Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I could really use some help I have posted this several times and it is due tonight (5 points: 1 pt for grammar/spelling, 4 pts

I could really use some help I have posted this several times and it is due tonight

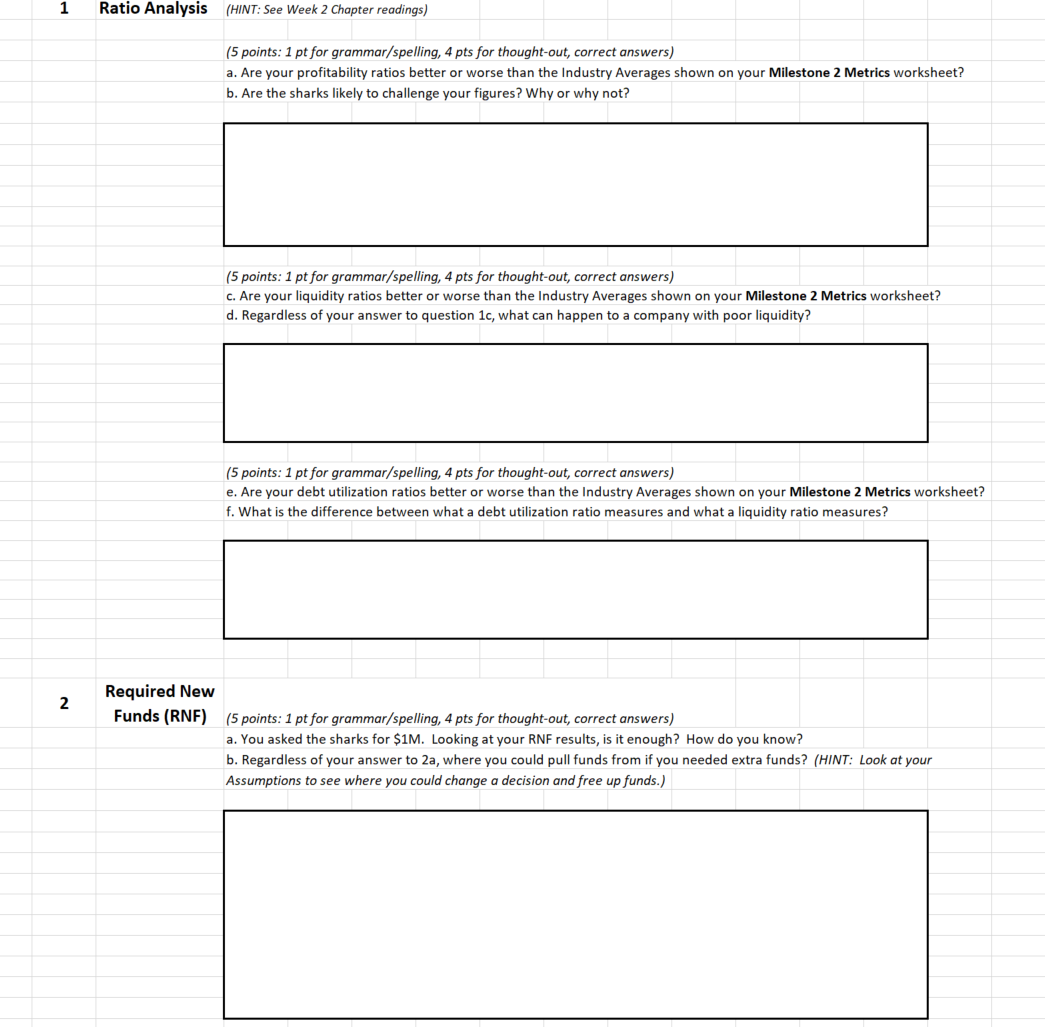

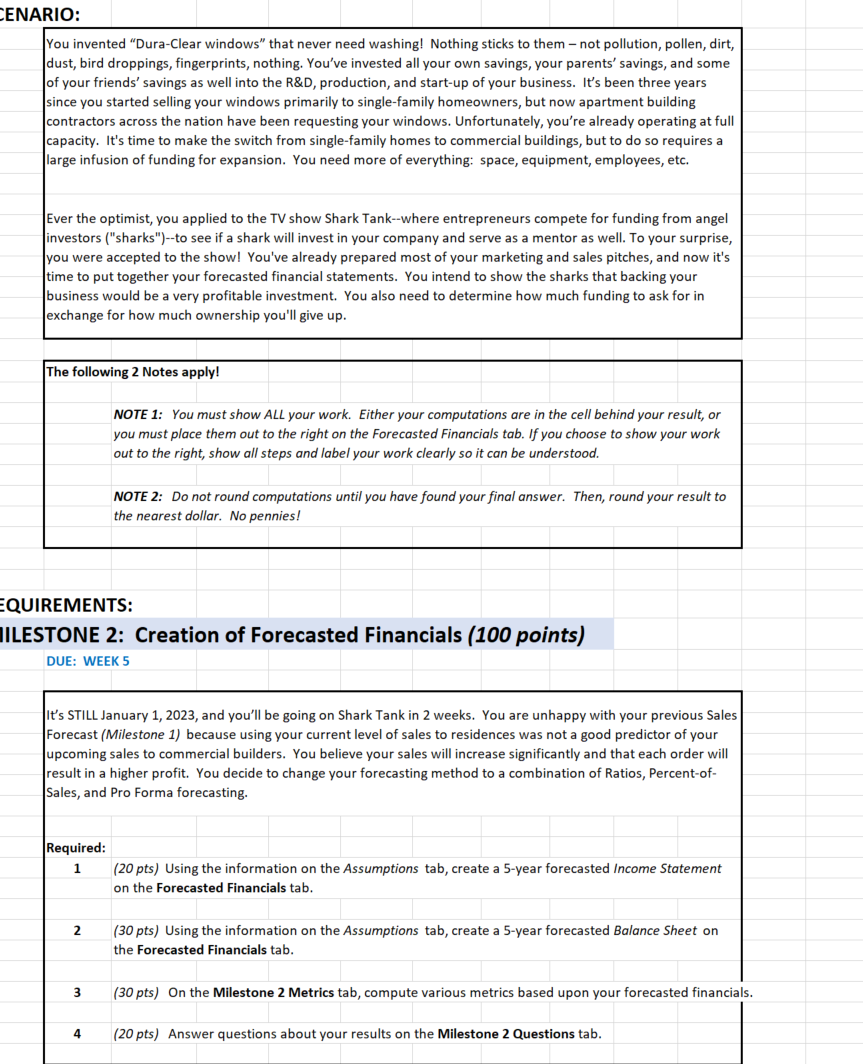

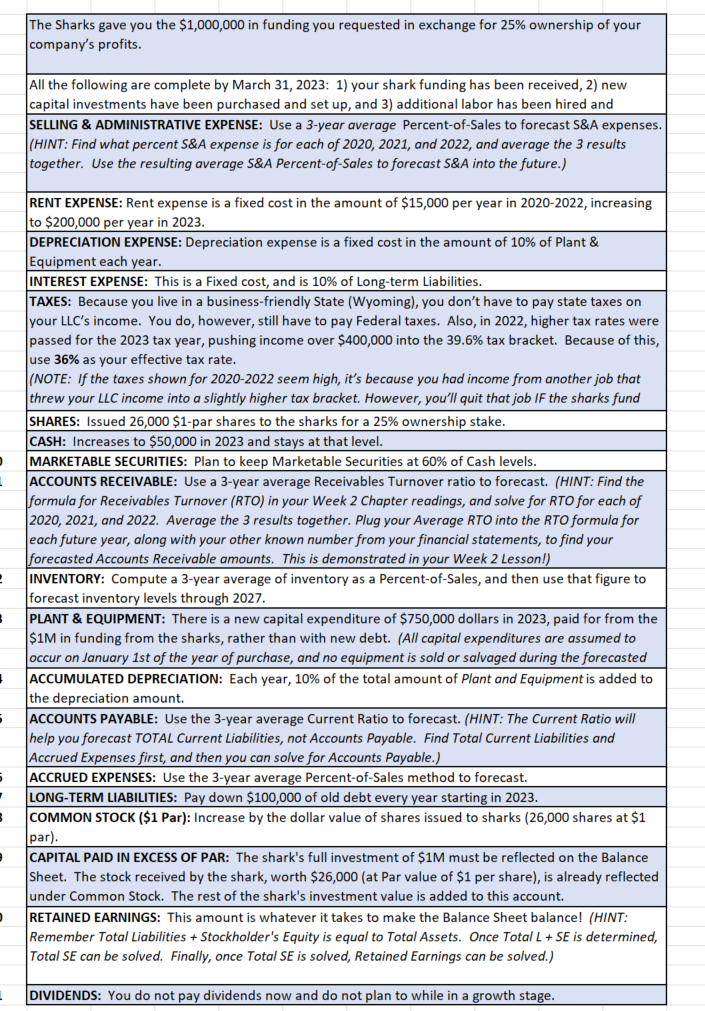

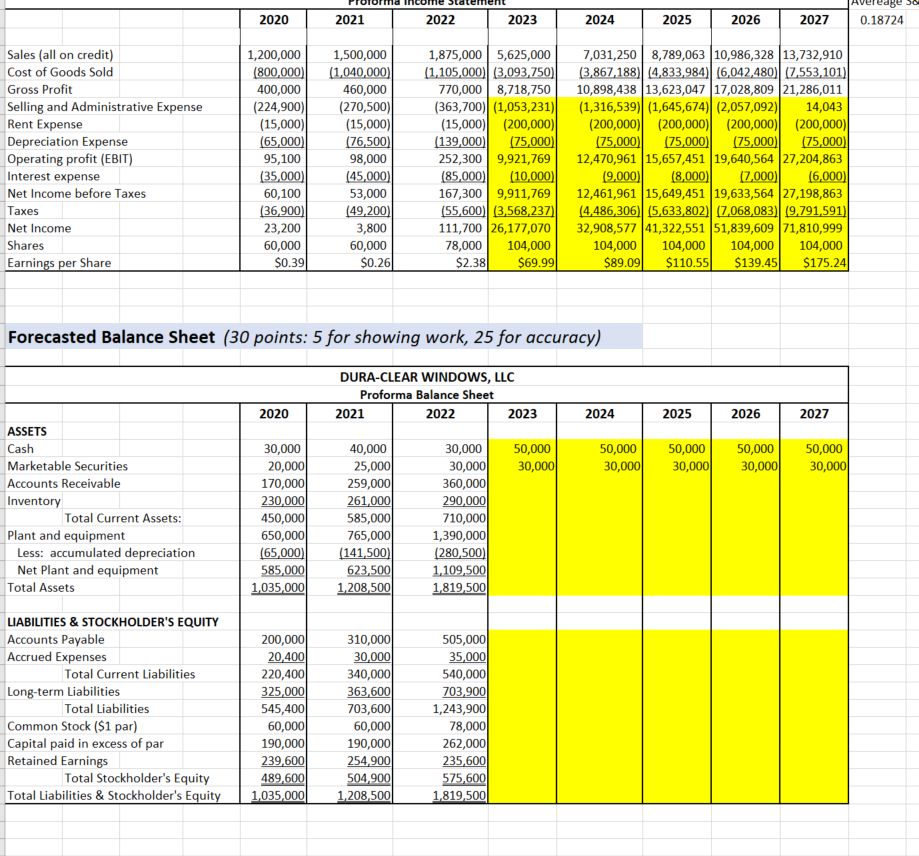

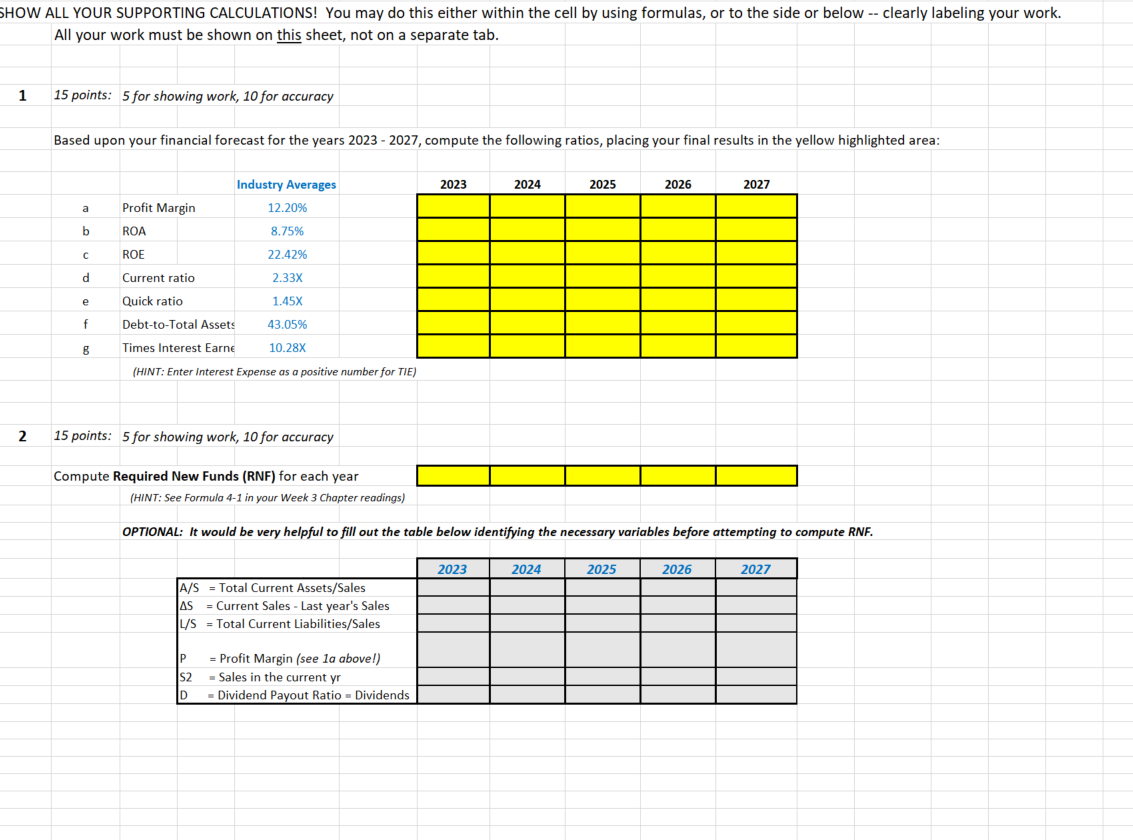

(5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) c. Are your liquidity ratios better or worse than the Industry Averages shown on your Milestone 2 Metrics worksheet? d. Regardless of your answer to question 1c, what can happen to a company with poor liquidity? (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) e. Are your debt utilization ratios better or worse than the Industry Averages shown on your Milestone 2 Metrics worksh f. What is the difference between what a debt utilization ratio measures and what a liquidity ratio measures? \\[ [ \\] (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. You asked the sharks for \\( \\$ 1 \\mathrm{M} \\). Looking at your RNF results, is it enough? How do you know? b. Regardless of your answer to 2a, where you could pull funds from if you needed extra funds? (HINT: Look at your You invented \"Dura-Clear windows\" that never need washing! Nothing sticks to them - not pollution, pollen, dirt, dust, bird droppings, fingerprints, nothing. You've invested all your own savings, your parents' savings, and some of your friends' savings as well into the R\\&D, production, and start-up of your business. It's been three years since you started selling your windows primarily to single-family homeowners, but now apartment building contractors across the nation have been requesting your windows. Unfortunately, you're already operating at full capacity. It's time to make the switch from single-family homes to commercial buildings, but to do so requires a large infusion of funding for