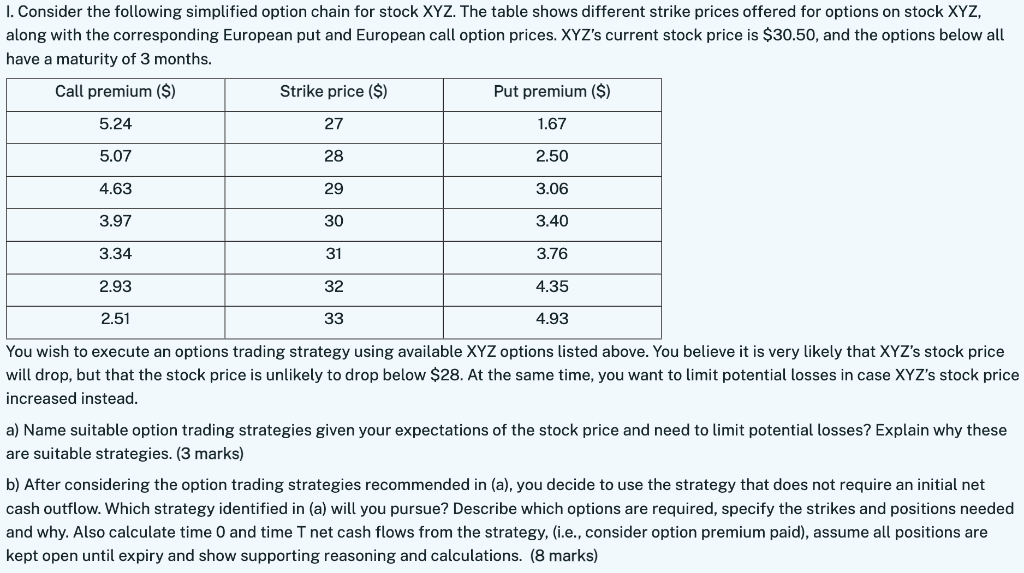

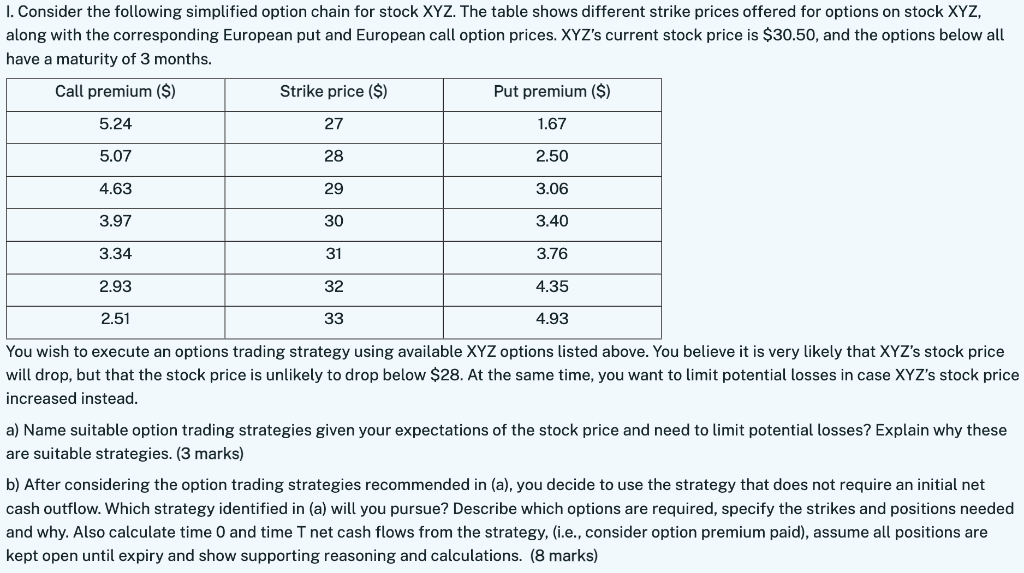

I. Consider the following simplified option chain for stock XYZ. The table shows different strike prices offered for options on stock XYZ, along with the corresponding European put and European call option prices. XYZ's current stock price is $30.50, and the options below all have a maturity of 3 months. You wish to execute an options trading strategy using available XYZ options listed above. You believe it is very likely that XYZ's stock price will drop, but that the stock price is unlikely to drop below $28. At the same time, you want to limit potential losses in case XYZ's stock price increased instead. a) Name suitable option trading strategies given your expectations of the stock price and need to limit potential losses? Explain why these are suitable strategies. (3 marks) b) After considering the option trading strategies recommended in (a), you decide to use the strategy that does not require an initial net cash outflow. Which strategy identified in (a) will you pursue? Describe which options are required, specify the strikes and positions needed and why. Also calculate time 0 and time T net cash flows from the strategy, (i.e., consider option premium paid), assume all positions are kept open until expiry and show supporting reasoning and calculations. ( 8 marks) I. Consider the following simplified option chain for stock XYZ. The table shows different strike prices offered for options on stock XYZ, along with the corresponding European put and European call option prices. XYZ's current stock price is $30.50, and the options below all have a maturity of 3 months. You wish to execute an options trading strategy using available XYZ options listed above. You believe it is very likely that XYZ's stock price will drop, but that the stock price is unlikely to drop below $28. At the same time, you want to limit potential losses in case XYZ's stock price increased instead. a) Name suitable option trading strategies given your expectations of the stock price and need to limit potential losses? Explain why these are suitable strategies. (3 marks) b) After considering the option trading strategies recommended in (a), you decide to use the strategy that does not require an initial net cash outflow. Which strategy identified in (a) will you pursue? Describe which options are required, specify the strikes and positions needed and why. Also calculate time 0 and time T net cash flows from the strategy, (i.e., consider option premium paid), assume all positions are kept open until expiry and show supporting reasoning and calculations. ( 8 marks)