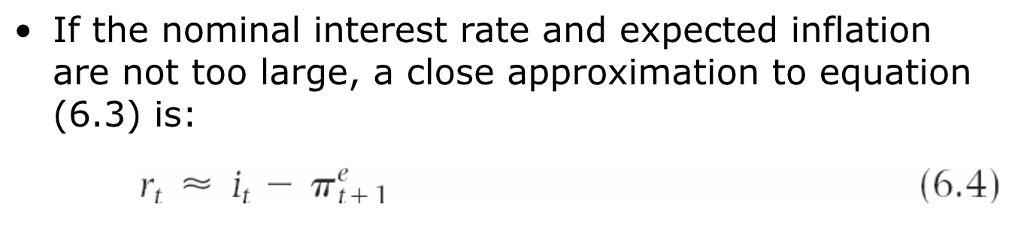

i) Compute the real interest rate on a risk free bond using the exact formula and the approximation formula for each set of assumptions, a)

i) Compute the real interest rate on a risk free bond using the exact formula and the approximation formula for each set of assumptions, a) through c):

a) i = 4% ,  ^e = 1%

^e = 1%

b) i = 9% ,  ^e = 7%

^e = 7%

c) i = 58% ,  ^e = 57%

^e = 57%

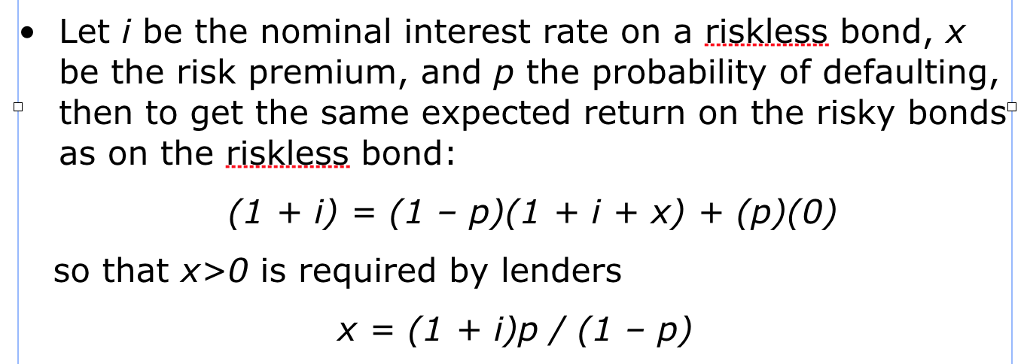

ii) For each set of assumptions a) through c) in part i), using the exact formula as shown in Chapter 6 of the text and slides, compute the equilibrium risk premium on a risky bond by assuming that the probability of default by a borrower is 5%. Show your workings, and briefly explain the equation that you use to compute the risk premiums.

iii) In part ii), you should have assumed that borrower payment upon default is zero. Often it is actually positive. How would you change the equation that you used to compute the risk premiums in this case?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started