expansion. You need more of everything: space, equipment, employees, etc. Ever the optimist, you applied to the TV show Shark Tank--where entrepreneurs compete for funding from angel investors (\"sharks\")--to see if a shark will invest in your company and serve as a mentor as well. To your surprise, you were accepted to the show! You've already prepared most of your marketing and sales pitches, and now it's time to put together your forecasted financial statements. You intend to show the sharks that backing your business would be a very profitable investment. You also need to determine how much funding to ask for in exchange for how much ownership you'll give up. JIREMENTS: ESTONE 2: Creation of Forecasted Financials (100 points) DUE: WEEK 5 It's STILL January 1, 2023, and you'll be going on Shark Tank in 2 weeks. You are unhappy with your previous Sales Forecast (Milestone 1) because using your current level of sales to residences was not a good predictor of your upcoming sales to commercial builders. You believe your sales will increase significantly and that each order will result in a higher profit. You decide to change your forecasting method to a combination of Ratios, Percent-ofSales, and Pro Forma forecasting. (HINT: Enter Interest Expense as a positive number for \\( T I E \\) ) 215 points: 5 for showing work, 10 for accuracy (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) c. Are your liquidity ratios better or worse than the Industry Averages shown on your Milestone 2 Metrics worksheet? d. Regardless of your answer to question 1c, what can happen to a company with poor liquidity? (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) e. Are your debt utilization ratios better or worse than the Industry Averages shown on your Milestone 2 Metrics worksh f. What is the difference between what a debt utilization ratio measures and what a liquidity ratio measures? \\[ [ \\] (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. You asked the sharks for \\( \\$ 1 \\mathrm{M} \\). Looking