Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I couldn't get the present value result correct. I'm so confused. Can you help me please? Please be specific what formula you put in the

I couldn't get the present value result correct. I'm so confused. Can you help me please? Please be specific what formula you put in the cell because I think Excel will grade it too, not just the number.

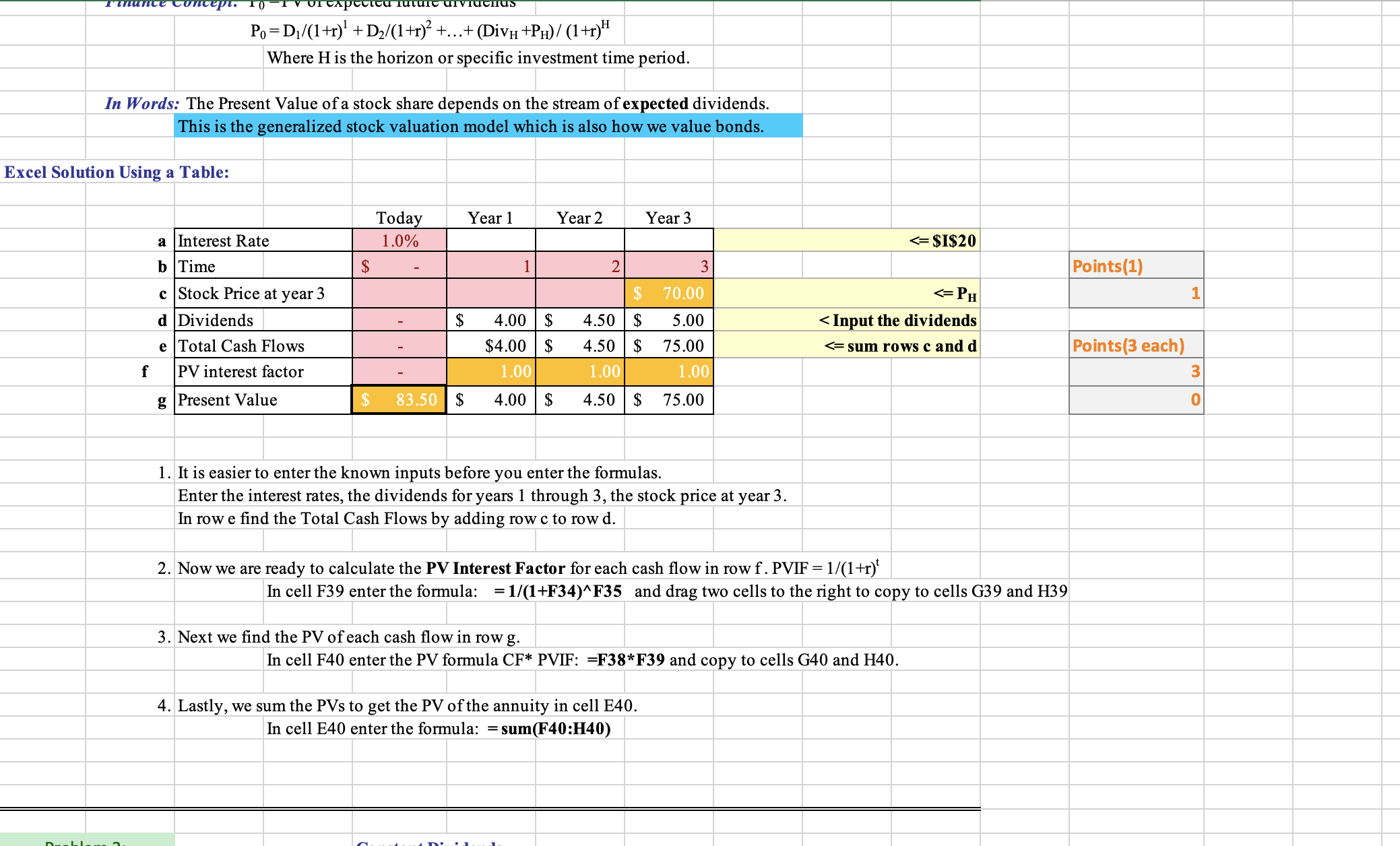

P0=D1/(1+r)1+D2/(1+r)2++(DivH+PH)/(1+r)H Where H is the horizon or specific investment time period. In Words: The Present Value of a stock share depends on the stream of expected dividends. This is the generalized stock valuation model which is also how we value bonds. Excel Solution Using a Table: 1. It is easier to enter the known inputs before you enter the formulas. Enter the interest rates, the dividends for years 1 through 3 , the stock price at year 3 . In row e find the Total Cash Flows by adding row c to row d. 2. Now we are ready to calculate the PV Interest Factor for each cash flow in row f. PVIF =1/(1+r)t In cell F39 enter the formula: =1/(1+F34)F35 and drag two cells to the right to copy to cells G39 and H39 3. Next we find the PV of each cash flow in row g. In cell F40 enter the PV formula CF* PVIF: =F38F39 and copy to cells G40 and H40. 4. Lastly, we sum the PVs to get the PV of the annuity in cell E40. In cell E40 enter the formula: =sum(F40:H40)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started