at your RNF results, is it enough? How do you know? b. Regardless of your answer to 2a, where you could pull funds from if you needed extra funds? (HINT: Look at your You invented \"Dura-Clear windows\" that never need washing! Nothing sticks to them - not pollution, pollen, dirt, dust, bird droppings, fingerprints, nothing. You've invested all your own savings, your parents' savings, and some of your friends' savings as well into the R\\&D, production, and start-up of your business. It's been three years since you started selling your windows primarily to single-family homeowners, but now apartment building contractors across the nation have been requesting your windows. Unfortunately, you're already operating at full capacity. It's time to make the switch from single-family homes to commercial buildings, but to do so requires a large infusion of funding for expansion. You need more of everything: space, equipment, employees, etc. Ever the optimist, you applied to the TV show Shark Tank--where entrepreneurs compete for funding from angel investors (\"sharks\")--to see if a shark will invest in your company and serve as a mentor as well. To your surprise, you were accepted to the show! You've already prepared most of your marketing and sales pitches, and now it's time to put together your forecasted financial statements. You intend to show the sharks that backing your business would be a very profitable investment. You also need to determine how much funding to ask for in exchange for how much ownership you'll give up. JIREMENTS: ESTONE 2: Creation of Forecasted Financials (100 points) DUE: WEEK 5 It's STILL January 1, 2023, and you'll be going on Shark Tank in 2 weeks. You are unhappy with your previous Sales Forecast (Milestone 1) because using your current level of sales to residences was not a good predictor of your upcoming sales to commercial builders. You believe your sales will increase significantly and that each order will result in a higher profit. You decide to change your forecasting method to a combination of Ratios, Percent-ofSales, and Pro Forma forecasting. (HINT: Enter Interest Expense as a positive number for \\( T I E \\) ) 215 points: 5 for showing work, 10 for accuracy

(5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) c. Are your liquidity ratios better or worse than the Industry Averages shown on your Milestone 2 Metrics worksheet? d. Regardless of your answer to question 1c, what can happen to a company with poor liquidity? (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) e. Are your debt utilization ratios better or worse than the Industry Averages shown on your Milestone 2 Metrics worksh f. What is the difference between what a debt utilization ratio measures and what a liquidity ratio measures? \\[ [ \\] (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. You asked the sharks for \\( \\$ 1 \\mathrm{M} \\). Looking at your RNF results, is it enough? How do you know? b. Regardless of your answer to 2a, where you could pull funds from if you needed extra funds? (HINT: Look at your You invented \"Dura-Clear windows\" that never need washing! Nothing sticks to them - not pollution, pollen, dirt, dust, bird droppings, fingerprints, nothing. You've invested all your own savings, your parents' savings, and some of your friends' savings as well into the R\\&D, production, and start-up of your business. It's been three years since you started selling your windows primarily to single-family homeowners, but now apartment building contractors across the nation have been requesting your windows. Unfortunately, you're already operating at full capacity. It's time to make the switch from single-family homes to commercial buildings, but to do so requires a large infusion of funding for expansion. You need more of everything: space, equipment, employees, etc. Ever the optimist, you applied to the TV show Shark Tank--where entrepreneurs compete for funding from angel investors (\"sharks\")--to see if a shark will invest in your company and serve as a mentor as well. To your surprise, you were accepted to the show! You've already prepared most of your marketing and sales pitches, and now it's time to put together your forecasted financial statements. You intend to show the sharks that backing your business would be a very profitable investment. You also need to determine how much funding to ask for in exchange for how much ownership you'll give up. JIREMENTS: ESTONE 2: Creation of Forecasted Financials (100 points) DUE: WEEK 5 It's STILL January 1, 2023, and you'll be going on Shark Tank in 2 weeks. You are unhappy with your previous Sales Forecast (Milestone 1) because using your current level of sales to residences was not a good predictor of your upcoming sales to commercial builders. You believe your sales will increase significantly and that each order will result in a higher profit. You decide to change your forecasting method to a combination of Ratios, Percent-ofSales, and Pro Forma forecasting. (HINT: Enter Interest Expense as a positive number for \\( T I E \\) ) 215 points: 5 for showing work, 10 for accuracy (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) c. Are your liquidity ratios better or worse than the Industry Averages shown on your Milestone 2 Metrics worksheet? d. Regardless of your answer to question 1c, what can happen to a company with poor liquidity? (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) e. Are your debt utilization ratios better or worse than the Industry Averages shown on your Milestone 2 Metrics worksh f. What is the difference between what a debt utilization ratio measures and what a liquidity ratio measures? \\[ [ \\] (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. You asked the sharks for \\( \\$ 1 \\mathrm{M} \\). Looking at your RNF results, is it enough? How do you know? b. Regardless of your answer to 2a, where you could pull funds from if you needed extra funds? (HINT: Look at your You invented \"Dura-Clear windows\" that never need washing! Nothing sticks to them - not pollution, pollen, dirt, dust, bird droppings, fingerprints, nothing. You've invested all your own savings, your parents' savings, and some of your friends' savings as well into the R\\&D, production, and start-up of your business. It's been three years since you started selling your windows primarily to single-family homeowners, but now apartment building contractors across the nation have been requesting your windows. Unfortunately, you're already operating at full capacity. It's time to make the switch from single-family homes to commercial buildings, but to do so requires a large infusion of funding for expansion. You need more of everything: space, equipment, employees, etc. Ever the optimist, you applied to the TV show Shark Tank--where entrepreneurs compete for funding from angel investors (\"sharks\")--to see if a shark will invest in your company and serve as a mentor as well. To your surprise, you were accepted to the show! You've already prepared most of your marketing and sales pitches, and now it's time to put together your forecasted financial statements. You intend to show the sharks that backing your business would be a very profitable investment. You also need to determine how much funding to ask for in exchange for how much ownership you'll give up. JIREMENTS: ESTONE 2: Creation of Forecasted Financials (100 points) DUE: WEEK 5 It's STILL January 1, 2023, and you'll be going on Shark Tank in 2 weeks. You are unhappy with your previous Sales Forecast (Milestone 1) because using your current level of sales to residences was not a good predictor of your upcoming sales to commercial builders. You believe your sales will increase significantly and that each order will result in a higher profit. You decide to change your forecasting method to a combination of Ratios, Percent-ofSales, and Pro Forma forecasting. (HINT: Enter Interest Expense as a positive number for \\( T I E \\) ) 215 points: 5 for showing work, 10 for accuracy Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started